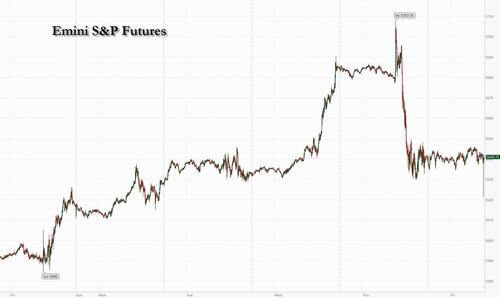

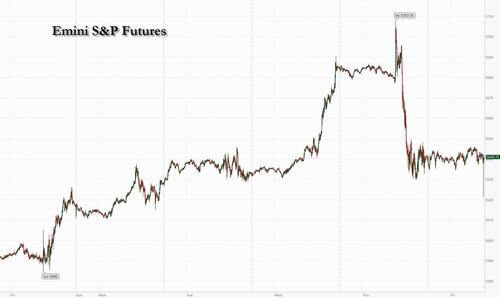

US equity futures are flat, erasing a modest earlier gain, as yesterday’s rotation continues this morning with RTY rallying +0.8% pre-mkt even as megacap tech stocks are higher (NVDA +93bp, AAPL +39bp, AMZN +19bp). As of 8:45am, S&P futures were little changed after the index fell almost 1% in the previous session. The yield on 10-year Treasuries was unchanged at 4.21% and the USD is lower despite a PPI report that came in hotter than expected. Commodities are mixed: oil is higher, base metals are lower. Today, the key focus will be PPI (which beat across the board) and banks earnings (which were mixed).

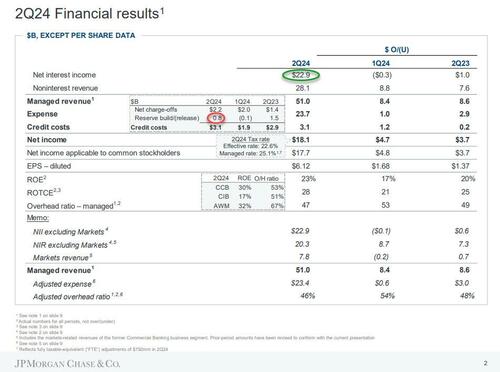

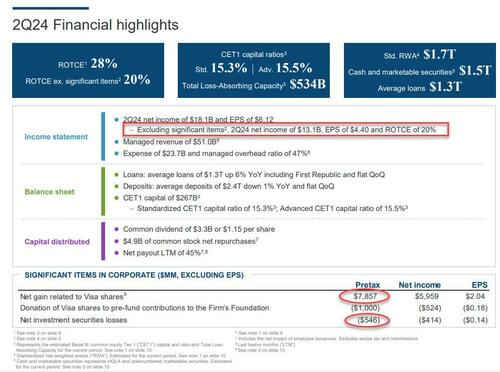

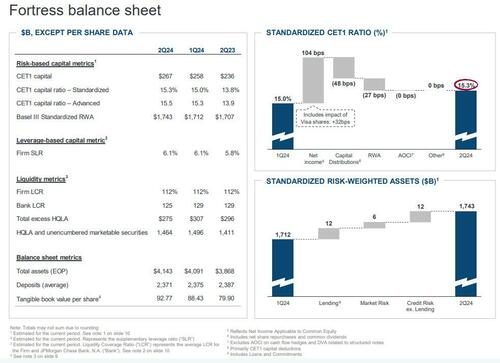

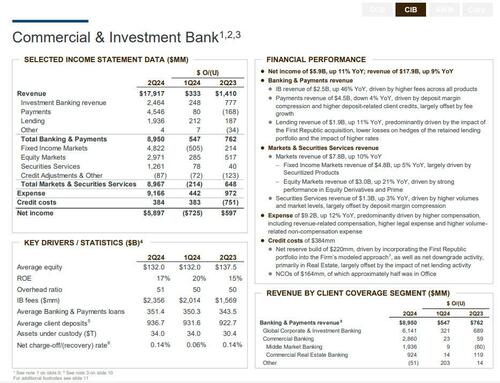

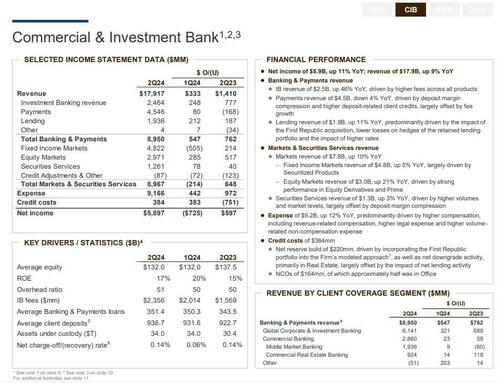

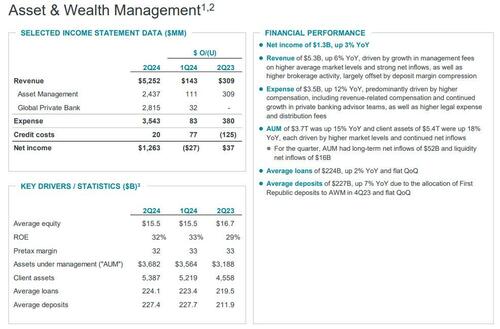

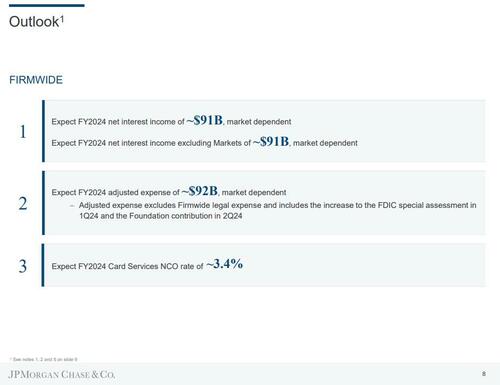

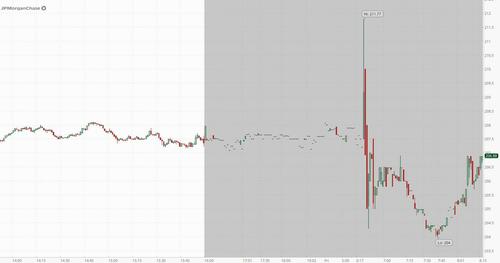

In premarket trading, Wells Fargo sank 5% after warning it won’t be able to whittle away costs as fast as forecast amid higher-than-expected expenses. JPMorgan swung between gains and losses after reporting record profit, while missing on a few key metrics, like net interest income. Citigroup climbed 3% as equity trading beat estimates even as the lender said costs for the year are likely to be at the high end of the range previously provided. Here are some other notable premarket movers:

- Tesla dropped 1% after UBS cut its rating on the electric-vehicle maker to sell, saying the stock has rallied “too much, too soon.”

- Array Technologies gains 5% after Citi raised the solar tracking equipment company to buy, touting its growth potential.

- AT&T slips 2% as the company suffered a massive hack of customer data — separate from one reported earlier this year — that included records of calls and texts for nearly all of its mobile-phone users for a six-month period in 2022.

- Bally’s ticks 1% higher after securing a funding commitment from Gaming and Leisure Properties.

- JPMorgan falls 1% despite investment banking revenue beating estimates. CEO Jamie Dimon said while there has been some progress, inflation and rates may stay higher than expected.

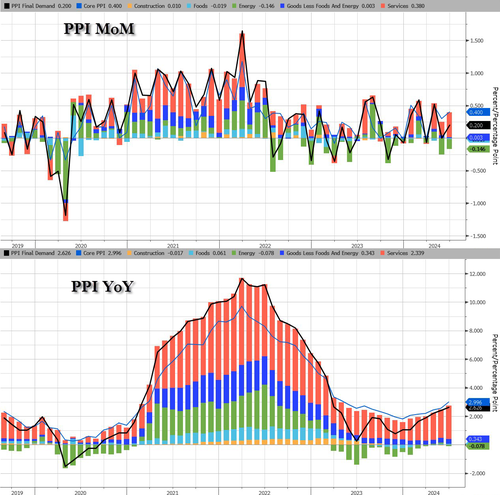

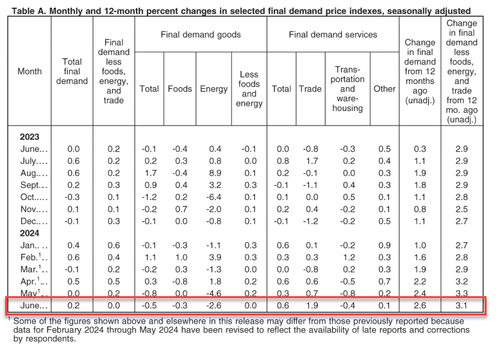

US producer prices climbed in June more than forecast as a pickup in margins at service providers more than offset declines in the cost of goods. Investors are also eager to hear from the largest banks about the state of the US economy and expectations for the rest of the year, including the potential impact of the presidential elections in November.

In Europe, the Stoxx 600 is up 0.2% – rising for a third day – led by gains in energy and consumer product shares. Here are the biggest movers Friday:

- Ericsson shares rise as much as 9.3% to the highest since September 2022 after the company reported stronger-than-expected sales, in part thanks to a growth revival in the key US market

- Addtech advances as much as 13%, the most since 2021 and to a record high, with DNB seeing a “solid” 1Q report from the Swedish industrial technology group, with net sales 4% ahead

- Lifco shares jump as much as 12% to hit a new record high after the maker of dental equipment, machinery and tools reported quarterly net sales above expectations in the second quarter

- Norwegian Air shares rise as much as 8.2% after 2Q Ebit surpassed expectations, leading analysts to predict upgrades to consensus forecasts, with DNB describing the report as “slightly postitive”

- Elkem shares jump as much as 11%, the most since July 2022, after the Norwegian silicon maker reported Ebitda for the second quarter that beat the average analyst estimate

- BFF Bank jumps as much as 14% to touch a two-month high after the Italian lender reported an increase in its past due exposures and risk-weighted assets, following a credit reclassification

- Volkswagen gains as much as 1% as Redburn raises its recommendation to neutral, saying the firm faces less exposure to any tariff escalations, with negotiations potentially dragging on

- European shipping companies extend their slide, with Denmark’s Maersk shedding as much as 4.6%, as economic uncertainty and excess capacity concerns continued to pressure freight rates

- Axfood falls as much as 8.8%, the most since 2022, after the Nordic retail group reported its latest earnings. DNB sees an overall week report, with its Dagab logistics unit the main drag

- EMS-Chemie shares slump as much as 7.2%, the most since 2020, after the Swiss company cut its revenue forecast and said the challenging economy and rising costs are weighing on demand

- Avanza shares drop as much as 6.5%, the most in three months, after the Swedish online bank and trading platform reported operating income for the second quarter that missed estimates

- Europris falls as much as 6.1% after DNB cut its recommendation for the Norwegian retail group to hold due to soft sales trend in its key Norwegian market and for its Swedish retail chain ÖoB

Earlier, Asian stocks declined as tech shares tracked their US peers lower after slowing inflation data. Equities in Hong Kong bucked the selloff amid prospects of lower borrowing costs. The MSCI Asia Pacific Index fell as much as 1.1%, the most in over a month, with TSMC, Samsung Electronics and Tokyo Electron among the biggest laggards. Tech-heavy markets such as Taiwan, Japan and South Korea led declines in the region. Equities in mainland China fluctuated as traders rebalanced their holdings ahead of next week’s Third Plenum. Property stocks climbed amid rising expectations for more support for the sector at the meeting. Meanwhile, shares in Hong Kong rose as soft US consumer price print boosted hopes for potential interest rate-cuts in the city. Here are the most notable movers:

- BOC Aviation shares rise as much as 5.3%, the most since April, after it closed a self-arranged club loan transaction with 25 banks globally totaling $2.3 billion.

- CK Infrastructure shares climb as much as 7.5% in Hong Kong, the most since December 2023, as the company considers a second listing on an overseas stock exchange.

- BayCurrent shares climb as much as 19%, the most since January 2022, after the Japanese IT services company reported first quarter operating income that beat analyst estimates and saw unit rates grow quarter-on-quarter.

- Chalco rises as much as 10% in Hong Kong and 6.4% on the mainland after JPMorgan upgrades the stock to overweight on expectations the company will raise its full-year payout ratio after its preliminary 2Q results beat estimates.

- Seven & I shares plunge as much as 8.4%, the most since August 2020, after the Japanese retail conglomerate reported first-quarter operating income that missed the average analyst estimates and weak performance in overseas convenience stores.

- Fast Retailing shares decline as much as 4.1%, the most since April 12, on concerns the stock’s recent gains will increase the probability that the Nikkei will reduce the company’s weighting in its benchmark average.

- Astro Malaysia Holdings shares plunge as much as 9.7% after the Inland Revenue Board served the company notices of additional tax assessment for 2019 to 2023.

- Huafon Chemical shares rise as much as 8%, the most since Feb. 7, after the company said it expects to report 1H profit rose by 1.6% to 24% y/y.

- Hanssem shares rally as much as 10% after Samsung Securities says the furniture manufacturer’s profits may get a lift from rising home sales in South Korea.

- Xtep International shares rise to the highest since June 11 as Goldman Sachs says the company’s ‘solid’ 2Q retail revenue growth is driven by online and emerging brands sales that were ahead of target.

In FX, the yen initially weakened against the dollar, paring some of the sharp rally seen in the prior session, before resuming its trek higher. An analysis of Bank of Japan accounts suggests authorities did step into the markets to prop up the yen on Thursday. USD/JPY was flat at ~158.90. The Bloomberg Dollar Spot Index is down 0.1% and set for a third day of declines. The Swedish krona is the weakest of the G-10 currencies, falling 0.5% against the greenback after underlying inflation slowed more than expected.

In rates, treasuries edged lower, with US 10-year yields rising 1bps to 4.22%. Long-end yields are higher by ~1bp with 2s10s spread steeper by ~1bp; US 10-year around 4.225% outperforms bunds by ~4bp, gilts by ~6bp. European government bonds underperform their US peers.

In commodities, oil prices advance, with WTI rising 1% to trade near $83.50 a barrel. Spot gold falls $12 to around $2,404/oz.

Bitcoin is incrementally softer and holds just above USD 57k, after briefly dipping below the level earlier. Ethereum remains firmly above USD 3k.

Today’s economic data slate includes June PPI (8:30am, which beat across the board) and July preliminary University of Michigan sentiment (10am). No Fed members are scheduled to speak

Market Snapshot

- S&P 500 futures little changed at 5,643.50

- STOXX Europe 600 up 0.3% to 521.21

- MXAP down 0.6% to 187.44

- MXAPJ up 0.1% to 587.14

- Nikkei down 2.4% to 41,190.68

- Topix down 1.2% to 2,894.56

- Hang Seng Index up 2.6% to 18,293.38

- Shanghai Composite little changed at 2,971.30

- Sensex up 1.0% to 80,665.58

- Australia S&P/ASX 200 up 0.9% to 7,959.28

- Kospi down 1.2% to 2,857.00

- German 10Y yield rose 4bps at 2.51%

- Euro up 0.1% to $1.0884

- Brent Futures up 0.9% to $86.16/bbl

- Gold spot down 0.4% to $2,406.32

- US Dollar Index little changed at 104.37

Top Overnight News

- US President Biden mistakenly referred to Ukrainian President Zelensky as President Putin before correcting himself during comments at the NATO summit, while he also mistakenly referred to Vice President Harris as Trump during his press conference. Furthermore, Biden said he has to finish the job because there is so much at stake and has taken three significant and intense neurological exams which say he is in good shape.

- US President Biden is expected to face a deluge of calls from House Democrats urging him to drop out of the presidential race regardless of his performance at the NATO press conference, according to Axios. It was also reported that dozens of Democratic lawmakers are to call for US President Biden to quit the race in the coming 48 hours: CBS.

- Three Biden officials directly involved in his re-election told NBC News that his chances of winning are zero and one said he needs to drop out, while it was also reported that some Biden advisers were discussing how to convince him to step aside: NYT.

- The Biden campaign is quietly assessing the viability of Vice President Harris’ candidacy against Donald Trump in a new head-to-head poll: MSNBC.

- Softbank has acquired U.K. semiconductor company Graphcore, the latest in a series of steps taken by the Japanese tech investment company in the artificial-intelligence field. The Bristol-based chip company, which specializes in AI, said that it is now a wholly-owned subsidiary of SoftBank Group and will continue to operate under the Graphcore name. WSJ

- Fed’s Goolsbee (non-voter) said the June CPI report is excellent and the improvement on shelter inflation is profoundly encouraging, while he added this is what a path to 2% inflation looks like and as inflation falls, leaving Fed policy rate steady means Fed is tightening policy. Goolsbee said the reason to tighten policy would be if the economy is overheating but added they are not overheating, as well as noted that he doesn’t like tying their hands on policy decisions and they need to decide when to cut rates, not trying to figure out a rate path for next seven months.

- China’s already formidable exports surged in June, China’s customs administration reported on Friday. But imports shrank, with Chinese companies and households becoming more cautious about spending money. The result was a record monthly trade surplus of just over $99 billion. NYT

- Despite billions of dollars in additional weapons and security assistance that NATO announced this week, allied officials said Ukraine would not be ready to launch a dramatic counteroffensive or retake large swaths of territory from Russia until next year. NYT

- Some American officials have grown more optimistic that a deal to release Israeli hostages held in Gaza in return for a cease-fire is at hand. But people briefed on the talks say it will be days until it is clear whether a breakthrough has been achieved because of difficulties in communication between Hamas officials in Qatar and the group’s leaders in Gaza. NYT

- Joe Biden vowed to stay in the presidential race despite new gaffes, including mixing up Volodymyr Zelenskiy and Vladimir Putin, and VP Kamala Harris and Donald Trump, during a press conference on the sidelines of the NATO summit. At least three more House Democrats, including Jim Himes, the top member from his party on the Intelligence Committee, called for Biden to drop his re-election bid. BBG

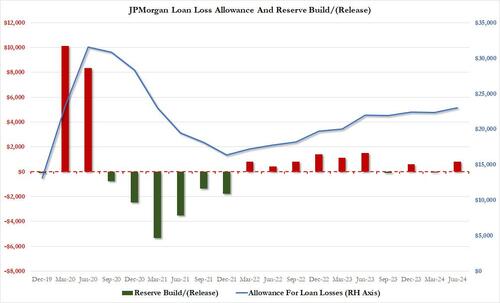

- Big bank earnings kick off today with JPMorgan, Citi and Wells Fargo as shares trounce the broader market. Investors are looking past another projected drop in net interest income, instead focusing on investment banking and a rebound in loan profits. BBG

- Boeing is said to have told some 737 Max customers that aircrafts due in 2025 and 2026 face additional delays. BBG

- U.S. Republican lawmakers are seeking a probe into Microsoft’s $1.5 billion investment in artificial intelligence firm G42, citing concerns about the transfer of advanced technology and possible ties the Abu Dhabi-based company may have with China. WSJ

- Axel Springer is considering a break-up, w/a separation of its media assets (including Politico and Business Insider) and classifieds business. FT

A more detailed look at global markets courtesy of Newquawk

APAC stocks took their cues from the mixed performance stateside where softer-than-expected CPI data boosted Fed rate cut bets and spurred a stock rotation out of large-cap tech into small-cap cyclicals. ASX 200 gained amid lower yields with gold miners, real estate, and consumer stocks leading the advances. Nikkei 225 underperformed after recently sliding back from record highs and amid speculated FX intervention. Hang Seng and Shanghai Comp. diverged as the former rallied back above the 18,000 level with strength seen in property and tech, while the mainland was lacklustre after mixed Chinese trade data in which Exports topped forecasts but Imports surprisingly contracted.

Top Asian News

- China’s Foreign Minister said in a phone call with his Dutch counterpart that China is willing to establish close ties with the new Dutch government and carry out all-around dialogue, as well as enhance mutual understanding. Furthermore, China believes the Dutch side will encourage the European side to look at China objectively and rationally and play a constructive role in maintaining a healthy and stable development of China-EU relations.

- Japanese government official said Japan conducted currency intervention to prop up the yen on Thursday, according to Mainichi citing an unidentified official. It was separately reported that the BoJ likely conducted rate checks in EUR/JPY on Friday, according to Nikkei.

- Japanese Finance Minister Suzuki said currency rates should be set by the market and rapid FX moves are undesirable, while he wouldn’t comment on FX levels, FX intervention and media reports that Japan conducted FX rate checks.

- Japanese Chief Cabinet Secretary Hayashi said no comment on FX intervention and wouldn’t comment on forex levels, while he added it is important for currencies to move in a stable manner reflecting fundamentals and they are ready to take all possible means on forex.

- Japanese top currency diplomat Kanda said no comment on FX intervention and noted recent yen moves are somewhat rapid, while he added they will take appropriate action on forex if needed. Furthermore, he is puzzled about the media report on intervention, while he did not comment on whether they intervened in the FX market and cannot think if government officials commented on forex intervention.

- BoJ Survey says wage growth spreading among small and medium firms this year. Growth being driven by rising prices, hiring competition and a recovery in earnings performance.

- Japan’s business lobby Doyukai Chief Niinami has asked the BoJ to raise rates in July, according to Nikkei.

- Japanese gov’t is reportedly expected to slightly cut its economy growth forecast for FY24 from the current view of 1.3%, via Reuters citing sources.

- BoJ data suggest Japan intervened in the FX market on July 11th, may have spent between JPY 3.37-3.57tln, according to Reuters; Accounts point to intervention of some JPY 3.5tln, according to Bloomberg.

European bourses, Stoxx 600 (+0.3%) are entirely in the green, continuing the price action seen in the prior session. Indices initially opened tentatively higher and continued higher as the morning progressed, though has edged off best levels in recent trade. European sectors hold a strong positive bias; Energy takes the top spot, benefiting from underlying strength in the crude complex. The Telecoms sector has been lifted by post-earnings strength in Ericsson (+7.2%). US equity futures (ES +0.1%, NQ U/C, RTY +0.7%) are mixed with the ES and NQ taking a breather from yesterday’s hefty selling pressure; the RTY continues to advance and holds at highs, with the rotation narrative remaining firm. Bank earnings today: BNY Melon, JPMorgan, Wells Fargo, Citi. Intel (INTC) exec. says they are on track for cumulative software sales of USD 1bln by end-2027

UBS has downgraded Tesla (TSLA) to Neutral from Sell with a price target of USD 197

Top European News

- Rio Tinto (RIO LN) studies mining megadeals after collapse of the BHP (BHP AT)-Anglo American (AAL LN) swoop; Rio is said to have held talks with bankers to ‘wargame’ a potential USD 32bln offer for Teck Resources (TECK), via Sky News. The article notes that Teck is among a “refreshed list” of potential takeover targets. One source stated that Rio is “not about to launch an imminent bid for Teck Resources, but acknowledged that it was on a list of possible targets.”

FX

- Despite initial upside earlier in the session, USD strength has begun to wane with the DXY now flat. Should the downside continue, a test of Thursday’s low at 104.07 could be seen.

- EUR/USD firmer on the session as the attempted recovery in the USD has begun to wane. Upside focus for EUR/USD remains on a potential breach of 1.09 after topping out bang on that level yesterday.

- GBP firmer vs. the USD with Cable on a 1.29 handle but below yesterday’s 1.2949 high. It has been a solid week of gains for the GBP amid hawkish interjections from MPC’s Haskel, Mann and Pill as well as a solid M/M June GDP print.

- JPY is a touch softer vs. the USD after some wild price action yesterday spurred by US CPI and suspected Japanese intervention. Since then, more volatile price action was observed overnight with the Nikkei suggesting the BoJ likely conducted rate checks in EUR/JPY.

- Antipodeans are both firmer vs the Dollar; AUD/USD is currently extending its winning streak vs. the USD to a 9th consecutive session, albeit is currently below yesterday’s CPI-induced 0.6798 peak.

- Soft Swedish inflation data saw EUR/SEK spike higher from 11.4240 to 11.4600. The significantly cooler than expected print serves to reinforce market expectations for an August cut.

- PBoC set USD/CNY mid-point at 7.1315 vs exp. 7.2514 (prev. 7.1339).

Fixed Income

- USTs are very slightly softer, in a paring of US CPI-induced strength and following a subdued 30yr auction on Thursday. Docket today includes US PPI and UoM Prelim. Currently trading around 110’30.

- Bunds hold a bearish bias, but still remains at elevated levels sparked by the dovish US CPI report. Bunds are down to a 131.56 base where they appear to have made a bit of a floor thus far having pulled back from an overnight 131.81 peak.

- Gilt price action is in-fitting with peers given the lack of UK-specific newsflow. Gapped lower by 26 ticks to 98.25 before slipping further to lows of 97.87; complex awaiting next week’s key wage and inflation metrics.

Commodities

- Crude is extending on yesterday’s modest gains which were supported by a softer Dollar following the US CPI metrics, with the strength continuing in APAC hours. Brent September topped USD 86/bbl to trade in a current USD 85.45-86.35/bbl parameter.

- Downbeat trade across all precious metals following yesterday’s US CPI-induced surge, with underperformance this morning seen in spot silver and palladium whilst spot gold posts shallower losses ahead of US PPI. Spot gold is subdued in a current USD 2,400.14-2,416.26/oz band.

- Mixed trade across base metals with copper bucking the trend this morning following yesterday’s slide despite the constructive US data for the metal.

Geopolitics

- “Israeli warplanes breach the sound barrier over areas north of Beirut (capital of Lebanon)”, according to Sky News Arabia

- US President Biden said NATO confirms support for Ukraine and will not allow Russia to achieve victory.

- NATO Secretary General Stoltenberg said Ukraine can count on NATO now and for the long haul, while he added that Chinese exercises with Belarusian forces are part of a pattern and confirms authoritarian regimes are aligning more.

- German Chancellor Scholz said more needs to be done to ramp up air defences for Ukraine, while he added their defence industry needs to be capable of expanding production capacities swiftly.

- South Korea and the US signed a guideline on nuclear deterrence and operation in the Korean Peninsula, according to the South Korean Presidential Office.

- “Israel says it was bombed in southern Syria in response to a projectile fired from the Golan”, via Al Arabiya..

US Event Calendar

- 08:30: June PPI Final Demand MoM, est. 0.1%, prior -0.2%

- June PPI Final Demand YoY, est. 2.3%, prior 2.2%

- June PPI Ex Food and Energy YoY, est. 2.5%, prior 2.3%

- June PPI Ex Food and Energy MoM, est. 0.2%, prior 0%

- 10:00: July U. of Mich. Current Conditions, est. 66.0, prior 65.9

- July U. of Mich. Sentiment, est. 68.5, prior 68.2

- July U. of Mich. Expectations, est. 69.3, prior 69.6

- July U. of Mich. 1 Yr Inflation, est. 2.9%, prior 3.0%

- July U. of Mich. 5-10 Yr Inflation, est. 3.0%, prior 3.0%

DB’s Jim Reid concludes the overnight wrap

Markets got another boost yesterday, as the latest US CPI print surprised on the downside once again, which led to growing hopes that inflation was finally being tamed. Of course, it’s worth remembering that one report doesn’t make a trend, but recent months have brought some of the weakest inflation numbers since the current surge began in 2021, and it’s led to growing expectations that the Fed will finally be able to start cutting rates in the months ahead. In fact, investors are now fully pricing in a rate cut by the September meeting, and yesterday saw the 2yr Treasury yield (-10.6bps) post its biggest daily decline since January. Equities also put in a strong session for the most part, and the small-cap Russell 2000 (+3.57%) had its best daily performance of 2024 so far. That said, one very notable exception were the Magnificent 7 (-4.26%), which put in their worst performance since October 2022, and their concentration meant that the S&P 500 (-0.88%) ended its run of 7 consecutive daily gains, even though nearly 80% of the index’s members were actually higher on the day.

In terms of the details of that CPI report, headline CPI for June actually fell by -0.1% on the month (vs. +0.1% expected), which was the biggest outright decline in prices since May 2020 during the Covid-19 pandemic. Other details in the report were also very promising, as core CPI came in at just +0.1% (vs. +0.2% expected), which is the weakest month for core inflation since January 2021. The declines were driven by several factors, but there was a meaningful step lower in shelter inflation, with Owners’ Equivalent Rent up just +0.28% in June, which was its weakest month since April 2021, and down from +0.43% in May. Bear in mind that the OER category alone makes up more than a quarter of the CPI basket, and around a third of core CPI, so if that shift lower is durable, then that’s very good news in terms of keeping inflation low.

Markets were also reassured that the latest print followed a series of softer inflation numbers in Q2, raising hopes that it wasn’t simply one good month. In fact, on a 3-month annualised basis, core CPI is up just +2.1% now, which is the lowest since March 2021. To be fair, the 6-month core CPI is still at +3.3%, which reflects the stronger prints from Q1, but that’s also on a downward trajectory, and similar prints to the last two would cement the idea that inflation is on a clear path lower. On the back of the print, our US economists have lowered their 2024 core CPI forecast by three tenths to 3.0% (on Q4/Q4 basis). See their full reaction note here.

With that inflation report in hand, there was immediate speculation that the Fed might accelerate the timing of their rate cuts and announce a first cut as soon as the September meeting. For instance, f utures are now fully pricing in a move by September, whereas beforehand it was only fully priced in by November. Likewise for the year as a whole, there were growing expectations that the Fed would deliver multiple rate cuts, with 61bps of cuts now priced in by the December meeting at the close, up from 51bps the previous day. When it came to Fed officials themselves, Chicago Fed President Goolsbee said that the latest data was “excellent”, and that his view “is this is what the path to 2% looks like”.

As investors priced in more rate cuts, the US Dollar index weakened -0.58%, and US Treasuries rallied strongly, with both the 2yr and 10yr yields falling to their lowest level since March. Specifically, the 2yr yield (-10.6bps) was down to 4.51%, in its biggest daily decline since January, and the 10yr yield (-7.4bps) was down to 4.21%. Treasuries did give up some of their initial post-CPI gains late on however, with the 10yr yield having traded as low 4.165% intra-day. And overnight, the 10yr yield (+1.0bps) has moved a bit higher to 4.22%. There were similar moves in Europe, with yields on 10yr bunds (-7.0bps), OATs (-6.3bps) and BTPs (-7.0bps) all falling as well.

For equities though, there was a much more divergent performance in the US, with small-caps surging whilst the Magnificent 7 slumped. That meant the small-cap Russell 2000 (+3.57%) had its best daily performance since December, rising to its highest level since March 2022. By contrast, the Magnificent 7 (-4.26%) had its worst performance since October 2022. Ultimately though, that meant the S&P 500 (-0.88%) fell back by a sizeable amount, even though more than three-quarters of the index’s members actually rose on the day. The equal-weighted S&P 500 (+1.17%) posted a strong advance, with the largest daily performance gap versus the main market cap-weighted index since 2020. Rate-sensitive sectors including real estate (+2.66%) and utilities (+1.83%) outperformed within the S&P 500. Meanwhile in Europe, there were more consistent gains, with advances for the STOXX 600 (+0.60%), the DAX (+0.69%) and the CAC 40 (+0.71%).

Speaking of Europe, there were some strong growth numbers from the UK yesterday, where monthly GDP was up by +0.4% in May (vs. +0.2% expected). The monthly GDP numbers can be a bit choppy, but if you look at the full three months leading up to May, the economy was +0.9% bigger than the previous three months, which is the fastest growth since January 2022. In turn, that meant that gilts underperformed, with the 10yr yield only down -5.2bps, and the weakness in the dollar also helped sterling reach its strongest level against the dollar in almost a year, at $1.2911. Staying on the UK, Luke Templeman and Galina Pozdnyakova published a piece yesterday on the country’s new listing rules, which you can read here.

Overnight in Asia, equity markets have lost ground across the region, with losses for the Nikkei (-2.23%), the KOSPI (-1.31%), the Shanghai Comp (-0.21%) and the CSI 300 (-0.20%). The main exception to that is the Hang Seng, which has surged +1.98% this morning. For the Nikkei, those losses have come amidst a sharp appreciation in the Japanese Yen, which strengthened by +1.79% yesterday against the US Dollar, reaching 158.83. In part that was down to the weakness of the dollar after the CPI print, but there was speculation about whether there’d been an intervention, and Japan’s current chief Masato Kanda said he was “not in a position” to comment on whether Japan had intervened. Looking forward, US equity futures haven’t seen much movement this morning, with those on the S&P 500 unchanged, and those on the NASDAQ 100 down -0.14%.

When it came to yesterday’s other data, the US weekly initial jobless claims for the week ending July 6 came in at a 6-week low of 222k (vs. 235k expected). Moreover, the continuing claims fell to 1.852m (vs. 1.860m expected) over the week ending June 29, which ends a run of 9 consecutive weekly gains.

To the day ahead now, and data releases include the US PPI reading or June, along with the University of Michigan’s preliminary consumer sentiment index for July. We’ll also get earnings releases from JPMorgan Chase, Citigroup, Wells Fargo and BNY Mellon.