After Being Wrong For Three Years, Marko Kolanovic Is Leaving JPMorgan

In retrospect, it was the best call of this market cycle.

After he was bullish – and dead wrong – all the way down from the Jan 2022 all time high, JPM’s chief equity strategist Marko Kolanovic capitulated in late September 2022 when, as we reported at the time he turned bearish on the last day of the month. To us, this was the signal that the worst slump since covid was over and a historic meltup lay ahead.

Kolanovic turned bearish. Bottom https://t.co/bXVFOHDoRS

— zerohedge (@zerohedge) September 30, 2022

We were right, and literally to the day, the market bottomed the day Kolanovic flip-flopped.

Actually, in retrospect we may have made another, just as good call: back in Feb 2023 we said that the rally won’t end until Wilson and Marko turn bullish.

Rally won’t end until Wilson and Marko turn bullish

— zerohedge (@zerohedge) February 7, 2023

That was also correct – with the S&P hitting a new record high on 32 days so far in 2024, yesterday being the latest one – but little did we know that instead of admitting defeat and pressing on, as so many of his peers do all the time, the Croatian would instead choose sepuku.

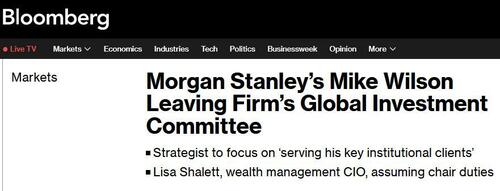

That’s right: back in February, Bloomberg reported that Mike Wilson (shortly before he capitulated and turned bullish) was tapped on the shoulder and stepped down from his role as chair of the bank’s Global Investment Committee.

However, the fact that he did eventually – finally – flip-flop back to bullish meant he at least got to keep his job.

Wall Street’s Biggest Bear, Mike Wilson, Finally Capitulates https://t.co/FNriOk63vX

— zerohedge (@zerohedge) May 21, 2024

Unfortunately for his JPMorgan colleague, it didn’t quite work out, and as Bloomberg reported this morning, Marko Kolanovic, technically the chief global market strategist of the world’s largest commercial bank and co-head of global research, is leaving the bank, according to an internal memo obtained by Bloomberg News.

Kolanovic, who had been at JPMorgan for 19 years, is “exploring other opportunities,” the memo stated. His Croat co-worker, Dubravko Lakos-Bujas, will lead market strategy and become chief market strategist, overseeing cross-asset, equity, and macro. Hussein Malik will be the sole head of global research. Stephen Dulake and Nicholas Rosato will co-lead fundamental research, a new team that brings together credit and equity research.

This is how Bloomberg describes Marko’s recent analytical (lack of) performance:

The move follows a disastrous two-year stretch of stock-market calls by Kolanovic. He was steadfastly bullish in much of 2022 as the S&P 500 Index sank 19% and strategists across Wall Street lowered their expectations for equities. He then turned bearish just as the market bottomed, missing last year’s 24% surge in the S&P 500 as well as the 14% gain in the first half of this year.

Indeed, while Marko was a phenomenal flow and derivatives analyst before he was promoted into the C-suite (in no small part thanks to the publicity we generated for him back in the day), unfortunately for him, that’s when politics intervened with his market analysis, and his work product started to suffer starting in 2018 and deteriorated progressively ever since. It got so bad that JPM’s own trading desk would frequently troll Kolanovic with their own repeatedly bullish – and correct – calls.

In any case, we wish Marko all the best and some advice: when he launches his own substack, don’t go the Zoltan route and seek $10,000 in monthly subscription fees. It just won’t work.

Tyler Durden

Wed, 07/03/2024 – 12:25

via ZeroHedge News https://ift.tt/spiLXhR Tyler Durden