Bonds & Stocks Bid As Government Job Openings Suddenly Surge

Despite the near-perfect track record of downward revisions over the last 17 months, the market seemed buoyed today by a better than expected JOLTS print – which was juiced almost entirely by government jobs

Source: Bloomberg

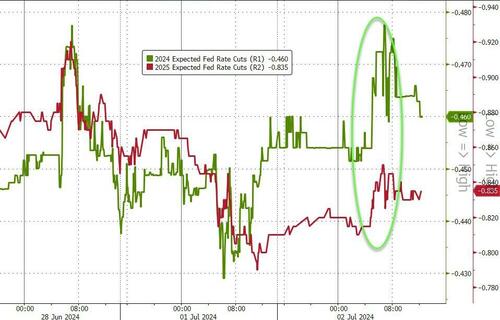

And that was enough to send rate-cut expectations (dovishly) higher

Source: Bloomberg

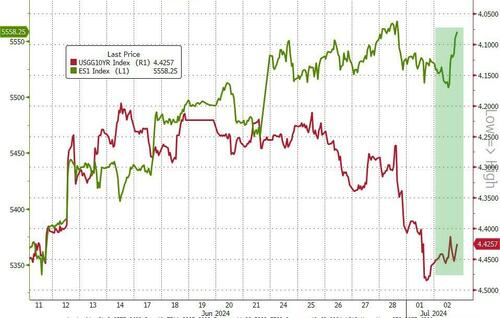

Which pulled stocks and bonds higher in price…

Source: Bloomberg

In equity land, Nasdaq was the biggest gainer while Small Caps lagged

…as the energy-tech/AI pair continued to flip-flop (today’s winner was tech over energy)…

Source: Bloomberg

TSLA had a big day, up almost 10% after beating expectations for deliveries (getting back towards unchanged for the year)…

Which helped lift the Mag7 to fresh record-er highs…

Source: Bloomberg

Treasury yields were lower across the curve with the belly outperforming (7Y -4bp[s, 2Y & 30Y -2bps)…

Source: Bloomberg

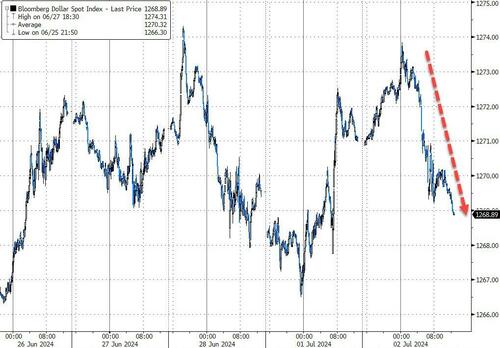

The dollar dived on the dovishness….

Source: Bloomberg

Gold traded sideways once again (despite the dollar weakness)…

Source: Bloomberg

Oil prices touched a new two-month highs before legging back down for the day with WTI holding around $83 into tonight’s API data…

Source: Bloomberg

Having rallied back up to the scene of the Mt.Gox headline crime, Bitcoin slipped back lower today…

Source: Bloomberg

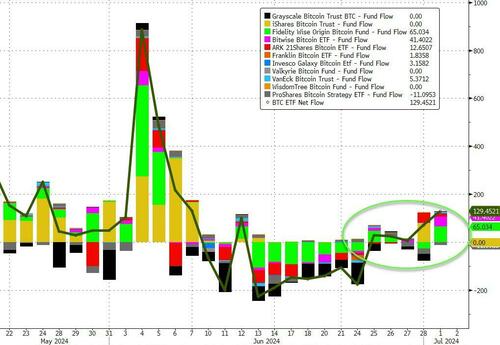

…despite 5 straight days of ETF inflows leading into this…

Source: Bloomberg

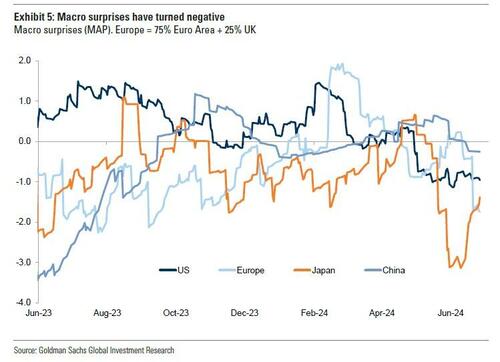

Finally, for the first time on over a year, macro-economic surprises have turned negative across every major region in the world…

Source: Bloomberg

Tim for The Fed to save the world (from Tyrannical Trump… with Simple Joe?)

Tyler Durden

Tue, 07/02/2024 – 16:00

via ZeroHedge News https://ift.tt/Si2YH0C Tyler Durden