Stellar 7Y Auction Sends Treasury Yields To Session Low

Following two very solid coupon auctions, when the US sold 2Y and 5Y paper earlier this week, moments ago the Treasury completed the week’s final coupon sale when it sold $44BN in 7Y paper in yet another very strong auction.

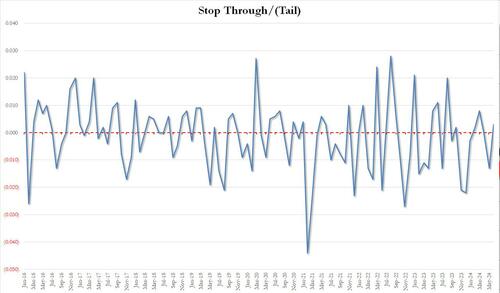

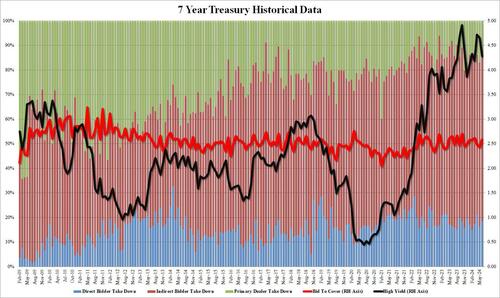

The high yield of 4.276% was almost 40bps below May’s 4.650% and also stopped through the When Issued 4.279% by 0.3bps. This was the 4th stop through for the tenor in the last 5 auctions.

The bid to cover pf 2.581 was far above last month’s 2.427 and was the highest since March. It was also far above the 2.53 six-auction average.

The internals were even better, with Indirects awarded 69.65% up from 66.88% and the highest since March. And with directs awarded 18.5%, up from 16.1% last month and above the recent average of 17.6%, Dealers were left with just 11.9%, the lowest since October ’23.

Overall, this was another very strong auction, and not surprisingly yields promptly slid to session lows in the secondary market with the 10Y down to 4.278%, at session lows, and about 5bps down on the day.

Tyler Durden

Thu, 06/27/2024 – 13:23

via ZeroHedge News https://ift.tt/yl0VofS Tyler Durden