China Inflation Unexpectedly Hits Five Month High Driven By Soaring Pork Prices

China’s consumer prices rose faster than expected in July, driven mostly by a surge in food/pork prices, even as core inflation continued to sink, raising concerns over persistent deflation in the world’s second-largest economy.

The country’s CPI rose 0.5% YoY In July year on year, the National Bureau of Statistics said on Friday, beating the median forecast of a 0.3%. The rise was the biggest since February, when prices grew 0.7%, and outpaced the 0.2% rise in June. Food price inflation rose across the board in July due to a decrease in supply from adverse weather. Meanwhile, both non-food price inflation and core inflation edged down in July, indicating continued weakness of domestic demand.

Meanwhile, deflation persisted in producer prices, a gauge reflecting goods as they leave factory gates as well as costs of materials and commodities, which were down 0.8% in July, the same as the previous month, if fractionally stronger than the -0.9% estimate. PPI inflation in upstream sectors rose modestly while that in downstream sectors fell slightly. In month-over-month terms, PPI inflation edged down to +1.8% in July vs. +1.9% in June. PPI inflation in producer goods ticked up to -0.7% yoy in July from -0.8% yoy in June, and PPI inflation in consumer goods edged down to -1.0% yoy in July (vs. -0.8% yoy in June).

Looking ahead, Goldman said it expects PPI deflation to lessen gradually, and CPI inflation to remain relatively low in the coming months.

Some more details from the report, courtesy of Goldman:

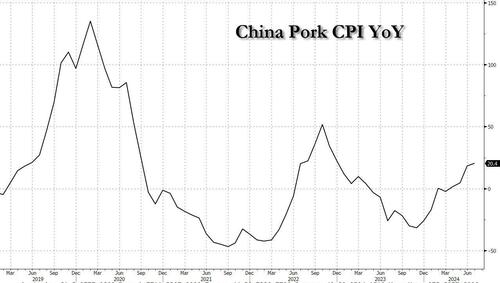

- In year-over-year terms, food prices were flat in July compared with a year ago (vs. -2.1% yoy in June). The prices of major food items rose in July due to adverse weather, especially for fresh vegetables/fruits. Among major food items, pork prices a major component of China’s consumer goods basket, leapt 20% YoY in July, the most since late 2022, and up from 18.1% in June. Prices have been highly volatile since outbreaks of African swine fever from 2018 to 2021 led to mass culling of herds. Inflation in fresh vegetable prices rose to +3.3% yoy in July from -7.3% yoy in June, and inflation in fresh fruit prices rose to -4.2% yoy in July (vs. -8.7% in June).

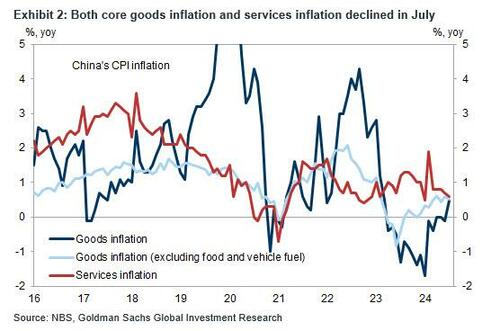

- Non-food CPI inflation edged down to +0.7% yoy in July from +0.8% yoy in June. The moderation is broad-based across various categories. After excluding food and energy prices, core CPI inflation softened to +0.4% yoy in July (vs. +0.6% in June), indicating still weak domestic demand. Although NBS mentioned that tourism-related prices, such as flight ticket fares and hotels, rose sequentially, the year-over-year growth moderated from June to July. Fuel costs increased by +5.1% yoy in July (vs. +5.6% yoy in June). Services inflation edged down to +0.6% yoy in July (vs. +0.7% in June; Exhibit 2).

Surging food prices aside (the result of recent flooding across China), consumer price growth has remained very weak in China over the past year, with frequent negative reading casting doubts over the strength of domestic demand in the midst of a three-year property slow-motion crash. Intense competition across Chinese industries, especially the automotive sector, have added to downward pressure on prices. Beijing has intensified its focus this year on manufacturing after a post-pandemic consumer rebound failed to materialise last year.

Lynn Song, chief China economist for ING, said flat food prices, which had been mired in deflation for the past year, were a “big part of the increase” in overall CPI. But he pointed to drags on prices in other areas, including transport facilities due to cheaper vehicle prices, communications due to falling smartphone prices, and declining rents.

“We expect price weakness to remain in the first two categories, while we are in wait-and-see mode on the rent category as policy support for the real estate market continues to roll out,” Song said.

Meanwhile, inflation in items that actually serve as assets to China’s shrinking middle class, refuses to take hold: new home prices in May fell by the most in almost a decade, adding to concerns over the property sector. Authorities in the same month introduced very modest measures to encourage state-owned enterprises to buy unused housing, in a bid to support the market, yet the token amount of the support was largely ignored by the market.

Chinese authorities also unveiled unexpected cuts to lending rates last month after widespread calls for more economic stimulus. These have yet to achieve anything.

Tyler Durden

Fri, 08/09/2024 – 10:20

via ZeroHedge News https://ift.tt/NKny0V9 Tyler Durden