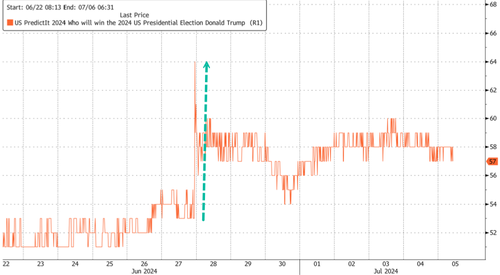

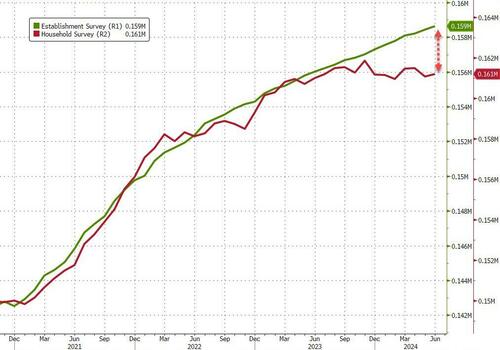

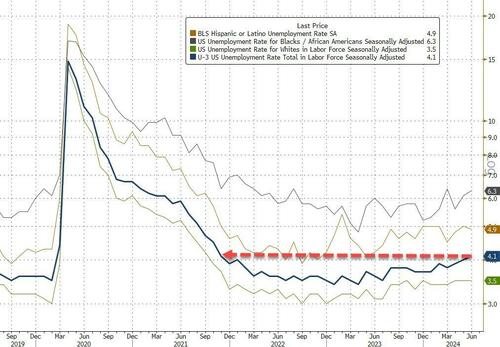

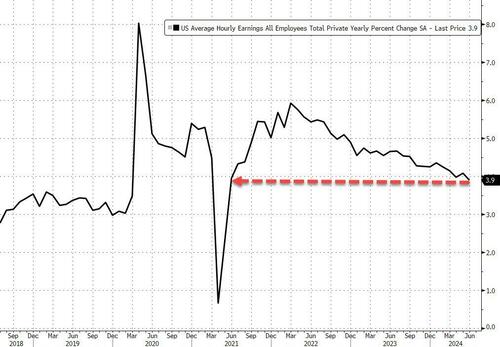

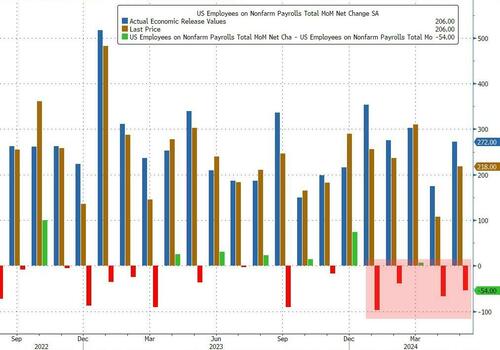

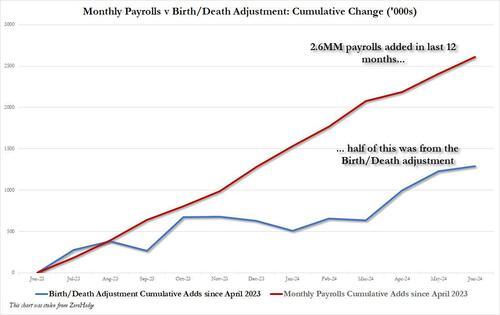

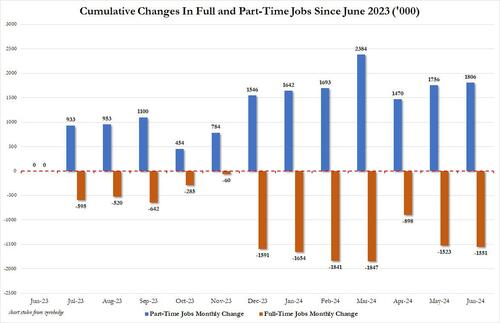

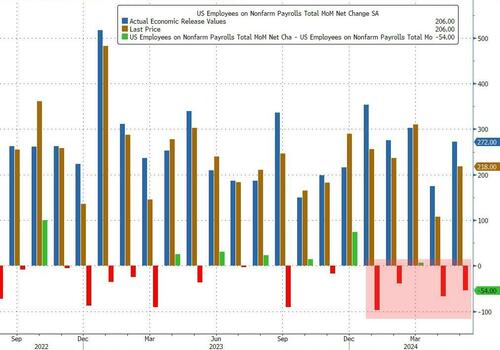

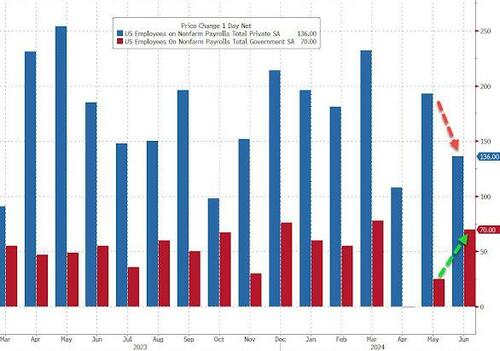

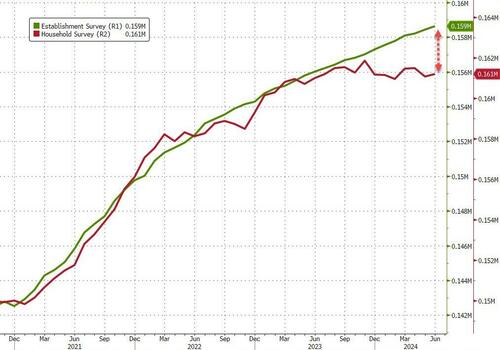

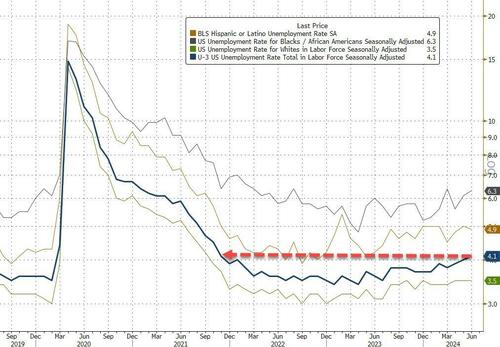

US equity futures are unchanged for two days in a row – having gone nowhere during the July 4th holiday – erasing an earlier attempt to break out to all time highs. At 8:00am ET, S&P futures were flat while Nasdaq futures rose 0.1% as global stocks traded at all-time highs before crucial US jobs data that’s expected to show some moderation in hiring. The US dollar dropped for fourth day to its lowest level in three weeks while the pound notched its longest winning streak in four years as Labour swept to power in the UK’s general election. Bond yields are modestly lower ahead of NFP. Commodities are mixed: oil and base metals are lower; precious metals are higher. Today, the key focus today will be NFP release and any further updates on the US election (our full NFP preview is here). Consensus sees 190k jobs being added, with Goldman calling for a street low 140K; unemployment is expected to hold at 4.0% while average hourly earnings are expected to rise 0.3%, down from last month’s 0.4%.

In premarket trading, tech are once again in the lead: TSLA rose 2.2%, on track to turn positive for 2024 after a seven-day winning streak that’s added about $200 billion in market value. Other techs also rose: GOOGL +39bp, AMZN +23bp; Semis are mixed: NVDA -16bp, AMD +20bp, MU -42bp. Macy’s rallied after the Wall Street Journal reported that Arkhouse Management and Brigade Capital Management have raised their buyout offer to about $6.9 billion.

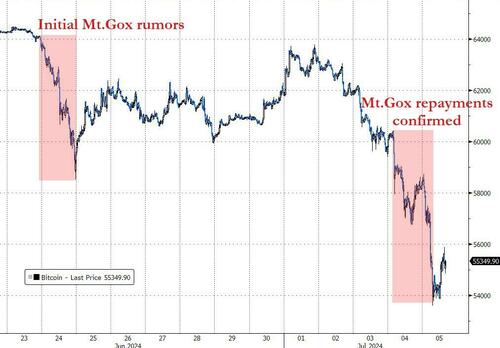

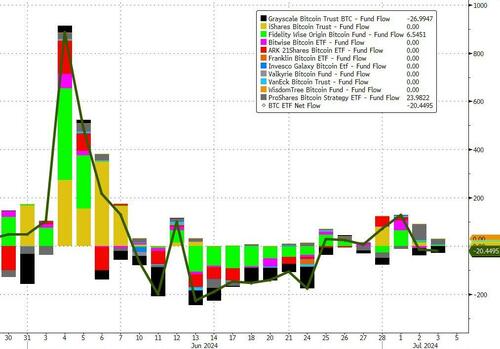

In contrast with the positive tone for equities, Bitcoin sank to the lowest since February without any actual incremental news, as a “motivated seller” took advantage of the liquidity vacuum of July 4th and the lack of ETF buying to dump several billion in hopes of pushing prices lower. And succeeded: bitcoin dropped for a fourth session as part of a wider crypto selloff. Crypto-related shares fell.

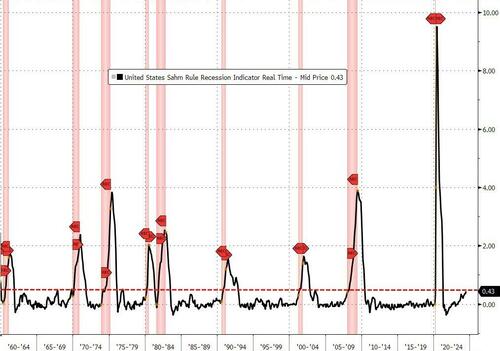

Turning back to equities, a series of soft US economic readings has revived hopes that the Federal Reserve will start cutting interest rates as soon as September, pushing MSCI Inc.’s world index of equities to a record.

“Given other evidence of a cooling economic backdrop — weaker ISM Manufacturing PMI and ISM Service Sector PMI reports — the payroll report could be increasingly decisive for the Fed as it seeks a rationale to signal an easing of rates,” said Quincy Krosby, chief global strategist for LPL Financial.

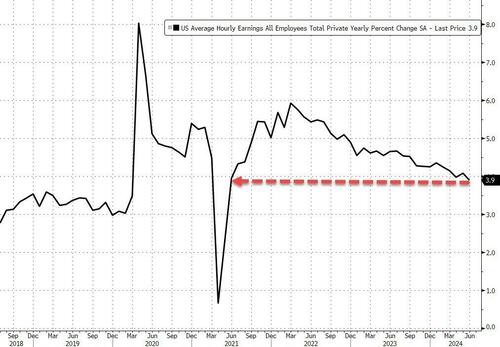

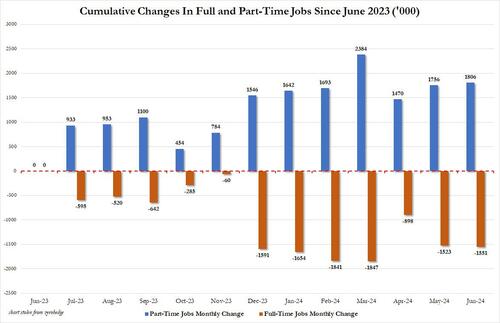

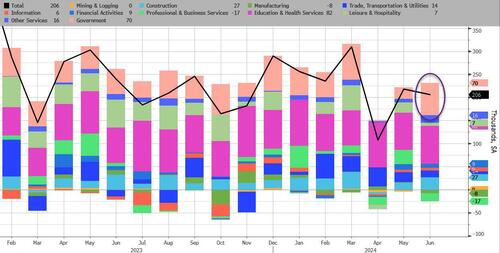

As previewed overnight, the focus during today’s skeleton crew session (where most traders are away from the office), will be the US jobs figures. Payrolls probably rose by 190,000 in June, a step-down in hiring from the previous month, according to the median estimate in a Bloomberg survey. Average hourly earnings likely increased 3.9% from a year earlier, the least in three years. The unemployment rate is seen holding at 4%, the highest level in more than two years.

“The US data will be very interesting for a couple of reasons — you see signs of a bit of a slowdown in the labor market, and the market appears for now to have taken that in stride because it does raise the possibility of an easier monetary policy going down the track,” said Richard Flax, chief investment officer at European digital wealth manager Moneyfarm.

On the policy front, New York Fed President John Williams said Friday that while inflation has cooled recently toward the central bank’s 2% target, policymakers are still some distance from their goal. “Inflation is now around 2-1/2%, so we have seen significant progress in bringing it down. But we still have a way to go to reach our 2% target on a sustained basis,” Williams said in prepared remarks for an event at the Reserve Bank of India in Mumbai. “We are committed to getting the job done.”

European stocks climbed, led by the tech sector. In the UK, domestically focused stocks and government bonds rose and the pound strengthened for a seventh day after the landslide victory for Labour, which handed Keir Starmer’s party 412 of the 650 seats in the House of Commons and a clear mandate to deliver on a pledge of greater economic stability.

“A clear majority could bring some much-needed stability to the UK political landscape at a time of heightened global uncertainty,” said Samuel Zief, head of global FX strategy at J.P. Morgan Private Bank. That “could provide a bit of a kicker for the pound,” he said.

France’s CAC40 advanced for a third day, following indications that Marine Le Pen’s National Rally party will likely fall short of an absolute majority in second-round elections this weekend. Still, no matter which party comes out on top in the French parliamentary vote, some investors are betting it marks the beginning of a more turbulent period for the country’s stock and bond markets. The CAC 40 has been the worst performer among major European stock indexes since the snap election was called last month, while at the height of the selloff a metric of bond-market risk soared to its highest since the sovereign debt crisis.

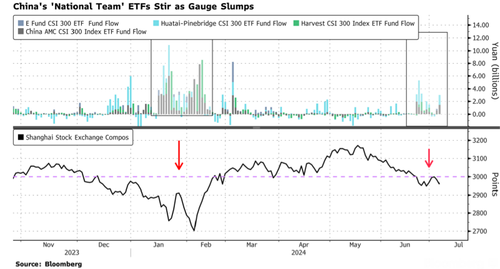

Earlier in the session, Asian equities were little changed as advances in South Korea and Taiwan were tempered by a continued selloff in Chinese shares. The MSCI Asia Pacific Index is steady for the day, though the gauge was still on track for its best weekly gain since mid-May. A measure of regional tech stocks climbed to a record high, propelled by Samsung Electronics showing its fastest pace of profit growth in years. Chinese shares in Hong Kong and mainland were the worst performers in the region, with the CSI 300 Index erasing its year-to-date gains. Chinese stocks extended their decline to a seventh straight week — the longest losing streak since early 2012 — as investor sentiment continues to weaken ahead of the Third Plenum later this month. About 800 stocks on the Shanghai and Shenzhen bourses closed below their book value on Friday, surpassing the number during the market trough in February and underscoring the pervasiveness of bearish sentiment, according to Bloomberg-compiled data.

China’s central bank took the next step toward selling government bonds to cool a record-breaking rally, saying it now has “hundreds of billions” of yuan of the securities at its disposal through agreements with lenders. “The domestic economy is really weak with May-Jun macro data and feedback from companies mostly turning south,” said Xin-Yao Ng, director of investment at abrdn. Plus, there are “low expectation for economic support from the Third Plenum.”

In FX, the US dollar dropped for a 4th straight session to a 1 month low. A disappointing US monthly jobs report could push down the dollar, Philip Wee, a senior FX strategist at DBS Bank Ltd. in Singapore, writes in a research note. “Once considered exceptional, the US economy has witnessed a significant downgrade in its growth outlook.” Sterling rose for a seventh straight day against the greenback, its longest winning streak in four years. The Japanese yen strengthened for a second day against the greenback to rebound further from the lowest level since 1986 reached on Wednesday. Most currencies traded within narrow ranges amid the wait-and-see mode following a US holiday on Thursday.

In rates, treasuries are richer across the curve in a slight bull-steepening move, following wider gains across European rates market after digesting Labour’s landslide UK election win, which broadly matched projections. Front-end yields are lower by more than 2bp with 2s10s, 5s30s spreads steeper by 0.5bp and 1.5bp on the day. 10-year TSY yields are around 4.34% is 2.6bp richer vs Wednesday’s close, in line with bunds while gilts outperform by 1.5bp in the sector

In commodities, oil traded near a two-month high as Hurricane Beryl portended a potentially worse storm season, while shrinking US crude stockpiles hinted at improved demand. Gold headed for a back-to-back weekly gain.

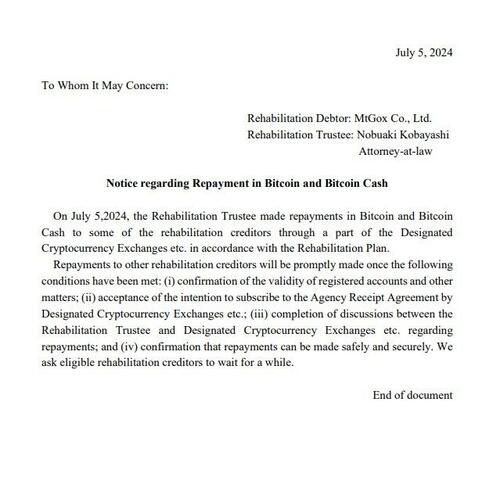

In crypto, Mt. Gox has begun repaying Bitcoin (BTC) and Bitcoin Cash (BCH) to creditors, according to Cointelegraph. Furthermore, Crypto exchange Mt Gox creditors “may need to wait up to three months to receive their bitcoin or bitcoin cash repayments depending on which crypto exchanges they made the claims with”, according to a trustee document cited by The Block. Crypto has been pressured across the session given the above reports. BTC falling over USD 5k on the session to a USD 53.56k base.

US economic data slate includes June jobs report at 8:30am New York time.

Market Snapshot

- S&P 500 futures little changed at 5,593.75

- STOXX Europe 600 up 0.4% to 519.36

- MXAP little changed at 184.57

- MXAPJ little changed at 576.72

- Nikkei little changed at 40,912.37

- Topix down 0.5% to 2,884.18

- Hang Seng Index down 1.3% to 17,799.61

- Shanghai Composite down 0.3% to 2,949.93

- Sensex down 0.4% to 79,731.19

- Australia S&P/ASX 200 down 0.1% to 7,822.26

- Kospi up 1.3% to 2,862.23

- German 10Y yield little changed at 2.59%

- Euro up 0.1% to $1.0827

- Brent Futures up 0.1% to $87.54/bbl

- Gold spot up 0.4% to $2,366.25

- US Dollar Index down 0.15% to 104.97

Top Overnight News

- Keir Starmer’s Labour won a landslide victory in the UK general election after Rishi Sunak’s Conservatives imploded, a result that dramatically reshapes the political landscape while still falling short of a ringing endorsement of the party’s plan for government.

- Global stocks traded at all-time highs before crucial US jobs data that’s expected to show some moderation in hiring. The pound added to its longest winning streak in four years as the Labour Party swept to power in UK elections.

- President Joe Biden is embarking on the most consequential weekend of his political career, knowing that he must restore the faith of voters, donors, and party officials deeply skeptical of his acuity — and that any misstep will prove fatal to his reelection campaign.

- China’s central bank took the next step toward selling government bonds to cool a record-breaking rally, saying it now has “hundreds of billions” of yuan of the securities at its disposal through agreements with lenders.

- Currency traders face a long and nail-biting wait this month until the Bank of Japan’s policy decision on July 31, when a potential interest-rate hike and cut to bond purchases may finally bring some relief to the embattled yen.

- Iran’s presidential runoff on Friday will see the election’s only reformist candidate, Masoud Pezeshkian, face off against anti-Western Islamist Saeed Jalili in the race to run the country’s government.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded somewhat mixed in the absence of a lead from the US owing to the Independence Day holiday, while there was also a lack of fireworks from the UK election exit polls which showed the Labour Party are on course for a landslide victory. ASX 200 was contained amid weakness in miners and the top-weighted financial sector. Nikkei 225 traded indecisively and initially climbed to fresh record highs but then failed to sustain the momentum as the yen began to strengthen and as participants also digested weak Household Spending data which showed a surprise contraction. KOSPI was boosted amid gains in index heavyweight Samsung Electronics following its preliminary Q2 earnings. Hang Seng and Shanghai Comp. were pressured with weakness seen in automakers after the EU confirmed it is to move ahead with planned tariffs on Chinese EVs with provisional duties effective today, while China is to continue the anti-dumping probe into EU port imports and will hold an EU brandy probe hearing on July 18th.

Top Asian News

- PBoC has hundreds of billions of yuan of medium- and long-term bonds at its disposal to borrow and signed agreements with several major financial institutions regarding bond borrowing, according to Bloomberg.

- China officially sets up a special fund for revitalisation of state firms’ land assets worth CNY 30bln, according to state media.

- China’s MOFCOM confirmed it is to hold an EU brandy probe hearing on July 18th.

- Japanese Finance Minister Suzuki warned of inflation concerns despite recent wage rises and noted that a weak yen is pushing up costs for imports and impacting prices, while he said they are to monitor stocks and FX trends urgently.

- BoJ report is to reportedly reveal broadening wage rise trend, according to Reuters sources; report likely to show increasing number of small and mid-sized firms raising wages.

European bourses have been tilting higher throughout the morning with the region benefitting from a continuation of recent broad gains and as political risk is removed in the UK (election), Germany (2025 budget) & France (polls erode chance of a RN majority), Stoxx 600 +0.5%. DAX 40, +1.0%, outperforms despite dismal industrial output metrics for May with tech names bolstered after Samsung’s update and the index generally benefitting from the German coalition government coming to a draft deal on the 2025 budget framework. UK’s FTSE 250 (+1.2%) outperforms the FTSE 100 (+0.3%) as the domestic economy welcomes the return of a Labour government, with housebuilders in particular benefitting. Stateside, futures have been pivoting the unchanged mark with specifics light on the return from Independence Day into a docket which is dominated by the monthly jobs report, ES +0.1%, NQ +0.1%. Foxconn (2317 TT) June revenue +16.1% Y/Y, Q2 +19.1% (-9.6% in Q1). Samsung Electronics (005939 KS) – The world’s largest memory chip, smartphone and TV maker sees a better than expected increase in Q2 profits, as the AI boom lifts chip prices. Sees Q2 profit rising to KRW 10.4tln (exp. 8.8tln; prev. 670bln in Q2 2023), and sees Q2 sales of KRW 74tln (exp. 74.5tln).

Top European News

- ECB’s Lagarde said officials are in no hurry to cut rates again after June’s move and the central bank requires additional reassurance that inflation is headed back towards 2% before it cuts rates further, according to an interview with RTP.

- German coalition government agreed on a 2025 draft budget after months of negotiations, according to a government source.

- Thereafter, German Finance Minister Lindner says the 2025 budget deal is EUR 481bln in size, incl. EUR 57bln in investments. Chancellor Scholz says they will fully meet the 2% NATO spending goal every year; high billion-EUR sum is planned for housing construction. Growth package to be presented on 17th July

UK Election

- UK election exit polls showed the Labour Party is set to win 410 seats for a 170-seat majority, Conservatives 131, Lib Dems 61, SNP 10, Reform 13, Greens 2. This suggested the Labour Party will win the most seats by any party since 2001 and the Conservatives are to win the fewest seats since the party was founded in 1834. The latest results show Labour has won for majority.

- UK Labour Party leader Starmer won his seat and said the people have spoken, while he added that people are ready for change and it is now time for them to deliver. Starmer said in his victory speech “country first, party second” and vowed a transformed Labour Party, while he added that he doesn’t promise it will be easy and they will have to move immediately

- UK PM Sunak won his parliament seat in Richmond and Northallerton, while he conceded defeat in the general election and stated that the Labour Party has won and the British people have delivered a sobering verdict. Furthermore, Sunak said he will continue to serve as a Member of Parliament and he takes responsibility for the loss. It was separately reported that Sunak is expected to resign as Conservative party leader on Friday morning, according to Times’ Shipman

- UK Reform Leader Farage won his parliament seat and said there is no enthusiasm for Labour, while he added they are coming for Labour votes and this is just the first step that will stun everyone.

- Goldman Sachs raises UK’s GDP growth forecast by 0.1ppts in 2025 and 2026 after the UK election; says Labour Party’s fiscal policy agenda to provide a modest boost to demand growth in the near-term.

FX

- A slightly softer start for the USD with the index weighed on by the EUR and GBP as election risk fades and passes respectively. DXY down to a 104.93 base with the 100- & 200-DMAs below and potentially in focus into Payrolls.

- GBP deriving some modest benefit from the passing of any election risk, though the outcome has been nailed on for weeks and Cable itself was unreactive to the exit poll and updates since; at the top-end of a 1.2755-1.2783 bound.

- EUR edging higher into Sunday’s second round of the French legislative elections and benefitting from the main market risk of a RN absolute majority being removed in the latest polls, single currency finds itself in a slim range and holding above a cluster of DMAs.

- JPY outperforms with USD/JPY below 161.00 and testing 160.50. No real move to comments from the Finance Minister or thereafter from a Reuters sources piece regarding a report next week which is set to reveal a broadening wage trend

- PBoC set USD/CNY mid-point at 7.1289 vs exp. 7.2704 (prev. 7.1305).

Fixed Income

- Benchmarks generally modestly firmer but very much in a holding pattern into payrolls.

- No move from Fed’s Williams who noted of progress in bringing inflation back to target, with the line echoing Powell earlier in the week who said they have made quite a bit of progress on inflation.

- USTs a touch firmer with the US yield curve mixed but slightly steeper into Payrolls.

- OATs steady into Sunday’s second round; Bunds unreactive to dismal German data this morning with no real or sustained move on the fiscal related updates before or since, with Bunds in a relatively narrow 130.53-130.78 band.

- Gilts gapped higher on the open but initially stalled shy of Thursday’s best before extending modestly but stopping within reach of Wednesday’s 97.78 WTD peak.

Commodities

- Crude benchmarks near the unchanged mark. Initially lifted alongside an uptick in stock performance in the early European morning before benefitting further on a steady flow of hurricane and geopolitical developments.

- WTI and Brent around USD 84.00/bbl and USD 87.40/bbl respectively, towards the mid-point of parameters.

- Metals generally firmer; spot gold picking up as the USD slips and as yields having a very slight negative bias into NFP. XAU at a fresh WTD peak of USD 2367/oz, stalling just shy of the 21st June high at USD 2368/oz.

- Base metals similarly supported with 3M LME Copper inching towards USD 10k/T, though iron ore was pressured in APAC trade with profit taking from recent gains seemingly the driver.

- Qatar set August Marine crude OSP at Oman/Dubai plus USD 0.15/bbl and land crude OSP at Oman/Dubai minus USD 0.40/bbl.

- Chevron (CVX) announced it was removing non-essential personnel from its Gulf of Mexico facilities due to approaching Hurricane Beryl but noted that production from its Gulf of Mexico assets remains at normal levels. It was also reported that Shell (SHEL LN) said is evacuating all personnel at its Perdido asset due to Hurricane Beryl, according to Reuters.

- Russian Energy Ministry says gasoline export supplies to “friendly countries” now 70% lower than average daily level in July 2023; Russia has ample fuel reserves for stable supply of domestic market.

Geopolitics

- Israeli PM Netanyahu told US President Biden he has decided to send a delegation to continue negotiations on hostages but reiterated that Israel will only end the war after achieving all of its objectives.

- US senior administration official said President Biden and Israeli PM Netanyahu walked through the draft Israel-Hamas agreement in a 30-minute call and the US believes there is a significant opening for a hostage deal, while the official stated that the Hamas response moves the process forward and could provide basis for closing a deal on hostages and ceasefire. Furthermore, the US official said outstanding issues relate to the implementation of an agreement in which there is significant work to be done and a deal is not likely to be closed in a period of days but they have had a breakthrough on the critical impasse in Israel-Hamas talks.

- Israel’s Mossad chief Barnea is travelling to Doha to resume Gaza ceasefire and hostage talks which will likely take place on Friday and will meet with Qatar’s PM in an effort to bring Israel and Hamas closer to a Gaza peace deal, according to a source cited by Reuters.

- Israeli official confirmed that the Mossad chief will lead a hostage negotiations delegation and another official said there is a real chance for a deal, while it was also stated that the proposal put forward by Hamas includes a very significant breakthrough and the official stated that they can proceed with a deal but it depends on PM Netanyahu.

- Hamas said it did not drop the condition of a ceasefire in Gaza, while it added that Israeli PM Netanyahu did not want a permanent ceasefire in Gaza and requires the movement to lay down arms, according to Al Arabiya.

- Hamas leader said they are waiting for a positive response from the Israeli side to start negotiations on the details of the deal, according to CNN.

- “There are some obstacles before reaching an agreement, including demanding that Hamas not have the right to object to the Palestinian “security” prisoners who will be released”, according to Sky News Arabia citing Israeli press Yedioth Ahronoth.

- “The army is making progress in Rafah But the fighting is expected to last at least another month.”, according to Israeli press Yedioth Ahronoth cited by Al Jazeera.

- Russia’s Defence Ministry said it is carrying out drills involving mobile nuclear missile launchers, according to Interfax.

US Event Calendar

- 08:30: June Change in Nonfarm Payrolls, est. 190,000, prior 272,000

- 08:30: June Change in Private Payrolls, est. 160,000, prior 229,000

- 08:30: June Underemployment Rate, prior 7.4%

- 08:30: June Unemployment Rate, est. 4.0%, prior 4.0%

- 08:30: June Labor Force Participation Rate, est. 62.6%, prior 62.5%

- 08:30: June Average Hourly Earnings YoY, est. 3.9%, prior 4.1%

- 08:30: June Average Hourly Earnings MoM, est. 0.3%, prior 0.4%

- 08:30: June Average Weekly Hours, est. 34.3, prior 34.3

DB’s Jim Reid concludes the overnight wrap

After 31 all time highs in H1, last night saw the first in H2 for the S&P 500 (+0.62%) after a steady rally once Europe went home. Meanwhile yields on 10yr Treasuries (-3.0bps) fell back after a bit of a two-way battle with some dovish-leaning comments from Fed Chair Powell initially sending yields lower, before this was outweighed by a more hawkish JOLTS report as he was speaking. However, after Europe went home US Treasury yields drifted back to near the pre-JOLTS levels. Market may wind down later ahead of tomorrow’s US Independence Day. However remember payrolls on Friday in what will be a lightly staffed US market. It seems like the year for such occurances as payrolls was released on Good Friday only three months ago.

Back to yesterday, one of the main highlights was a panel at the ECB’s forum in Sintra, in which both Fed Chair Powell and ECB President Lagarde were speaking. Powell sounded positive about disinflation, saying that “inflation now shows signs of resuming its disinflationary trend”. That reassured investors that the Fed was becoming more confident about the path of inflation, although Powell also pointed out that given the strength of the economy and the labour market “we have the ability to take our time and get this right”.

However, Powell’s optimistic remarks on disinflation were countered by the latest JOLTS report of job openings, which showed a tighter labour market than expected. For instance, the number of job openings unexpectedly rose in May to 8.140m (vs. 7.946m expected), and the hires rate also ticked up a tenth to 3.6%. In addition, the quits rates held steady at 2.2% for a 7th consecutive month, so there was little sign of a further deterioration in the labour market that we’ve seen in other recent data.

On balance, the more dovish tones won out though, and investors became a bit more confident in the prospect of rate cuts this year. Indeed, investors dialled up the chance of a cut by the September meeting from 69% to 75%, even though Powell said that “I am not going to be landing on any specific dates” when he was asked about September. We also saw similar moves in the yield curve, with the 2yr yield coming down -1.45bps to 4.741%, whilst the 10yr yield fell -3.0bps to 4.432%. Intraday the 2s10s curve reached its steepest level since January before re-flattening a bit and closing at -31.4bps. The intra-day highs were just a week after hitting the most inverted since December. The 23.4bps range over the last week shows both the scale of the move in the last few days and also how narrow the range has been since January. This morning in Asia, yields on 10yr USTs are edging back up less than a basis point across the curve.

Meanwhile in the Euro Area, ECB President Lagarde didn’t provide too much news on the policy path, but we did get the flash CPI release for June yesterday, which saw headline inflation fall by a tenth to +2.5% as expected. Even so, core CPI was a bit stronger than expected, coming in at +2.9% (vs. +2.8% expected). In light of that, investors further priced out the chance of a cut at the next meeting in a couple of weeks’ time, which is now down to just 7%. But they still think there’s a strong chance of a cut by the September meeting, which is now priced as a 72% chance from 70% on Monday.

Over in France, all eyes are on Sunday’s election, and yesterday saw Marine Le Pen say that the National Rally would still try and form a government even if they didn’t achieve an overall majority. But other parties have been seeking to stop them reaching a majority, and over 200 candidates have now dropped out from the second round. In most cases, they’ve been withdrawals by Macron’s centrist group or the left-wing alliance in order to stop the National Rally from winning. So there are now less than a hundred three-way contests on Sunday. In terms of the market reaction, yesterday saw the Franco-German spread tighten for a third consecutive day, which is the first time that’s happened since the snap election announcement. That took it down by -2.7bps to 71.4bps, and the moves came in the context of a broader sovereign bond rally across Europe, which saw yields on 10yr bunds (-0.4bps), OATs (-3.2bps) and BTPs (-5.0bps) all move lower.

When it came to equities, Europe saw declines across the continent, with the STOXX 600 (-0.42%), the DAX (-0.69%) and the CAC 40 (-0.30%) all moving lower. Meanwhile the US continued to diverge from Europe, especially with the late rally, as the S&P 500 (+0.62%) closed at a record high, powered by the Magnificent 7 (+1.00%) own record high which included a +10.20% rise for Tesla on better Q2 delivery numbers. Small caps rallied as well with the Russell 2000 gaining a more subdued +0.19%.

Asian markets are mostly trading higher this morning with the exception of mainland China . The Hang Seng (+0.93%) is outperforming with the Nikkei (+0.88%) breaking back above the 40,000 level for the first time in three months. Elsewhere, the KOSPI (+0.40%) is also edging higher but Chinese stocks are falling following a disappointing reading on service sector activity (more on this below). S&P 500 (-0.14%) and NASDAQ 100 (-0.11%) futures are seeing minor losses but European ones are up around half a percent after missing out on the US late rally.

Coming back to China, service sector activity decelerated in June dragged down by slower growth in new orders. The Caixin services PMI fell to 51.2 (v/s 53.4 expected) from 54 in May, marking the lowest reading since October 2023 thus raising concerns over a broader slowdown. Meanwhile in Japan services activity contracted for the first time in nearly two years in June as the final estimate of the Jibun Bank services PMI slipped to 49.4 from 53.8 in May, ending 21 straight months of expansion.

Elsewhere, retail sales in Australia advanced +0.6% m/m in May (v/s +0.3% expected) as against a +0.1% increase in April, reinforcing the case for an interest-rate hike. Following release, yields on 3yr government bonds extended their rise, edging up by +2.3bps to trade at 4.16% as we go to print.

Here in the UK, attention is also shifting to politics ahead of tomorrow’s general election. Today we should get a lot of final opinion polls, including an MRP poll from YouGov at 5pm London time that will have seat projections for the different constituencies. As it stands, all opinion polls still give the opposition Labour Party a decisive lead that’s consistent with them reaching a majority in the House of Commons. For instance, Politico’s polling average gives them a 20-point lead on 41%, ahead of the governing Conservatives on 21%. They’re followed up by the right-wing Reform UK led by Nigel Farage, who are currently in third on 16%.

To the day ahead now, and data releases include the final services and composite PMIs for June from around the world, and in the US there’s also the ISM services index for June, the ADP’s report of private payrolls for June, the weekly initial jobless claims, along with the trade balance and factory orders for May. From central banks, we’ll get the minutes from the Fed’s June meeting, and hear from ECB President Lagarde, ECB Vice President de Guindos, the ECB’s Cipollone, Lane and Knot, and the Fed’s Williams.