US equity futures are stronger with the Russell/small caps again outperforming as the market rotation was supercharged over the weekend after Trump’s assassination attempt, sending both yields and the dollar higher, and is pushing a broadening that is extending July’s gains. Futures on the S&P 500 rose 0.4% at 6:35ET am in New York, while Nasdaq 100 contracts traded 0.5% higher. Pre-mkt, Mag7 and Semis are stronger with TSLA +4.9%, AAPL +2.1% standing out. Bank earnings continue this morning. The yield curve is twisting steeper and the USD rises, as soaring odds of Trump winning the US election spurred a climb in Treasury yields, led by the long end, and revived risk appetite as US equity futures climbed, outperforming European peers. In commodities there is general weakness but some strength in base with crude leading the Energy complex. As the market shifts its focus toward earnings to search for fundamental support for the nascent broadening, the macro keys this week are Retail Sales, Housing Starts, and at least ten Fed speakers including Jerome Powell today.

In premarket trading, Apple jumped 2.1% after the tech giant was named a “top pick” at Morgan Stanley, which said its artificial intelligence platform is a “clear catalyst” to boost iPhone and iPad shipments, according to Morgan Stanley. Baxter International and Staar Surgical dropped after Morgan Stanley downgraded both companies to underweight from equal-weight. Trump Media surged 50% after a failed assassination attack over the weekend boosted the former US president’s bid to return to the White House.

After a historic weekend, investors weighed the market implications of the attack on Donald Trump that threatened to upend the US election. The attempted assassination threatened to shatter the calm that’s lately pushed the S&P 500 Index from one record to the next, causing traders who have been focused on Federal Reserve policy and economic resiliency to also consider political implications. While traders generally don’t expect the assassination attempt to derail the stock market’s trajectory, a pick-up in near-term price swings is likely, especially since Trump is now virtually guaranteed to win unless the deep state tries to whack him again and succeeds. They’ll also contend with the start of earnings season and fresh economic data that could help determine the Fed’s policy path. The assassination attempt also sent shockwaves through the nation and spurred figures on both sides of the aisle to call for leaders to rise above the political fray and attempt to heal national divisions which of course nobody will do.

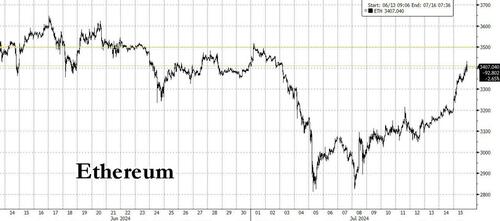

While the Saturday shooting grabbed headlines in an already tumultuous political season, investors are left assessing the attack’s impact on Trump’s chances of reclaiming the presidency. Among the industries most likely to trade on his chances of re-eletion are prison operators, Bitcoin miners and firearms companies, traders said. The shooting also added a layer of uncertainty for anyone already weighing the prospect of interest-rate cuts in the world’s largest economy at the same time that equity valuations remain elevated relative to history.

“While this was a horrific event, equity futures are likely steady because investors remain very focused on Fed policy and the probability of interest-rate cuts still coming later this year,” said Yung-Yu Ma, chief investment officer at BMO Wealth Management.

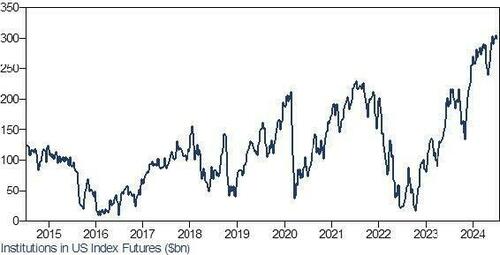

A Deutsche Bank AG gauge of equity exposure among rules-based and discretionary investors jumped to the 96th percentile of historical observations last week. From a contrarian standpoint, such optimism suggests little buying power in the future.

“The assassination attempt reminds investors there are always potential unknowns which can potentially affect markets,” said Stephen Solaka, co-founder of Belmont Capital Group. “If anything, it will create a floor on volatility moving forward, but how much of a rise, if any, will be a reflection of movement in the market.”

“Equities will continue to be driven by earnings, not these events, at the index level,” said Michael Purves, chief executive officer at Tallbacken Capital Advisors. “That said, some stocks will get an added boost if Trump is perceived to be the winner in November.”

Besides political uncertainty, investors will remain focused on an earnings season that’s ramping up in the US this week with reports from Netflix Inc., Johnson & Johnson and State Street Corp., among others.

European stocks trimmed losses after weak economic data from China and as disappointing updates from Swatch and Burberry weighed on luxury shares. Miners also underperform while media and travel stocks outperform. Here are the most notable performers:

- Orkla gains as much as 6.7% after the Norwegian consumer-products group reported earnings that DNB says beat expectations on several metrics.

- Burberry shares drop as much as 17% after the British luxury label said its first-quarter performance for 2025 was “disappointing” and suspended its dividend. The group also replaced CEO Jonathan Akeroyd.

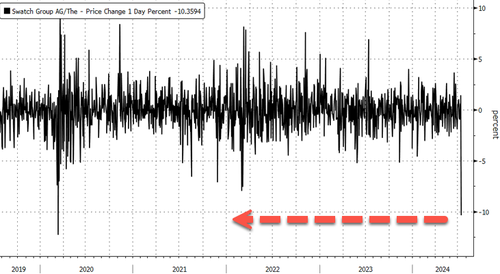

- Swatch shares drop as much as 12%, after the Swiss watchmaker reported disappointing 1H results on weak China demand and FX effects.

- Europe’s luxury stocks follow Burberry and Swatch lower, with Kering and Richemont both down at least 2.8%.

- Ocado shares slump as much as 12% after Bernstein downgraded the online grocery company to underperform, citing a slow demand take-up for its automated warehouse.

- Nordex shares fall as much as 5.2% after the wind-turbine company’s second quarter orders experienced a sharp drop from the prior year.

- BayWa shares fall as much as 35%, the most on record, after the German agricultural firm commissioned a restructuring opinion in response to “a strained financing situation.”

- TomTom shares drop as much as 9.3% after the navigation technology company said it now expects full year group and location technology revenues at the lower end of guidance ranges due to lower automotive operational revenues.

- Gjensidige shares fall as much as 9% after the Norwegian insurance group’s 2Q earnings broadly missed estimates.

- Ionos shares falls as much as 7.5% after analysts at Oddo BHF cut the German cloud solutions provider to neutral from outperform following its 1H results that included reduced sales targets for 2024-2025.

Earlier in the session, Asia stocks dropped as losses in Hong Kong offset gains in other markets after China’s economic growth disappointed. The MSCI Asia Pacific ex-Japan Index slipped 0.2%, with Chinese tech names including Tencent and Alibaba among the biggest drags. A gauge of Chinese stocks trading in Hong Kong fell the most in more than two weeks. Mainland shares edged higher with eyes on the Third Plenum underway. Traders assessed disappointing economic data from China and a ramp-up of the so-called Trump trades after an assassination attempt on the former president. Growing expectations that Donald Trump may win the US elections are also raising worries over escalating tariffs on exports from Asia’s largest economy.

In FX, the dollar rose while the Mexican peso lagged major peers, declining more than 1% on Monday. Yen traded around 157.89 per dollar with Japan out on holiday.

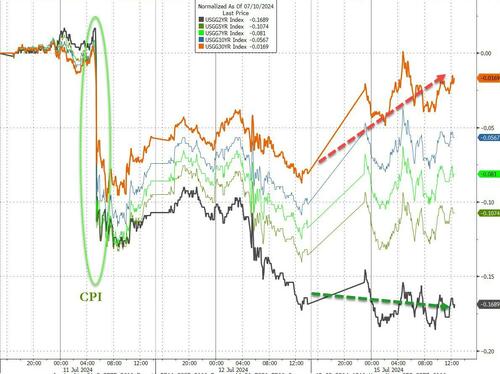

In rates, treasuries trade off session lows, although yields remain cheaper by up to 5bp across long-end of the curve following rising odds of Donald Trump winning the US presidential election after he survived an assassination attempt on Saturday. Short-end yields are little changed, steepening 2s10s and 5s30s curves by ~4bp on the day; 10-year at 4.22% is cheaper by 4bp vs Friday’s close with bunds and gilts in the sector little changed. Treasuries lagged core European bonds, which trade slightly richer on the day. In Europe, bund and gilt yields fell, led by the front end. US session focus includes comments from Fed Chair Powell, slated to speak during US afternoon. Treasury coupon issuance for the week includes $13b 20-year reopening (Wednesday) and $19b 10-year TIPS (Thursday)

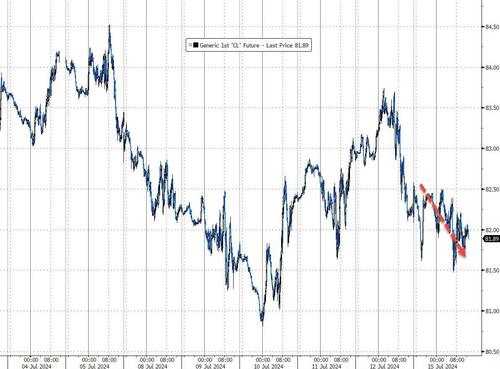

In commodities, WTI drifts 0.2% higher to near $82.39. Spot gold falls roughly $3 to trade near $2,409/oz.

Bitcoin rose to $62,692 as markets reacted to the Trump assassination attempt which boosted the odds of his re-election; the former President is seen as being pro-crypto.

Looking at the calendar, US economic data slate includes July Empire manufacturing at 8:30am; retail sales, industrial production and housing starts are ahead this week. Fed members scheduled to speak include Powell at 12:30pm (no text, Q&A expected) and Daly (4:35pm)

Market Snapshot

- S&P 500 futures up 0.4% to 5,687.50

- STOXX Europe 600 down 0.2% to 523.16

- MXAP down 0.1% to 187.71

- MXAPJ down 0.2% to 586.07

- Nikkei down 2.4% to 41,190.68

- Topix down 1.2% to 2,894.56

- Hang Seng Index down 1.5% to 18,015.94

- Shanghai Composite little changed at 2,974.01

- Sensex up 0.3% to 80,776.63

- Australia S&P/ASX 200 up 0.7% to 8,017.62

- Kospi up 0.1% to 2,860.92

- German 10Y yield -2bps at 2.47%

- Euro little changed at $1.0907

- Brent Futures little changed at $85.06/bbl

- Gold spot down 0.1% to $2,409.37

- US Dollar Index little changed at 104.10

Top Overnight News

- Donald Trump shifted his campaign focus to unity after being wounded in an assassination attempt, asking his onetime primary rival Nikki Haley to attend the RNC in Milwaukee. Trump odds making new highs as are Republican sweep odds in the wake of Trump’s assassination attempt. Simple breakdown is good for US equities (tax cuts/deregulation), bad for intl export exposed equities (tariffs), good for dollar (tariffs/bad for mxn) and bad for rates (bear steepener). Domestic-facing US stocks have outperformed those with foreign sales.

- Meta has decided to lift restrictions on Donald Trump’s Facebook and Instagram accounts, even as the Republican presidential candidate has escalated his rhetoric against its chief executive Mark Zuckerberg. The social media company said in a post on Friday that Trump would “no longer be subject to the heightened suspension penalties” as it believes “that the American people should be able to hear from the nominees for president on the same basis”. FT

- China’s economic data is mixed, with a miss on Q2 GDP (+4.7% vs. the Street +5.1% and down from +5.3% in Q1) and June retail sales (+2% vs. the Street +3.4% and down from +3.7% in May) while industrial production for June came in slightly ahead (+5.3% vs. the Street +5%, but down from +5.6% in May). RTRS

- China withdrew cash from its banking system for a fifth consecutive month amid caution toward monetary easing as currency depreciation pressures mount. The PBOC drained a net 3 billion yuan ($414 million) of cash via its medium-term lending facility on Monday, while holding the interest rate on its one-year policy loans at 2.5%, as the Third Plenum gets underway in the nation’s capital. The twice-a-decade meeting of China’s top leadership has at times marked pivotal policy shifts. BBG

- Apple’s annual sales in India hit a record of almost $8 billion, underscoring a rapidly growing market where the iPhone maker now assembles more of its devices and operates two flagship stores. The India revenue jumped about 33% in the 12 months through March from $6 billion a year earlier, according to a person familiar with the matter. Apple’s pricey iPhones accounted for more than half of the sales. BBG

- Hamas denied it’s pulling out of cease fire talks, a day after an Israeli air strike on Gaza aimed at killing two top Hamas officials left at least 90 people dead and 300 injured. BBG

- The DOJ is considering whether to pursue additional changes in how the residential real estate market functions (the DOJ is concerned the current settlement over broker fees may not go far enough). WSJ

- Luxury stocks fell after Burberry suspended dividends and replaced its CEO, and Swatch earnings disappointed. RTRS

- Allstate’s CEO notes that the rate of auto insurance price increases is cooling, but he doesn’t see it falling below the overall CPI for the next 10 years. Barron’s

- Google parent Alphabet is in talks to buy cybersecurity startup Wiz for as much as $23 billion, a person familiar said. It would be the company’s largest acquisition. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed as participants reflected on the Trump assassination attempt over the weekend and a slew of Chinese data including disappointing GDP, Retail Sales and House Prices, while Japanese markets remained closed for Marine Day. ASX 200 rose above the 8,000 level for the first time with tech and telecoms leading the gains across sectors. Hang Seng and Shanghai Comp. were mixed with the former dragged lower by losses in tech, property and consumer stocks amid mostly weak Chinese data, while the mainland just about remained afloat despite the disappointing releases in which GDP and Retail Sales missed forecasts, while House Prices further deteriorated but Industrial Production topped estimates. Furthermore, the PBoC maintained its 1-year MLF Rate and injected funds through 7-day reverse repos, while top Chinese Communist Party officials kicked off the third plenum.

Top Asian News

- PBoC conducted a CNY 100bln (CNY 103bln maturing) 1-year MLF operation with the rate kept unchanged at 2.50%, as expected.

- China’s stats bureau said China’s economic operations were generally steady in H1 but the external environment is complex and external demand is still not sufficient, while it added that the economic recovery foundation still needs to be consolidated. The stats bureau also said 5% GDP growth in H1 was ‘hard won’ and Q2 economic growth was affected by short-term factors such as extreme weather and flooding. Furthermore, it stated the Chinese economy’s medium- to long-term improving trend remains unchanged but it faces increasing external uncertainties and many domestic difficulties and challenges in H2, while it noted the property market is still in the process of adjustments.

- Goldman Sachs cuts China’s 2024 GDP growth forecast to 4.9% (prev. view of 5.0%).

- JPMorgan cuts China’s 2024 GDP growth forecast to 4.7% (prev. view 5.2%).

European bourses, Stoxx 600 (-0.2%) are almost entirely in the red, with sentiment hit following negative updates from Luxury names Burberry (-15%) and Swatch (-10%), alongside the downbeat Chinese data overnight. European sectors hold a strong negative bias; Media takes the spot alongside Travel & Leisure; Consumer Products is dragged down by the Luxury sector amid post-earning losses in Burberry & Swatch, with weak Chinese growth data also not helping; data which has also weighed on Basic Resources. US Equity Futures (ES +0.4%, NQ +5%, RTY 1%) are entirely in the green, with clear outperformance in the RTY, a continuation of the rotation play seen following US CPI last week; significant strength in Bitcoin is also helping.

Top European News

- BoE’s Dhingra said on The Rest is Money podcast that demand is too soft for inflation to rise sharply and now is the time to start normalising interest rates so we can finally stop squeezing living standards.

- UK PM Starmer is expected to introduce an AI bill as part of 35 bills to be included in the King’s Speech on Wednesday, according to FT. It was reported by Bloomberg that Starmer will use the upcoming King’s Speech to showcase his government’s efforts to spur economic growth in the UK. Furthermore, the UK government said it will strengthen the role of the Office for Budget Responsibility and enforce new spending rules in the legislative agenda in the week ahead, according to Reuters.

- Airbus (AIR FP) upgrades 20yr demand forecasts led by wide-body craft.

- Germany Economy Ministry monthly report says budget deal lays the foundation for reliable politics which should build confidence in H2.

- Italy has reportedly voted in favour of EU tariffs on Chinese EVs via written procedure, according to a diplomatic source via Reuters

FX

- DXY is pressured again and down as low as 104.09 but holding above last Friday’s 104.04 trough, and seemingly fading some of the initial strength overnight as the markets digested an assassination attempt on former President Trump.

- EUR/USD is oscillating around the 1.09 mark and respecting Friday’s 1.0862-1.0911 range. Focus will be on the ECB this week, however, the gathering is set to be a non-event with officials set to sit on their hands and most likely wait until September to enact further policy easing.

- GBP is marginally softer vs. the USD in what was an impressive run for Cable last week. 1.2990 was the high from last week with 1.30 yet to be breached.

- Steady trade for the USD/JPY after an eventful last week which was dominated by suspected intervention by Japanese officials. The pair currently holds around 157.80.

- Antipodeans are mixed with the Kiwi the laggard of the two, losing on the AUD/NZD cross which has climbed above 1.11.

- PBoC set USD/CNY mid-point at 7.1313 vs exp. 7.2548 (prev. 7.1315).

Fixed Income

- USTs were pressured overnight after the attempted assassination of former President Trump and the strengthening of his betting odds for the November election; USTs went as low as 110-24+, but were then lifted alongside a bid in EGBs in the European morning.

- Bunds were initially subdued, in tandem with the UST weakness, but has since lifted across the board with Bunds leading and approaching Friday’s 132.08 peak, a turnaround which has seemingly been driven by poor European equity performance and an easing of selling price and wage pressures in an ECB survey on Access to Finance of Enterprises.

- Gilts are firmer and following Bunds/EGBs with specifics light, but ahead of a busy data-driven docket. Gilts in a 98.07-98.32 band, unable to extend convincingly above Friday’s 98.31 peak with resistance thereafter at 98.53.

Commodities

- Crude has been choppy and off best levels overnight in the aftermath of the below-forecast Chinese GDP metrics. Since, a slight pickup has been seen in the complex, in tandem with recent Dollar weakness. Brent September trades on either side of USD 85/bbl.

- Precious metals are lower but with the downside limited amid a lack of newsflow during the European morning. XAU/USD resides in a narrow USD 2,401.40-2,414.03/oz range.

- Base metals are lower across the board as a function of the downbeat Chinese data overnight which saw GDP miss forecasts after the disappointing inflation and import metrics last week.

- Iraq’s crude oil production was above the agreed quota by 184k bpd in June, while it will adhere to the required production level in the agreement, which is 4mln bpd, for July and the coming months, according to the Iraqi Oil Minister. Furthermore, the Oil Ministry stated that Iraq will compensate for any overproduction since the beginning of the year during the compensation period that extends until the end of September 2025.

- Kuwait Petroleum Corporation announced a new ‘giant’ oil discovery with oil reserves exceeding 3bln barrels and said the newly discovered oil field’s reserves are equivalent to the country’s entire production in three years.

- India’s June Gold imports up at USD 3.06bln (prev. 3.33bln M/M), via Trade Ministry

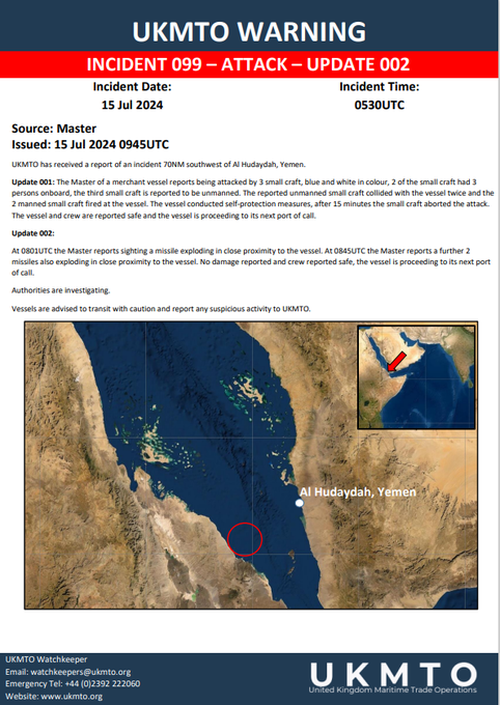

Geopolitics: Middle East

- Two Egyptian sources said Gaza talks have stopped until the Israeli side demonstrates that it is serious, while a senior source cited by Egypt’s Al Qahera News TV stated that Egypt called for Israel to not obstruct ongoing Gaza ceasefire negotiations and not to put forward new principles that contradict what was previously agreed upon. Furthermore, a senior source claimed Israel is wasting time in formal meetings to lure the Israeli public opinion away from reaching a deal, while a Hamas senior official cited by Al Jazeera said that Hamas awaits a response from mediators on proposals introduced to Israel.

- Israeli strikes on Gaza City killed at least 17 and wounded 50, according to health officials. It was also reported that at least 71 Palestinians were killed and 289 injured in an Israeli attack on Khan Younis which targeted Hamas military chief Mohammed Deif. Furthermore, Hamas said that those killed in Khan Younis were civilians and the attack was a grave escalation, while it added that the attack showed Israel wasn’t interested in reaching a ceasefire agreement.

- Israeli military official said it was still verifying the result of a strike on Hamas military chief Mohammed Deif, while Hamas denied the killing of its top commander. It was later reported that the Israeli military said Khan Younis Brigade commander Rafa Salama was killed on Saturday by the Israeli strike on Gaza and Israel’s military chief said Hamas is trying to hide the results of the strike on its armed wing commander Deif.

- Syrian army said one soldier was killed and three others were injured in Israeli strikes on military sites and a residential building in Damascus.

- Yemen’s Houthis said they conducted military operations in the Gulf of Aden and Israel’s Eilat.

- US State Department announced on Friday new sanctions targeting Iran’s chemical weapons research and development.

Geopolitics: Other

- Kremlin spokesman Peskov said Russia is able to respond to the US deploying long-range missiles in Europe, while he warned that European capitals could be victims of the US placing long-range missiles in Europe, according to TASS.

- Chinese and Russian naval fleets recently conducted the 4th joint sea patrol in the western and northern Pacific Ocean, according to Chinese state media.

- China Maritime Safety Administration issued a navigational warning barring entry into some waters of the South China Sea where military exercises will be held from 12:00 local time on July 16th to 11:00 local time on July 17th.

- North Korean Defence Ministry condemned a joint statement by South Korea and the US on nuclear guidelines, according to KCNA.

US Event calendar

- 08:30: July Empire Manufacturing, est. -8.0, prior -6.0

Central Bank Speakers

- 12:30: Fed’s Powell Interviewed by David Rubenstein

- 16:35: Fed’s Daly Speaks in Q&A on Economy, Tech

DB’s JIm Reid concludes the overnight wrap

I’m actually taking the day off today, after this goes to press, as I’ve been ordered to join the family at a Theme Park. I hate, hate, hate rollercoasters so nothing would give me more pleasure than being at work instead. I’m going to be shattered too as I was up late watching England lose the final of the Euros last night. I’m used to such occurrences but one of my 6yr old twins was in floods of tears for an hour after the game. I had to comfort him while trying not to say “get used to it son”. Interestingly the other identical twin who is equally obsessed with sport didn’t bat an eyelid.

I’ll avoid all rollercoaster cliches but the week starts off with the financial world assessing what the failed assassination attempt on Donald Trump means for the Presidential race and for markets. Real Clear Politics has the probability of a Trump victory increasing from around 55% on Friday to around 65% as we type. On a state basis, the shooting took place in Pennsylvania, one of the three most important battleground states and one Biden almost certainly needs to win to be President given where current polling is. Before the weekend Trump was around 3.5% ahead in the state in the latest poll of polls. When Biden performed poorly in the debate 2 and a half weeks ago, Treasuries sold off 20bps in a couple of sessions as markets looked to price in a more fiscally loose Trump clean sweep. Since then there has been positive inflation data which has reversed that sell-off. With Japan closed overnight there is no US bond trading but Treasury futures are falling and are giving up much of the gains seen after Thursday’s weak CPI print so expect yields to open a handful of basis points higher. S&P 500 (+0.19%) and NASDAQ 100 (+0.26%) futures are edging higher along with the dollar index (+0.12%).

Outside of the Presidential race, the most consequential event of the week could come today as Fed Chair Powell is interviewed at the Economic Club of Washington DC at 5pm London time. Will his tone take a notably dovish shift given the soft CPI print last week. Our economists new Fed forecasts would suggest he might as they now expect three cuts in the remainder of 2024 (Sep, Nov, Dec) as a mid-cycle adjustment before three more from September 2025. See “Keeping the expansion alive with 75(bps) before ’25” for more. Eight other FOMC voters will also be on the radar this week (see them detailed in the diary at the end) so we’ll have a good idea of whether the Fed are moving direction by the end of the week. Interestingly, our economists point out that back in December 2023 and March 2024 the Fed median forecasts from the SEP expected 75bps of cuts this year with unemployment at 4.0-4.1% and core PCE inflation 2.4-2.6% by year-end. Recent data suggest that reasonable year-end forecasts are now 4.0-4.2% for unemployment and 2.5-2.6% for core PCE.

Staying with central bankers, the ECB meets on Thursday with the council expected to vote to stay on hold for now. See our economists’ preview here. Also watch for the quarterly ECB bank lending survey tomorrow. This has tentitatively turned more positive in the last couple of quarters, especially in the expectations component. In terms of the other main non-data highlights, earnings season in the US starts to build, China’s Third Plenum starts today through to Thursday with all eyes on potential policies and reforms targeted at key economic issues including the property sector. On the same days the Republican National Convention will take place with the main event being the unveiling of the Vice President nomination and the reaction to the assassination attempt. Staying with politics, Wednesday sees the UK State Opening of Parliament and the King’s Speech which contains the new government’s legislative program for the year. The following day sees a European Parliament vote on whether European Commission President Von der Leyen gets a second term.

In terms of data and earnings, on a day by day basis the highlights are as follows. Today sees US Empire manufacturing, Eurozone IP with Blackrock and Goldman reporting. Tomorrow sees the very important US retail sales, the NAHB US housing index, German/EuroZone ZEW survey, Canadian CPI with BoA and Morgan Stanley reporting. Wednesday sees US IP, capacity ulitisation, building permits, housing starts, the Fed Beige Book, UK CPI, a 20yr UST auction with Johnson and Johnson and ASML the earnings highlights. Thursday sees the US Phili Fed index, jobless claims as ever, UK employment data, and with TSMC and Netflix reporting. Friday sees Japanese CPI, UK retail sales and public finance data, German PPI with Amex the earnings highlight.

Also of note will be the stock market after a fascinating week last week where the Mag-7 underperformed the index with the highlight being Thursday’s largest performance gap between the S&P 500 and the equal weighted equivalent since November 2020, just after the Pfizer vaccine announcement. I did what I thought was a very good CoTD on Friday reminding readers of what happened to other sectors when the tech bubble burst in March 2000. The three “dullest” sectors (Consumer Staples, Healthcare and Utilities) had performed badly in the last few months of the bubble but rallied +25-35% in the final 9 months of the year as tech slumped. It wasn’t until 2001 and 2002 that the wider market really slumped. So if tech does see a correction, the market will likely go down given their size, but several sectors could rally notably. See the CoTD from Friday here.

As we start the week, Asian equity markets are seeing low trading volumes with Japan on holiday. The Hang Seng (-1.30%) is leading losses following disappointing economic figures from China while the CSI (+0.07%) and the Shanghai Composite (+0.08%) are fairly flat alongside the KOSPI (+0.02%).

Coming back to China, GDP grew +4.7% y/y in the second quarter (the worst in five quarters), missing the +5.1% forecast and down from +5.3% growth in Q1, hampered mainly by weak consumer spending and demand. On a q/q basis, GDP in the April-June period rose +0.7% from the previous quarter, versus a revised growth of +1.5% in the January-March period. Other data showed that China’s retail sales slowed to +2.0% y/y in June (v/s +3.4% expected and the worst since December 2022) after advancing +3.7% in May, thus highlighting that the world’s second largest economy is struggling to boost consumption. Adding to the negative sentiment, China’s home prices fell again in June, declining -0.67% on the month with existing home prices declining -0.85%.

Meanwhile, industrial output rose +5.3% y/y (v/s +5.0% expected) in June from a year earlier, slowing from +5.6% in May, but above expectations at least. Overall the data means that there will be a lot to discuss at the Third Plenum this week.

Now recapping last week, the main story was around US inflation after the weak US CPI on Thursday (-0.1% vs +0.1% expected) was followed by a fairly sanguine June PPI on Friday. Although headline PPI climbed more than expected, by +0.2% month-on-month (vs +0.1% expected) and +2.6% year-on-year (vs 2.3% expected), the categories used to calculate PCE were on the weaker side. This narrative found further support from the University of Michigan’s preliminary inflation expectations results for July. 1yr expectations were in line with expectations at 2.9% (down from 3.0% last month) and 5-10yr inflation expectations dipped to 2.9% (vs 3.0% expected). The survey also showed consumers becoming slightly more pessimistic on the economic outlook, with consumer sentiment disappointingly dropping from 68.2 to 66.0 (vs 68.5 expected), its lowest level in 8 months.

Off the back of the weaker inflation data, investors dialled up their expectations of Fed rate cuts, with the total number of cuts expected by year-end up +12.6bps to 63bps on the week (+2.2bps on Friday). Markets moved to fully price in a 25bps cut by the September meeting, up from 72% on Monday, spurring a rally in US Treasuries. The 2yr yield ended the week down -15.4bps (and -6.3bps on Friday) to 4.45%, its lowest level since early February. 10yr yields followed suit, falling -9.5bps (and -2.7bps on Friday) to their lowest level (4.18%) since March. In Europe it was a similar story, as 10yr bund yields finished the week -5.9bps lower, although they lost some ground on Friday (+3.3bps).

Risk assets also got a boost with the S&P 500 rising +0.87% (and +0.55% on Friday). The big story within equities was a rotation away from tech mega caps after the CPI print. The Magnificent 7 index was down -1.71% on the week (despite +0.45% on Friday). By contrast, the equal-weighted S&P 500 was up +2.90% (+0.81% Friday), while the small cap Russell 2000 gained +6.00% (and +1.09% on Friday), its largest weekly gain since November. A notable underperformer within the S&P 500 on Friday were banks (-1.50%) after underwhelming results from Wells Fargo (-6.02%), JPMorgan (-1.21%) and Citigroup (-1.81%). Meanwhile, European stocks posted a solid rally, as the STOXX 600 recorded a gain of +1.45% (and +0.88% on Friday).

There were some notable moves in the FX space. The USD dollar index weakened amid prospects of more rate cuts, falling -0.75% (and -0.33% on Friday). This followed a -0.94% decline the week before, making it the weakest two-week run for the dollar YTD. On the other side, sterling reached its highest level against the dollar in almost year at 1.2911, and the strongest against the euro in almost two years at 1.1909. Elsewhere, the yen recovered by +2.4% against the dollar across Thursday and Friday (to 157.83) amid reported FX intervention, having hit a post-1986 low earlier in the week.