“Create Some Unwelcome” Noise: Universal Music Crashes 30% On Streaming Revenue Woes

Shares of Universal Music Group plummeted up to 30% in Amsterdam on Thursday after the world’s largest record label, representing top artists like Taylor Swift, Billie Eilish, Drake, Adele, and Ariana Grande, reported disappointing second-quarter earnings. The report fell short of investor expectations regarding subscription and streaming revenue growth.

Universal’s second-quarter report showed subscription revenue in recorded music grew 6.5% year-over-year, or 6.9% in constant currency, missing the Bloomberg estimate of surveyed analysts for growth of 11%.

- Recorded Music subscription revenue grew 6.5% year-over-year, or 6.9% in constant currency and streaming revenue decreased 4.2% year-over-year, or 3.9% in constant currency, while physical revenue grew 9.5% year-over-year, or 14.4% in constant currency and license and other revenue grew 18.0% year-over-year on both a reported and constant currency basis

On an earnings call, Chief Financial Officer Boyd Muir told investors that Spotify and YouTube’s weak advertising revenue growth were some of the major drivers of softer sales. He said there are emerging roadblocks with social media platforms becoming major music distributors.

Universal Music has been pushing for platforms to compensate artists fairly and has advocated for a new streaming royalty model. The company started pulling its music from ByteDance Ltd.-owned TikTok in February after talks to extend a licensing deal failed. In May, it reached a deal with TikTok that included better pay for songwriters and artists, new promotional agreements and protections against AI-generated music. -Bloomberg

Here’s a snapshot of second-quarter results:

-

Revenue EU2.93 billion, +8.7% y/y, estimate EU2.88 billion (Bloomberg Consensus)

-

Recorded Music revenue EU2.20 billion, estimate EU2.22 billion

-

Music Publishing revenue EU511 million, estimate EU519.9 million

-

Merchandising & Other revenue EU227 million, estimate EU165.4 million

-

Ebitda EU580 million, estimate EU591.4 million

-

Adjusted Ebitda EU649 million, estimate EU641.4 million

-

Adjusted Ebitda margin 22.1%, estimate 22.3%

-

Revenue in constant currency +9.6%, estimate +8.14%

-

Recorded Music revenue in constant currency +6.8%, estimate +7.05%

-

Music Publishing revenue in constant currency +10.4%, estimate +11.2%

-

Merchandising & Other revenue in constant currency +43.7%, estimate +6.24%

-

Net income EU625.0 million

Here are first-half results:

-

Ebitda EU1.07 billion, estimate EU1.08 billion

-

Recorded Music Ebitda EU959 million, estimate EU942 million

-

Music Publishing Ebitda EU229 million, estimate EU238.4 million

-

Merchandising & Other Ebitda EU18 million, estimate EU21.9 million (2 estimates)

Shares in Amsterdam plunged as much as 30% today.

Citi analysts told clients that the results “undermine” what had been seen as defensive growth credentials. Citi, Barclays, and Guggenheim removed positive stances on the company, while Kepler Cheuvreux downgraded.

More from Wall Street analysts (courtesy of Bloomberg):

Citi (neutral vs buy)

- Analyst Thomas Singlehurst says the mix was radically different from expectations, with 2Q Streaming & Subscription constant currency growth meaningfully below

- Main concerns are unprecedented level of volatility between different revenue lines, and that cash conversion appears to have got worse

- While sources of volatility may only be temporary, sentiment may be hit until there is evidence of re-acceleration in growth and inflection in cash flow

- Results undermine defensive growth credentials

Cowen (buy)

- Results beat on revenue and profitability, but subscription streaming growth a meaningful miss and ad-supported streaming performance also disappointed, analyst Doug Creutz writes

- While still confident in the long-term growth trajectory, the 2Q results “create some unwelcome” noise

Morgan Stanley (overweight)

- Analyst Ed Young says revenue miss, and unexpected deceleration, in Subscription and Streaming within Recorded Music likely to be key focus

- This was offset by revenue beats elsewhere, which does highlight diversified sources of growth

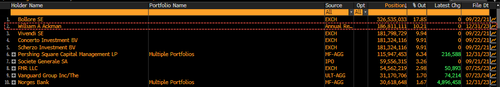

Meanwhile, Bill Ackman’s Pershing Square holds a 10% stake as the second largest shareholder of the music group.

Oops.

Tyler Durden

Thu, 07/25/2024 – 07:45

via ZeroHedge News https://ift.tt/92VRUFs Tyler Durden