Relief Rally?

By Bas van Geffen, CFA, Senior Macro Strategist at Rabobank

Relied Rally Already?

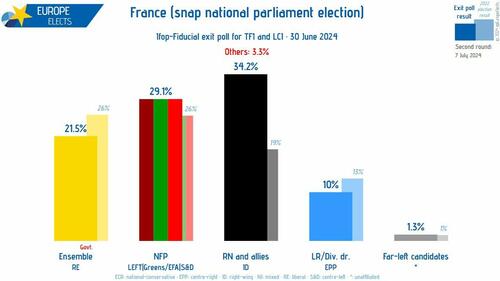

Macron gambled and lost. That much was clear heading into France’s elections this weekend. Macron’s party attracted only about 20% of the votes, behind Le Pen’s Rassemblement National (33.4%) and the left-wing coalition Nouveau Front Populaire (28.1%).

So, this morning markets mostly breathe a small sigh of relief as Rassemblement National did not get as much support as some polls had suggested. Le Pen’s party won 39 seats out of the 76 seats that were assigned outright in the first round. Based on yesterday’s votes Ipsos projects Rassemblement National at 230-280 seats versus the 289 required to win an absolute majority. The euro strengthened somewhat, the French CAC40 leads European equity markets higher, and the spread between French and German yields narrowed to a two-week low.

But uncertainty remains very high into the second round of voting, in which the remaining seats will be distributed. An unusually large number of candidates passed the bar for this run-off vote. In 306 constituencies voters will be able to choose between three candidates; in another five the ballot will even include four options. And that’s before all of the tactical manoeuvres.

Candidates could still pull out of the race, to avoid splitting the vote. Centrist parties have historically banded together in such a way. Moreover, the left-wing coalition suggested that they may do so in order to block Le Pen from obtaining a majority in parliament. And then there is the potential for tactical voting on Sunday, in which the electorate could still opt to vote for the least-bad outcome, rather than their preferred candidate. Such strategies could still benefit Macron.

Even so, yesterday’s polls made it clear that Macron will probably have to work with another party to legislate post-elections, and that situation of so-called cohabitation is not French politicians’ strong suit. So, although the budgetary risk of the left-wing Nouveau Front Populaire may have receded, policy paralysis remains a distinct possibility. That would slow down solutions for the structural problems that plague the French economy, it could be detrimental to French fiscal metrics, and it may limit Macron’s ability to execute on his vision for a stronger Europe.

European manufacturing is one of the areas that needs to be shored up. The purchasing managers’ index for June reported the fastest fall in manufacturing output in the year to date, and new orders fell at a faster pace too. This puts European manufacturers in sharp contrast with peers in other parts of the world, where there were signs of recovery in June. This could indicate that Europe’s data are a temporary setback, but it may also be indicative of continued structural issues in the region’s industry.

Elsewhere, the People’s Bank of China announced that it will borrow government bonds from primary dealers. The central bank has previously suggested it is looking into potentially trading sovereign debt in order “to steady the operation of the bond market”. Yet, the motive of the central bank remains somewhat unclear. These borrowing operations could simply be used for temporary liquidity management, or to limit disorderly market moves.

However, it could also be an attempt to fade the rally in bonds. The PBOC’s announcement came as yields fell to a record low, as concerns about the economy drive investors to safe assets. Policymakers have been trying to stem this rally through verbal intervention with little success so far. The PBOC holds a fairly small amount of bonds, which limits its power to intervene outright. Borrowing securities might be a way to acquire assets to sell, but that is an untested policy.

Tyler Durden

Mon, 07/01/2024 – 11:20

via ZeroHedge News https://ift.tt/yp6VOS3 Tyler Durden