Payrolls: Goldilocks Or Not?

By Peter Tchir of Academy Securities

On the surface the NFP data had a “goldilocks” type of character.

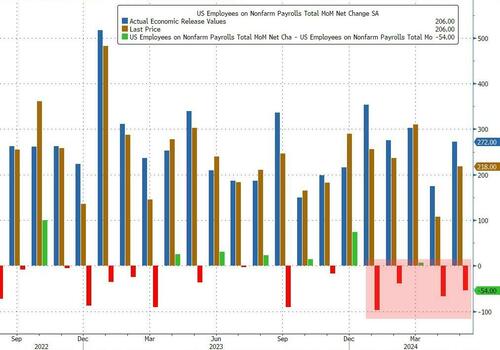

- Establishment jobs at 206k, good, but not too good.

- The household survey wasn’t too bad (this time) adding 116k jobs.

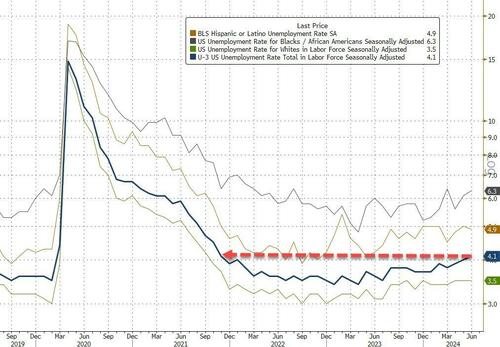

- The unemployment rate ticked up, marginally, to a still strong 4.1% – again, good, but not too good.

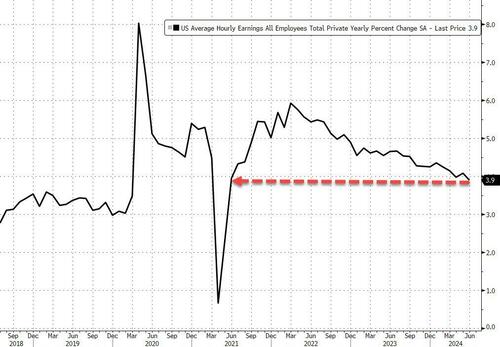

- Earnings, while still high at 0.3%, have stabilized, and hours worked remained stable at 34.3, indicating stability. All good, but not too good.

The obvious flaws in the report were:

- Downward revisions of 111k to the prior 2 months.

A significant miss on Private Payrolls. Private payrolls were only 136k, and we lost 8k in manufacturing. The headline number was supported by government jobs, which is consistent with JOLTS where the increase in jobs available was totally linked to government jobs, as opposed to private sector jobs.

The bigger questions remain:

- ISM Services Employment Index has been below 50 for 5 months in a row! In a “service” economy that is not good.

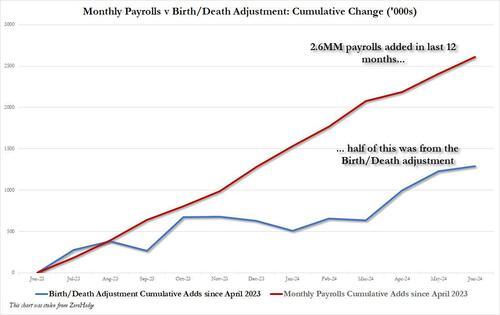

- The Birth/Death model “only” added 59k jobs. Since April of last year, 1.9 MILLION jobs have been attributed to this model. Maybe it is correct, but we have argued for some time that there are two potential flaws with this adjustment:

- The “gig” economy in all its various forms has led to a dramatic increase in EIN requests (tax IDs) that may not convert to the same number of jobs as tax ID requests did historically (drivers might have one for each provider they work with, as could influencers and others trying to maximize their take home pay from “gig” economy jobs).

- The seasonal adjustments may still reflect too much emphasis on “winters” in the Northeast, and not capture the massive geographical shift we have seen in the past few years. It might be difficult to start home construction in January in Connecticut, but not so hard to start in Tennessee. If that sort of transition isn’t being captured (and I suspect it isn’t as the seasonal adjustments seem to change only over longer periods of time), then we might see some weak results from this model in the summer.

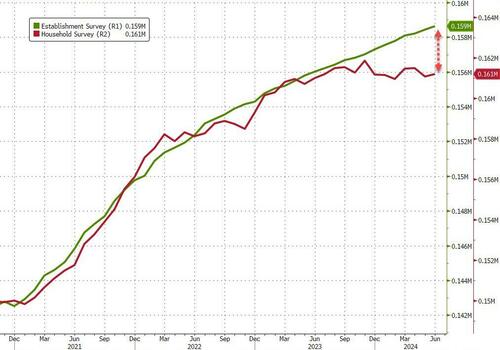

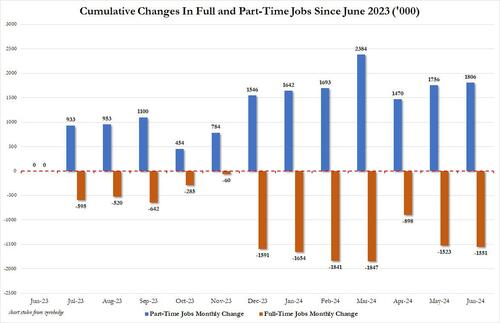

- Part-time versus full-time jobs. The household survey (which has underperformed the establishment survey in terms of job creation) has 1.8 million part-time jobs added in the past year, versus 1.55 million full-time jobs being lost!

Bottom Line

We still have the drama unfolding in D.C., which we think warrants hedging against geopolitical risk (Don’t Assume) and lots of questions about valuations and breadth, but we can see an initial “goldilocks” type of reaction to the data.

- Treasury yields should do ok, as both the obvious and not so obvious aspects of this report support the Fed and lower yields. Having said that, we are near the lower bound of 4.3% on our 4.3% to 4.5% range, so trimming exposure here makes sense. The one thing that seems consistent in D.C. is that no one cares seriously about closing the deficit to do anything about it and that should weigh on the longer end of the yield curve.

- Equities could continue their bounce by cherry picking the good aspects of the report, and building on the momentum that has driven the Nasdaq 100 higher by 2.5% in this holiday shortened week. With trading volume expected to be very light today, that could continue. But, and this remains a big but, the risk that the data is deemed to be negative for the economy, such that it hurts equities is increasing, and we think vigilance on the geopolitical front is well warranted.

- Credit. Rangebound rates and a decent (even moderately slowing economy) shouldn’t pose a threat to credit spreads. Supply should ease, and there is fierce competition amongst lenders, for all but the weakest companies. Credit should remain boring, and generally continue to tighten over the summer.

Tyler Durden

Fri, 07/05/2024 – 10:30

via ZeroHedge News https://ift.tt/NFhwBGl Tyler Durden