Bank of England Cuts Rate to 5.0% In “Finely Balanced” 5-4 Vote, Offers No Signals On Next Moves

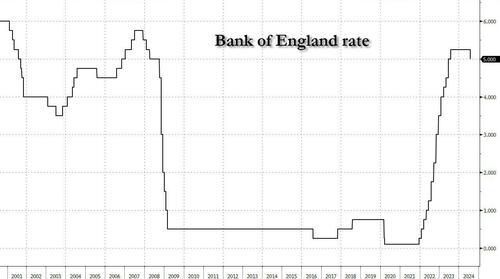

The global easing train is now well and truly on its way. While the Fed got close to cutting rates yesterday, but instead punted to September, moments ago it was the Bank of England that joined the SNB and ECB and became the latest western central bank to begin an easing cycle when it cut interest rates by 0.25%, taking them down to 5.00%, its first rate cut since the global covid crash (the market was pricing 60% odd of a rate cut ahead of the decision so not exactly a big surprise).

The cut – which was an extremely close decision, with the Monetary Policy Committee voting 5-4 to cut rates (vs 2-7 in the last meeting) with Bailey, Breeden, Lombardelli, Ramsden and Dhingra voting to cut and Pill, Greene, Mann, and Haskel voting for unchanged – brings to an end the joint-longest peak in rates since BoE was granted independence.

The Monetary Policy Committee voted by a majority of 5-4 to reduce #BankRate to 5%. Find out more: https://t.co/zBZeLlwSxD pic.twitter.com/YOcCTfER5o

— Bank of England (@bankofengland) August 1, 2024

The minutes of the meeting noted that for some of the MPC members voting for a cut the decision was finely balanced with risks to the inflation outlook remaining skewed to the upside. Importantly, the minutes did not provide any indications about the future rate cuts stating that “[t]he Committee continues to monitor closely the risks of inflation persistence and will decide the appropriate degree of monetary policy restrictiveness at each meeting”.

Governor Andrew Bailey, who cast the tie-breaking vote for a quarter-point cut – said that the decision was “finely balanced” for some of those supporting the move, and warned that the MPC must be careful not to cut rates too quickly, or by too much.

Furthermore, the MPC said that “monetary policy will need to continue to remain restrictive for sufficiently long until the risks to inflation returning sustainably to the 2% target in the medium term have dissipated further” (in June, it said “restrictive for sufficiently long to return inflation to the 2% target sustainably”.)

From those who voted to cut, the decision was finely balanced: inflationary persistence had not yet conclusively dissipated, and there remained some upside risks to the outlook. Additionally, “there had been some progress in moderating risks of persistence in inflation,” the minutes said. Business surveys pointed to “waning wage and price pressures.” For some of those officials, the decision was “finely balanced” as inflationary persistence “had not yet conclusively dissipated.”

For those who voted to hold rates, members thought that there was a greater risk of more enduring structural shifts, such as a rise in the medium- term equilibrium rate of employment, a fall in potential growth and a rise in the long-run neutral interest rate, contributing to domestic inflationary persistence. They preferred to maintain the current level of Bank Rate until there was stronger evidence that these upside pressures would not materialize.

Alongside Bailey, Clare Lombardelli, the new deputy governor for monetary policy, backed the reduction in what was her first meeting. They were joined by deputy governors Sarah Breeden and Dave Ramsden as well as external member Swati Dhingra.

Chief Economist Huw Pill and external policymakers Jonathan Haskel, Megan Greene and Catherine Mann preferred to hold. It was Haskel’s last vote. In June, only two members supported a cut.

On Inflation, the BoE said risks that inflation pressures from second round effects endure into the medium-term

Economic projections:

- Inflation:

- 2024 forecast at 2.75% (prev. 2.5%),

- 2025 at 2.25% (prev. 2.25%),

- 2026 at 1.5% (prev. 1.5%)

- Growth:

- 2024 forecast at 1 25% (prev. 0.5%),

- 2025 at 1.0% (prev. 1.0%),

- 2026 at 1.25% (prev. 1.25%)

Separately, as the Bank of England prepares for its annual adjustment in September of the QT program to reduce its holdings of bonds, UBS notes that Thursday’s MPC report includes the latest analysis of the impact of QT. The BoE said that QT has had a small impact on gilt yields and the QT operations have had little impact on market functioning, which suggests they could increase active sales in the next 120-month period. It says that between February 2022 and June 2024, UK 10y bond yields rose 275bp while UK term premia rose 75bp; but QT is likely to account for just 10bp (though perhaps as much as 20bp) of the total rise in the term premium. It added that measures of gilt market liquidity have, if anything, improved since the start of QT, with some signs that sales may in fact have had a positive effect by alleviating collateral scarcity at shorter maturities.

As Bloomberg notes, the reduction will come as welcome relief for mortgage borrowers and business after 12 months with rates stuck at a 16-year high, and offers the new government an initial boon. Prime Minister Keir Starmer and his chancellor, Rachel Reeves, have been in office less than a month and have promised to boost growth to fix the UK’s ailing public services. Lower rates will help growth and bring down debt-servicing costs, giving the government more money for its spending priorities.

The BOE was briefed on the chancellor’s policy changes on Monday, when public-sector workers were awarded a £10 billion pay rise, but officials did not include them in the August projections. The effects on the fiscal stance will be in the November forecast following the full budget on Oct. 30.

Looking ahead, there was no specific guidance on where interest rates may settle, nor of the speed of cuts needed to get there. The minutes indicated that the BOE may lower borrowing costs only slowly, and financial market bets before the announcement pointed to only one further reduction this year.

“Inflationary pressures have eased enough that we’ve been able to cut interest rates today,” Bailey said in a statement. “But we need to make sure inflation stays low, and be careful not to cut interest rates too quickly or too much.”

The decision, according to Bloomberg, is an early gift to the new Labour government and aligns the BOE with a slow-to-start bandwagon of easing across advanced economies. That shift will possibly soon be joined by the US Federal Reserve after Chair Jerome Powell signaled on Wednesday that officials are on course to cut rates in September unless inflation progress stalls.

Similar to its peers, the UK central bank displayed a cautious approach toward future changes in borrowing costs, with the minutes adding that officials will “decide the appropriate degree of monetary policy restrictiveness at each meeting.”

Even so, the bank’s forecasts point to a steeper path of rate cuts over the next three years than markets currently expect.

On market assumptions that rates fall to 4.1% in 2025 and 3.5% in three years’ time, inflation is at 1.7% after two years and 1.5% after three – well below the 2% target.

UK consumer-price growth is back at that level, but underlying pressures remain uncomfortably high. The BOE said headline inflation will bounce back to 2.7% by the end of the year, and that what happens after that depends on how wages and services prices evolve. Inflation risks will remain “skewed to the upside throughout the forecast period,” the BOE said in its documents. “Monetary policy would need to continue to remain restrictive for sufficiently long until the risks to inflation returning to the 2% target in the medium term had dissipated further.”

The committee decided to cut despite stickier underlying inflation than hoped and stronger growth than anticipated – both elements cited by the minority that opposed the move in a vote that was the MPC’s tightest since September 2023.

Services inflation was 5.7% in June, well above the BOE’s forecast for 5.1%, and wage growth has dropped only slowly.

The economy is also rebounding from recession more strongly than expected. The BOE upgraded growth for this year to 1.25% from 0.5%, but left projections for 2025 and 2026 unchanged at 1% and 1.25%.

With the market generally expecting a rate cut, there was little reaction to the news, with both cable (which had fallen sharply ahead of the announcement) and rates barely reacting to the news, dropping from 1.2780 to 1.2754 before the BOE only to pick up slightly after to 1.2770, while Gilts lifted from 99.73 to 99.99 before paring to 99.59 15 minutes after.

Tyler Durden

Thu, 08/01/2024 – 07:24

via ZeroHedge News https://ift.tt/hdpgJ0B Tyler Durden