US equity futures slide with tech dragging down S&P and Nasdaq futures as both Semis and Mag7 are being sold pre-mkt with ASML -6% on a Bloomberg report the Biden administration is considering using the most severe restrictions available on companies like Tokyo Electron and European chip giant ASML (which tumbled to the lowest since early June), if companies continue to give China access to advanced semiconductor technology. As of 7:45am ET, S&P futures are down 1% and Nasdaq 100 futs tumble 1.4% with tech giants such as AAPL, NVDA, TSLA, AMD, MU, AVGO, MSFT, AMAT all down 1.4% – 4%. Meanwhile, the great rotation continues for another day with Russell futs positive. The yield curve is twisting flatter as 10-year Treasury yields rose while the dollar weakened and the yen jumps, sending the USDJPY lower as much as 200 pips to just above 156. Commodities are lower with Energy/Metals in the red though Ags are strong and WTI is flat. Today’s macro data focus is on Housing data, Industrial Production, and the Fed’s Beige Book. There are two Fed speakers and the 20Y bond auction which JPM rates strategist believe will require a concession.

In premarket trading, Nvidia, Advanced Micro Devices, Broadcom and other chipmakers lost more than 3% with Dutch chip giant ASML Holding plunging 7.5%, the most since 2022, even after the Dutch company reported strong orders in the second quarter, after Bloomberg reported that the Biden administration has told allies that it’s considering using the most severe trade restrictions available if companies continue giving China access to advanced chip technology. Nvidia is down 4%. Here are other notable premarket movers:

- Aehr Test Systems rises 11% after the maker of semiconductor test equipment gave a fiscal year revenue forecast that topped the average of two estimates available.

- American Airlines ticks 1% lower after TD Cowen stepped away from its buy rating, fretting over summer discounting.

- Bloom Energy gains 10% after the company said it will provide CoreWeave with power solutions for an AI data center.

- Five Below slides 15% after the discount retailer cut second-quarter earnings-per-share guidance and announced CEO Joel Anderson would step down.

- Gates Industrial rises 7% after the maker of power transmission equipment was included in the S&P Smallcap 600 Index.

- GitLab gains 15% after Reuters reported the software developer was exploring a sale after attracting interest from potential bidders.

- Spirit Airlines (SAVE) declines 6.3% after the low-cost carrier estimated that total revenue for the second quarter would be lower than previously expected mostly due to non-ticket revenue.

The Biden administration is considering using the most severe trade restrictions available if companies including ASML continue to give China access to advanced semiconductor technology, Bloomberg News reported on Wednesday. Meanwhile, an anti-China stance is also at the top of the agenda for Republican nominee Donald Trump who in an interview with Bloomberg questioned whether the US has a duty to defend Taiwan, a major chipmaking hub.

“Regardless of whether it’s a Democrat or Republican victory, there will always be a negative push toward China,” John Taylor, director of global multisector strategies at AllianceBernstein, said in an interview with Bloomberg TV. “One is more brazen and the other is more behind the scenes but the outcome is essentially the same.”

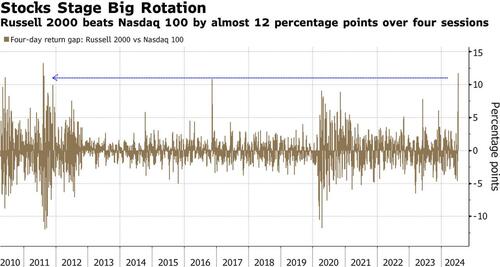

The move in stocks represents a small pullback after a stellar run of gains, fueled by soft inflation data and optimism that the Federal Reserve will cut interest rates. The S&P 500 closed at another all-time high on Tuesday, and in only five days, the Russell 2000 jumped almost 12% — hitting the most-overbought level since 2017.

“We had gotten a little too frothy,” said Tim Graf, head of EMEA macro strategy at State Street Global Markets. “Investors are underweight smalls, hugely overweight large caps and rotating a bit.”

European stocks slumped for a third day as the start of the second-quarter earnings season failed to revive investor optimism and trade tensions between the US and China over semiconductors weighed on sentiment. The Stoxx Europe 600 fell 0.8% and was trading at session lows as technology stocks led the drop, with ASML Holding NV slumping as much as 7.7% after Bloomberg News reported that the Biden administration is mulling more severe measures to restrict the company’s exports to China. ASM International and BE Semiconductors also fell more than 2.5%. Adidas AG gained 5% after raising its annual profit target for the second time in three months. Roche Holding AG jumped on promising early-stage study results for a weight-loss pill. Here are the most notable European movers:

- Adidas shares jump as much as 5.1% in Frankfurt after the sportswear maker reported preliminary second-quarter revenue that topped consensus expectations, and boosted its full-year sales growth and operating profit forecasts.

- Accelleron shares jump as much as 9.4% to a record after the Swiss engine parts maker increased its revenue and margin forecast for the year.

- Barco shares rise as much as 9.4% as investors looked past weaker-than-expected earnings at the electronic components company and focused on its projection for a second-half recovery.

- Handelsbanken advanced as much as 8.3%, most since March 2020, after Sweden’s largest property lender reported better-than-expected revenues, with higher fees and net interest income that helped offset increased costs.

- Roche shares jump as much as 7.4%, the most since March 2020, after the Swiss drugmaker said an early-stage study of its experimental pill showed meaningful weight reduction in patients with obesity.

- ASML shares decline 7.7%, the most since Oct. 2022, after Bloomberg reported that the Biden administration is mulling more severe measures to restrict the company’s exports to China.

- Demant shares slump as much as 14% as the Danish hearing-aids group warned on its full-year growth after preliminary second-quarter results missed expectations.

- Nel shares fell as much as 10%, the most since May 30 after the Norwegian hydrogen technology firm reported slower revenues than consensus, as well as worse cash burn than expected, according to Citigroup.

- Genus shares drop as much as 8.6% after the company warned profits from its cattle-breeding arm ABS will be lower than previously expected in FY25 due to weak demand in several countries, including China and Brazil.

- Scandic falls as much as 7%, the most since February, after the Nordic hotel chain reported second-quarter sales slightly below expectations.

- EssilorLuxottica shares drop as much as 4.4% to a five-month low after the luxury eyewear maker struck a deal to acquire the Supreme brand from VF for $1.5 billion in cash.

Earlier, Asian stocks rose, on course to snap a three-day losing streak, as global bets on Federal Reserve rate cuts increased while the market awaited more details from a key Chinese policy meeting. The MSCI Asia Pacific Index rose as much as 0.6%, with health-care and industrials the biggest boosts as tech stocks declined. Benchmarks climbed in Australia and New Zealand, while equities fell in South Korea and Taiwan and were mixed in Japan. Stocks fluctuated in Hong Kong and mainland China as sentiment remained fragile amid tougher rhetoric from the Biden administration and Trump’s campaign. Traders are focusing on the Third Plenum ending Thursday, in which top leaders will unveil the long-term development agenda for the world’s second-largest economy. Asian equity market performance is “a mixed bag,” said Homin Lee, senior macro strategist at Lombard Odier Singapore. “Investors are in a waiting mode ahead of China’s Third Plenum and also the conclusion of the Republican National Convention where Trump could provide more concrete details on his governing agenda.”

In FX, the dollar fell as traders dissected Donald Trump’s views on FX; the pound topped $1.30 as traders pared bets on an interest-rate cut in August after stickier-than-expected inflation data. The yen rallied 1% against the dollar, reducing the need for Japanese authorities to step into the market again. In his interview, Trump also said the strength of the dollar has been hurting the competitiveness of US exports and pointing to the weakness of yen and yuan; that’s raised some speculation among strategists that he might adopt policies to reduce the value of the greenback if he takes office. Both currencies rose, with the yen climbing to 156.46 versus the greenback, outperforming major currencies, while the offshore Chinese renminbi broke through the 50 day moving average to 7.2640 per dollar.

“The one thing that China and Japan and other Asian currencies are worried about is getting a tariff target on their back,” Mark McCormick, global head of currency and emerging market strategy at TD Bank, said in an interview with Bloomberg TV. “These currencies should be stronger.”

In rates, treasuries bear-flatten as front-end yields rise around 4bp on the day with long-end little changed vs Tuesday’s close. The Treasury yield curve extends Tuesday’s flattening move, tightening 2s10s and 5s30s spreads by ~3bp. The 10-year TSY yield is around 4.17% is ~2bp higher on the day with UK 10-year cheaper by an additional 1.5bp after UK inflation came in hotter than expected. Gilts lag slightly after UK inflation data pointed to stubborn underlying price pressures and swaps traders priced in less monetary easing by the Bank of England. With higher front-end yields, some Fed easing premium leaves the market, though around 62bp by December remains priced in vs 65bp at Tuesday’s close. Treasury coupon issuance resumes with $13b 20-year reopening at 1pm; WI 20-year yield at ~4.475% is ~2bp cheaper than last month’s auction.

In commodities, crude futures were steady. Spot gold was little changed at $2,471/oz. Bitcoin climbed above $65,000.

Looking at today’s calendar, US economic data slate includes June housing starts (8:30am) and industrial production (9:15am). Fed members scheduled to speak include Barkin (9am) and Waller (9:35am). Fed releases latest Beige book at 2pm.

Market Snapshot

- S&P 500 futures down 0.8% to 5,671.50

- STOXX Europe 600 down 0.6% to 514.37

- MXAP up 0.4% to 187.66

- MXAPJ little changed at 581.85

- Nikkei down 0.4% to 41,097.69

- Topix up 0.4% to 2,915.21

- Hang Seng Index little changed at 17,739.41

- Shanghai Composite down 0.5% to 2,962.86

- Sensex little changed at 80,716.55

- Australia S&P/ASX 200 up 0.7% to 8,057.90

- Kospi down 0.8% to 2,843.29

- German 10Y yield little changed at 2.41%

- Euro up 0.2% to $1.0916

- Brent Futures up 0.3% to $83.97/bbl

- Gold spot up 0.2% to $2,474.38

- US Dollar Index down 0.31% to 103.94

Top Overnight News

- The US is said to be considering its most severe trade restrictions yet on China’s chips access. The Biden administration told allies it may impose controls on foreign-made products that use American technology, if companies continue to allow China to access advanced technology. BBG

- ASML shares dropped the most since October 2022 on the risk of tougher trade curbs. Its orders outlook for the third quarter missed estimates, while second-quarter bookings beat. Tokyo Electron fell the most in three months. BBG

- Fed’s Williams (voter) says the Fed is closer but not ready to cut; a rate cut will be appropriate in the coming months; more data will help provide confidence on inflation; seeing broad-based declines in inflation: WSJ.

- US President Biden is set to announce support for major Supreme Court changes, while proposals could include term limits and an enforceable ethics code: Washington Post.

- Former US President Trump said “Trumponomics” equates to low interest rates and tariffs, while he said he would not seek to remove Fed Chair Powell before his term ends and would consider JPMorgan CEO Dimon to serve as Treasury Secretary. Furthermore, he said the Fed should abstain from cutting rates before the November election and wants to bring the corporate tax rate to as low as 15%: Bloomberg Businessweek interview.

- UK CPI runs slightly hot in June, coming in +2% headline (vs. the Street +1.9% and vs. +2% in May), +3.5% core (vs. the Street +3.4% and vs. +3.5% in May), and +5.7% services (vs. the Street +5.6% and vs. +5.7% in May). RTRS

- Bank of America is putting more money and balance-sheet resources behind its trading business, according to Chief Executive Officer Brian Moynihan. “You are seeing much more stability” in sales and trading, with back-to-back quarters of more than $1 billion in profit, Moynihan. “We will keep giving them more — risk-weighted assets, balance sheet, capital and investments in technology — because that is obviously a very expensive business to run from a day-to-day basis,” Moynihan said. BBG

- Donald Trump said he’d allow Jerome Powell to serve out his term if he wins the election, and warned the Fed shouldn’t cut rates before November. In a Businessweek interview conducted in late June, he also said he’d bring the corporate tax rate to as low as 15% and consider JPMorgan’s Jamie Dimon for Treasury secretary, and was cool to the idea of defending Taiwan from Chinese aggression. BBG

- Atlas Capital Group secured a construction loan worth nearly $1B to build a pair of residential towers in downtown NYC, the largest such deal in the city since COVID. NY Post

- Fundraising groups aligned with Donald Trump raised more than $400mn for his presidential election campaign between April and June — a record second-quarter haul that almost matches the sums raised during his entire 2016 campaign. FT

- Amazon’s advertising portal for merchants briefly crashed, disrupting Prime Day. Sales climbed almost 12% in the first seven hours of the event versus last year, according to Momentum Commerce. BBG

- Five Below issued a downside preannouncement (it sees Q2 comps down 6-7% vs. the Street -4.6% w/EPS of 53-56c vs. the Street 63c) and says its CEO is stepping down. RTRS

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mixed despite the positive handover from Wall St where the S&P 500 and DJIA extended to fresh record highs following better-than-expected Retail Sales data, as China trade frictions and tariff threats clouded over Asia-Pac sentiment. ASX 200 gained with notable strength in gold-related stocks after the precious metal rose to a fresh record level, while the mining sector is positive but with upside capped amid indecision in BHP despite posting better-than-expected quarterly iron ore output. Nikkei 225 gradually reversed its initial advances with trade restrained by a lack of drivers and a quiet calendar aside from the monthly Reuters Tankan survey which showed an improvement in large manufacturers’ sentiment. Hang Seng and Shanghai Comp. were lacklustre amid tariff fears and trade frictions after Trump suggested 60%-100% tariffs on China, while the Biden administration is to issue a proposed rule on Chinese connected vehicles in about a month and warned allies of stricter trade rules in the China chip crackdown.

Top Asian News

- PBoC reportedly questions banks on bond holdings in a push to cool the rally, according to Bloomberg.

- US reportedly warned allies of stricter trade rules in the China chip crackdown with the US mulling whether to impose the Foreign Direct Product Rule, while US restriction would hit technology from Tokyo Electron (8035 JT) and ASML (ASML NA), according to Bloomberg.

- Former US President Trump said he no longer plans to ban TikTok, while he wants new tariffs for China of between 60%-100% and would impose a 10% tariff on imports from other countries, according to a Bloomberg interview.

- Japan’s Outgoing Top Currency Diplomat Kanda says will respond appropriately to excessive FX moves, via Kyodo; if speculators cause excessive moves, “we have no choice but to respond appropriately”. In close contact with other countries’ authorities, there has been no criticism.

- Traders suspect Japanese intervention could be behind the surge in JPY, according to Reuters

European bourses, Stoxx 600 (-0.5%) are almost entirely in the red, with sentiment hit after ASML (-6.6%) reported Q2 earnings, which has significantly weighed on the AEX (-0.9%) and more notably on the tech-heavy NQ. Updates from Maersk also factor, Co. noted that Red Sea disruptions have extended beyond far-east Europe. European sectors hold a strong negative bias, with Tech the clear underperformer, dragged down by ASML weakness. Consumer Products were initially the best-performing sector, propped up by post-earning gains in Adidas; but the sector is now flat. US Equity Futures (ES -0.7%, NQ -1.3%, RTY U/C) are entirely in the red, with clear underperformance in the tech-heavy NQ, in reaction to the ASML results; Nvidia (-3.1%), AMD (-3%), Broadcom (-3.1%). The RTY remains fairly resilient to the selling pressure.

Top European News

- ASML (ASML NA) – Q2 (EUR): Revenue 6.24bln (exp. 6.03bln), Net Income 1.58bln (exp. 1.44bln), Bookings 5.57bln (exp. 4.41bln), EPS 4.01 (exp. 3.68). Q3 Outlook Revenue 6.7-7.3bln (exp. 7.66bln). CEO: currently see strong developments in AI, driving most of the industry recovery and growth, ahead of other market segments.

- Maersk (MAERSKB DC) said the Red Sea disruptions have extended beyond far-east Europe routes to the entire ocean network; Asian exports are more impacted than Asian imports by the ongoing situation in the Red Sea

FX

- DXY is firmly below 104 and at its lowest level since 21st March with the USD hit by a combination of strength in low yielders as carry trades are unwound and a strong NZD and GBP post-CPI. Thereafter, commentary from Fed’s Williams who noted the “Fed is closer but not ready to cut”, helped to prop up DXY from a 103.67 base.

- EUR/USD is lifted by the pull back in the USD with the dollar very much the dominant force for the pair. EZ fundamentals are lacking ahead of tomorrow’s ECB; EUR/USD has been as high as 1.0944; next target is the March 14th peak at 1.0954.

- GBP is firmer in the wake of UK inflation data which came in above expectations**; services inflation is markedly above the MPC’s expectation. Cable above 1.30 for the first time since July 19th.

- JPY is the best performer across the majors with USD/JPY now down as low as 156.11 vs. the session high at 158.61. This follows on from a broader move triggered last week by comments from Powell, soft US CPI and Japanese intervention. Some desks are attributing today’s aggressive price action to a reassessment of the JPY’s role as a funding currency alongside the pullback in US yields, which could also have broader implications for high yielders; whilst Reuters suggests intervention could be playing a role.

- NZD performing well despite a miss on both QQ and YY headline inflation with some desks noting the strength in non-tradeable inflation. After an initial dip to a multi-month low at 0.6041, the pair has managed to eclipse yesterday’s 0.6079 high.

- USD/CHF has slipped today to 0.8875, in fitting with the broader unwind of carry trades.

- PBoC set USD/CNY mid-point at 7.1318 vs exp. 7.2630 (prev. 7.1328).

Fixed Income

- USTs are directionally in-fitting with peers but with magnitudes more contained so far, holding just below Wednesday’s 111-13+ peak having been within half a tick overnight and around three shy in the European morning. A modest hawkish reaction was seen following commentary from Fed’s Williams, who noted that “the Fed is closer but not ready to cut”.

- Bunds saw two way action on the UK CPI (more below) but was ultimately softer and printed a 132.35 base, around 14 ticks below opening levels. Thereafter, a deterioration in the broader risk tone was seen and potentially driven by ASML (strong numbers, however Q3 guidance soft & China exposure), Trump tariff talk overnight and an update from Maersk around increasing Red Sea disruptions.

- An essentially unchanged open for Gilts after a sticky UK CPI release. Data which lessens but does not entirely remove the possibility of an August cut; a narrative which, alongside participants waiting for Thursday’s wages. 2029 DMO tap was robust, but not quite as strong as the prior tap, which briefly weighed on Gilts by a couple of ticks.

- UK sells GBP 4bln 4.125% 2029 Gilt: b/c 3.1x (prev. 3.59x), average yield 4.023% (prev. 4.083%), tail 0.9bps (prev. 0.3bps)

- Germany sells EUR 0.824bln vs exp. EUR 1bln 2.50% 2054 Bund and EUR 0.808bln vs exp. EUR 1.5bln 0.00% 2052 Bund.

Commodities

- Initially firmer but then reversed amid the broader risk aversion, though the initial upside were seemingly as a function of the weaker Dollar coupled with the heightened geopolitical landscape after Former President Trump flagged a hawkish policy towards China. Brent September currently holds around USD 83.60/bbl.

- Mixed trade across precious metals with outperformance seen in spot palladium while spot silver is the clear laggard. Spot gold ekes mild gains following yesterday’s rise to fresh ATHs at USD 2,482.42/oz as the yellow metal zeros in on USD 2,500/oz.

- Base metals trade mostly firmer despite the broader risk aversion following back-to-back sessions of losses amid China woes earlier in the week. In more recent trade, the complex is seemingly propped up by the softer Dollar.

- US Private Inventory Data (bbls): Crude -4.4mln (exp. +1mln), Distillate +4.9mln (exp. -0.5mln), Gasoline +0.4mln (exp. -1.7mln), Cushing -0.7mln.

- Russia plans to make extra crude production cuts to compensate for pumping above its OPEC+ quota in the warm seasons of this year and next, according to Bloomberg sources.

- Antofagasta (ANTO LN) Q2’24 Production report: quarterly production +20%, FY production exp. in lower end of guidance range of 670-710k tonnes. Gold Production 33,600 ounces.

Geopolitics: Middle East

- Israeli media reported more than 80 rockets were fired from Lebanon on Tuesday night, according to Sky News Arabia.

- Lebanon’s Hezbollah chief says Israel persistence in targeting civilians will push Lebanon to target “new colonies” that were not previously targeted.

Geopolitics: Other

- Russian Deputy PM Novak says the latest EU sanctions targeting Russia’s LNG industry are illegal, according to TASS.

- Hungarian Foreign Minister said efforts are being made to hold a second peace conference on Ukraine this year, according to RIA.

- Japan is making the final arrangement to contribute USD 3.3bln to Ukraine aid using frozen Russian assets which is about 6% of the total G7 package, according to Kyodo.

- Former US President Trump said Taiwan should pay the US for protection from China and that he is at best lukewarm about standing up to Chinese aggression, according to a Bloomberg interview. It was later reported that Taiwan’s Premier said regarding the Trump interview that the relationship between Taiwan and the US is very firm, while he added that peace and stability of the Taiwan Strait and the Indo-Pacific region are our common responsibility and that Taiwan is willing to take on more responsibility.

US Event Calendar

- 07:00: July MBA Mortgage Applications 3.9%, prior -0.2%

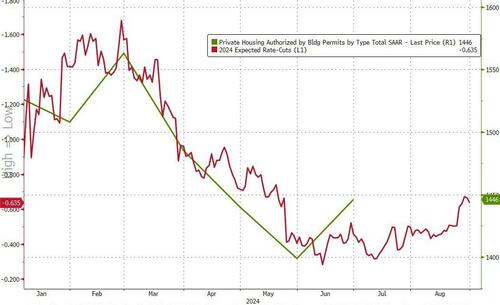

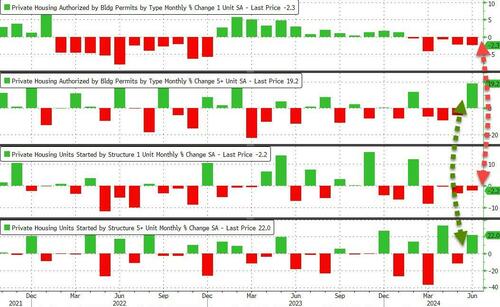

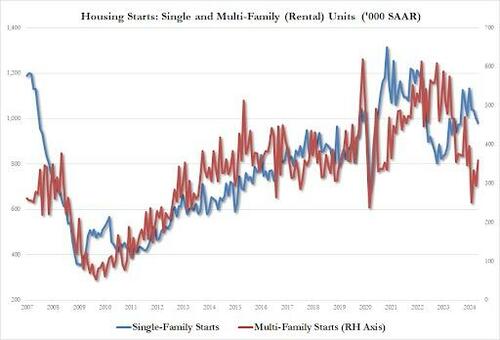

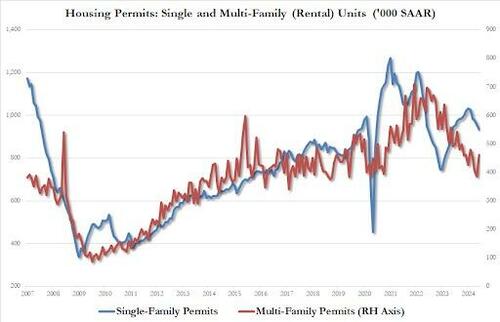

- 08:30: June Housing Starts, est. 1.3m, prior 1.28m

- June Building Permits, est. 1.4m, prior 1.39m, revised 1.4m

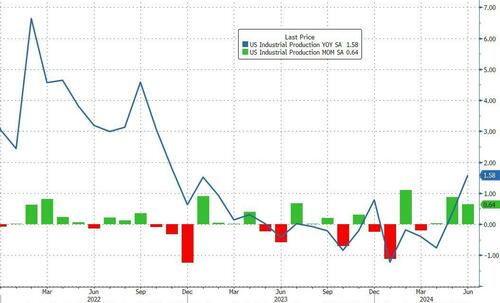

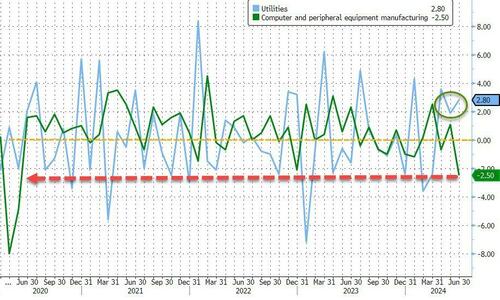

- 09:15: June Capacity Utilization, est. 78.4%, prior 78.7%, revised 78.2%

- June Manufacturing (SIC) Production, est. 0.1%, prior 0.9%

- June Industrial Production MoM, est. 0.3%, prior 0.9%, revised 0.7%

- 14:00: Federal Reserve Releases Beige Book

DB’s Jim Reid concludes the overnight wrap

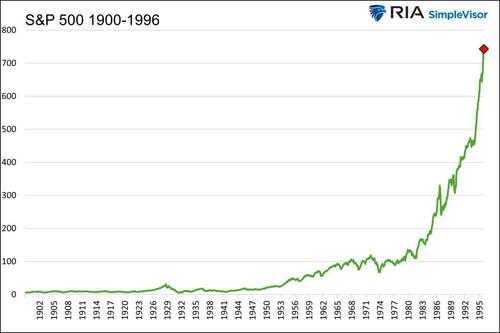

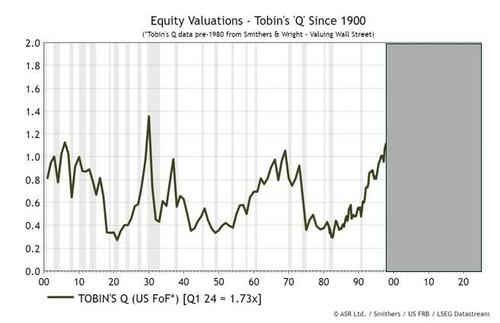

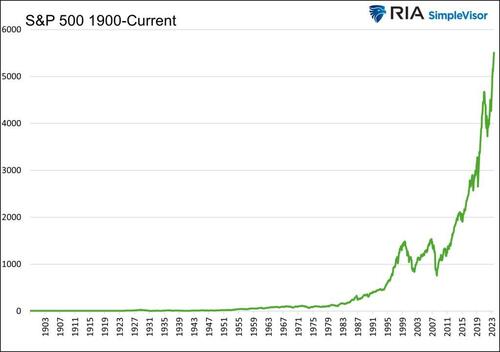

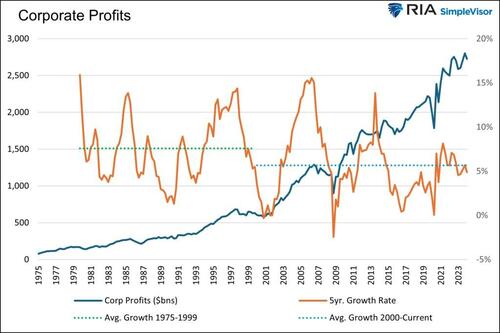

Rotation is the key word in financial markets at the moment as the leadership of the US market has very rapidly shifted away from the Mag-7 to the wider market. This trend is only a few days old but so far its been done without any damage to the overall market as last night the S&P 500 (+0.64%) closed at its 38th all-time high of 2024 so far, having now risen for 10 of the last 11 sessions. A further rise today would be the first 11 out of 12 run since April 2019. Zooming out the S&P 500 has risen for 28 out of the last 37 weeks, the best such streak in 35 years.

The small-cap Russell 2000 (+3.50%) reached another two-and-a-half year high, with a massive +11.54% increase seen over the last week alone, its largest 5-day gain since April 2020. This strength has been spread across many sectors, including those that have struggled in recent times, with the KBW Regional Banking Index up +14.88% in the last week alone. In this period the Mag-7 is down -2.68% and was -0.43% lower yesterday. The YTD price outperformance of the Mag-7 versus the Russell 2000 has thus narrowed from nearly 50pp a week ago (+49% vs 0% respectively) to about 33pp now (+45% vs +12%).

The equal-weighted S&P 500 (+1.74%) also closed at an all-time high last night, surpassing its previous record back in March and marking its best 5-day outperformance over the market-cap weighted S&P 500 since 2020. Our CoTD on Friday (link here) looked at how unloved sectors can rocket once a rotation away from tech occurs and yesterday’s (link here) looked at the stretched positioning for Mega Cap Growth and Tech versus the rest and plotted this against earnings growth. Our strategists think the earnings gap will narrow sharply into year-end which will influence the respective positioning. So rotation is indeed the word du jour. Yesterday did show that overall markets have to be slightly careful of the rotation trade as heavyweights Nvidia (-1.62%), Microsoft (-0.98%), Meta (-1.28%) and Alphabet (-1.40%) were all notably lower. For now having 446 S&P 500 advancers on the session meant that these losses could be absorbed.

For the most part, sentiment was supported by the retail sales data, which showed headline retail sales were unchanged in June (vs. -0.3% expected). The details were also pretty good, as the measure excluding autos had its fastest growth in 3 months at +0.4% (vs. +0.1% expected), and there were positive revisions to the May number as well. In turn, that led to growing optimism about the Q2 GDP release next week, and the Atlanta Fed’s GDPNow estimate now sees growth coming in at an annualised rate of +2.5%. It got as low as +1.5% on July 3.

Admittedly, that strength in retail sales did work against the other main theme at the moment, which is the growing anticipation about rate cuts. But ultimately, near-term expectations for rate cuts didn’t shift too much, as the positive retail sales data wasn’t enough to push back against the other data over recent weeks, and futures are still fully pricing in a rate cut by the Fed’s September meeting. Those expectations for rate cuts got some support yesterday from commodity price moves, with Brent crude oil prices (-1.28%) falling back to a one-month low of $83.76/bbl. In addition, Canada’s CPI also surprised on the downside in June, coming in at +2.7% (vs. +2.8% expected).

Altogether a lower yield narrative dominated, as 1 0yr US yields (-7.1bps to 4.16%) closed at their lowest level in 4 months with a temporary 4bps intra-day sell-off after retail sales not holding. And 2yr yields fell to a 5-month low (-4.1bps to 4.42%). The rally in Treasuries was helped along by dovish-leaning comments from Fed Governor Kugler who said that “continued rebalancing [in the labour market] suggests that inflation will continue to move down toward our 2% target”. Meanwhile, with the strong US data doing little to damage rate cut hopes, gold prices (+1.19%) also closed at an all-time nominal high of $2,459/oz.

Overnight a Bloomberg interview with Trump has come out with the former President highlighting that he would allow Powell to serve out his term as Fed Chair (until 2026) and that he believes tariffs are great economically and great as a negotiating tool with other countries.

Back to markets and sovereign bonds also rallied in Europe yesterday, with attention now increasingly shifting to the ECB’s decision tomorrow, and yields on 10yr bunds (-4.6bps), OATs (-3.2bps) and BTPs (-4.7bps) all fell back. However, there were fresh losses for European equities, with the STOXX 600 (-0.28%), the DAX (-0.39%) and the CAC 40 (-0.69%) all losing ground for a second day running.

This morning in Asia equity markets are mostly trading lower with the Shanghai Composite (-0.45%), the CSI (-0.20%) and the Hang Seng (-0.10%) all dipping. Elsewhere, the KOSPI (-0.22%) is also losing ground while the Nikkei (+0.08%) is trading just above flat. Meanwhile, the S&P/ASX 200 (+0.98%) is notably outperforming reaching an all-time high. S&P 500 (-0.13%) and NASDAQ 100 (-0.26%) futures are pausing for breath in Asia hours and Treasury yields have edged up a bit.

Early morning data showed that New Zealand’s Q2 CPI rose +3.3% y/y against +3.4% expected and slowing from the prior quarter’s +4.0%.

Looking forward, attention will be on the UK today, as the CPI release is coming out shortly after we go to press. That’s an important one for the Bank of England, as current market pricing is saying there’s a 49% chance of a rate cut at the next meeting, so this could well be an important piece of data in tilting that balance either way. Elsewhere in the UK, we’ve also got the State Opening of Parliament happening today, where the King’s Speech will outline the new government’s legislative agenda for the upcoming parliamentary session.

Otherwise, the IMF updated their growth forecasts yesterday, which painted a broadly similar picture for the global economy relative to three months ago. For this year, they still see global growth at +3.2%, and the 2025 number was revised up a tenth to +3.3%. That said, there were some bigger moves at the country level, and several emerging markets saw decent upgrades. That included China, where growth in both 2024 and 2025 was revised up four-tenths, and they now forecast growth of +5.0% in 2024 and +4.5% in 2025. India’s growth was also revised up two-tenths this year to +7.0%.

Finally on yesterday’s other data, the German ZEW survey came in a bit stronger than expected in July, with the current situation up to a one-year high of -68.9 (vs. -74.8 expected). However, the expectations component did fall to 41.8 (vs. 41.0 expected), which ended a run of 11 consecutive monthly gains. Meanwhile in the US, the NAHB’s housing market index fell to a seven-month low of 42 in July (vs. 43 expected).

To the day ahead now, and data releases include the UK CPI print for June, US industrial production, capacity utilisation, housing starts and building permits for June. From central banks, we’ll hear from the Fed’s Barkin and Waller, and the Fed will also be releasing their Beige Book. Finally in the political sphere, the King’s Speech is taking place in the UK, where the government will announce their legislative agenda.