Submitted by QTR’s Fringe Finance

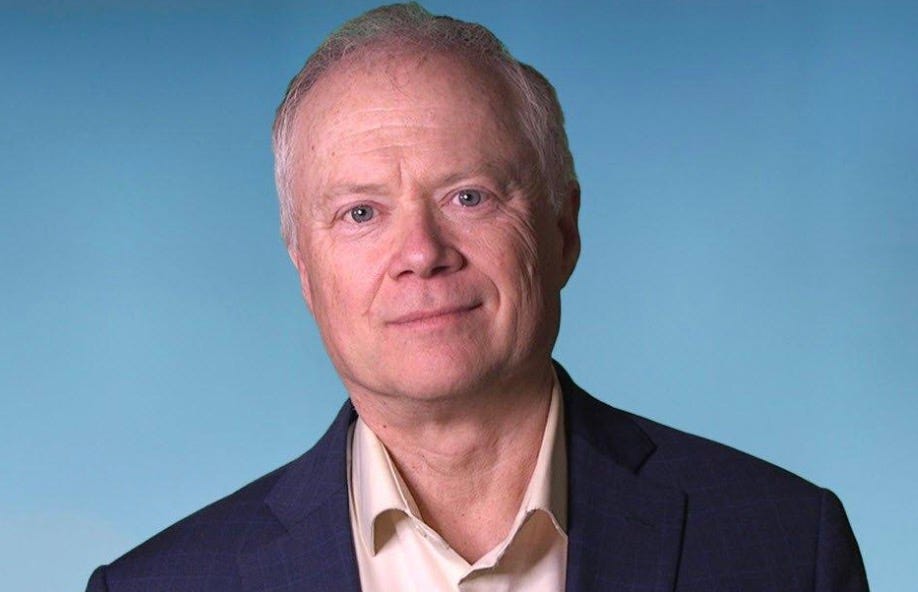

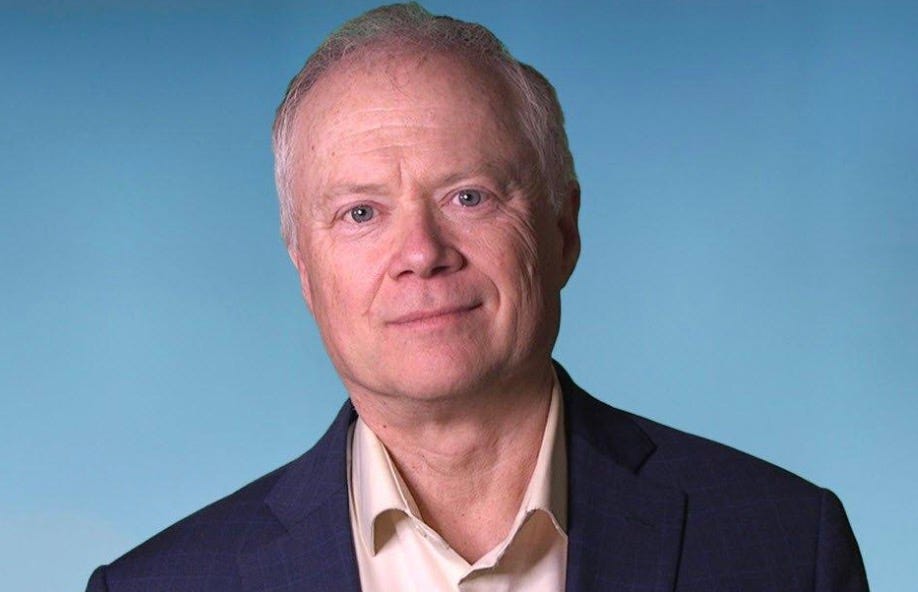

I had the wonderful pleasure of interviewing my friend Chris Martenson from Peak Prosperity this week. Martenson, PhD (Duke), MBA (Cornell) is an economic researcher and futurist specializing in energy and resource depletion, and founder of PeakProsperity.com.

He is one of a small list of favorites of mine that I am constantly reading and following on Twitter and on his site. He was also one of the first to sound the alarm about Covid in the U.S. while the mainstream media (and the rest of the nation) hadn’t figured out the obvious yet.

In our 75 minute audio interview, we discussed a wide range of topics, including the potential for World War 3, the immigration crisis, the state of the economy in the U.S., our nation’s response to Covid and looking back on the events of 9/11 more than 20 years later.

Chris told me right off the bat that he has significant concerns about the Russia/Ukraine war escalating due to the U.S. war machine making unilateral decisions: “So here’s the event that bothers me the most right now. A month ago, we hear that Ukraine has used some of their first long-range capabilities to attack Russia’s over-the-horizon nuclear early detection radar system. One of them, right?”

“A couple of weeks later, a second one. All right. Do you think anybody listening to this really believes that we voted for somebody who made that decision to target those things?”

He continued: “They didn’t consult any congressmen or senators. There’s like no presidential input involved. Somebody somewhere in the deep state said, you know what, let’s blind Russia right now for nuclear attacks and hope for the best. Or what? I don’t know what their plan is, but we can all feel it—that we have an out-of-control machine that makes decisions that have nothing to do with what’s best for you or me or anybody else.”

The conversation then look a hard turn into discussing the deep state, the U.S. war machine and the events of 9/11. Chris and I both shared our concerns with the details we were given about the events of September 11, 2001, specifically regarding Building 7.

Chris told me: “My PhD from Duke University is in a life science. But to get there, I took physics, I took chemistry, organic chemistry, all kinds of things, right? So I’m a big believer in chemistry. Physics and chemistry, okay? So with that said, there’s some laws out there. There are natural laws, like the law of gravity. You can not believe in it. You can decide that you can cross your legs, float, but nobody does it, right? It just doesn’t happen. It’s this thing. It’s like death. I’m gonna evade death. No, you’re not, right?”

He continued: “Second, there’s this law of the conservation of momentum, right? So if you’re standing on a pond that’s frozen over and I’m standing on a pond and you push on me, we’re both going in opposite directions, right? It’s just how it is. So when we look at Building Seven, if you were standing on the corner, any one of the four corners, it fell symmetrically like an imploding building, but leave that aside, that observation. If you were standing on the corner at the moment it let go, NIST itself had to finally admit that for two and a quarter seconds, that building fell at free fall.”

Chris explained why this is so concerning: “Meaning if you dropped a bowling ball into the air off the corner of the building at the same time that let go, it would track at the same pace. Like if you jumped off a bridge that was 88 feet high. Yes. If you jumped off that building, you and the corner of that building would be eye to eye staring at each other as it went down.”

“That building had 80,000 tons of structural steel in it. It doesn’t just go away. It can’t, but it did. For two and a quarter seconds, there was no resistance to downward momentum. That’s not… you can’t crumple that. There’s no possible way to begin progressively collapsing this thing. You can’t do that. So we have to then come up with an explanation for how 80,000 tons of structural steel stepped aside and provided no resistance for two and a quarter seconds.”

After hashing out our thoughts on 9/11, our conversation turned to the forthcoming election. Martenson expressed to me that the election either could “already be in the bag” or “not be happening”, two ideas I couldn’t help but be skeptical of.

Chris told me: “So what is the media not talking about? What’s not happening that really ought to be happening? And on that front, you know what’s really unnerving to me? Biden and Harris aren’t really campaigning. You know, they just sort of weakly started lately. I was starting to see a few ads here and there, but it’s lame. It’s like they don’t even care. And so how is it that you wouldn’t even campaign? Well, one of two reasons. You’re not worried about the election because it’s already in the bag, right? Or there’s not going to be one.”

Turing our attention to the problems the nation faces, we talked about the U.S. debt crisis and the nation’s immigration crisis.

“We clearly have a runaway monetary fiscal train at this point in time, and it’s just headed towards what I call the nuclear reactor critical mass runaway moment,” Chris told me. “Higher interest payments beget more borrowing, which begets higher interest rates, which begets higher interest payments. And you’re on that spiral. That’s the death spiral, which happens to companies, but it can happen to countries too.”

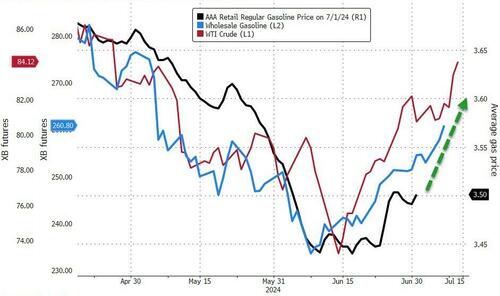

He continued: “We could have probably kicked the can another cycle or two, but now you have the rest of the world backing away, if not trotting away from the U.S. dollar, and people don’t get it yet. China’s negatively hoarding their treasuries, they’re dis-hoarding right now. So China’s selling. Japan’s in a world of hurt. I don’t know if you see, but the yen’s here banging around at the 160 level again. So they’re selling, and their big bank has to probably sell some treasuries. Russia, obviously not buying any of our crap—they kicked that habit in 2018. But Saudi Arabia now not buying treasuries, dis-hoarding.”

And he raised questions about where, exactly, treasury demand is coming from, telling me: “So who’s buying? Well, you go to the Treasury International Capital Report. You find out, oh good, the Cayman Islands stepped in. Dude, we need an audit of the Fed right away. I don’t think it’s always suspicious to see it, no, because every time we need the Cayman Islands and the UK to step up and buy just hand over fist treasuries, somehow they do.”

Finally, Chris — like most of us watching flawed policy unfold — says we’re definitely going back to QE: “But listen, here’s a prediction. It’s very easy to make for me. The Fed’s going to have to go back to QE. It’s not just lowering interest rates—that’s going to do dick all for us at this point. They’re going to go back to QE because we can’t risk a treasury failure. We have $9 trillion of debt, new and existing, rolling through the auction market this next calendar year. And so the Fed’s going to have to step in and start buying that stuff. Full stop. That’s inflation.”

Last, we discussed some alarming facts about the ongoing immigration crisis in the U.S., namely the idea that there are tons of military aged men coming from countries like China and entering the country.

Chris thinks its part of a larger plan: “Well, they’re letting in the teams that are going to attack us and dismantle us from within when the war starts. I mean, that sounds conspiratorial, but God damn, if I can’t help but think that. You know, military. It’s the data. You can’t exclude it out of hand. You just can’t. Maybe not all of them. Let’s say we had 20 million people come in over the last five, six years or whatever the number is now, right?”

“What if just 10% of them are nefarious? They’re MS-13 gang members who got disordered from a Nicaraguan jail, or they’re actual SEAL team equivalents coming from China, Afghanistan, wherever, right? That’s just 10%. Okay, well, there’s 2 million people inside our country now who are poised to cause damage if called upon, right? And no one knows where they are and they don’t have social security numbers. Nobody can track them. You know, it’s just, you’re a racist if you do.”

You can listen to the full 75 minute long audio discussion at this link.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. These positions can change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.