Authored by David Turver via DailySceptic.org,

We hear a lot about how we are supposedly in a climate crisis and how The Science™ tells us we are about to succumb to global boiling. Most climate activists claim that we must cut emissions by spending more money on windmills and solar panels or we will all burn to a crisp.

I would describe myself as a lukewarmer, by which I mean that I acknowledge the earth is warming and that human emissions of CO2 have made some contribution to that warming. However, it is also true that the climate has changed dramatically without human intervention; clearly, there are other causes of climate change too.

The strategy of reducing emissions of greenhouse gases to Net Zero is classified as a “mitigation strategy” in the parlance of the IPCC. The alternative strategy is adaptation which means taking measures to adjust to climate change such as building flood defences, irrigation systems or developing new strains of crops to cope better with changing weather patterns. Most spending effort in the West is geared towards mitigation.

But, what if the Net Zero cure is worse than the disease? What if mitigation is less effective than adaptation?

Mitigation Drawbacks

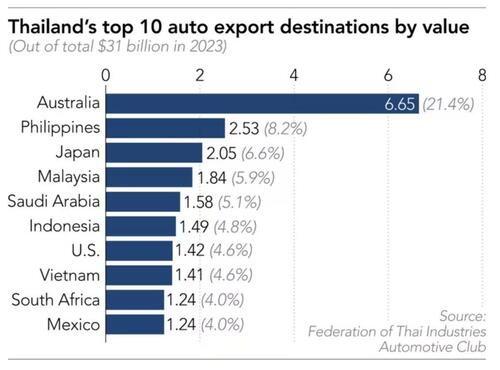

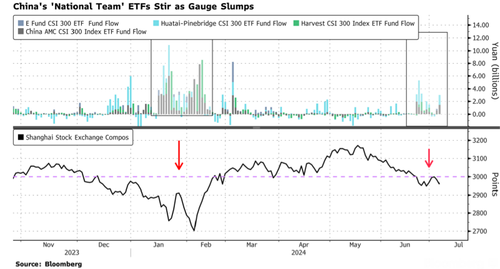

The mitigation strategy has significant drawbacks. First, mitigation only works if CO2 is the main climate control knob. But we know this cannot be the case because we can clearly see that temperatures have changed significantly over past millennia, as illustrated in Figure 1 below sourced from Figure 7.1 of the IPCC’s First Assessment report. These changes cannot have been caused by humans or our CO2 emissions.

Figure 1 – Global Temperature Change from IPCC First Assessment Report

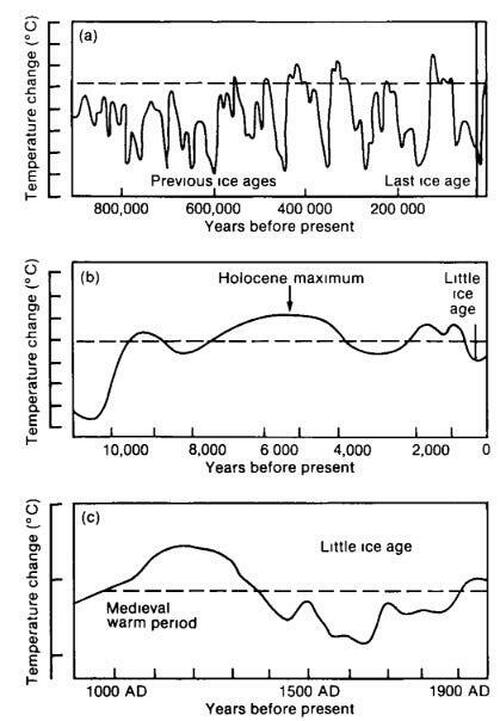

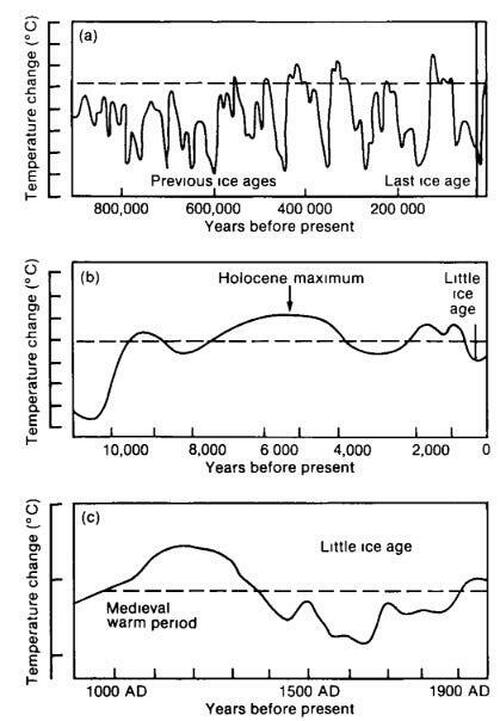

Second, mitigation can only work if everyone else slashes emissions too and we can see from Figure 2 (from Our World in Data) that this is not happening.

Figure 2 – Global CO2 Emissions from 1900 to 2022 (Source – Our World in Data)

Moreover, there are plenty of potential climatic events that could occur that we ought to be prepared for, and which will require energy and ingenuity to deal with. For example, we could see another Mount Tambora-like eruption which ejected about 40km2 of material into the atmosphere and caused a reduction in global temperatures. This led to 1816 being termed the Year Without a Summer, where European summer temperatures were the lowest on record and led to an agricultural disaster with widespread food shortages and famine.

Adaptation Success

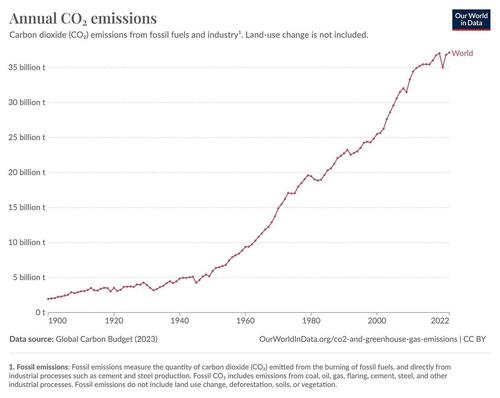

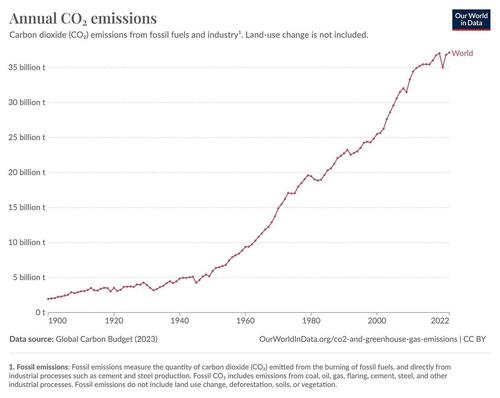

Adaptation has been a remarkable success. The rate of people dying from natural disasters has plummeted by a factor of more than 50 in the past century as shown in Figure 3 below, sourced from Our World in Data.

Figure 3 – Decadal Average Death Rates from Natural Disasters (Source: Our World in Data)

This improvement has come despite (more likely because of) the near 20-fold increase in CO2 emissions that we saw in Figure 2.

Cheap energy has led to big improvements in crop yields through mechanisation, irrigation and availability of fertiliser. Cheap energy has enabled flood defences to be built and homes to be more resilient to extreme weather.

Adaptation measures have many benefits. They require no international treaty and they can be applied locally where they produce results quickly. They also work to protect against changes in the climate that are not driven by CO2. Adaptation measures might also have additional benefits such as more efficient water use or more robust crop varieties. There is no reason why we cannot continue to adapt.

Risks of Net Zero

By contrast, the risks of Net Zero mitigation policies are manifest. First and most obvious, they cannot work against climatic changes that are driven by forces other than CO2. Second is the outright cost. In 2020, the National Grid ESO estimated the cost of the energy transition to be around £3 trillion. This is probably an underestimate because the cost of renewables has gone up since then (see AR6) as interest rates have gone up from almost zero to over 5%. To put this in context, U.K. GDP was £2.3 trillion in 2023, so the cost will be at least 1.3 times GDP. For further context, the budget for NHS England was £155bn in 2022-23, so the cost of Net Zero will be around 19 times the NHS budget.

The increased penetration of renewables has led to a massive increase in our electricity bills. This increase comes from renewables subsidies as well as grid balancing costs and the massive costs of expanding the grid out to remote offshore wind farms.

Expensive energy has led to creeping deindustrialisation as we have seen with the closure of Port Talbot and our last fertiliser plant. With geo-political tensions rising the closure of domestic steel, fertiliser and chemical industries means we are less able to defend ourselves and feed the nation in the event of a crisis.

Expensive energy also means we run the risk of missing out on the industries of the future such as AI. For instance, Amazon has recently bought a 960MW datacentre campus that is adjacent to and powered by a nuclear power station. Mark Zuckerberg has said the next generation of datacentres will be 1GW or above and Microsoft is considering building a $100bn datacentre campus that could consume 5GW for OpenAI by 2030. Clearly, AI is very energy hungry and suitable datacentres cannot be run on zephyrs and sunbeams, nor with expensive energy.

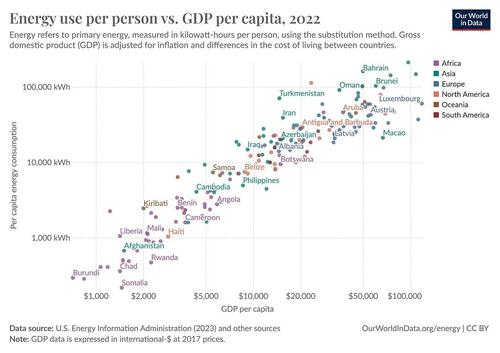

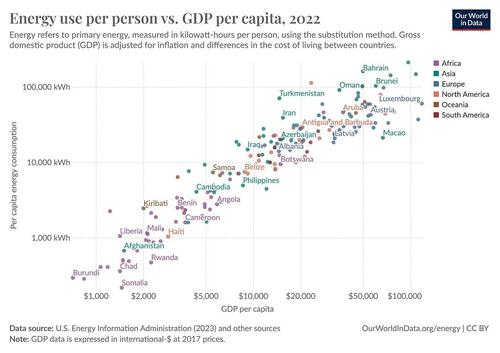

Our grid planning authority is planning to reduce total end user demand by about half to 600-800TWh per year by 2050, with just over 300TWh for industrial and commercial use, with the rest being used for heating homes and road and rail transport. However, just 10 of those 1GW datacentres would consume 87.6TWh in a year or about a quarter of the energy budget for the whole of industry and commerce. We are clearly heading towards a world of energy scarcity where we can no longer make the basic building blocks of a modern society, nor will we be able to compete in modern technologies. As Figure 4 below, again from Our World in Data, reminds us, there are no rich countries with low energy consumption.

Figure 4 – Energy Use per Person-vs-GDP per Capita (Source: Our World in Data)

Impact of Net Zero Policies

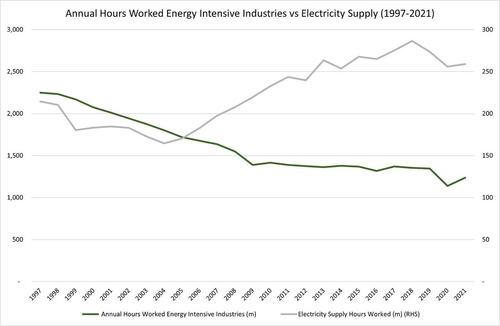

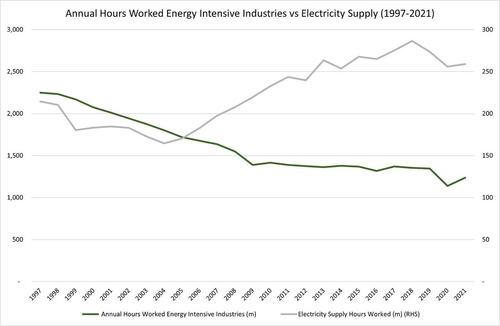

Net Zero is driving us to penury. Significant damage has already been done with productive industries shrinking compared to the whole economy since 1997. The trouble is, these industries are far more productive in terms of Gross Value Added (GVA) per hour worked than most service industries, and they consume more energy. This is why Sir Jim Ratcliffe has warned that the “chemicals industry in the U.K. is finished” and the main reason is that energy costs are five times those of the U.S. and there are carbon taxes levied on such products. This explains why we have lost six times as many jobs in energy intensive industries than have been gained in our green energy sector (see Figure 5).

Figure 5 – Hours Worked in Energy Intensive Industries vs Electricity Supply (1997-2021)

The job losses have not finished either, with Stellantis (owner of Vauxhall) warning that Labour’s plan to ban new petrol cars by 2030 will lead to plant closures.

Of course, Net Zero policies have also pushed up our electricity bills with the myriad of subsidy schemes costing about £11bn each year, with extra grid balancing and extension costs on top. Plus all of the climate doom-mongering is taking a toll on the mental health of children.

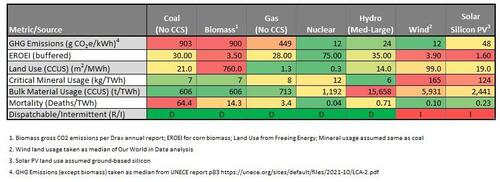

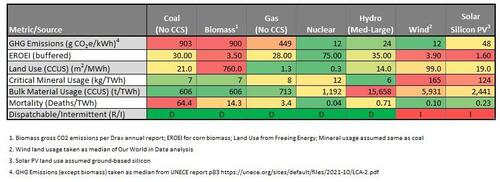

Even though this economic destruction is being carried out in the name of the environment, it is far from clear that wind and solar power are environmentally friendly. I showed in this article, using data mostly from the UNECE, that renewables rank poorly overall on a range of sustainability measures including land use and mineral intensity, see Figure 6.

Figure 6 – Wind and Solar Score Badly on a Range of Sustainability measures

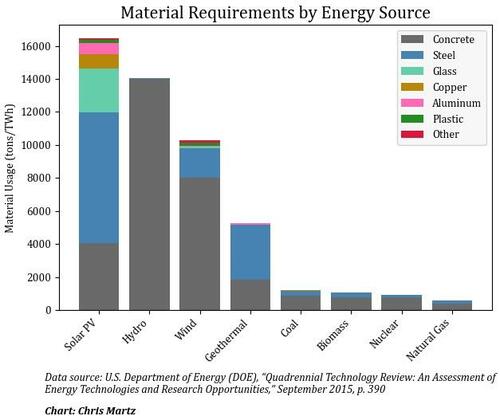

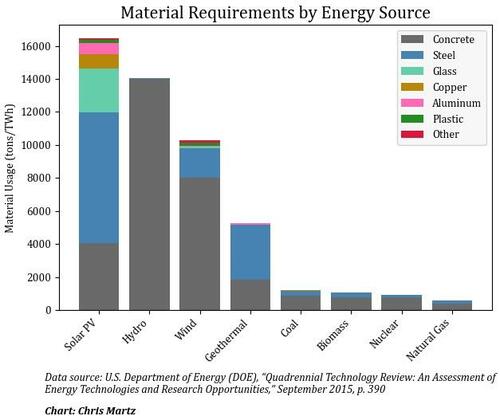

Other studies using US DOE data into the material intensity of wind and solar power have shown a similar result, see Figure 7.

Figure 7 – Material Requirements by Energy Source

All we get in return for all this effort is expensive, intermittent energy that needs even more minerals to be mined to make the storage required.

Conclusions

It is my belief that the economic, social and national security risks of Net Zero policies are far greater than those posed by climate change.

The risks of climate change can be averted by continuing to adapt, just as we have for millennia. It is certain that unilateral action by the U.K., or indeed multilateral action by much of the West, will do nothing to change the weather while the countries of the developing world continue to increase their consumption of hydrocarbons to make themselves richer. Indeed, even if mitigation measures were adopted globally, it is naïve to believe that bad weather will cease and we will suddenly get the “stable climate” demanded by more than 170 lawyers.

Yet we continue down the path of Net Zero, wreaking havoc on industry, jobs and the environment, pushing up energy bills and damaging the mental health of our children. The Net Zero ‘cure’ is worse than the supposed climate change disease.

* * *

David Turver writes the Eigen Values Substack page, where this article first appeared.