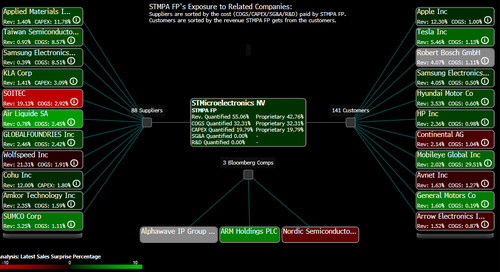

Shares of chipmaker STMicroelectronics tumbled in Europe after the company slashed its full-year revenue and margins guidance for the second time (the last cut was in April) on soft chip orders from the automotive industry. Demand troubles from STMicro’s industrial clients may signal a slowing global economy.

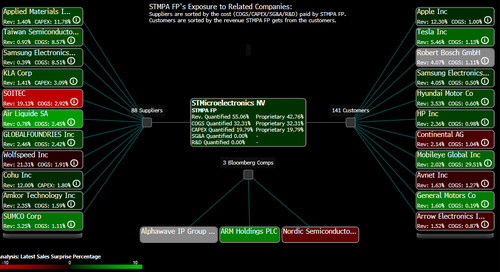

The Franco-Italian company, whose clients include Apple, Tesla, Robert Bosch, Samsung Electronics, Hyundai Motors, and General Motors, has revised its revenue forecast for the year to $13.2 billion to $13.7 billion, down from the previous range of $14 billion to $15 billion. Additionally, its gross margin is now expected to be around 40%, compared to the earlier estimate in the low 40s.

STMicro’s Supply Chain

Here’s a snapshot of the full-year outlook (courtesy of Bloomberg):

-

Sees net revenue $13.2 billion to $13.7 billion, saw $14 billion to $15 billion, estimate $14.29 billion (Bloomberg Consensus)

-

Sees gross margin 40%, estimate 41.1%

“During the quarter, contrary to our prior expectations, customer orders for industrial did not improve and automotive demand declined,” CEO Jean-Marc Chery wrote in the second quarter financial results. He said automotive revenues were lower than expected and offset higher sales in the company’s personal electronics business.

In a call with investors, the CEO said, “We are facing a longer and more pronounced correction in industrial than what we anticipated due to a progressive weakening of demand amplified by a severe inventory correction.”

The slowdown in the electric vehicle market has been a main pressure on chip companies with high exposure. Sliding EV sales have been visible from Tesla to Porsche to Ford Motor to Mercedes-Benz.

Interestingly enough, the CEO said an unnamed customer in China could spark significant growth for the company later this year:

“I confirm that H2 will be a growth driver for ST for all the components related to electrical vehicles, particularly for silicon carbide, and particularly everywhere, in China and also with our main customer.”

On Wall Street, JPMorgan analyst Sandeep Deshpande told clients that “Despite a small beat in the reported quarter, the company did not see the expected recovery in industrial orders and automotive orders declined,” adding, “The key question is, given the company’s very significant sequential cuts, will the market believe that the worst is over?”

Here’s what other Wall Street analysts are saying (courtesy of Bloomberg):

Stifel, Juergen Wagner (buy)

- EPS estimates for 2024 could be cut by about 15% as inventory correction in automotive and industrial remains a burden

- The downgrade is likely expected but the magnitude is slightly higher than feared

Bernstein, Sara Russo (outperform)

- Automotive was lower than expected with microcontrollers and power & discrete segments struggling, while industrial also showed no improvement

- Guidance does imply that 4Q will see sequential improvement versus 3Q, but after several quarters of missed guidance, it may be challenging for investors to hold confidence in that forecast

- “The lack of clarity on the bottoming out of the cycle is what’s difficult” for STMicro

Citi, Andrew Gardiner (buy)

- The outlook cut was more than expected, indicating a 6% downgrade to 2024 revenue estimates and even more for Ebit

- Given the severity of two guidance cuts at 1Q and 2Q results, “the bottom of cycle cuts” is probably near

JPMorgan, Sandeep Deshpande (overweight)

- Key question is whether the market will believe that worst is over after sequential cuts to outlook

- End-market datapoints in automotive are still declining in the quarter, but “we believe we are close to the trough”

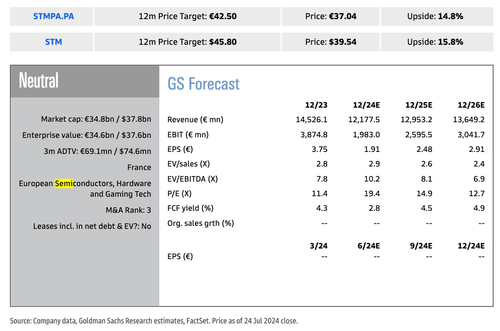

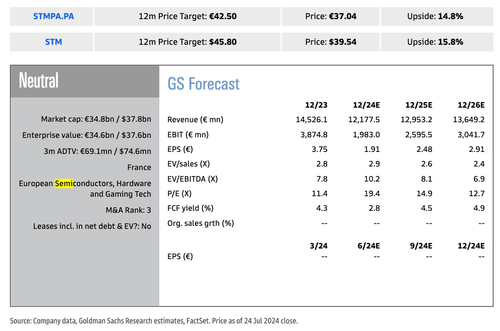

Here’s more from Goldman’s Alexander Duval:

We expect a negative stock price reaction to results, noting the miss on 3Q24 EBIT and significantly below consensus FY24 sales and GM guidance at the midpoint. The shares have underperformed EU Tech by -1%/-8% in the last 1M/3M, albeit we note that the stock is down -4% this week following peer NXP’s below cons next-quarter guidance. The guide down and commentary on automotive demand may also be taken as a potential negative read to peer Infineon, albeit IFX has significantly less Tesla exposure in EVs and greater exposure to the more dynamic China EV segment, and has already made cuts to its PSS and Industrial segment guidance. We also look for further colour on the call (8:30am UK time) on the demand trends specific product categories in the automotive business (e.g. EV and ADAS), inventories/lead times, pricing dynamics across various segments, and potential timelines for a recovery in industrial and consumer demand.

Duval’s 12-month price targets stand at 42.5 euros/ ADR $45.8 “based on an 8x CY25E EV/EBITDA multiple,” adding “there are risks to our view and price targets include a quicker/slower-than-expected inventory correction trough in consumer semis, accelerating/slowing Silicon Carbide momentum at competitors and evidence that currently favourable pricing can be sustainable.”

Shares of STMicro in Europe fell nearly 14%.

The quarterly results for chipmakers have been mixed so far.

Texas Instruments said Chinese electronics makers were increasing orders again after working through stockpiles. Meanwhile, Dutch chipmaker NXP Semiconductors NV reported revenue declines because of the auto industry slowdown. BE Semiconductor Industries reported a 20% decline in net profit for the second quarter because of sliding revenue and increased R&D expenses. Nvidia will be reporting earnings in late August.

As for the AI bubble and chip companies powering main equity indexes higher in recent months, well, Steve Clayton, head of equity funds at Hargreaves Lansdown, warned the party is over, “If there was a bubble in the AI and Magnificent 7-part of the market, then last night saw it pop.”