Project 2025: The Good, The Bad, & The Frustrating

Authored by Connor O’Keefe via The Mises Institute,

Anyone following the 2024 presidential election has undoubtedly heard about the political establishment’s latest villain, Project 2025. This policy agenda — technically named the 2025 Presidential Transition Project — was produced by a group of conservative policy analysts, most of whom are associated with the Heritage Foundation.

The project centers around a 900-page book meant to provide the next Republican administration to win the White House with a plan and guide for implementing conservative policies at the helm of a federal government staffed with people who almost universally oppose those policies.

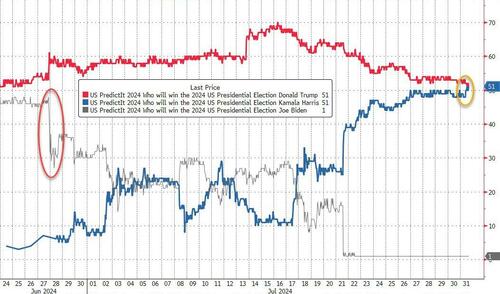

In recent months, Project 2025 has exploded to the forefront of political discourse. Democrats like Kamala Harris are presenting the agenda as an evil scheme concocted by Donald Trump and his allies that is guaranteed to come to fruition, in full, if she loses this election.

Donald Trump has disavowed Project 2025 and made a point to dismiss it as an irrelevant plan that’s unrelated to him and his campaign.

The rift even reportedly caused project head Paul Dans to resign and Trump’s team to celebrate the “demise of Project 2025.” Yet the Democrats and much of the media are still conflating the Heritage-led project with Donald Trump in an effort to terrify Americans into voting blue.

For their part, those involved in Project 2025 are leaning into the hysteria, with Heritage president Kevin Roberts, for example, implying on a podcast that the effort represents a second American revolution that “will remain bloodless if the left allows it to be.”

Despite how prevalent Project 2025 has become in our political discourse, it’s remarkably hard to get trustworthy information about it. Almost all the rhetoric surrounding it either hysterically claims it will impose some kind of fascistic, theocratic quasi-slave state on the American people for a couple years before we’re all killed by climate change, or it’s a bold, tactful playbook that will solve just about all of America’s problems if implemented.

In truth, Project 2025 does not warrant much hype or dread.

The predominant 900-page book does contain several fantastic passages and sections.

But most policy prescriptions presented in the massive volume fall far short of what’s required to address the many problems facing the American people.

By far the best sections come mainly at the beginning where the authors lay out how the federal government actually works. The numerous White House offices are broken down in great detail, with an emphasis put on explaining which roles can and cannot be appointed by the president, along with how people in the various positions could derail the sitting administration’s policy ambitions. Similar analysis can be found in the later chapters on various executive agencies.

This effort is clearly a reaction to Trump’s first term when a series of ill-advised appointments and a general lack of institutional understanding doomed most of the Trump team’s objectives from the start. The people behind this project are not only serious about avoiding the same mistakes in a second term but in actively maneuvering around and eliminating the entrenched bureaucratic resistance.

With its nonspecific language, the opening chapters of Project 2025’s book provide an excellent guide for any presidential team that voters send to the White House on a platform to which the permanent, unelected bureaucracy stands in near-total opposition. This is required knowledge for anyone who is serious about rolling back federal power, and it alone makes Project 2025 a valuable resource in the struggle against the political establishment.

That said, things start to go downhill as soon as the authors turn to the specific policies they want the next Republican administration to implement. To be clear, there are some very good policies laid out. For example, the authors call for winding down Fannie Mae and Freddie Mac, abolishing the federal sugar program, and eliminating the Department of Education. There is also a fairly decent chapter on the Federal Reserve, which Jonathan Newman reviewed last week.

But most of what the authors call for is frustratingly moderate. In almost every single case, the highly publicized plans to cut federal agencies like the Department of Homeland Security are, in fact, calls to keep everything those agencies do in place but to move the offices in question to other federal agencies. In other words, the authors of Project 2025 are mostly planning to reorganize, not cut, the federal government.

There is lip service paid to actual rollbacks of federal power. But typically, the authors quickly dismiss such ambitions as impossible and instead spend most of their time theorizing about how conservatives could steer the federal Leviathan to push their preferred social and cultural values if they took full control of the executive agencies. The authors never explain why rollbacks — which they claim to prefer — would remain impossible if their assumption of a total conservative takeover came true.

Foreign policy-wise, Project 2025 is much closer to Bush-era neoconservativism than the populist, “America First” brand its advocates and opponents attach to it. Various authors accuse the federal government of being weak on China, Iran, Venezuela, North Korea and Russia. A Project 2025 foreign policy can be boiled down to spending more money to act even more aggressively in the Pacific, Middle East, South America and Eastern Europe under the ahistorical assumption that it will get each of these “hostile foreign regimes” to calm down.

So overall, the policy vision of Project 2025 is much more familiar and moderate than the rhetoric surrounding it would have you expect.

In theory, it might make sense to pair sweeping institutional changes that create opportunities to later roll back the administrative state with moderate policies that wouldn’t generate a complete freak-out from the progressive left and political establishment. But, as we see today, in reality, the freak-out happens nonetheless.

And so, if the left and the political establishment are going to call you crazy radicals anyway, why not push for the kinds of sweeping changes that are actually needed to address the many problems we face? For some of the authors behind Project 2025, it could very well be because they do not actually want to cut government spending or roll back Washington’s power.

But for those who understand that significantly slashing the bloated, corrupt, often malicious federal government is the only way out of many of our national predicaments, Project 2025 remains, in its current form, woefully inadequate.

Tyler Durden

Wed, 07/31/2024 – 18:40

via ZeroHedge News https://ift.tt/6HnkAb7 Tyler Durden