WTI Extends Bounce Off 6-Mo Lows After Sixth Straight Weekly Crude Draw

Oil prices have rebounded strongly overnight on the heels of the BoJ’s big dovish ‘fold’, which trumped the across-the-board inventory builds reported by API.

Additionally, traders are also closely monitoring geopolitical risks. In the Middle East, nations are bracing for a potential Iranian attack on Israel as payback for assassinations of Hezbollah and Hamas leaders. Ukrainian troops also launched a rare cross-border attack into Russia.

But for now, the tactical trade will be dependent on the official inventory data.

API

-

Crude +0.18mm

-

Cushing +1.07mm

-

Gasoline +3.31mm

-

Distillates +1.22mm

DOE

-

Crude -3.728mm (-800k exp)

-

Cushing +579k

-

Gasoline +1.34mm

-

Distillates +949k

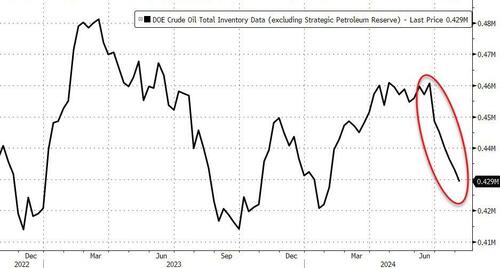

Contrary to API’s reported build, the official DOE data shows Crude stocks falling for the sixth straight week (the longest streak of inventory draws since January 2022)…

Source: Bloomberg

Total US Crude stocks fell to their lowest since February…

Source: Bloomberg

The Biden admin added 736k barrels to the SPR (the biggest weekly addition since June)…

Source: Bloomberg

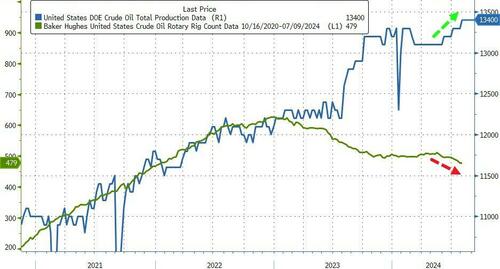

US crude production rose to a new record high last week, as the rig count continues to decline…

Source: Bloomberg

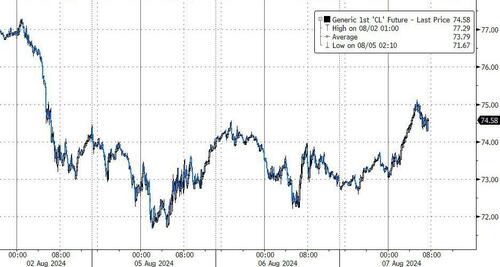

WTI is holding gains after the DOE data…

Oil still faces headwinds from faltering demand in China and the US, and the potential addition of supply from the OPEC+ alliance from next quarter.

“Those who firmly believe that economic contraction is inevitable will be happy to desert equities and commodities in the foreseeable future,” said Tamas Varga, an analyst at brokerage PVM Oil Associates Ltd.

“But the rest, and they are probably the majority, will be reluctant to do so unless genuine signs of recession emerge.”

An escalation of hostilities in the Middle East may spark further price gains, but a disruption to crude output from the region is needed for a sustained increase.

Tyler Durden

Wed, 08/07/2024 – 10:38

via ZeroHedge News https://ift.tt/sL8Ae4i Tyler Durden