Authored by Victor Davis Hanson via American Greatness,

Half the country thinks something has gone drastically wrong in America, to the point that it is rapidly becoming unrecognizable. Millions feel they are virtual lab rats in some grand research project conducted by entitled elites who could care less when the experiment blows up.

Consider:

Our military turns over $60 billion in state-of-the-art weapons to terrorists in Kabul and then flees in disgrace?

Terrorist flags fly in place of incinerated Old Glory at the iconic Union Station in Washington as radical students and green card-holding guests deface statues with threats that “Hamas is coming” while spewing hatred toward Jews—and all with impunity?

A wide-open border with 10 million unaudited illegal immigrants?

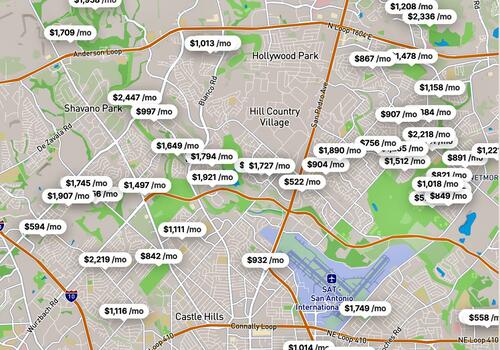

Once beautiful downtowns resembling Nairobi or Cairo—as paralyzed mayors spend billions without a clue how to remedy the self-created disaster?

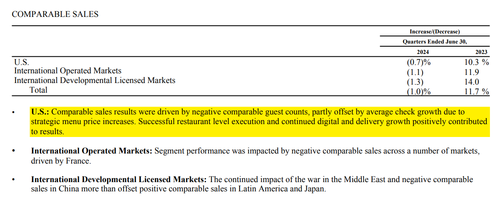

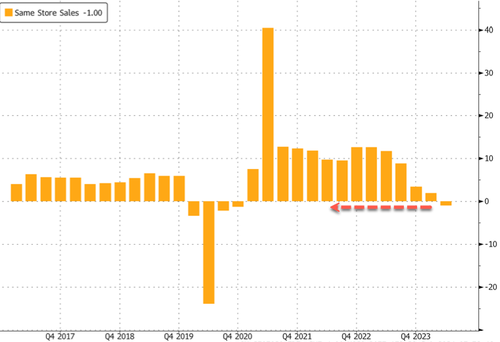

Fast food drive-ins priced as if they were near-gourmet restaurants?

In truth, this apparent rapid cultural, economic, and political upheaval is well into its third decade. The disruptions are the results of the long-term effects of globalization and the high-tech revolution that brought enormous wealth into the hands of a tiny utopian elite. Almost overnight, every American household became a consumer of cellular phones and cameras, laptop computers, social media, and Google searches.

We then entered into a virtual, soulless world of hedonism, narcissism, and the cheap, anonymous cruelty of click-bait, cancel culture, doxing, ghosting, blacklisting, and trolling. The toxic COVID lockdown and the DEI racist fixations that followed the George Floyd death only accelerated what had been an ongoing three-decade devolution.

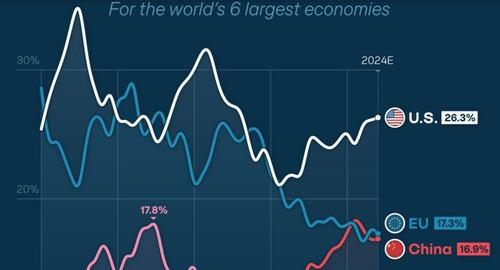

By 2000, a former market of 300 million American consumers was widening to a globalized 7 billion shoppers—at least for those mostly on the two coasts, whose expertise and merchandising were universalized in megaprofit high-tech, finance, investment, media, law, and entertainment.

Americans of the 20th century had never quite seen anything like the mega-global celebrities from Michael Jackson to Taylor Swift, or a Bezos fortune of $170 billion, or the sorts who fly in their Gulfstream private jets to Davos, Sun Valley, and Aspen to lament the ignorance of the backward muscular classes and to plot their noblesse oblige salvation for them.

Indeed, for those reliant on muscular jobs and the production of the material essentials of life—agriculture, fuels, construction, assembly, timber, mining, and services—their livelihoods were often xeroxed abroad. Millions of their jobs were offshored or outsourced to third- and second-world countries with cheaper labor, abundant natural resources, and less overhead that made investment “wiser” and more profitable.

Anointed Americans in the “soft” or informational economy achieved levels of wealth never seen before in history. Meanwhile, Americans in the “hard” or concrete sectors saw stagnation in wages, job losses, and the erosion of middle-class life itself.

That the universities, the media, the administrative state, entertainment, high tech, and the federal government were mostly on the coasts became a geographical force multiplier of the growing economic and cultural divide—perhaps in the manner that the Civil War became not just an ideological conflict but one of definable geography as well.

Red-state and blue-state cultures followed these radical displacements in the global economy. Urban bicoastal America created an ethos and an accompanying narrative that it was blessed, rich, and all-knowing because it had been rightfully rewarded for supposedly being innately smarter, better credentialed, more worldly and—given its wealth—more moral than the losers who fell behind. The new multibillionaires reinvented the Democrat Party into a concord of the hyper-rich and subsidized poor, abandoning the now caricatured working and losing middle classes.

Indeed, a sort of atheistic, reverse-Calvinism arose. The elite left-wing, monied classes were left-wing and monied precisely because of some sort of fated reward for their obvious innate superior virtue and wisdom—even as millions fled from failing blue states to their freer and more prosperous red counterparts.

An entire moral vocabulary of condemnation followed to stigmatize those who supposedly lacked the know-how or morality to appreciate their elite benefactors—clingers, deplorables, irredeemables, hobbits, chumps, dregs, and “crazies,” to use the parlance of Barack Obama, John McCain, Hillary Clinton, and Joe Biden. Their targets were the relics of a vanishing America who did quirky things like salute the flag, go to church, believe there were still only two sexes, honor America as always far better than the alternative, and believe they were the muscles that kept the nation fed, fueled, and housed for one more day.

The chief characteristic of the 21st century American revolution’s vast recalibrations in wealth was not just the transition from the muscular to the supposedly cerebral, but from right to left. Look at the Fortune 400. There is a pattern in the rankings—mostly progressives and rich—and the winners’ wealth is usually not created from old sources like transportation, manufacturing, agriculture, or construction.

The real multibillion-dollar fortunes in America are now in tech and investment. The hierarchies that own and manage Amazon, Apple, Citigroup, Goldman Sachs, Google, JPMorgan, Chase, Microsoft, or Morgan Stanley are now decidedly left-wing Democrats. That 21st century reality marked a radical change from the past. Democrats now typically vastly outraise Republicans in most national campaigns. Their philanthropic foundations dwarf those of their right-wing rivals.

Elite hard-left universities are flush with multibillion-dollar endowments in a manner unimaginable just 40 years ago. And they are no longer merely liberal but overwhelmingly woke and uncompromisingly hard left—with millions of dollars to waste on their unicorn chases of mandated equality and racist “anti-racism.” Hollywood, the media, new and old, and Wall Street are not just far wealthier than ever but far more intolerant and sanctimonious as well.

It was not just money that gave the new left-wing oligarchy such clout in the administrative state, Wall Street, tech, the media, the corporate world, and the university. It was the accompanying assurance that, unlike other Americans, the lab rats of the mostly rural or interior parts of the country were exempt. They were to be free to apply their bankrupt agendas—open borders, DEI, globalism, climate change gospels, critical legal theory, modern monetary theory, critical race theory—to distant others. They assumed correctly that they were never really to be subject to the concrete and real-life disasters arising from the implementation of their ideology.

Certainly, guilt over their largess, together with our 21st century secular update of sanctimonious New England puritanism, explain this overweening left-wing new zealotry to change the world, but largely at others’ expense. They are the descendants of Salem, who share the same superstitions and fanaticism to punish all who doubt their purity and wisdom.

So arose the idea among elites of a borderless America, where yearly 2-3 million poor and downtrodden of Latin America, and soon the world at large, could surge into a humane and progressive America—without the ossified and illiberal idea of background checks, or legal “technicalities.”

The arrivals’ abject poverty would remind the bigoted American middle classes of the need to expand their welfare state—as if a lifelong victim of the institutional oppression of Oaxaca, Mexico became a legitimate victim of white capitalist America the very moment he set foot across a now mythical border. Importing massive poverty would remind the middle classes that racism and inequality were still on the rise.

The locus classicus of this self-righteousness and contrition was emblemized when a few dozen illegal aliens were redirected toward tony Martha’s Vineyard. The locals immediately rushed to reveal to us two realities: 1) shower the illegals with food, upscale clothing, and other essentials to virtue signal their universal concern for the downtrodden; and 2) bus them out of the neighborhood as quickly as possible to where they “belonged”—either among the inner-city poor or struggling rural Hispanic communities of the American southwest.

In the abstract, open borders were what any progressive nation should aspire to; in the concrete among the architects of such idealism—not in their backyard.

Following the death of George Floyd, corporations, universities, and administrative state agencies rushed to compete to “level the playing field” by eroding meritocratic criteria such as calcified SAT tests, background checks, resumes, etc., and began hiring by race, gender, and sexual orientation.

Tens of thousands of DEI commissars and their henchmen have now spread far beyond their birthplaces in the university (where elite schools routinely restrict so-called whites [ca. 65–70 percent of the population] to 20–40 percent of incoming classes). At some Ivy League schools and their kindred elite campuses, grades are “adjusted” to ensure 60-80 percent are A’s.

Almost everything in revolutionary America has “evolved” beyond silly notions like “meritocracy” and “standards” and has instead become DEI hot-wired—from the hiring and promotion of airline pilots, selection of actors, management of the Secret Service, and the rank and file of FBI and CIA operatives to admissions to medical school, corporate boardrooms, and advertising.

In response, a dangerous underground cynicism grows commensurately. As in the old Soviet Union, so too here arises our official “truth” beside the subterranean truth that most rely on when an incompetent Secret Service hierarchy allows a shooter to take pot shots at a president’s head, or there is a sharp rise in passenger jet near misses and go-arounds, or students in mass demand exemptions from final schedules or expect amnesties when they storm campus buildings, or major corporations—like Disney, Target, Anheuser Busch, and John Deere—ostentatiously virtue signal.

In sum, we are knee-deep in an authoritarian commissariat that we do not even dare formally acknowledge. DEI, like open borders, was predicated on the idea that the good one percent who ran the country was too good to experience the trickle-down from the commissar system it imposed on others.

Ditto the top-down green revolution. We are to assume that sweaty truckers should have no problem juicing up their battery engines every 300 miles. Hispanics in Bakersfield should appreciate turning down their air conditioning when it hits 115. Lower-middle-class moms should learn the advantages of high-cost electric stoves and ovens once they are forcibly weaned off their cheap but too-hot natural gas appliances.

Meanwhile, the sales of designer Italian cooking platforms, 10,000-square-foot air-conditioned second homes (the Obamas own three), private jets, yachts, and huge limo SUVs have reached record levels. The model is John Kerryism—or the rationale that to help the uneducated, dumber, and less moral people survive global warming, the enlightened need the tools to do it. So, they must avoid messy airports, 9-hour delays due to missed connections, and the stuffy, cramped middle seat on modern commercial jets.

The idea of 100,000-200,000 legal immigrants admitted annually and meritocratically, charter schools in the inner city, beefed-up policing in our major urban areas, nationwide civic education, reemphasis on assimilation, integration, and intermarriage of the melting pot, wide use of nuclear power—all the things that might make the life of the middle class more secure, more prosperous, and more confident—are deemed corny and passé.

Again, what we got in the last quarter century was a shrill elite that subjects their Jacobin theories upon a distant other but has absolutely no intention of ever getting near the very disasters they wrought, much less suffering the collateral damage that was inevitable from their social engineering.

Or, to put it another way, they were to be our few genius white-coasted researchers while we were their many expendable lab rats.