Suppressing Silver Prices Has Been Official US Policy Since 1965

Authored by Chris Powell via MoneyMetals.com,

In the July 18 edition of Gold Newsletter, editor and publisher Brien Lundin wrote about the failure of silver prices to keep up with gold prices.

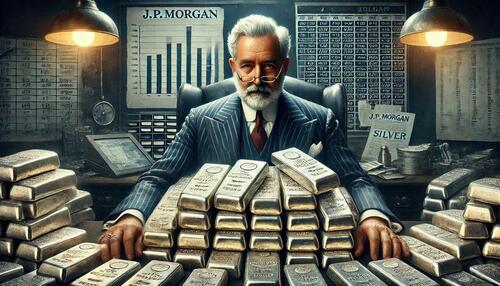

“I’m not the kind of conspiracy buff that many of my friends in the industry are,” Lundin wrote, “but it’s hard to look at silver and not see some hidden hands at work (especially considering who holds so much of the metal in both physical and paper forms while acting as custodian for the biggest silver exchange-traded fund).”

Of course, Lundin meant investment bank JPMorgan Chase and silver ETF SLV.

Why anyone would invest in silver or the other precious and monetary metals with JPMorgan Chase can be explained only by ignorance.

In the last decade, the bank has pleaded guilty to five felonies and has paid more than a billion dollars in government fines and civil lawsuit settlements, including a fine of $920 million for manipulation of the monetary metals markets by some of its traders:

But silver market manipulation long has been bigger than even JPMorgan Chase.

Indeed, silver price suppression has been U.S. government policy since President Lyndon B. Johnson signed the Coinage Act of 1965, which removed silver from the country’s money.

Signing the act into law, Johnson proclaimed:

“If anybody has any idea of hoarding our silver coins, let me say this. Treasury has a lot of silver on hand, and it can be and it will be used to keep the price of silver in line with its value in our present silver coin. There will be no profit in holding them out of circulation for the value of their silver content”:

https://www.presidency.ucsb.edu/documents/remarks-the-signing-the-coinage-act

It’s not known how long the U.S. government’s strategic silver inventory lasted after 1965 and how much was used for executing the price-suppression policy Johnson proclaimed, but eventually, collectors and investors did exactly what the president warned would bring them no profit. They removed the silver coins from circulation and hoarded them as the steady inflation of the U.S. dollar made them worth far more than their face value.

JPMorganChase Bank long has been a primary dealer in U.S. government securities and has been particularly close to the U.S. Treasury Department, so when SLV was launched in 2006 and the bank became custodian of the fund’s silver, suspicion of government involvement with the bank and the ETF was fairly aroused. (The bank now is also the custodian of the metal of the major gold ETF, GLD, prompting more fair suspicion.)

After SLV was founded, complaints that JPMorgan Chase was manipulating the silver market grew loud enough that the bank felt obliged to answer them publicly.

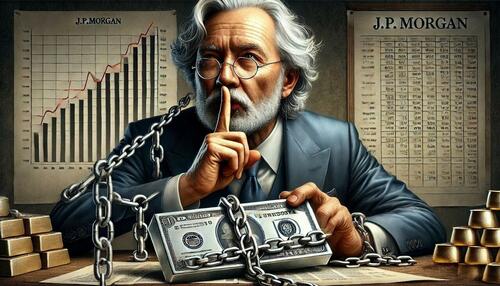

First, the bank’s CEO, Jamie Dimon, said the bank had no interest of its own in the monetary metals and traded them only for clients. Then in 2012 the head of the bank’s commodity desk, Blythe Masters, went on CNBC to emphasize this denial, particularly in regard to silver.

“There’s been a tremendous amount of speculation, particularly in the blogosphere, on this topic,” Masters told the CNBC reporter. “I think the challenge is that it represents a misunderstanding of the nature of our business. … Our business is a client-driven business where we execute on behalf of clients to achieve their financial and risk-management objectives. … We have offsetting positions. We have no stake in whether prices rise or decline.”

But since CNBC is a mainstream financial news organization, its reporter failed to put the critical follow-up question to Masters: Do JPMorgan Chase’s clients trading silver and other monetary or precious metals include governments, particularly the U.S. government, directly or indirectly?

The answer to that question was provided inadvertently 10 years later, and barely noticed by mainstream financial news organizations, during the trial of the JPMorgan Chase traders charged with and convicted of “spoofing” the monetary metals futures markets. In the very last paragraph of its July 31 report about the trial, Bloomberg News reported:

“Another set of important clients were central banks, which trade gold for their reserves and are among the biggest players in the bullion market. At least 10 central banks held their metal in vaults run by JPMorgan in 2010, according to documents disclosed in court”:

A mechanism for governments to use for surreptitious manipulation of the monetary metals futures markets was already in place at CME Group, operator of all the major futures exchanges in the United States. It is called the Central Bank Incentive Program, whereby CME Group exchanges provide volume trading discounts to governments, central banks, and international organizations for trading all futures contracts on CME Group’s exchanges.

CME Group’s master statement to the U.S. Securities and Exchange Commission says: “The customer base of our derivatives exchanges includes professional traders, financial institutions, institutional and individual investors, major corporations, manufacturers, producers, governments, and central banks”:

https://www.gata.org/node/18925

http://investor.cmegroup.com/node/43571/html

https://www.gata.org/files/CMEGroup-CentralBankIncentiveProgram-Feb2019.pdf

So there remain some compelling questions in the monetary metals sector.

— Would Western governments and particularly the U.S. government have worked so hard for so long to control the price of gold, as documented by GATA here —

— while leaving the other major monetary metal, silver, alone?

After all, for many years the world might have sensed monetary debasement almost as readily from a rising silver price as from a rising gold price, even if these days, with inflation sending most important prices soaring, it’s hard not to sense monetary debasement nearly everywhere one looks, except maybe, as Lundin notes, when one looks at silver.

— Why do all the major bullion banks seem to trade gold and silver the same way at the same time? It sure looks like collusion. If it is collusion, it would violate anti-trust law in the United States, United Kingdom, and other Western countries — unless, of course, the bullion banks are simply executing government trades and thus giving camouflage to government intervention.

The Gold Reserve Act of 1934 authorizes the U.S. Treasury Department, through its Exchange Stabilization Fund, to intervene secretly in any market in the world:

https://home.treasury.gov/policy-issues/international/exchange-stabilization-fund

That intervention like this is going on has been essentially confirmed by the U.S. Commodity Futures Trading Commission, which repeatedly has refused to answer not just for GATA but even for a U.S. representative whether the commission has jurisdiction over manipulative futures trading undertaken by or at the behest of the U.S. government or whether such manipulation is legal:

https://www.gata.org/node/19917

— By amassing a big hoard of silver “for clients” and serving as custodian of the silver ETF SLV, has JPMorgan Chase in effect reconstituted the U.S. government’s strategic silver reserve for interventional purposes?

— What exactly goes on every day on the trading desk at the Federal Reserve Bank of New York? What markets are being traded there by the U.S. government, how are they being traded, and why? Is the desk trading more than the government bonds it reports trading? Why can’t the public be allowed to observe this trading?

— Is the Bank for International Settlements trading the monetary metals for the U.S. government, directly or through intermediaries?

In 2005 the head of the BIS’ monetary and economic department, William R. White, told a conference at BIS headquarters in Switzerland that a primary purpose of cooperation among central banks is “the provision of international credits and joint efforts to influence asset prices (especially gold and foreign exchange) in circumstances where this might be thought useful”:

https://www.gata.org/node/4279

The United States is a member of the BIS and White’s “asset prices” easily could cover the prices of the other traditional monetary metal, silver.

Gold Newsletter’s Lundin is right that it’s hard not to suspect that “hidden hands” are at work against the silver price just as they have been against gold. Or at least it’s hard not to suspect that “hidden hands” are at work as long as you’re not part of a mainstream financial news organization or an executive of the typically oblivious silver-mining company.

Tyler Durden

Sun, 07/28/2024 – 10:30

via ZeroHedge News https://ift.tt/XQEwbHi Tyler Durden