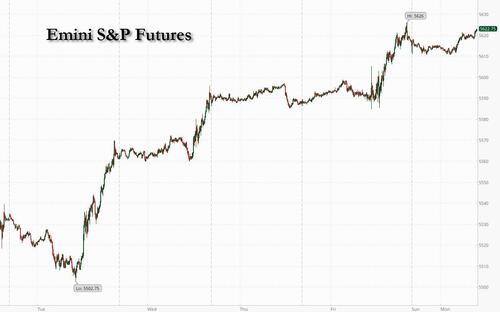

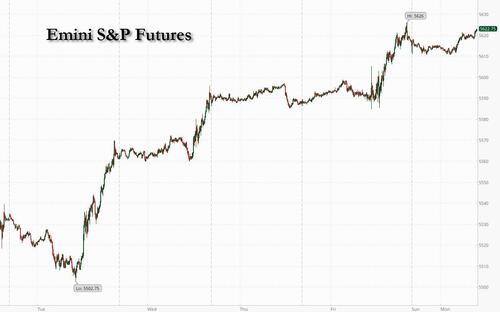

Futures are mixed with small-caps leading as calm returned to markets after traders focused on the positive implications from a French election where the far-left ended up winning and contemplated unleashing a flood of spending. European stocks rose and the euro pared earlier losses. At 8:00am S&P 500 futures were fractionally in the green, erasing an earlier loss, and following the biggest weekly advance for the index since April; the Nasdaq was in the green as has been the case pretty much every single day this year. US Treasuries started off the week on the backfoot, as traders braced for Federal Reserve Chair Jerome Powell’s congressional testimony and US inflation data this week: bond yields are +2-3bps and 10Y yield trade around 4:31%. The USD is flat following its worst week since early March. Commodities begin the week under pressure with weakness across all three complexes. Today’s macro data focus is on NY Fed’s 1-year inflation expectations, but the impactful data comes from CPI/PPI on Thurs/Fri and the ten Fedspeakers this week. We may see US markets chop sideways into CPI and the kick off of earnings season later this week, though we are still in a period of positive seasonality

Pre-mkt, semis are higher ex-NVDA with the balance of Mag6 names in the green. In other corporate news, Boeing agreed to plead guilty to criminal conspiracy to defraud the US after the Justice Department concluded the planemaker failed to adhere to an earlier settlement stemming from two crashes of its 737 Max jetliner. Here are the most notable premarket movers:

- Corning (GLW) rises 7% after posting preliminary 2Q core sales that topped expectations.

- Gilead Sciences (GILD) gains 2.7% after Raymond James upgraded the biotech to outperform on the potential for its HIV and liver disease treatments to drive growth.

- HilleVax (HLVX) shares are halted after the biopharmaceutical company said a clinical study did not meet its primary endpoints.

- Morphic (MORF) soars 76% after agreeing to be purchased by Eli Lilly in a $3.2 billion deal.

- Paramount (PARA) rises 2% after it agreed to merge with Skydance Media in a deal that hands control of the storied Hollywood studio to producer David Ellison, ending one of the industry’s most dramatic acquisitions.

- R1 RCM (RCM) rises 13% after holder TCP-ASC said it’s in the process of finalizing a proposal to acquire all of the outstanding shares of the revenue-management company that it doesn’t already own.

- ServiceNow (NOW) slips 3% as Guggenheim cut its rating to sell, saying the software company’s valuation doesn’t match future risks.

- SolarEdge Technologies (SEDG) rises 5% after BofA upgrades the renewable energy equipment company to neutral, saying the stock is already pricing in the worse case scenario, including inventory write downs and liquidity constraints.

Over the weekend, in a stunning reversal a left-wing coalition of far-left parties received the most votes in French legislative elections on the weekend, but failed to secure enough seats to form a government. That outcome limits how much any party can do, leading to bets that President Emmanuel Macron will form a new coalition between the center and center-left. In the runup to the vote, investors had been concerned about the prospect of a Le Pen takeover after Macron’s crushing defeat in last month’s European parliamentary elections.

“A hung parliament is not necessarily a bad outcome because it means that the most extreme policies are less likely to make it to the legislature,” said Azad Zangana, a senior European economist at Schroders. “It’s still a very uncertain period going forward.”

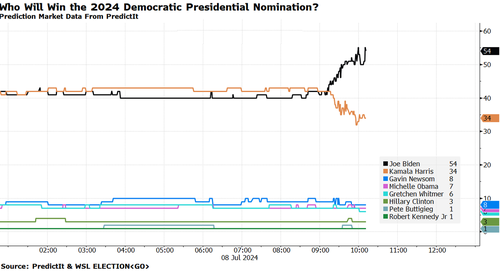

Meanwhile, the political situation in the US is even more ridiculous as Joe Biden’s continues to salvage his embattled reelection bid, fending off calls from Democratic lawmakers to step aside, although the chorus of voices against the dementia-addled president is too big and it is only a matter of time before Joe is forced to step down.

Turning to the calendar, Powell’s testimony on Tuesday and Wednesday will be closely watched ahead of Thursday’s consumer price figures for June. The Fed Chair is likely to say policymakers need further confirmation they have vanquished inflation before they’re ready to cut interest rates when he speaks to Congress. And yes, earnings season begins again: this Friday we get Q2 reports from major US banks including JPMorgan.

European stocks started off in the red but quickly traded higher as the narrative once again reversed itself and the Stoxx 600 was up 0.4%. French stocks rise while the yield spread with Germany narrows slightly as the worst-case scenarios in the French election have been avoided, although investors expect uncertainty to persist as political gridlock looms. The CAC 40 is up 0.5% after swiftly reversing an opening decline. The spread between French and German 10-year yields falls 1bps to 65bps.

Earlier, Asian stocks declined as a slump in Chinese equities extended ahead of a key policy meeting, weighing on the broader region. The MSCI Asia Pacific Index swung to a loss of as much as 0.3% after gaining 0.4% earlier. Industrial and Commercial Bank of China and Bank of China were among the biggest drags. TSMC, which has the highest weighting on the regional benchmark, jumped 3% to a record high after Morgan Stanley raised its price target. A selloff in equities in mainland China and Hong Kong deepened, with the Hang Seng China Enterprises Index nearing a technical correction. A patchy economic recovery and intensifying concern over potential geopolitical risks stemming from the upcoming US election have hurt investor sentiment.

In FX, the Bloomberg Dollar Spot Index is flat while the Japanese yen is among the weakest of the G-10 currencies, falling 0.2% against the greenback. The euro reversed an earlier loss and traded roughly flat around $1.0840 after falling to as much as $1.0802 earlier with traders mulling the impact of a political gridlock in France on the country’s finances. Options traders remain bearish on the euro versus Group-of-four peers over the next week, albeit with lower conviction compared to the run-up to the French legislative elections.

“The worst outcome for the euro has been averted for now,” said Alvin Tan, head of Asia FX strategy at RBC Capital Markets in Singapore. “But the political situation in France remains uncertain and the fiscal balance is unlikely to improve significantly as a result”

In rates, treasuries were slightly cheaper across the curve, led by bear-flattening in bunds after an unexpected win by a left-wing coalition in the second round of French legislative election gave no party an absolute majority. Treasury yields are cheaper by ~2bp across the curve with front-end and belly leading losses, flattening 5s30s spread slightly, and 10-year just under 4.30%. The French yield premium vs German counterparts increased. US session has few scheduled events; ahead this week are two days of congressional testimony on monetary policy by Fed Chair Jerome Powell and coupon auction cycle, both starting Tuesday. Treasury issuance resumes Tuesday with $58b 3-year note sale, followed by $39b 10-year and $22b 30-year reopenings Wednesday and Thursday.

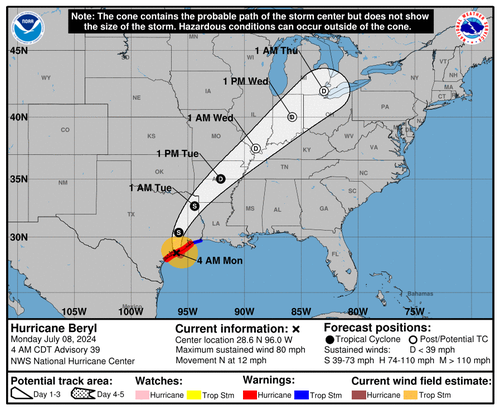

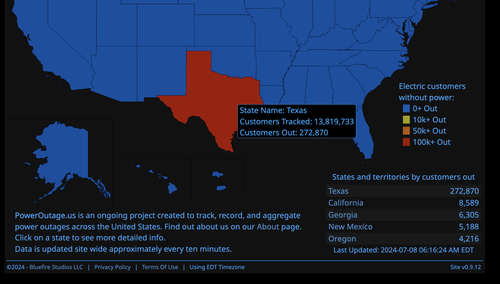

In commodities, oil edged lower after four straight weekly gains, even as traders tracked twin threats to crude production posed by a hurricane in the US and wildfires in Canada. WTI fell 1.1% to trade near $82.25 a barrel. Spot gold falls $20 to around $2,372/oz. Gold was steady, and iron ore extended a decline from a one-month high.

Looking at today’s calendar, US economic data slate includes June New York 1-year inflation expectations (11am) and May consumer credit (3pm). Ahead this week are CPI, PPI and University of Michigan sentiment. No Fed speakers scheduled for Monday. Weekly calendar includes Barr, Bowman, Goolsbee, Cook, Bostic and Musalem in addition to Powell

Market Snapshot

- S&P 500 futures little changed at 5,620.25

- MXAP down 0.2% to 184.00

- MXAPJ little changed at 576.21

- Nikkei down 0.3% to 40,780.70

- Topix down 0.6% to 2,867.61

- Hang Seng Index down 1.5% to 17,524.06

- Shanghai Composite down 0.9% to 2,922.45

- Sensex little changed at 79,945.06

- Australia S&P/ASX 200 down 0.8% to 7,763.17

- Kospi down 0.2% to 2,857.76

- STOXX Europe 600 up 0.6% to 519.70

- German 10Y yield +1.6bps at 2.57%

- Euro little changed at $1.0841

- Brent Futures down 0.6% to $86.04/bbl

- Gold spot down 0.7% to $2,374.97

- US Dollar Index little changed at 104.87

Top Overnight News

- Biden said he is convinced he is the most qualified person to beat Donald Trump and has done ten major events since the debate, while he pointed to his successes when asked if he was the same man as he was when he took office three years ago. Biden also stated he is still in good shape and that no one has said he needs neurological and cognitive tests.

- Democrat Rep. Schiff said either Biden has to win overwhelmingly or he had to pass the torch and that Kamala Harris could win overwhelmingly but Biden needs to make a decision, according to Reuters.

- Microsoft orders China employees to only use iPhones for work from September, cutting off Android devices from the workplace, according to Bloomberg

- Japanese workers’ base salaries jumped the most since 1993, an encouraging sign that the underlying pay trend may start to support consumption and enable the Bank of Japan to raise interest rates again. Base pay increased 2.5% in May from a year ago, the fastest growth since 1993, outpacing the 1.9% gain in the headline figure, the labor ministry reported Monday. BBG

- The BOJ said wage hikes were broadening across the economy due to tight labor market conditions, signaling its confidence the country was making progress toward durably achieving its 2% inflation target. The optimistic assessment, made at the BOJ’s quarterly meeting of regional branch managers on Monday, may heighten the case for the central bank to raise interest rates as soon as its next meeting on July 30-31. RTRS

- European stocks edged higher as traders weighed the unexpected French election result, which leaves the left-wing grouping without enough seats to form a government. France now heads into political gridlock, with no clear majority. Jean-Luc Melenchon vowed to implement the leftist New Popular Front’s entire spending program. President Emmanuel Macron’s group was second with Marine Le Pen’s National Rally trailing in third. BBG

- Hamas has dropped its objections over a US-backed cease-fire proposal to halt the Gaza conflict with Israel, a person familiar with the matter said, the clearest sign yet that a truce is possible after months of fruitless negotiations. BBG

- White House considers a fresh set of oil-linked sanctions on Russia focused on the tankers delivering Moscow’s crude around the world, but concerns about high gas prices are keeping them from being enacted. NYT

- Several influential congressional Democrats said on a private call they want Joe Biden to step aside, according to people familiar. The president remained defiant. He registered his best showing yet in a Bloomberg News/Morning Consult tracking poll of battleground states, but still trailing Trump. BBG

- Former president Donald Trump’s campaign is aiming to announce his running mate by July 15, the first day of the Republican National Convention, according to people familiar with the situation, and internal discussions have largely centered on two finalists as he nears a decision. Trump has not communicated his choice, the people familiar with the situation said, but discussions inside the campaign have narrowed in on Sens. J.D. Vance (R-Ohio) and Marco Rubio (R-Fla.). WaPo

- The start of the artificial-intelligence arms race was all about going big: Giant models trained on mountains of data, attempting to mimic human-level intelligence. Now, tech giants and startups are thinking smaller as they slim down AI software to make it cheaper, faster and more specialized. This category of AI software—called small or medium language models—is trained on less data and often designed for specific tasks. WSJ

- Boeing agreed to plead guilty to misleading air-safety regulators in the run-up to two deadly 737 MAX crashes. Boeing will formally acknowledge guilt and accept fresh punishment over its dealings with the Federal Aviation Administration before two 737 MAX crashes that killed 346 people. As part of a plea to one count of conspiracy to defraud the U.S., prosecutors have asked the company to pay a second $244 million criminal fine and spend $455 million over the next three years to improve its compliance and safety programs. WSJ

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly lower as the region failed to resume the momentum from last Friday’s dovish post-NFP reaction, while the weekend macro news flow was light aside from the French election results. ASX 200 was dragged lower by energy and mining stocks, while a surprise contraction in Home Loans added to the glum mood. Nikkei 225 faded after initially bucking the trend and hitting a fresh record high before reversing course, as participants digested mixed data. Hang Seng and Shanghai Comp. were pressured with underperformance in Hong Kong amid weakness in property stocks, while the mainland also lacked demand ahead of this week’s key releases from China including CPI and the latest trade data

Top Asian News

- PBoC said it will conduct a temporary repo or reverse repo based on market conditions effective from July 8th and the tenor of the temp repo or reverse repo will be overnight loans, while it added the move is to maintain banking system liquidity reasonably ample and to increase the accuracy and efficiency of open market operations.

- China’s MOFCOM said China’s Vice Premier will co-chair the fifth meeting of the Sino-Russian intergovernmental cooperation committee in Russia on July 9th, according to Reuters.

- China’s auto manufacturers association is strongly dissatisfied with the EU Commission’s anti-subsidy tax rate, according to Reuters.

- Tokyo Governor Koike won re-election for a third term, according to exit polls cited by Reuters.

- Japan’s government says regular pay rose 2.5% Y/Y, which was the fastest pace of increase since January 1993.

- BoJ raises assessment for 2 of Japan’s 9 regions in quarterly report; cuts assessment for 2 of Japan’s 9 regions; maintains assessment for 5 of Japan’s 9 regions. Many regions said wage hikes are spreading among smaller firms to retain and hire new workers.

- China Auto Industry CPCA says 1.78mln passenger cars sold in June -6.9% Y/Y (vs 1.72mln in May); Tesla (TSLA) exported 11,746 China-made vehicles in June (vs 17,358 in May); says new energy vehicle exports currently face “temporary” pressure.

European bourses, Stoxx 600 (+0.6%), began the session on a weaker footing with initial sentiment hampered by the French second round parliamentary elections, which resulted in a hung parliament. However, optimism soon lifted and benchmarks soared to session highs, CAC 40 +0.5%, potentially stemming from comments by French Socialist leader Faure who said the NFP will select a PM from within the alliance within the week, via AFP. European sectors hold a strong positive bias vs an initially negative bias. Insurance takes the top spot, with JPM noting that given the recent sell-off within the sector and specifically Axa (+1.5%), there is a buying opportunity. Elsewhere, Energy and Basic Resources both lag amid weakness in the crude and metals complex, respectively. US Equity Futures (ES U/C, NQ +0.1%, RTY +0.2%) are mixed and trading incrementally on either side of the unchanged mark. Sentiment has improved in recent trade, given the strength in European equities since the cash open.

Top European News

- German Economy Minister Habeck says the debt brake could only be held so far because defence spending goals were not reached; finance conditions do not fit to the security situation in Germany

- Maersk (MAERSKB DC) says extreme weather conditions are forecasted along the South African coastline for the next few days, particularly between Cape Town & Port Elizabeth. Weather will impact vessel movement and operation.

FX

- DXY is marginally lower and back on a 104 handle in what has been a relatively quiet start to the week. The index is managing to hold above last week’s NFP-induced 104.82 low with Thursday’s CPI report set to be the next big test for the greenback.

- EUR has been able to shrug off initial worries surrounding the fallout of the French election which showed a strong showing for the left and uncertainty stemming from a hung Parliament. EUR/USD gapped lower at the open to 1.08 before printing a subsequent session high at 1.0842.

- GBP is steady vs the Dollar with fresh fundamentals lacking, though with traders mindful of speak from BoE’s Haskel later on. 1.2821 is the high watermark for Cable thus far, with not much in the way of resistance until the 12th June high at 1.2860.

- JPY is a touch softer vs. the USD but near levels traded on Friday in the wake of the NFP report. USD/JPY made an incremental new low overnight at 160.27 before the USD clawed back some losses vs. peers.

- Antipodeans are trivially softer vs the Dollar; AUD advanced as high as 0.6761 overnight before scaling back gains and slipping back below its 50DMA at 0.6742.

- PBoC set USD/CNY mid-point at 7.1286 vs exp. 7.2640 (prev. 7.1289)

- CNB Minutes (June): Zamrazilova & Kubelkova dissented and voted for a 25bp move. At upcoming meetings, board should discuss the option of slowing the decline in rates or stabilising them for some time. Frait said the CZK may be undervalued.

Fixed Income

- OATs gapped lower by 39 ticks on the open before then slipping further to a 123.36 base. Pressure in the wake of the surprise election outcome where NFP won. However, OATs have since picked up and are near unchanged on the session up to a 123.95 peak, potentially a function of the market cheering a removal of the right-wing risk.

- USTs are slightly underperforming Bunds/Gilts but only modestly so. US enters a particularly busy week with dual-testimony from Powell and then CPI headlining. Treasuries are pressured by around 7 ticks to a 110-11+ base, but remains in relative proximity to Friday’s 110-20 peak.

- Bunds are softer and holding just below the 131.00 mark in a 130.77-131.13 band. Data saw EZ Sentix for July come in at -7.3 (exp. 0.0, prev. 0.3), though sparked no real reaction.

Commodities

- Crude is softer intraday despite the rebound in risk across stocks, amid positive vibes regarding the Israel-Hamas ceasefire proposal. Brent September slipped from a USD 86.92/bbl peak to a USD 85.95/bbl trough.

- Precious metals are lower across the board and giving back some recent gains as the Dollar attempts a recovery and the DXY tries to mount 105.00 once again.

- Base metals are flat/mixed, with prices recovering from the overnight weakness as Chinese property stocks slumped.

- Hurricane Beryl makes landfall in Texas after hitting Mexico

- NHC said Beryl is forecast to strengthen to a hurricane again before landfall and a storm surge warning was extended along the Texas coast. NHC also announced that a hurricane warning is in effect for the Texas coast from Baffin Bay northward to San Luis Pass and Galveston Island, as well as for the south of Baffin Bay to the mouth of the Rio Grande River, according to Reuters. Furthermore, the NHC later confirmed that Beryl became a hurricane again.

- US Coast Guard shut the Port of Houston ahead of approaching Beryl, while ports of Texas, Freeport & Galveston were also shut by the Coast Guard, according to Reuters.

- Citgo began cutting production at its Corpus Christi, Texas refinery (165k bpd) ahead of Beryl but plans to keep the refinery running at minimum rates during the storm, according to sources cited by Reuters. It was later reported that the Port of Corpus Christi announced the port was closed due to Beryl.

- A fire broke out at a gas pipeline in Crimea due to an accident although there were no casualties, according to Russia-installed officials.

Geopolitics: Middle East

- Israeli PM Netanyahu said any Gaza deal must allow Israel to continue fighting until all war objectives are met and the deal must not allow weapon smuggling to Hamas via the Gaza-Egypt border. Netanyahu added that thousands of armed militants cannot return to northern Gaza under the deal and that the proposal to which Israel agreed allows the return of hostages without compromising war objectives, according to Reuters.

- A revised proposal on a Hamas-Israel deal stated talks on the release of Israeli hostages including soldiers will start in a 16-day period after the first phase and an agreement on a hostage release deal is to be concluded before the end of the fifth week of the second phase, according to a senior Hamas source. Furthermore, the revised proposal involves mediators to guarantee a temporary ceasefire, aid delivery, and the withdrawal of Israeli troops as long as indirect talks continue to implement the second phase, according to Reuters.

- Egypt is to host Israeli and American delegations to discuss outstanding issues in Gaza and a ceasefire agreement, according to senior sources cited by Al Qahera News TV. It was also reported that CIA Director Burns is expected to visit Cairo this week for Gaza ceasefire talks.

- An Israeli air strike on a school sheltering displaced Palestinians in Gaza’s Al-Nuseirat killed at least 13 people, while the Israeli military said its airstrike targeted militants in an area near a Gaza school. It was also reported that senior Hamas government official Ehab Al-Ghussein was killed by Israel’s air strike in Gaza City, according to Reuters.

- Lebanon’s Hezbollah said it launched its “largest” air operation, sending explosive drones at a mountaintop Israeli military intelligence base in the annexed Golan Heights, according to SCMP.

- Moderate Pezeshkian beat his hard-line rival in the Iranian presidential race runoff, according to the interior ministry, while the vote is unlikely to result in a shift of policies but may shape the succession for Iran’s Supreme Leader Khamenei, according to Reuters.

Geopolitics: Other

- Local Ukrainian authorities say air defences are operating during a rare daytime Russian missile attack, strikes reported in Kyiv. “A series of violent explosions in the center of the Ukrainian capital Kiev”, according to Sky News Arabia

- Ukrainian security source said Ukrainian forces hit a Russian munitions depot in the Voronezh region using drones, while a state of emergency was introduced in some parts of the Voronezh region following the drone attack.

- Russia has halted a Ukrainian attempt to hijack a Russian strategic bomber to Ukraine, via Tass; Ozerne airfield was struck to stop this.

- NATO will need 35-50 additional brigades under new plans to defend against Russia; Germany will need to quadruple air defence capacities under new NATO defence plans, according to sources cited by Reuters.

- North Korean leader Kim’s sister said South Korea’s recent drills near the border are inexcusable and explicit provocation, while she added that if North Korea’s sovereignty is violated, North Korea’s armed forces will immediately carry out their mission and duty according to the constitution.

- China is developing a new stealth aircraft which will be a fifth-generation fighter jet with stealth function and is likely to be deployed on China’s third aircraft carrier the Fujian, according to Nikkei.

- Philippines President’s Office announced the Philippines and Japan signed a reciprocal access agreement

US Event Calendar

- 11:00: June NY Fed 1-Yr Inflation Expectat, prior 3.17%

- 15:00: May Consumer Credit, est. $9b, prior $6.4b

DB’s Jim Reid concludes the overnight wrap

The main story this morning is obviously the second round of the French elections where yet another electoral shock has been served up in 2024 with the far-left New Popular Front securing the surprise outcome of being the largest group. They are in line to win 182 seats (around 160 expected in the final Ifop poll on Friday). The far-right RN party and allies has claimed 143 seats (around 190 expected on Friday but edging lower all of last week). Macron’s ENS movement are looking set for 163 seats (around 135 expected on Friday). The tactical voting to block the far-right has succeeded so much that it’s swung the pendulum in the opposite direction but without anyone having an overall majority which would have been 289 seats.

The NPF have the most fiscally aggressive program in terms of both spending and taxation and the market will be suspicious that the prospect of them being in government now or later will bring higher deficits with the associated concerns about debt sustainability and tense relations with Europe. Last night the far-left were already talking about wealth taxes and increases on taxes on corporates which won’t be market friendly. However trying to build a government that has any kind of stability looks a very high bar this morning. Political paralysis for the next 12 months seems the most likely outcome. See our economists’ blog overnight here for the most likely scenarios.

In addition to this, our economists, strategists and Euro rates and credit traders will host a call at 10am London time this morning. Please register here if you’d like to attend. So far this morning the Euro (-0.08%) is only trading fractionally lower at 1.0831 against the dollar while European equity futures tied to the STOXX 50 (+0.32%) are edging higher as I type. OAT futures are lower but well within the trading range from Friday.

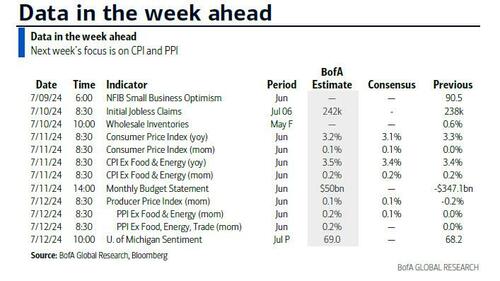

Moving on, there’s a lot to digest this week with the US CPI report (Thursday) and Fed Chair Powell’s testimonies to the Senate and House committees (Tuesday and Wednesday) the obvious highlights alongside PPI and the start of US Q2 earnings season on Friday with JP Morgan, Citi and Wells Fargo reporting.

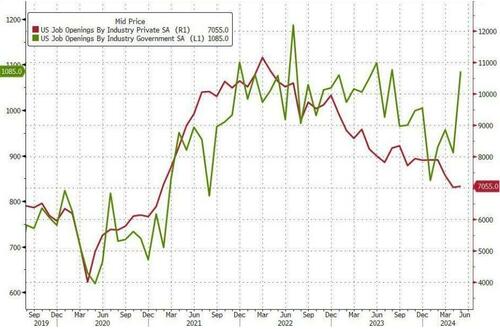

Outside of these the day by day highlights are NY Fed 1-yr inflation expectations today, tomorrow’s US small business optimism survey to see if the “K” shaped recovery continues. Wednesday sees China’s CPI and PPI, Japan’s PPI, Norwegian and Danish CPI, Italian IP and a US 10yr Treasury auction. Thursday sees the latest US monthly budget numbers alongside jobless claims which will continue to get close attention given recent mixed signals on the US labour market. There is also a 30yr Treasury auction. On Friday the University of Michigan survey and Swedish CPI will be the highlight outside of the main events mentioned above. In geopolitics, there is a NATO summit Tuesday through Thursday, and Indian PM Modi visits Russia today and tomorrow both of which may generate headlines. The full week ahead is at the end as usual.

Let’s now preview the US CPI and PPI releases and review a mixed payroll print on Friday. The headline CPI should print soft (+0.09% MoM DB forecast vs. +0.01% previously) thanks to falling gas prices. However core is expected to edge up (+0.25% MoM vs. +0.16%). If our economists are correct, YoY headline CPI will fall by two-tenths to 3.1%, with core edging up a tenth to 3.5%. However three-month annualised core would fall four tenth to 2.9%, though the six-month annualised rate would stay at 3.7%. For the PPI we always look at the categories feeding into core PCE, namely health care services, airfares and portfolio management. The final of these three should be firm given the recent rally in equities and airfares could bounce back after a weak May. This also could be the end of easy comps as our econ team point out that weak July and August prints will soon roll out of the YoY numbers.

This is important as if markets do want a September cut then a bit more progress is needed on inflation absent an “unexpected weakening” (in Powell’s words) in the employment situation.

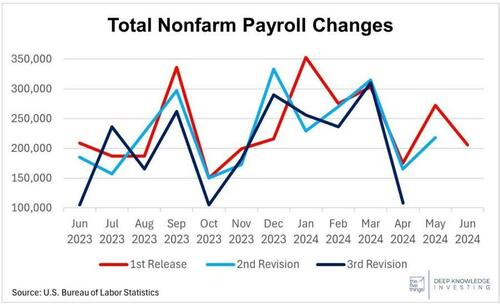

With that in mind it’s useful to review a mixed employment report on Friday. Payrolls at +206k were decent but the last 2 months of revisions were -111k and private payrolls only expanded at +136k. Unemployment edged up a tenth to 4.1% and is now 0.7pp above its cyclical lows. This hasn’t yet triggered the Sahm rule of a recession always occurring after unemployment rises 0.5pp from its lows, as the rule deals in 3 month moving averages. However at 0.43pp it is now close.

Where this time could be slightly different for the Sahm rule, or at least require a higher trigger, is that the participation rate continues to improve. On Friday for example, the prime-age (25-54 age group) participation rate hit 83.7%, its highest since 2001. Also new entrants to the labour force was the highest since 2017. So as unemployment rises go (and it was a soft 4.1% given the 2 decimal print was 4.05%) it was a decent one.

In Asia, Chinese stocks are underperforming with the Hang Seng (-1.21%) leading losses followed by the Shanghai Composite (-0.54%) and the CSI (-0.47%). The Nikkei (+0.20%) and the KOSPI (+0.10%) are seeing minor gains. S&P 500 (-0.12%) and NASDAQ 100 (-0.11%) futures are edging lower and 10yr UST yields are up a basis point.

Early morning data showed that labour cash earnings in Japan grew +1.9% y/y in May (v/s +2.1% expected), but still marking the biggest gain since June 2023. It followed a downwardly revised increase of +1.6% in April. Meanwhile, real wages fell -1.4% y/y in May (v/s -1.2% expected) with the decline extending to a record 26th straight month. Japan’s current account surplus grew for the 15th straight month swelling to 2.85 trillion yen in May (v/s 2.35 trillion yen expected) from the previous month’s 2.05 trillion yen surplus.

In central bank news, the People’s Bank of China (PBOC) revealed this morning that they would start conducting temporary bond repurchase agreements or reverse repos to make open market operations more efficient, aiming to maintain sufficient liquidity in the banking system.

Looking back at last week now and markets continued to advance, as poorer data led investors to dial up the chance of future rate cuts. Indeed on Friday, there was a very underwhelming US jobs report (discussed above), which added to the run of weak data recently.

The payrolls report came on the heels of some weak ISM services and manufacturing prints earlier in the week, and it led to a sharp rally in US Treasuries. For instance, the 2yr yield ended the week down -15.0bps (-10.2bps Friday) at 4.60%, which is its lowest closing level since March. And the 10yr yield was also down -11.8bps last week (-8.0bps Friday) to 4.28%. Hopes for a rate cut were also evident from fed funds futures, and by the end of the week they were pricing in 50.8bps of cuts by the December meeting, so at least two 25bp rate cuts are now fully priced in by year-end. But in Europe it was a different story, with yields on 10yr bunds ending the week up +5.6bps (-5.3bps Friday) at 2.55% as French political risk reduced.

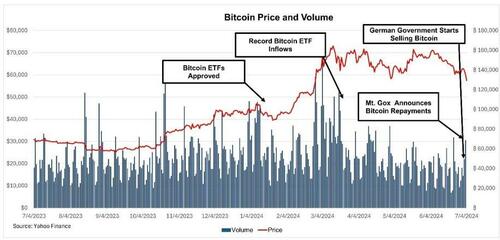

Finally, risk assets did pretty well against this backdrop, as the prospect of rate cuts outweighed the weak economic data. That helped the S&P 500 to end the week at another all-time high, posting a +1.95% gain (+0.54% Friday). And the moves were echoed elsewhere, with Europe’s STOXX 600 posting a +1.01% gain (-0.18% Friday), whilst Japan’s Nikkei was up +3.36% (unch. Friday). Otherwise, we also saw Brent crude oil prices rise for a fourth consecutive week to $86.54/bbl, and gold prices were up +2.81% (+1.51% Friday) in their best week since early April.