Germany’s (Lack Of) Defense Spending Will Start An Immediate Clash With Trump

Authored by Mike Shedlock via MishTalk.com,

Germany’s defense minister asked for an increase of $7.3 billion. He was given only $1.2 billion. German aid to Ukraine is cut in half.

Germany Promised to Step Up Militarily

The New York Times reports the non-surprise of the day: Germany Promised to Step Up Militarily. Its Budget Says Differently.

Two-and-a-half years after Chancellor Olaf Scholz vowed to overhaul Germany’s military, his government’s proposed budget for 2025 calls for only a modest increase in defense spending.

With the war in Ukraine grinding on, Russia continuing to saber-rattle and Donald J. Trump gaining momentum for a return to the White House, Germany has been under increasing pressure from its allies to step into a more robust security role.

To live up to that pledge, Boris Pistorius, Germany’s defense minister, had asked for an increase of 6.7 billion, or $7.3 billion, over the 52 billion euros, or nearly $57 billion, in this year’s budget. He was given only 1.2 billion. The shortfall deepened concerns that Mr. Scholz’s unpopular government lacks the will or political backing to push Germans to overcome their historical reluctance to take the lead militarily since the calamity of World War II.

The budget, which has to pass Parliament before being adopted, also proposes that Germany cut its military aid to Ukraine by half in 2025.

Mr. Trump has repeatedly complained about the European allies not paying their fair share in the NATO alliance, and said that he would “encourage” Russia “to do whatever the hell they want” to countries that had not paid the money they owed.

Aid to Ukraine and NATO

Germany is the second largest contributor to Ukraine. That contribution will be cut in half.

Senator J.D. Vance, Trump’s Vice President running mate, is an open critic of aid to Ukraine.

Trump won’t care much about the cut to Ukraine other than to welcome it. But expect an immediate confrontation over Germany’s military spending and contribution to NATO.

Debt Brakes and Treaty Requirements About to Smash the EU

On June 21, I commented Debt Brakes and Treaty Requirements About to Smash the EU

Long Term Fiscal Issues

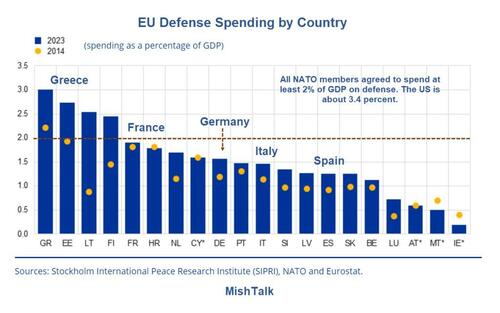

In addition to the Excessive Debt Proceedings against many countries, every EU county has defense spending issues, climate spending issues, and demographic issues as shown in the lead chart.

EU’s Golden Rules

According to the reformed rules, an EU member state’s debt may not exceed 60% of gross domestic product (GDP).

Highly indebted EU countries with debt levels over 90% of GDP have to reduce their debt ratio by one percentage point annually, countries

Additionally, the general government deficit — the shortfall between government revenue and spending — must be kept below 3%.

According to the commission’s economic forecast, France is at -5.5%, Italy is at -4.4% and Belgium is at -4.4% and will breach this deficit limit in 2024.

Austria, Finland, Estonia, Hungary, Malta, Poland, Romania, and Slovakia also have deficits that are too high according to the rules. Spain is at exactly -3.0%.

France in the Crosshairs of Budget and Debt Rules

France is in the immediate crosshairs of EU deficit rules and debt rules.

Please note the EU Rebukes France, Italy and Others Over Excessive Debt.

The assessments of the 27 EU states’ budgets and economies will be published by the European Commission on Wednesday, with France, Italy and Belgium among the member states to be reprimanded over their accumulated excessive new debt.

The Commission said it was satisfied that “the opening of a deficit-based excessive deficit procedure is warranted” in the case of seven countries. The group also included Hungary, Malta, Poland and Slovakia.

The EU suspended debt and deficit regulations to help countries cope with the economic fallout of the COVID-19 pandemic and Russia’s invasion of Ukraine.

The rules are now back in place and now any EU country going over debt and deficit limits run the risk of legal action.

Long-Term Challenges

Also consider the ECB report Longer-Term Challenges for Fiscal Policy in the Euro Area

In the future, various longer-term challenges are likely to exert pressure on public finances in the euro area. On top of the existing fiscal burdens – as reflected in the high debt ratios in a number of euro area countries, which were exacerbated by the pandemic and the subsequent energy crisis – there are several important longer-term challenges for fiscal dynamics. This article starts by reviewing some of the most important challenges and discussing their fiscal relevance, with a focus on demographic ageing (Section 2), the end of the “peace dividend” (Section 3), digitalisation (Section 4) and climate change (Section 5). Acknowledging the uncertainties surrounding any quantification of these challenges, Section 6 then presents some tentative – purely indicative – estimates of the additional fiscal effort that could be required to ensure the long-term sustainability of public finances in the presence of such developments. The implications of digitalisation are excluded from that exercise, given the particular uncertainty that surrounds their quantification. Section 7 then provides some concluding remarks.

Cumulative Impact

Achieving a government debt-to-GDP ratio of 60% by 2070 from today’s debt levels would require euro area governments to immediately and permanently increase their primary balances by 2% of GDP on average.

Moreover, additional fiscal burdens may well emerge in the medium term. For instance, the model-based simulations used in this article exclude the digitalisation gap, the long-term implications of which are still hard to grasp. Furthermore, one does not need to go back very far in time to find a large fiscal shock appearing out of the blue: the euro area’s government debt-to-GDP ratio increased by a total of 13 percentage points in 2020 in response to the COVID-19 pandemic. At the same time, the simulation of climate change is based on simplified assumptions and on the unlikely premise that limiting global warming to 1.5°C is still feasible. It also does not capture the impact of societal repercussions (such as conflict), tipping points or macroeconomic effects (such as changes to prices and productivity). This suggests that there could be substantial additional fiscal costs associated with climate change.

Fiscal Costs of the End of the “Peace Dividend”

After Russia’s annexation of Crimea in 2014, all NATO members agreed to spend at least 2% of GDP on defense.

Germany and France have reduced their spending from over 4% of GDP to less than 2% today.

Expect Major Trumpian Confrontation Fireworks

Macron wants an EU army and more support for Ukraine. But that will not happen because France is under severe budget constraints.

Germany can afford to spend more and pledged to do more, yet refuses to do so. Trump rates to be more than a little irate.

Expect fireworks because they are coming. And those defense spending fireworks will be on top of tariff fireworks.

Meanwhile, Back in the States a Recession has Started

Note that 5 out of 12 Fed Districts Show Flat or Declining Economic Growth

The Fed’s Beige Book solidifies the recession view.

Recession When?

I think a recession started in May or June and I have seen little to change my mind.

For discussion, please see Weak Data Says a Recession Has Already Started, Let’s Now Discuss When

Add a Surge in Continued Unemployment Claims, discussed today, to the trend of weakness appearing nearly everywhere.

Tyler Durden

Sat, 07/20/2024 – 08:10

via ZeroHedge News https://ift.tt/hzEgebw Tyler Durden