“Little Cash On The Sidelines” May Indicate Firepower To Sustain Equity Rally Diminishes

While Goldman Sachs flow of funds expert Scott Rubner issued a ‘correction watch‘ on major US equity indexes ahead of the Superbowl of earnings for Mag7 stocks, analysts at BCA Research have informed clients that US stocks “will soon peak, and a bear market will commence.”

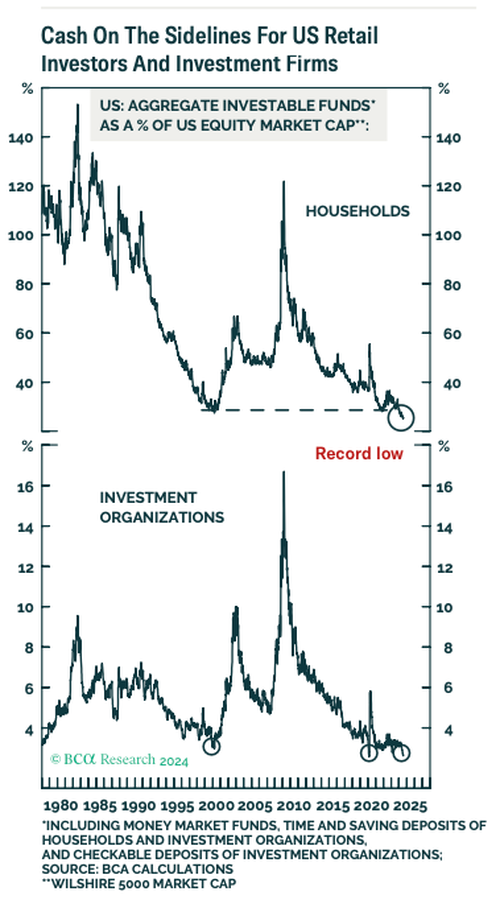

Arthur Budaghyan leads the team at BCA Research, which published the note “Little Cash On The Sidelines” for clients on Wednesday. The rationale behind peaking stocks is record low levels of “cash on the sidelines” for US retail investors and investment firms, which only suggest “there is little firepower.”

Budaghyan begins the note by explaining “cash on the sidelines,” as the percentage of the US equity market cap has slid to a record low, suggesting limited flows into securities markets, such as equities and government bonds.

Given this view, Budaghyan stated, “The odds are that US stocks will soon peak, and a bear market will commence. Global asset allocators should overweight government bonds versus stocks. A sizable allocation to US dollar cash is also warranted.”

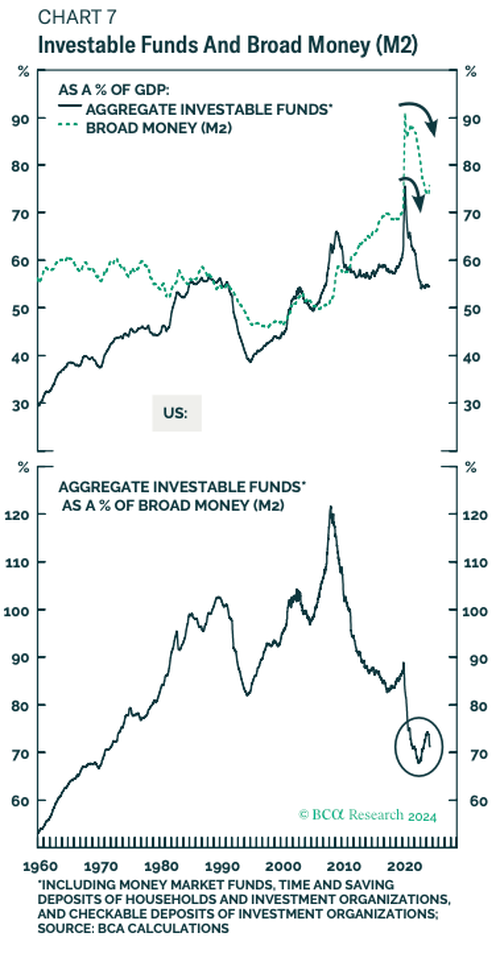

To clarify what happened to the sideline cash, Budaghyan said, “The aggregate amount of investable funds is still large in absolute terms, though it has stagnated as the Fed reduced its asset holdings.”

Additionally, investable funds have declined as the Fed’s quantitative tightening has reduced the money supply.

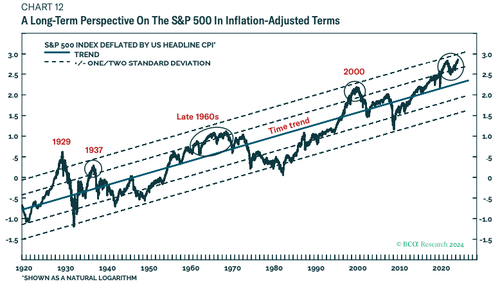

For the technicians…

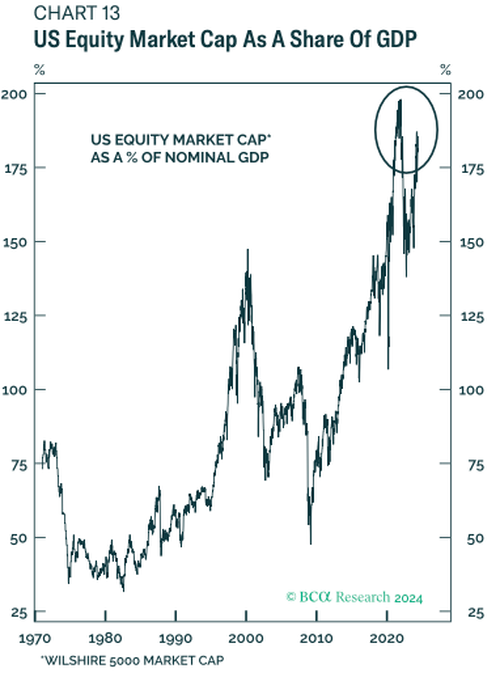

The conclusion here is that the low ratio of investable funds and the overvalued US equity market could be a tipping point in the equity market rally powered by AI themes.

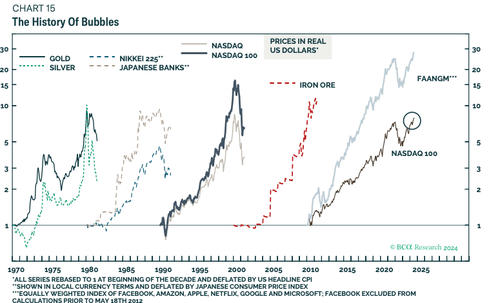

History of bubbles.

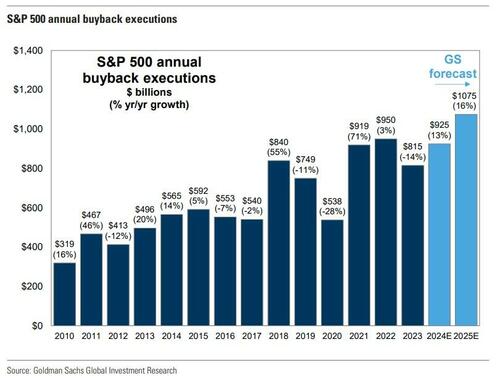

Meanwhile, keeping the lofty valuations alive has been record stock buybacks from megacorps like Apple, Microsoft, Alphabet, and Nvidia, dominate buybacks. For example, Apple’s buyback program will account for 10% of 2024 buybacks.

As noted earlier, Goldman’s Rubner maintains a ‘correction watch’ for stocks.

Tyler Durden

Thu, 07/25/2024 – 13:45

via ZeroHedge News https://ift.tt/QzycgLF Tyler Durden