Authored by Michael Every via Rabobank,

Aye: we got a rate cut – or rather two.

First, the Bank of Canada (BoC) cut 25bp again to 4.50%. As our yes-we-Canuck strategist Christian Lawrence notes, this was mainly priced in. The accompanying Monetary Policy Report (MPR) and press conference highlighted future decisions will be made meeting by meeting and data dependence is key, with upside inflation pressures from shelter and some services vs. downside from excess supply and labour market slack. Yet the MPR’s new forecasts see higher CPI inflation next year and slowing GDP growth for this year and next: stagflation, eh? Christian now expects two more 25bp cuts in 2024, an additional cut compared to his forecast prior to this meeting, and four cuts in 2025 to take the policy rate to its terminal low of 3.00%. This stands in contrast to the US, where our Fed watcher, Philip Marey, expects two 25bp cuts this year and two 25bp next before holding. In light of this policy divergence, we maintain the view that USD/CAD will trade above 1.40 this year, but the market is heavily short CAD, so expect pullbacks.

Second, the PBOC cut again, unexpectedly lowering its one-year policy rate by 20bp to 2.3%, the biggest cut since April 2020, underlining the message sent by Monday’s trimming of the more important 7-day repo rate by 10bp to 1.70%. Banks are already passing on lower deposit rates to savers: which will do nothing to encourage spending in the current environment, and people will instead save even more to generate the same return they were earning before.

In short, it’s going to be hard for the Fed to be more dovish than everyone else even if former Fed member Dudley, so hawkish recently, just told Bloomberg, “I Changed My Mind. The Fed Needs to Cut Rates Now.” In his eyes, waiting until September unnecessarily increases the risk of a recession. Keynes would applaud someone changing their mind when the facts change. The problem is the facts haven’t changed. The US has seen a few better inflation prints; but structural inflation embers are still burning, waiting to be poked with a rate-cut stick. The unemployment rate has risen past the limit of the so-called Sahm Rule, and it’s historically always the case that once unemployment starts to rise, it rarely stops at a slightly higher level; again, the Fed and the Street were, and are, assuming that this time would be different. If it isn’t, the US and global outlook are far uglier than most want to admit.

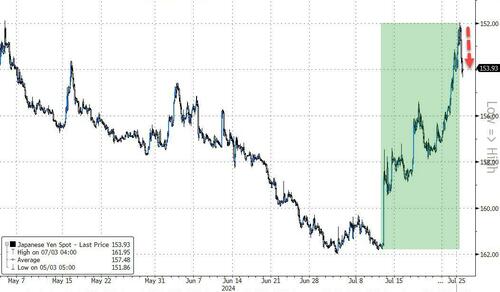

Meanwhile, one of the exceptions to that dovish rule remains the BOJ, where speculation continues to build that next week could see another (tiny 10bp) rate hike: JPY is around 153 on that basis.

But, ai!, the Eurozone PMIs! The manufacturing total was 45.6 and services 51.9, lower than expectations, with German manufacturing at just 42.6 the cause. German Chancellor Scholz insists he’s running for re-election in 2025 and is bullish about his chances. It’s hard to make the same case for German industry either cyclically or structurally. The IFO survey today is now being eyed.

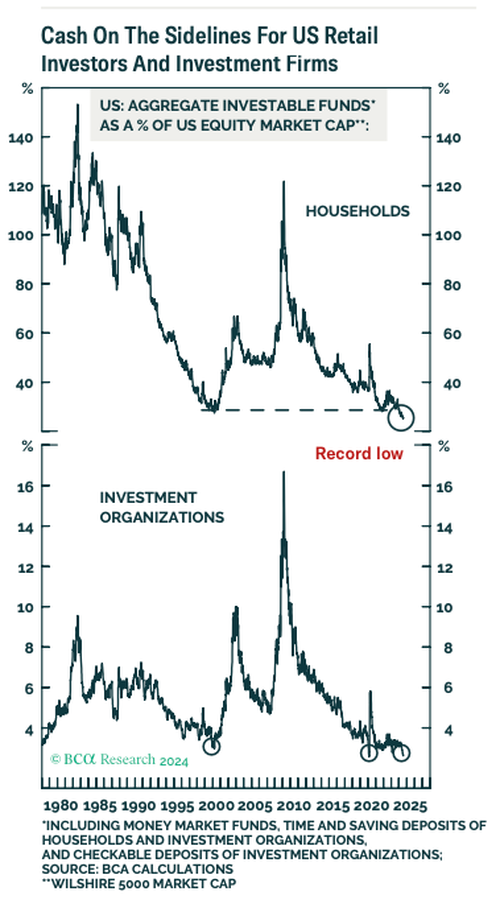

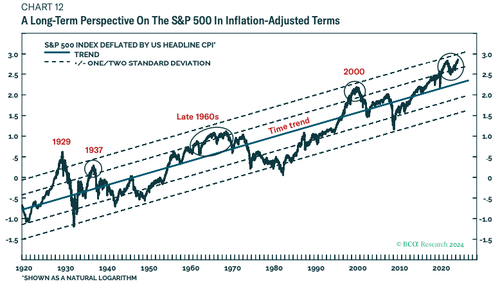

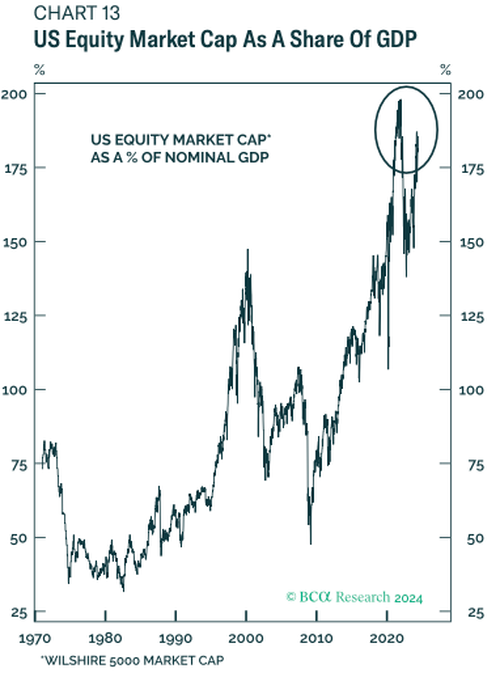

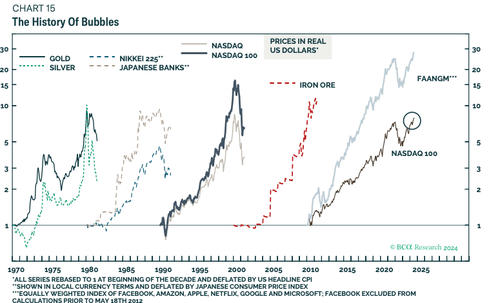

Moreover, it was “ai, ai, AI!” with tech stocks slumping, as Bloomberg puts it, on “AI doubts”. This isn’t an equity daily, but the word “bubble” has been used to describe the belief that just saying “AI” somehow generates profits. If people start to see that has a South Park Underpants Gnomes quality to it, expect more shocks: but given Wall Street produces so much ‘(under)pants’ research, as we say in England, it’s impossible to make a call on when, or if, that will happen.

A related anecdote: a US pharmacy chain is to adopt AI to save costs, forcing customers to an AI and not their pharmacist about their prescription; I recall being told years ago that the UK’s National Health Service had outsourced the transcription of doctors’ patient notes to Asia to save costs, but it was stopped when “problem with Eustachian tubes” came back as “problem with Euston Station Tube.” That caused earache for public health officials.

And where the ayes either have it or don’t, Washington, D.C.:

President Biden bowed out of the 2024 race, more gracefully, with a speech; MAGA-red and chartreuse green imagery is everywhere – and either saying something about AI or human intelligence, in some cases the exact same footage is being used, negatively with a red border, and positively with a dance soundtrack, a chartreuse border, and strobe lights; early polls suggest that while things may have tightened, Trump still retains a lead; the US capitol was again filled with angry street protests, burned US flags, and a defaced Liberty Bell; and Israeli PM Netanyahu urged the US to stand with it against Iran, underlining how geopolitics continues to loom over everything. Over three more months of this to go, folks, the election, not Iran, during which markets and the Fed have to try and work out what this will all end up meaning for the economy, as all manner of inflationary goodies are offered by both sides.

On which, the release from The Coalition for a Prosperous America (CPA) on how adapting economic models to reality, not economic theory, shows tariffs can produce strong real GDP growth rather than stagflation got zero coverage.

As expected, of course.

Specifically, they claim a 10% tariff on all US imports, raising $263bn in revenue, could be redirected into a $1,200 tax refund for lower income households and tax refunds of 3-4% for middle-income households, generating economic growth of $728bn, 2.8m additional jobs, higher domestic production, and a 5.7% increase in real income for the average US household. The cost would be headline inflation around 0.5 percentage points a year higher than otherwise expected over a six-year period, or by 3.26ppts cumulatively. That latter figure would move markets. Then again, so would a US boom on that scale; and that’s with the 10% universal tariff, not the 60-100% figure touted vs. China.

Traditional economic modellers, and the politicians who have listened to them for a generation, will scream “¡Ay, caramba!”…

…which is topical given Mexico are thinking along the same tariff lines. As are many others.

Moreover, I doubt this election will see substantial debate on this critical policy issue among the sea of Trump-red and Harris-green ADHD infotainment we will be drowned in; not even from the media ‘intelligentsia’ who sneer at it from above. It’s too technical, too controversial, and seen as too partisan – even though both parties are now backing the same policy, just on a different scale, and for different sectors. And, as I keep arguing, it means too much volatility for people, markets, and sectors who like things the way they are – with simple maths, simple models, and simple policy of as few tariffs as possible.

Nonetheless, rest assured that *I* (and a few others) will keep ploughing this intellectual furrow, because it matters; far more than the cyclicality of July vs. September, November, or December; especially were that idea to win in November, which for now remains the base case for our Fed-watcher based on a poll of polls.