Mad 7: Microsoft Tanks, Down $250 Billion After Cloud Miss

In our preview of today’s main event, we said that mood for the Mag7 would be defined by Microsoft’s fiscal Q4 earnings, and for those long the AI sector we have some bad news: Microsoft, true to its name, just shat the bed, because despite beating on revenue and EPS, the company missed on cloud and its shares are tumbling.

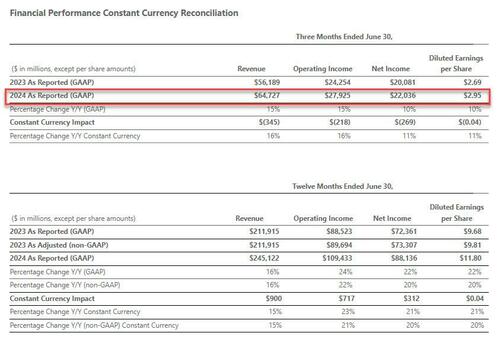

Here is what Microsoft just reported for Q4:

- EPS $2.95, up 11% YoY, and beating estimate of $2.93

- Revenue $64.73 billion, up1% YoY. and beating estimate $64.52 billion

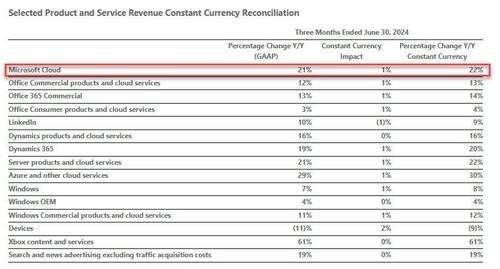

- Intelligent Cloud revenue $28.52 billion, missing estimate $28.72 billion

- Azure and other cloud services revenue Ex-FX +30%, in line with estimates of +30.3%

- Productivity and Business Processes revenue $20.32 billion, beating estimate $20.21 billion

- More Personal Computing revenue $15.90 billion, beating estimate $15.54 billion

- Intelligent Cloud revenue $28.52 billion, missing estimate $28.72 billion

- Revenue at constant currency +16%, beating estimate +14.7%

- Operating income $27.93 billion, beating estimate $27.63 billion

- Capital expenditure $13.87 billion, beating estimate $13.27 billion, which normally would have been sufficient to send the stock higher but not this time.

Here is the big picture breakdown:

And the segment detail:

While the results were generally strong, investor focused on the AI-heavy cloud segment: here, Azure posted a 29% revenue gain in the quarter, decelerating from the 31% growth in the previous period, with revenues just missing estimates.

Commenting on the quarter, CEO Satya Nadella said that “our strong performance this fiscal year speaks both to our innovation and to the trust customers continue to place in Microsoft. As a platform company, we are focused on meeting the mission-critical needs of our customers across our at-scale platforms today, while also ensuring we lead the AI era.”

Nadella has been infusing Microsoft’s product line with AI technology from partner OpenAI, including digital assistants called Copilots that can summarize documents and generate computer code, emails and other content. The company also is selling Azure cloud subscriptions featuring OpenAI products. However, judging by the disappointing cloud numbers, chatbots, pardon AI is rapidly emerging as the next “3D TV” megadud.

The market did not take it quite that way and the stock is plunging 8% – or roughly $250 billion in market cap – in after hours trading on the small miss in cloud revenue…

… with both S&P and nasdaq futures getting hammered after hours as the world’s biggest company craters.

Tyler Durden

Tue, 07/30/2024 – 16:14

via ZeroHedge News https://ift.tt/yRiX6cq Tyler Durden