WTF Are S&P Global Services PMI Respondents Drinking?

Following the mixed picture on Manufacturing (despite the collapse in ‘hard’ data), the Servcies dats could not be more mixed:

-

S&P Global US Services PMI rose to 55.3 from 54.8, better than the 55.1 expected (and flash print)

-

ISM US Services PMI plunged to 48.8 from 53.8, well below the 52.7 expected.

Source: Bloomberg

So to clarify:

-

S&P Global Services respondents see their industry at its strongest since April 2022

-

ISM Services respondents see their industry at its weakest since April 2020 (COVID Lockdowns)

Under the hood, ISM was a shitshow (time for a rate-cut?)

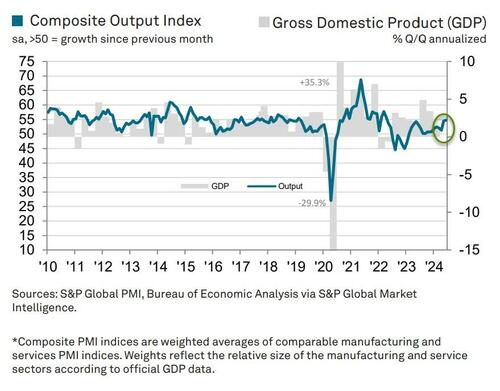

The S&P Global US Composite PMI Output Index posted 54.8 in June, up from 54.5 in May and signaling the fastest increase in business activity since April 2022, with Services continuing to outperform the Goods side of the economy

Source: Bloomberg

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

“US service sector companies reported an encouragingly solid end to the second quarter, with output rising at the fastest rate for over two years. Both new order inflows and hiring have also accelerated, the latter buoyed by firms taking on more workers in response to rising backlogs of work.

“With additional – albeit more muted – support coming from the manufacturing sector, the survey data point to GDP rising at an annualized 2.0% rate in the second quarter, with a 2.5% rate seen for June. Forward momentum is therefore gathering pace.

This is not what the doves wanted to see…

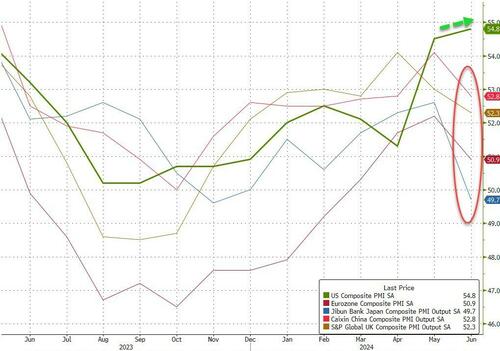

Oh and BTW – the entire rest of the world is seeing economic composites tumbling… but not Biden’s Murica!

But…

“There is some nervousness creeping in regarding the post-election business environment, but for now at least confidence about the outlook for the coming year remains elevated by recent standards and supportive of businesses investing in expansion.

“Some of this optimism relates to ongoing convictions that interest rates will start to fall before the end of the year. In this respect, a further cooling of price pressures in the survey – notably in the services sector – adds to signs that inflation should trend lower in the coming months to open the door further for rate cuts.”

So, once again, it’s not the economy, it’s The Fed, stupid!

Tyler Durden

Wed, 07/03/2024 – 10:07

via ZeroHedge News https://ift.tt/gm15icj Tyler Durden