A Lot Of Moving Parts…

Authored by Peter Tchir via Academy Securities,

As stocks resumed their sell-off on Wednesday, with the S&P finally closing 2% lower in a single session, there are a few things to point to and highlight.

De-Grossing, Rotation versus De-Risking

This was the focus of this weekend’s Know When to Fold ‘Em report.

We continue to see quant/systematic/CTA strategies as major sources of ongoing selling. These strategies tend to be very “momentum” driven and tend to increase their position size as they are working. Whether it is owning stocks, or putting on flatteners (both of which are purported to be big trades within this subset of the investing world), they tend to add as they are winning. They tend to act as “stop loss seeking” trades. They push and push, investors betting against these trades get sopped, they push more, etc. It is extremely successful (and we continue to argue was the major reason 10’s hit 5% last autumn). They are also very quick and remorseless when cutting positions. Very little “hemming and hawing” – triggers get hit, they close out. Look for more pressure on equities and less inversion in 2s vs 10s as these trades get unwound.

Vol targeting funds, anything from sophisticated risk parity strategies, to 60/40 strategies may also be getting forced to sell stocks and even longer dated bonds. In a simple, two asset vol targeting strategy (where positions are designed to have a certain expected volatility at the portfolio level), there are 3 things that are important. The volatility of each asset class and the correlation of the 2 asset classes. While it may be counterintuitive, shifting correlations are usually the biggest driver. It is also far worse for expected portfolio vol when only one asset class sees a major spike in vol, if the assets are negatively correlated. So as VIX goes higher, with the MOVE index (a measure of treasury vol) remaining well below recent highs, it should cause vol targeting funds to sell stocks and likely bonds (de-risking). These parameters are not necessarily adjusted daily but expect more selling pressure form this category of investors.

Retail has been plowing money into the stock market. That has slowed, but there is zero evidence of any sort of major profit taking or fear from retail, which, is often triggered only after further declines.

Vol selling, as a strategy has blossomed in recent years (the zero day to expiration option market has been a factor in this growth). This strategy can often be viewed as picking up nickels in front of a steam roller. Now, for quite an extended period, the strategies have picked up a LOT of nickels, but are they being tested? Outflows from these strategies will suppress volatility selling, which should lead to more volatility, and given current positioning, likely more equity downside.

AI Cost versus Benefit

We all know the cost of implementing any sort of AI strategy has been increasing rapidly over the past year (chip shortages, etc.). While every AI implementation strategy was cheered by stock investors, we may finally be seeing the first signs that markets question if the cost of AI hasn’t outpaced the benefits of AI for the moment.

Jobs

The BLS updated their Q4 data and showed about 300k fewer jobs than originally estimated. This is above and beyond the “monthly” revisions – which continue to be amazingly skewed to the downside (amazingly, as the law of averages would not predict the number of downward revisions versus upward revisions, nor the relative size of such revisions).

We have pointed out that the Birth/Death Model is Distorting the jobs reports. The argument has been that the model has been an increasingly large percentage of total jobs (and in some months, without it, we would have had negative job growth). When a model, or “plugged number” becomes a disproportionately large part of the number you are trying to estimate, you should be worried.

Add to that our thesis, that seasonal adjustments, which take years to change, are wrong and have been overstating jobs in Q1 and will hurt jobs in Q3. The basic argument is that the adjustments still are biased towards weather and living patterns that have changed a lot (the demographic move away from places with cold winters, to those with hot summers, is not fully captured in current adjustment process and will contribute to weaker than expected reports this summer).

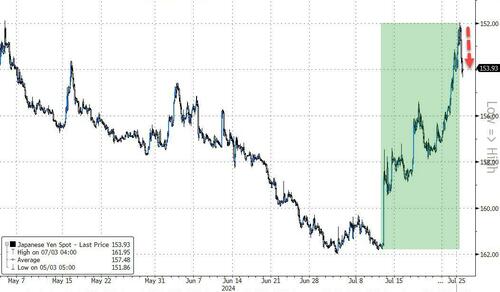

The Yen

Lot of chatter about “carry trades” and what influence the rapidly appreciating Yen might have on global asset prices. It has gone from 162 as recently as July 11th, to 152 as I type this morning.

I don’t have a strong view on this, but am paying some attention, as it is coming up repeatedly in conversations.

Bottom Line

More de-risking.

We are still looking for an improving PCE report (progress on inflation, etc.), but let’s not forget, the first leg of this tech sell-off occurred on what was a favorable CPI report. So whatever equity bounce we get on the headline (if it is good data) is likely to be just another opportunity to sell.

Treasuries almost got back to our 4.3% to 4.5% range on 10’s yesterday. Yields are lower again, but the spread between 2s and 10s, at -14, is hovering around the least inverted number in 2 years, and we continue to have “normal” curves as a target.

Credit should weaken a touch in sympathy with equities heading lower, but should outperform significantly!

Good luck and so much for a nice “quiet” summer week!

Tyler Durden

Thu, 07/25/2024 – 14:05

via ZeroHedge News https://ift.tt/mYtEGVW Tyler Durden