Ethereum ETFs Are Coming – Here’s What You Need To Know

Authored by Alex O’Donnell via CoinTelegraph.com,

After years of regulatory pushback and countless amended registration filings, spot Ether exchange-traded funds (ETFs) are finally hitting the market.

For the first time, shares of publicly-traded Ethereum (ETH) ETFs will be listed alongside the likes of Apple Inc (AAPL) and SPDR S&P 500 ETF Trust (SPY) on some of the United States’ most popular brokerage platforms.

The anticipated listings are a defining moment for cryptocurrency markets and an opportunity for millions of US institutional and retail investors. Here’s what you need to know to make the most of it.

When will spot Ether ETFs be available?

The Chicago Board Options Exchange (CBOE) confirmed July 23 as the launch date for the five ETFs assigned to trade on its platform: 21Shares Core Ethereum ETF, Fidelity Ethereum Fund, Invesco Galaxy Ethereum ETF, VanEck Ethereum ETF, and Franklin Ethereum ETF.

The four other spot ETH ETFs will trade on either Nasdaq or New York Stock Exchange (NYSE) Arca. Despite no official announcements yet from those exchanges, they are widely expected to list on July 23 as well.

Where can I buy Ethereum ETF shares?

The short answer: virtually any major brokerage platform. Every spot ETH ETF set to list in the last week of July has already obtained regulatory sign-off to trade on at least one major U.S. exchange — specifically either the Nasdaq, the New York Stock Exchange (NYSE) Arca or Cboe BZX.

Everyday investors don’t trade directly on those exchanges. Instead, they rely on brokerage platforms — household names such as Fidelity, E*TRADE, Robinhood, Charles Schwab, and TD Ameritrade — as intermediaries.

Once ETH ETF shares are listed on public exchanges, expect all of the big name brokerages, and others, to be able to facilitate trades.

What are my options and how do I know which is best?

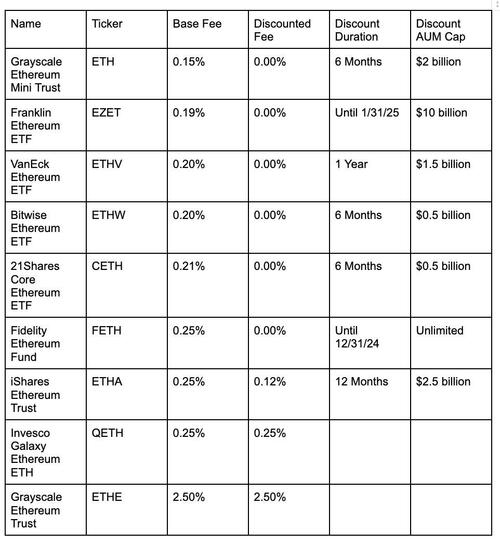

Nine spot Ether ETFs are set to begin trading. In terms of underlying mechanics, the funds are virtually identical. Every ETF is sponsored by a reputable fund manager, holds spot ETH with a qualified custodian, and relies on a core group of professional market-makers to create and redeem shares. They also all benefit from the same standard investor protections, including insurance against brokerage failures and cybersecurity risks.

For most investors, the deciding factor boils down to fees. For eight of the nine ETFs, management fees range from 0.15% to 0.25%. The one big exception is Grayscale Ethereum Trust (ETHE), which started trading under a different fund structure in 2017 and still charges management fees of 2.5%.

Comparison of the first nine spot Ethereum ETFs.

Most — but not all — of the Ethereum ETFs are temporarily waiving or discounting fees in a bid to woo investors. Greyscale Ethereum Trust is again among the big outliers here, along with Invesco Galaxy Ethereum ETF (QETH).

Ironically, the clear frontrunner in the fee race is also a Grayscale product. The Grayscale Ethereum Mini Trust (ETH) — a newer fund created specifically to list as an ETF — has management fees of only 0.15%. Those fees are waived entirely for the first six months after listing, or until the fund hits $2 billion in assets under management (AUM).

Another compelling choice is Franklin Templeton’s Franklin Ethereum ETF (EZET). At 0.19%, its management fees are the second lowest of the bunch, and they are fully waived through January 2025 or until the fund clears $10 billion in AUM.

Will spot Ether ETFs offer staking?

The short answer here is “No.” The longer answer: “Maybe, but not anytime soon.”

As a refresher, staking involves depositing ETH to a validator node on Ethereum’s Beacon Chain. Staked ETH earns a cut of network fees and other rewards but also risks “slashing” — or forfeiting staked collateral — if the validator misbehaves or fails.

Staking is attractive because it significantly boosts returns. Annual rewards rates stand at around 3.7% as of July 19, according to StakingRewards.com.

Earlier this year, several issuers — including Fidelity, BlackRock and Franklin Templeton — sought regulatory signoff to add staking to spot ETH ETFs. The SEC denied those requests.

The issue boils down to liquidity, according to several people involved in the talks who spoke to Cointelegraph on the condition of anonymity. Staked ETH usually takes days to withdraw from Beacon chain. That’s a problem for issuers, who are required to promptly redeem ETF shares for underlying fund assets on request.

Issuers are still exploring ways to add staking to the current crop of spot ETH ETFs — possibly by maintaining a “buffer” of liquid spot Ether — but a workable plan is months away at best, the people told Cointelegraph. For now, staking is off the table for Ether ETFs.

Ether could hit a new all-time high after next week’s ETH ETF launch

Ether’s price could be on track to a new all-time high after the launch of the first United States spot Ether ETFs, according to Matt Hougan, chief investment officer of Bitwise.

Hougan cited three main reasons for Ether reaching a new all-time high, including ETH’s inflation rate, the fact that Ether stakers aren’t selling like Bitcoin miners and that 28% of Ether supply is already out of the market.

In a July 16 blog post, Hougan wrote:

“Ethereum’s inflation rate over the past year is exactly 0% […] Significant new demand meets 0% new supply? I like that math. And if activity on Ethereum ticks up, so does the amount of ETH being consumed. That’s another lever of organic demand working in investors’ favor.”

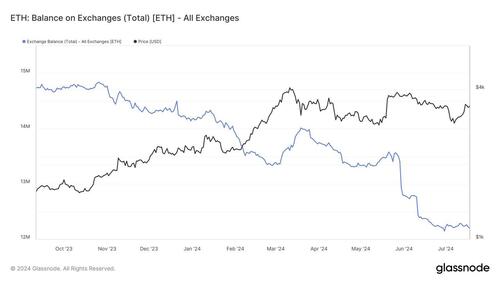

Other factors also point to an incoming rally, including the number of Ether withdrawals from centralized exchanges, according to crypto analyst Leon Waidmann.

The analyst wrote in a July 19 X post:

“$126M worth of ETH was withdrawn from exchanges this week, signaling massive accumulation ahead of the ETF launch. Next big ETH rally incoming.”

ETH: Balance on exchanges (total). Source: Leon Waidmann

$3,500 remains formidable resistance

However, Ether futures suggest little confidence in the chance of Ether breaking above the $4,000 mark in the short term, as the $3,500 mark remains a significant resistance zone.

Ether’s relative strength index (RSI) also suggests that Ether’s price needs to cool down before rallying to a new all-time high. On the daily chart, Ether’s RSI rose to 58, which suggests that the asset is not yet overbought but is trading above its fair value, according to TradingView data.

ETH/USD, RSI, 1-day chart. Source: TradingView

The RSI is a popular momentum indicator used to measure whether an asset is oversold or overbought based on the magnitude of recent price changes.

Ethereum shakeout could happen first

Ether’s price could first see a sell-the-news event after the initial ETF launch before starting its sustained rally toward new all-time highs.

Hence, the real opportunity to invest in Ether long term could come after the first few weeks of the ETF debut, according to Alvin Kan, chief operating officer of Bitget Wallet.

Kan told Cointelegraph:

“Similar to how the market reacted when BTC spot ETFs got approved, we expect ETH to jump in price for a short time after its own ETF gets the green light. However, there might be followed by some selling pressure for a week or two afterward, as a result of outflows from instruments like Grayscale’s ETF.”

ETH’s price will be able to climb in a more sustained manner after the initial shakeout, added Kan:

“Once this initial shakeout is over, the price of ETH could start to climb steadily each month, depending on the daily inflows into the new ETH spot ETF.”

Other analysts expect the Ether ETF to have wider ramifications on the altcoin market. For instance, popular crypto trader Mikybull expects the ETFs to catalyze the next altcoin bull market cycle.

The trader wrote in a July 19 X post:

“ETH ETFs will be the major catalyst for a massive rally sparking a huge Alts season in this cycle.”

ETH/USD, 2-month chart. Source: Mikybull

Ether’s price rallied over 11% during the past week, but ETH is still trading 29% below its old all-time high of $4,890 reached in November 2021.

Tyler Durden

Mon, 07/22/2024 – 07:20

via ZeroHedge News https://ift.tt/uacskBJ Tyler Durden