Bank of America Jumps 4% Despite Missing On FICC, Net Interest Income And Looming CRE Loss Tsunami

After ugly earnings from Wells Fargo, a mediocre report from JPM and strong results from Goldman, this morning Bank of America became the latest major bank to report Q2 numbers which were mostly stronger than expected, however there were several rather notable red flags including a miss in FICC, Wealth and Investment Management, the company’s NIM came in below expectations while charge-offs hit a multiyear high. That said, at least initially, the market liked the results and pushed BAC stock up 4%, after trading and investment-banking results both topped analysts’ estimates and gave a forecast for net interest income that also exceeded expectations even though the Net Interest Yield this quarter missed consensus expectations yet again.

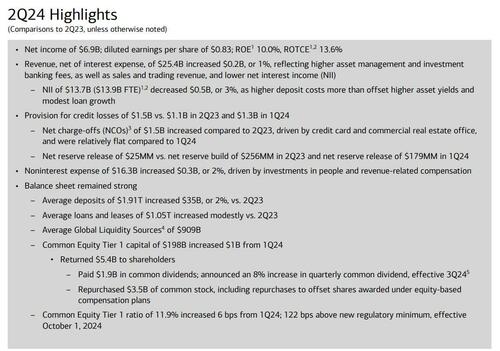

With that in mind, here is what BofA reported for the second quarter:

- Revenue $25.4BN, up 1% YoY and beating estimates of $25.22BN

- Trading revenue excluding DVA $4.68 billion, beating estimate $4.53 billion

- FICC trading revenue excluding DVA $2.74 billion, missing estimate $2.8 billion

- Equities trading revenue excluding DVA $1.94 billion, beating estimate $1.73 billion

- Wealth & investment management total revenue $5.57 billion, missing estimate $5.58 billion

- Revenue net of interest expense $25.38 billion, beating estimate $25.27 billion

- Investment banking revenue $1.56 billion, beating estimate $1.45 billion

- Trading revenue excluding DVA $4.68 billion, beating estimate $4.53 billion

- EPS $0.83, down 6% YoY and beating estimates of $0.80

Some more highlights from the quarter as reported:

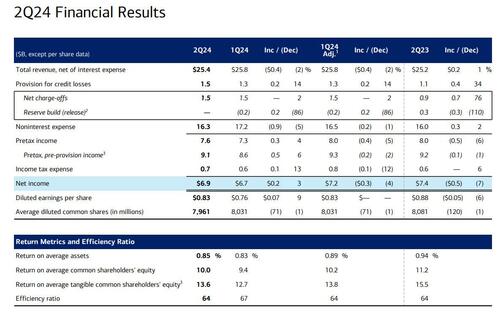

And visually

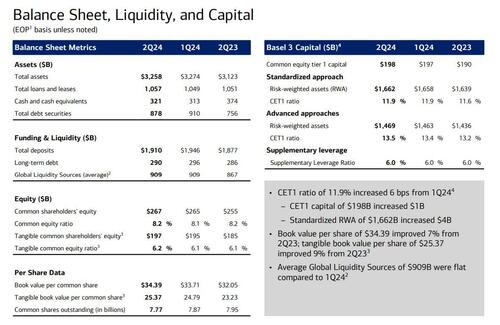

Digging into the balance sheet, we find some more, if irrelevant, beats

- Return on average equity 9.98%, estimate 9.57%

- Return on average assets 0.85%, estimate 0.82%

- Return on average tangible common equity 13.6%, estimate 13.1%

- Basel III common equity Tier 1 ratio fully phased-in, advanced approach 13.5%, estimate 13.5%

- Standardized CET1 ratio 11.9%, estimate 11.9%

- Efficiency ratio 63.9%, estimate 64.2%

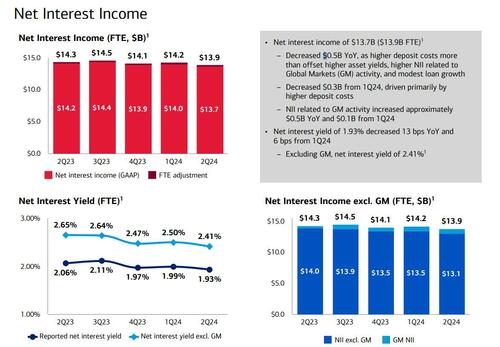

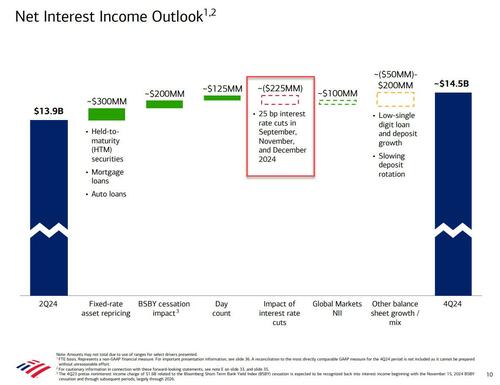

What was far more important is that for yet another quarter, Net Interest Yield dropped, sliding to 1.93% from 1.99% and missing the 1.95% estimate, as a result of “higher deposit costs.” Net Interest Income also missed, dropping to $13.7BN, below the $13.8BN estimate, dropping from $14.0BN and the lowest in years. This is how BofA explained the drop:

- NII decreased $0.5B YoY, as higher deposit costs more than offset higher asset yields, higher NII related to Global Markets (GM) activity, and modest loan growth

- Decreased $0.3B from 1Q24, driven primarily by higher deposit costs

- NII related to GM activity increased approximately $0.5B YoY and $0.1B from 1Q24

Curiously, while BofA conceded the disappointing Net Interest Income, it projected a very solid jump in the second half, one which would push it from $13.9BN (on FTE basis) to $14.5BN, with gains coming from Held to Maturity securities ($300MM), and slowing deposit rotation (up to $200MM), offset by a surprising forecast: a $225MM in NII decline due to no less than 3 rate cuts in the second half, in September, November and December!

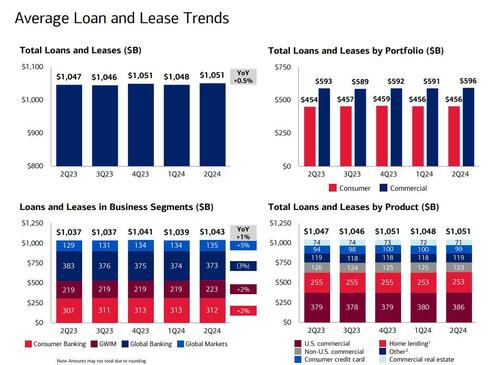

Taking a closer look at the balance sheet, we find that BofA’s Q2 loans rose to $1.057 trillion, above the estimate of $1.05 trillion and higher both sequentially and YoY…

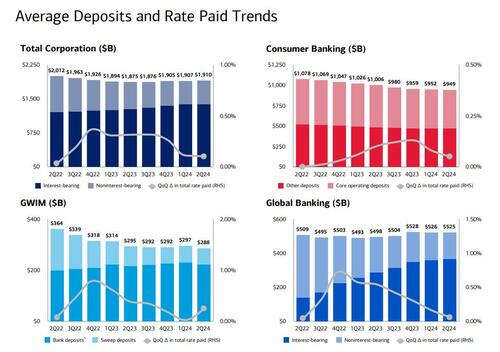

…. while total deposits $1.91 trillion, came in below the estimate of $1.93 trillion, and were a decline compared to Q1 as a result of the Fed’s balance sheet tapering which implicitly drains liquidity from the market.

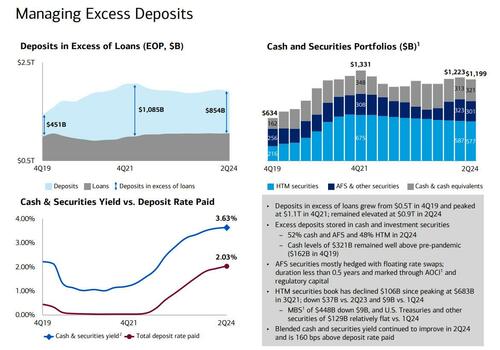

BofA was kind enough to show once again that the Fed’s massive excess reserves have ended up in what we first correctly described over a decade ago: the bank’s deposits in excess of loans, which in Q2 amounted to $854 billion, down from a record high of $1.1 trillion in Q4 2021. Here are some more details:

- Deposits in excess of loans grew from $0.5T in 4Q19 and peaked at $1.1T in 4Q21; remained elevated at $0.9T in 2Q24

- Excess deposits stored in cash and investment securities

- 52% cash and AFS and 48% HTM in 2Q24

- Cash levels of $321B remained well above pre-pandemic ($162B in 4Q19)

- AFS securities mostly hedged with floating rate swaps; duration less than 0.5 years and marked through AOCI and regulatory capital

- HTM securities book has declined $106B since peaking at $683B in 3Q21; down $37B vs. 2Q23 and $9B vs. 1Q24

- MBS of $448B down $9B, and U.S. Treasuries and other securities of $129B relatively flat vs. 1Q24

- The blended cash and securities yield was 160 bps above deposit rate paid in Q2

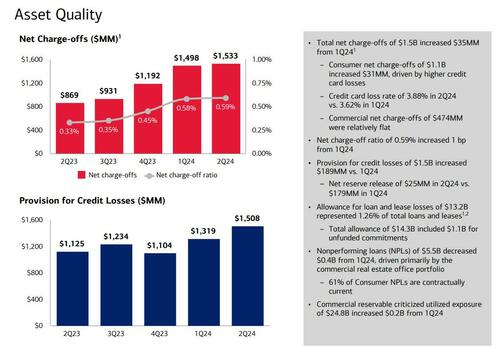

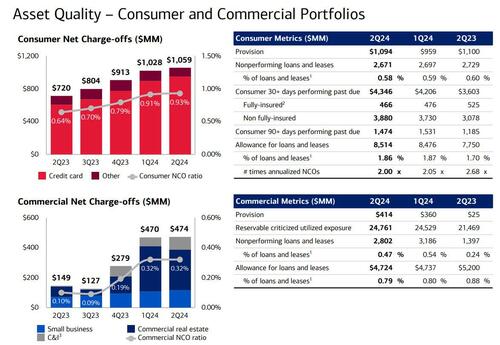

A much more concerning red flag emerges when looking at the bank’s asset quality: here we find that total net charge offs rose $35MM to $1.533BN, much higher than the $1.45BN expected, and the highest in years, driven by higher credit card losses. According to the bank, credit card loss rate jumped to 3.88% in 2Q24 vs. 3.62% in 1Q24. The bank’s provision for credit losses also jumped by $189 million to $1.5B sequentially; however the reserve release component was just $25MM in 2Q24 vs. $179MM in 1Q24. Expect this number to surge as the US economy slides into contraction, and as everyone imitated JPM which saw its reserve build spike in Q2.

There was a silver lining: BofA reported that nonperforming loans (NPLs) of $5.5B decreased $0.4B from 1Q24, driven primarily by the commercial real estate office portfolio.

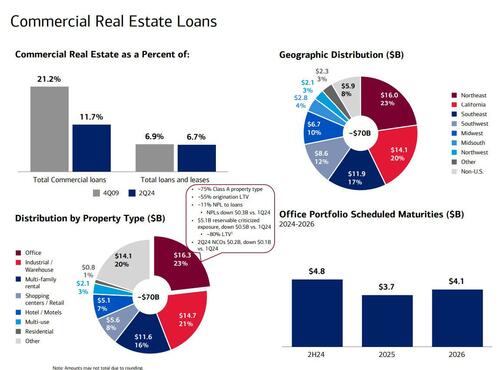

And speaking of BofA’s CRE exposure, the bank dedicated a slide to recent developments here. Not surprisingly, while CRE as a percent of total loans has declined notably (from 21.2% in 2009 to 11.7% in Q2 24), it is effectively unchanged as a % of total loans and leases. And furthermore, the single largest CRE loan type remains the deeply stressed Office, which amounts to $16.3 billion (mostly among Northeast and California properties). And here is the big deal that nobody has noticed, and which could shock BofA stock in coming years. The bank projects $4.8BN in office maturities in H2 and another $8BN in 2025 and 2026. Good luck collecting these!

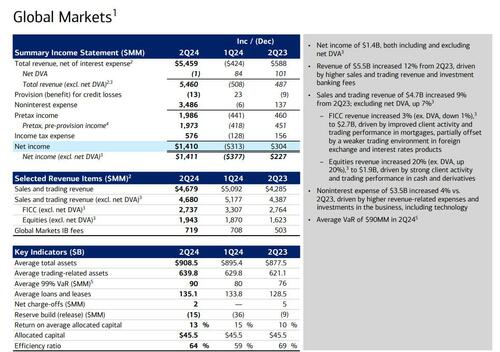

While none of that is good, there was some good news for BofA’s global markets where equity trading revenue beat as FICC missed again.

- Trading revenue excluding DVA $4.68 billion, beating estimate $4.53 billion

- FICC trading revenue excluding DVA $2.74 billion, missing estimate $2.8 billion

- Equities trading revenue excluding DVA $1.94 billion, beating estimate $1.73 billion

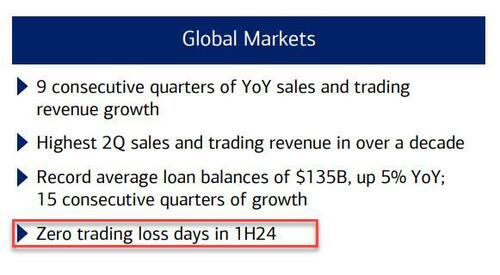

Some more details from the report:

Revenue of $5.5B increased 12% from 2Q23, driven by higher sales and trading revenue and investment banking fees

- Sales and trading revenue of $4.7B increased 9% from 2Q23; excluding net DVA, up 7%3

- FICC revenue increased 3% (ex. DVA, down 1%) to $2.7B, below the $2.8BN expected, “driven by improved client activity and trading performance in mortgages, partially offset by a weaker trading environment in foreign exchange and interest rates products“

- Equities revenue increased 20% (ex. DVA, up 20%) to $1.9B, beating estimates of $1.7BN, and “driven by strong client activity and trading performance in cash and derivatives“

- Noninterest expense of $3.5B increased 4% vs. 2Q23, driven by higher revenue-related expenses and investments in the business, including technology

Just how good is BofA’s market division: Here’s the answer.

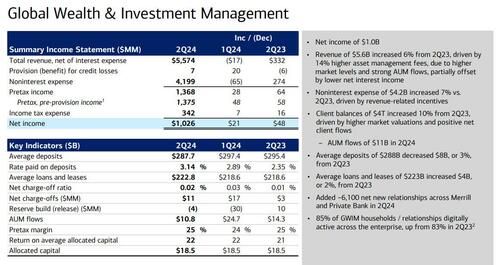

But if markets was solid, Wealth and Investment Management disappointed, with revenue of $5.57BN dropping sequentially, and just below estimates, with Net Interest Income once again blamed. Some more details:

- Client balances of $4T increased 10% from 2Q23, driven by higher market valuations and positive net client flows

- AUM flows of $11B in 2Q24;

- Average deposits of $288B decreased $8B, or 3%, from 2Q23

- Average loans and leases of $223B increased $4B, or 2%, from 2Q23

- Added ~6,100 net new relationships across Merrill and Private Bank in 2Q24

- 85% of GWIM households / relationships digitally active across the enterprise, up from 83% in 2Q232

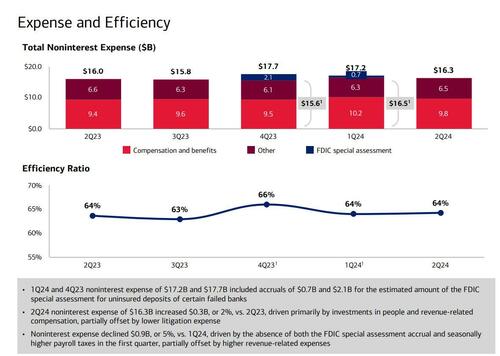

Turning to the expense side of the business, things here were no better as compensation expenses rose to $9.83 billion, above estimates of $9.77 billion, while total non-interest expenses $16.31 billion also printed higher than the estimate $16.3 billion, if below last quarter’s $17.2 billion.

And while we expect the market to realize just how painfully the under-reserves BofA will be hit in coming years as the bulk of its office loans default in the coming years, until then, here is a dose of optimism from CEO Brian Moynihan who said that “the strength and earnings power of our leading consumer-banking business is complemented by the growth and profitability of our global markets, global banking, and wealth-management businesses.”

Clearly this was enough for the generally dumb market to be convinced that all is well, and BofA stock is now up 4% having already gained 24% this year through Monday. It appears that the pain is deferred until late 2024 and early 2025, some time after the Trump admin takes over.

The full BofA Investor presentation can be found here: Link.

Tyler Durden

Tue, 07/16/2024 – 10:24

via ZeroHedge News https://ift.tt/fAZLx0N Tyler Durden