When the 56 delegates to the Second Continental Congress ratified the Declaration of Independence 248 years ago tomorrow, they were creating much more than a nation. They were giving birth to an idea.

America, at its core, is an idea. And it’s one that ranks as one of the greatest innovations in the history of human civilization, right up there with the wheel, the steam engine, the printing press, and the Internet.

The idea of America wasn’t born in 1776, however. By then it had already evolved over thousands of years.

The ancient Greeks embraced individual liberty, direct democracy, and a respect for the rule of law.

The Roman republic further refined Greek democracy and developed a more professional legal code. The early Roman Empire embodied peace through strength, ushering in nearly two centuries of geopolitical stability and economic prosperity under the Pax Romana.

The later Byzantine Empire fused Greek and Roman ideas with Judeo-Christian values. And by 1000 AD, the Republic of Venice– borrowing from Rome’s republican form of government– infused an early form of capitalism to this model.

The Dutch republic of the 1600s refined the concept of a powerful, free, capitalist society even further, as did philosophers like Rousseau, Montesquieu, John Locke, and Adam Smith.

So, when the Founding Fathers wrote the Declaration of Independence (and subsequently the US Constitution), they didn’t have to start from scratch; they drew from a rich, 2,000-year intellectual heritage of the giants who came before them.

This means that America is ultimately a composite of the very best ideas that human civilization ever had to offer— and the combined concept was then elevated to unprecedented heights.

Nothing is perfect, and America wasn’t either.

But based on this idea, the United States became the world’s largest economy in less than a century and the dominant global superpower about 80 years later. That is an unparalleled achievement which no other superpower in human history has come close to matching.

It’s also worth pointing out that the majority of the world’s most important innovations, from airplanes and air conditioning to cell phones and chocolate chip cookies, were either born or perfected in America.

Again, none of this is an accident. America’s success is deliberate outcome from combining the best ideas from 2,000+ years of human civilization… plus some disciplined execution and a little bit of luck.

Obviously, America has weathered challenges as well. The Civil War. The Great Depression. The turmoil of the 1960s.

But its foundation of economic potential, plus a baseline of social cohesion and shared values, have always allowed the nation to overcome… and for the idea of America to persist.

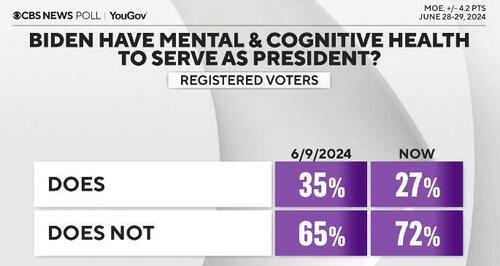

The country is now at an undeniable crossroads, and it’s not just about a single election.

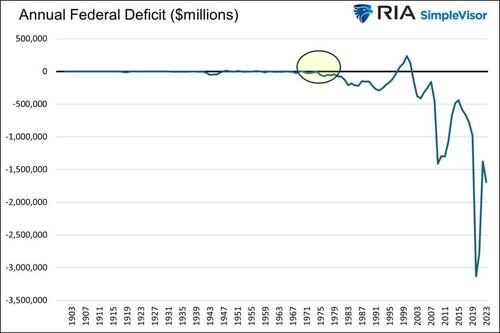

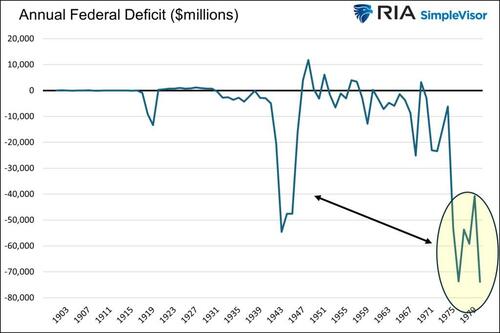

There are obvious signs of national decline: rising inflation, mounting debt, diminished global standing, a loss of government dignity, and stinging embarrassments like the shameful withdrawal from Afghanistan.

Even the idea of America itself is on the ropes; there are powerful forces within government, media, and the education system who seek to redefine America’s core principles.

Capitalism has been demonized and reinvented. Individual liberty has given way to a radical woke ideology. And the concept of limited government is almost a punchline at this point.

Still, there is a plausible scenario in which America’s best days are ahead.

If politicians embrace the principles that originally fueled the country’s prosperity—such as capitalism and laissez-faire productivity—America could experience an economic boom not seen since the Industrial Revolution.

By cutting taxes, slashing anti-capitalist regulation, and embracing the free market, the increase in productivity could be staggering.

This boom would lead to increased tax revenue, i.e. funds which could rebuild the military, secure the southern border, save Social Security, curb inflation, balance the budget, and chip away at the national debt.

As China buckles under the consequences of its central planning and upside-down demographic pyramid (brought on by its idiotic “One Child policy”), the United States could easily reassert its global primacy.

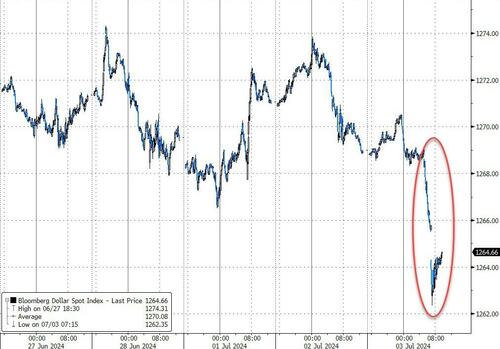

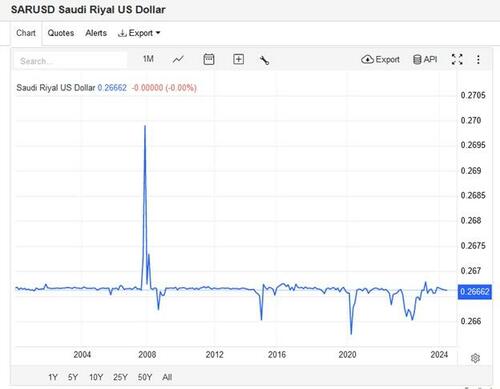

The dollar’s status as the global reserve currency would be unquestioned, and the world could see a new era of global peace and prosperity.

This is not a pipe dream. It’s a genuine possibility.

The other possibility is that the government does nothing to arrest America’s decline.

The debt continues to spiral further out of control. Rising deficits trigger painful inflation. Excessive regulation stifles economic growth, leaving the economy stagnant and performing far below its full potential.

Individuals are constrained by politicians’ incessant and debilitating rules about how to live, what to buy, and what to drive. The social fabric continues to tear apart with idiotic mandates, censorship, wokeness, gaslighting, and a hatred for capitalism.

Unfortunately, that is the road the country is presently on. Yes, it can be fixed. They can change directions. And we certainly hope that happens.

But as we used to say in the military, hope is not a course of action. That’s why we have a Plan B.

Having a Plan B is not being negative or pessimistic. It’s certainly not irrational. And it’s not unpatriotic.

The fierce individuality to NOT bow down to circumstances is exactly what has allowed America to persevere so many times before.

And taking sensible steps to preserve, protect, and defend what you have worked so hard to achieve in life is about as core of an American value as it gets.

Source

from Schiff Sovereign https://ift.tt/XodVTBm

via IFTTT