Big Mac Demand Drops At Micky D’s As Same-Store Sales Slide For First Time Since 2020

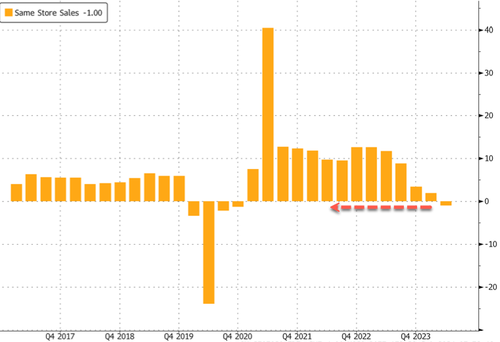

McDonald’s reported disappointing Q2 results, missing both the average earnings and revenue expectations tracked by FactSet. The largest fast-food chain in the country reported the first quarterly decline in same-store sales since Q4 2020, as sliding Big Mac demand is evident of low and mid-tier consumers being squeezed by elevated inflation and sky-high interest rates produced by failed Bidenomics.

“We are confident that Accelerating the Arches is the right playbook for our business and as consumers are more discriminating with their spend, we are focused on the outstanding execution of delivering reliable, everyday value and accelerating strategic growth drivers like chicken and loyalty,” MCD Chairman and CEO Chris Kempczinski wrote in a press release.

McDonald’s reported adjusted earnings of $2.97 per share for the quarter, down from $3.17 one year ago. This missed the average analyst estimate of $3.07 tracked by FactSet. Revenue was flat at around $6.49 billion, falling short of the average analyst estimate of $6.62 billion.

For the April-June period, sales at burger shops fell 1% worldwide. This was the first decline since Q4 2020, when the government-enforced shutdown and panic doom broadcasted by MSM kept everyone out of stores and hiding in their homes. In the US, same-store sales fell about 1%.

Here’s a snapshot of the second quarter financial performance (courtesy of MCD):

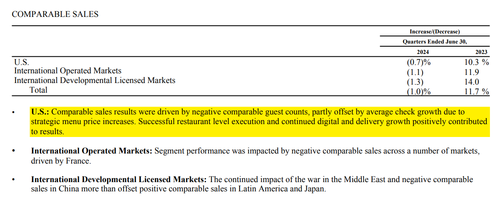

Global comparable sales decreased 1%, reflecting negative comparable sales across all segments:

-

US decreased 0.7%

-

International Operated Markets segment decreased 1.1%

-

International Developmental Licensed Markets segment decreased 1.3%

Continues:

-

Consolidated revenues were flat (increased 1% in constant currencies).

-

Systemwide sales decreased 1% (increased 1% in constant currencies).

-

Consolidated operating income decreased 6% (5% in constant currencies). Results included $97 million of pre-tax non-cash impairment charges and $57 million of pre-tax restructuring charges associated with Accelerating the Organization. Excluding these current year charges, as well as prior year pre-tax charges of $18 million, consolidated operating income decreased 2% (was flat in constant currencies).**

-

Diluted earnings per share was $2.80, a decrease of 11% (10% in constant currencies). Excluding the current year charges described above of $0.17 per share, diluted earnings per share was $2.97, a decrease of 6% (5% in constant currencies) when also excluding prior year charges.**

Here’s more color on comparable sales:

Same-store sales in Q2 have slipped into negative territory for the first time since Q4 2020.

Goldman’s Eric Mihelc and Scott Feiler’s take on MCD’s earnings this morning is as follows for their clients:

MCD +0.5%…Missed both comp sales/EPS as expected but focus is on recent/forward trends From Scott: “I am not arguing it’s good (it’s not), but the comps at -1% in total and -0.7% in the US are sort of in-line with where most expectations/bogies were into the quarter. The big factor for the stock will depend on what they say about QTD and the reception to the value launch (end of June) when they speak on the call. The print alone is not a huge surprise and likely won’t have a big impact to MCD shares or the group. Details: 2Q EPS of $2.97 vs Consensus $3.07, with total comps -1% vs Consensus +0.4% and US comps -0.7% vs Consensus +0.5% (we think bogey was -1%). International comps missed as well.

Here’s what other Wall Street analysts are saying about MCD’s ER (courtesy of BBG):

Bernstein (market perform), Danilo Gargiulo

- “Despite missing on consensus, McDonald’s results were better than feared, especially in the US where the contraction was a mere -0.7% same store sales growth,” Gargiulo writes

- He’s looking to gain a better understanding on the main cause of the international markets slowness and the “path toward recovery”

Citi (neutral) Jon Tower

- US comps are “slightly better than feared,” as many investors were anticipating negative low-single digits, though IOM missed Citi/Street estimates by a “wide mark,” Tower writes

- Adjusted Ebit was also a miss, with G&A expense a 5% headwind vs his estimate

- Expects management comments on call to be “cautious” regarding the current state of the global consumer, with “value initiatives likely improving traffic, but mix a major headwind”

- Consensus estimates are likely to move lower, and shares are likely to continue seeing pressure in the near term

Baird (outperform), David Tarantino

- “The company held guidance ranges for key operating metrics (including unit growth, EBIT margin), but we expect a more muted comps outlook to lead to a slight downward revision to 2024-2025 EPS estimates,” Tarantino writes

- Sensed that recent investor expectations called for US comps. flat to down 1%

- Sees opportunity for the company to show improved fundamental performance in upcoming quarters, which can result in improved investor sentiment on the stock

- Key focus area for call: perspective on recent demand trends, including initial performance for the $5 Meal Deal in U.S.; initiatives to support comps performance amid what looks to be “an increasingly challenging global macro backdrop”

TD Cowen (buy), Andrew Charles

“2Q results were challenged in the US as expected while IOM was negative, in-line with the bear thesis,” Charles writes

- To him, key factor to determine today’s stock move will be conference call comments on plans to improve 2H traffic, which he thinks will include ongoing focus on value, and how this has resonated in July after $5 Meal Deal launch June 25

In early May, McDonald’s warned its cash-strapped customers were desperately seeking cheaper food. We noted at the time, “McDonald’s Admits Consumers Are Broke With Planned Reintroduction Of $5 Meal Deal.” The implementation of the $5 meal deal occurred on June 25, which was in the final days of last quarter.

Based on Q2 earnings, McDonald’s sliding Big Mac demand from cash-strapped consumers is an ominous sign that low/mid-tier households are under deep financial stress.

We’ve detailed for months about the onset of a consumer slowdown:

- Goldman Tells Top Clients To Start “Shorting The Middle-Income Consumer”

- Walmart, Target Unleash Price-Cut Tsunami As Working-Poor Hit Brick-Wall

- Goldman’s Commentary On Consumer Health Is An Ominous One

- “Did Something Change?”: Goldman Trading Desk Warns Hedge Funds Are Suddenly Dumping Consumer Stocks

- Restaurant Stocks Slide As Wall Street Sours On Consumer

Days ago, a Bloomberg report provided some hope that the meal deal has spurred some demand in the current quarter:

About 93% of McDonald’s locations have committed to selling the bundle past the initial four-week window that started June 25, according to a memo seen by Bloomberg News. The timetables will vary across the country, with some locations planning to make it available through August.

Early performance indicates the meal deal “is meeting the objective of driving guests back to our restaurants,” McDonald’s said in a message signed by Tariq Hassan, chief marketing officer, and Myra Doria, national field president. “Driving guest counts ultimately propels our business and is the key to sustained growth,” they added.

MCD confirmed that this morning:

- MCDONALD’S: NUMBER OF $5 MEAL DEALS SOLD ABOVE EXPECTATIONS

Shares of MCD are mixed in premarket trading in New York. On the year, shares are down 15%.

In recent weeks, we penned a note titled “Restaurant Stocks Slide As Wall Street Sours On Consumer.”

McDonald’s plans to extend the meal deal through the end of the year, signaling that executives are concerned the downturn in the consumer space could worsen from here.

Tyler Durden

Mon, 07/29/2024 – 10:00

via ZeroHedge News https://ift.tt/LonqVCZ Tyler Durden