Futures Flat In Muted Trading As Sentiment Remains Extremely Fragile

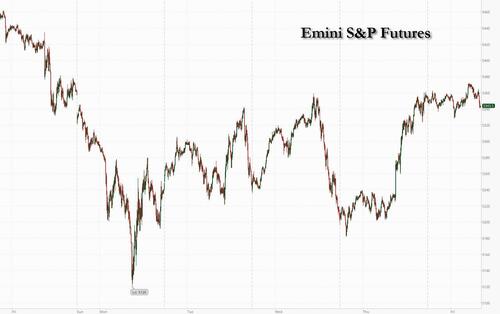

With both Goldman and JPMorgan asking the question on everyone’s lips, namely whether the market has bottomed, so far the answer remains elusive with futures flat on the last trading session of the day, but erasing earlier gains as sentiment remains on edge thanks to a VIX around 24 and the yen, the currency at the basis of the carry trade, failing to drop. Perhaps the only good news is that the wild week is ending on a subdued note, with Friday trading seeing light equity volumes and small moves across stocks, bonds and currencies as even traders are exhausted from the week’s fireworks. Remarkably, US stocks are close to wiping out all the losses from the Monday’s market meltdown, with S&P 500 futures unchanged as of 7:45am, fading an earlier gain of 0.5%, after markets roared back on Thursday as data showed much fewer American filed for jobless benefits, alleviating fears of a looming recession. Nasdaq futures were modestly in the green led by Mag7 and semi stocks. European stocks are already positive on the week as investors hunted for bargains from the selloff. Treasury yields dipped and the dollar weakened. The VIX Index hovered around 23. Otherwise it will be a quiet data on the data front with no macro releases scheduled as investors now wait for next week’s data, which includes reports on the all important CPI and retail sales.

In premarket trading, Expedia surged after posting better-than-expected second-quarter results. Paramount Global rose 5% after the media company beat adjusted EPS estimates in the 2Q. The company also took on an impairment charge of $5.98 billion on its cable networks and announced a 15% cut to its US workforce. Here are some of the other most notable premarket movers:

- Adma Biologics a maker of plasma-derived drugs for immune-compromised patients, soars 19% after the company boosted its year revenue and net income forecast.

- Blend Labs climbs 10% after the mortgage lending software company reported 2Q results that beat expectations.

- DigitalOcean gains 5% after the software company reported 2Q results that beat expectations and raised its full-year adjusted Ebitda margin forecast.

- Doximity rallies 30% after the healthcare software company raised its full-year forecast for revenue.

- Expedia jumps 9% after the online travel company reported 2Q results that beat expectations on key metrics.

- Five9 slumps 14% after the call-center software provider reduced full-year revenue guidance, saying bookings slowed in 2Q as corporate clients cut budgets.

- Honest Co. rises 13% after the consumer products company reported 2Q results that largely topped Wall Street expectations.

- Mitek Systems plunges 26% after the company cut its revenue guidance for the full year.

- Pitney Bowes soars 24% after the shipping and mailing company reported revenue for the 2Q that beat.

- PubMatic plunges 27% after the company posted results and provided a forecast that disappointed.

- Rocket Lab USA gains 12% after the space systems company said it has successfully hot fired its new rocket engine Archimedes for the first time.

- Sweetgreen soars 25% after the salad restaurant chain boosted its full-year revenue forecast.

- Trade Desk gains 5% after the advertising technology company reported 2Q results that beat expectations.

Mixed signals from the Fed may prompt caution among investors, especially after Kansas City Fed President Jeffrey Schmid indicated he’s not ready to support a reduction in interest rates with inflation above the target, according to comments made on Thursday in the US.

“Market volatility could remain elevated for some time,” said Mark Haefele, chief investment officer at UBS Global Wealth Management. But “investors shouldn’t overreact to swings in market sentiment,” he said. Since that flied in the face of sharply higher expectations for rate cuts by year-end, swaps traders trimmed bets on aggressive Fed easing in 2024. The global repricing has been so sharp that at one point interest-rate swaps implied a 60% chance of an emergency rate cut by the Fed in the coming week — well before its next scheduled meeting in September. Current pricing suggests about 40 basis points of cuts for September.

“Scope for higher bond yields is limited as central banks may have realized it’s time to move back to more neutral settings,” said Martin van Vliet, a macro strategist at Robeco. “This scare will will have reinforced the feeling among central banks that they need to take back the restrictiveness of monetary policy.”

The Stoxx Europe 600 index climbed 0.8%, led by energy, real estate and miners. Hargreaves Lansdown gained after a consortium including CVC and ADIA agreed to buy the investment manager in a £5.4 billion ($6.9 billion) deal. Trading volumes in European stocks were about 35% below average levels on Friday, according to data compiled by Bloomberg. Here are some of the biggest European movers on Friday:

- Lotus Bakeries shares rise as much as 8%, touching a record high, after the Belgian cake-and-cookie maker reported first-half earnings that beat estimates, and said the outlook for its Biscoff brand remains positive in the second half.

- LEG Immobilien shares rise as much as 5.3%, after the German property firm raised its Adjusted Funds From Operations (AFFO) forecast for the full year.

- Hargreaves Lansdown shares rise as much as 2.6% after the investment firm agreed to a premium-priced takeover offer. Analysts at Jefferies and Shore Capital believe there is scope for the stock to earn a higher valuation, but think the deal will go ahead.

- Lanxess shares rise as much as 4.8% after the German specialty chemicals firm posted second quarter results that analysts called strong, with the consumer protection division a positive surprise.

- Jenoptik shares rise 9%, the most in three months, as the German optical technology company beat profit and revenue estimates in its second quarter results.

- Just Eat shares rise as much as 6% in Amsterdam after Morgan Stanley raises the stock to overweight from equal-weight, saying New York City’s fee caps for food delivery platforms now look more likely to be raised.

- Entain shares rise as much as 4.5%, extending gains booked on Thursday, after the gambling company posted an earnings beat and raised its outlook.

- Galderma shares rise as much as 3.9% after J.P. Morgan initiated coverage of the firm with a recommendation of overweight, saying it sees the Swiss dermatology giant delivering a sustained double-digit top-line growth.

- Bellway shares rise as much as 2.9%, with the homebuilder’s trading statement suggesting annual operating profit will be comfortably ahead of consensus after it built more houses and sold them at higher prices than anticipated, according to Peel Hunt.

- Generali shares fall as much as 2.9% after the Italian insurance company posted a sharp drop in second-quarter earnings, weighed down by claims from storms and flooding. The result overshadowed plans for a new €500 million buyback program.

Earlier in the session, the Asian stock rally lost some momentum as the yen temporarily resumed its rise. Japan’s Topix index narrowed its gain to 0.9% from as much as 2% earlier. Chinese shares turned flat after an earlier advance as perceptions grew that a better-than-expected inflation print mainly resulted from seasonal factors like weather.

In rates, treasury long-end yields are richer by 4bp near session lows as US trading day begins with bull-flattening move, partially unwinding Thursday’s selloff sparked by jobless claims data. Similar long-end-led gains seen in core European rates. Front-end yields are little changed, flattening 2s10s spread by ~3bp, 5s30s by ~1bp; 10-year around 3.95% is near top of 3.665% – 4.02% weekly range with bunds and gilts lagging slightly in the sector.

In FX, the Bloomberg Dollar Spot Index fell 0.2%, extending Thursday’s 0.2% drop as jobless claims data alleviated jitters about recession. The yen fluctuated between gain and losses. USD/JPY is down 0.1% at 146.90, erasing an earlier 0.4% advance; the pair has been whipsawed this week, falling as low as 141.70 as yen-carry positions were unwound amid a jump in volatility.

“Risk conditions are improving and the great bulk of JPY-funded carry positions have apparently been cleared,” said Westpac Banking Corp.’s Richard Franulovich and Tim Riddell wrote in a note to clients. “Against that backdrop USD/JPY has found a short term floor and probably spins its wheels around 146-148”

In commodities, oil was steady following a Thursday rally, against the backdrop of simmering tensions in the Middle East. Gold slipped.

Bitcoin is in the green and back above the $60k mark, but has eased back from a $62.7k high which printed in APAC trade.

There is nothing on today’s macro calendar. Investors now wait for next week’s data, which includes reports on the all important CPI and retail sales.

Market Snapshot

- S&P 500 futures unch to 5,346

- STOXX Europe 600 up 0.8% to 500.39

- MXAP up 1.4% to 175.30

- MXAPJ up 1.7% to 553.52

- Nikkei up 0.6% to 35,025.00

- Topix up 0.9% to 2,483.30

- Hang Seng Index up 1.2% to 17,090.23

- Shanghai Composite down 0.3% to 2,862.19

- Sensex up 1.1% to 79,739.49

- Australia S&P/ASX 200 up 1.2% to 7,777.70

- Kospi up 1.2% to 2,588.43

- German 10Y yield -1.7 bps at 2.25%

- Euro little changed at $1.0920

- Brent Futures up 0.7% to $79.53/bbl

- Gold spot down 0.1% to $2,423.98

- US Dollar Index little changed at 103.18

Top Overnight News

- China’s Jul CPI comes in a bit firmer than expected in Jul because of weather-linked food inflation (+0.5% vs. the Street +0.3% and up from +0.2% in June) while PPI deflation persists (-0.8% vs. the Street -0.9% and flat vs. -0.8% in June). RTRS

- TSMC’s revenue jumped 45% in July from a year ago on strong demand for AI chips, an early sign the company may beat quarterly sales forecasts. Separately, SMIC is expediting plans to add capacity as the US restricts China’s access to foreign technology. BBG

- The U.S. has warned Iran that its newly elected government and economy could suffer a devastating blow if it were to mount a major attack against Israel, a U.S. official said. WSJ

- Iran and its allies are considering how to retaliate against Israel without triggering an all-out war. WSJ

- Federal Reserve policymakers are increasingly confident that inflation is cooling enough to allow interest-rate cuts ahead, and they will take their cues on the size and timing of those rate cuts not from stock-market turmoil but from the economic data. RTRS

- Trump says presidents should have influence over monetary policy (“I was very successful, and I think I have a better instinct than, in many cases, people that would be on the Federal Reserve or the chairman”). WSJ

- Trump and Harris will meet for a debate Sept 10 on ABC (Trump proposed two other debate dates, but the fate of those is unclear at the moment). CNN

- Consumer staples firms turn their focus to India as the next major growth opportunity as China optimism fades. RTRS

- Disney plans to spend at least $5 billion in the UK and Europe over the next five years to produce movies and TV shows. FT

- The biggest publicly traded alternative asset managers have more than a half-trillion dollars to put to work — and they’re gearing up for a deals comeback. Seven of the firms reported a collective $722 billion in dry powder as of June 30 — a 9% increase from a year earlier, according to earnings data compiled by Bloomberg. Now that the Federal Reserve is expected to cut interest rates, money managers have extra firepower to make deals again. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks took impetus from the relief rally on Wall St where sentiment was underpinned after a larger-than-expected decline in Initial Jobless Claims soothed some of the recent labour market concerns. ASX 200 gained with outperformance in tech front-running the advances seen across all sectors. Nikkei 225 briefly reclaimed the 35,000 status and momentarily turned positive for the week after fully recovering from Monday’s turmoil, but later faltered heading into the Japanese long weekend. Hang Seng and Shanghai Comp. were positive after encouraging signals from China’s inflation data and with notable strength in China’s largest chipmaker SMIC after its Q2 results which showed profits dropped sharply but beat expectations and revenue climbed, while it also forecasts double-digit percentage sequential revenue growth for Q3. However, the gains in the mainland were limited after the PBoC’s open market operations for this week resulted in the largest net liquidity drain in four months.

Top Asian News

- TSMC (2330 TT) July Sales TWD 256.95bln (207.8bln in June).

- China’s Industry Association reports July vehicles sales -5.2% Y/Y (prev. -2.7%), January-July +4.4% (prev. +7.9%); NEV July sales +27 Y/Y.

European bourses are firmer, Euro Stoxx 50 +0.4%, having begun the session with modest gains in limited newsflow and have been extended modestly on opening levels thereafter. Sectors primarily in the green, action overall though somewhat modest given the lack of specific drivers. Materials and Energy outperform slightly, with Chinese CPI and geopolitics respectively assisting. Breakdown has slight outperformance in the FTSE 100 +0.5%, with the region’s housing sector performing well after Hargreaves Lansdown accepted a takeover offer. Stateside, futures are in the green with the tone largely a continuation of the post-claims move, ES +0.2%, NQ +0.4%; as above, specifics light and the docket ahead devoid of US-related Tier 1 catalysts or earnings.

Top European News

- China Commerce Ministry says findings in the EU’s EV prelim ruling lacks factual and legal basis and seriously violate WTO rules. Resorted to the dispute mechanism of the WTO.

FX

- DXY is slightly softer but still holding steady above the 103.00 mark and by extension Thursday’s 102.91 base.

- G10s are rangebound; EUR and GBP both slightly firmer vs. the USD with the single currency just above 1.09 and Cable around 1.2750.

- JPY essentially unchanged despite posting a fairly large range overnight, though one that is dwarfed in comparison to the WTD band of 141.66-147.89.

- NOK unreactive to an in-line CPI-ATE print when compared to market expectations but one that came in 0.3pps lower than the Norges Bank’s view for the month.

- CAD holding steady into jobs data for the region this morning.

- PBoC set USD/CNY mid-point at 7.1449 vs exp. 7.1690 (prev. 7.1460)

- Peru Central Bank cut its reference rate by 25bps to 5.50% (exp. unchanged at 5.75%), while it stated that future rate changes will be dependent on new information about inflation and its determinants.

Fixed Income

- Overall, benchmarks are bid but with specifics light and action thus far in familiar ranges.

- USTs firmer and just shy of the 113-00 handle having picked up from a 112-17+ base after a particularly poor 30yr tap last night.

- Bunds in the green, but again only modestly so. No reaction to final inflation metrics from Germany or Italy.

- For reference, next week’s auction docket for EZ member nations generally has been heavily trimmed, as is usually the case given low summer liquidity.

Commodities

- Crude benchmarks have been steady thus far, despite the ongoing creeping up of geopolitical tensions.

- Geopols. remain in focus and a potential market-driver over the next few sessions, as it stands talks are ongoing regarding a ceasefire while language from the IRGC remains escalatory.

- NatGas is in the red, with lows still running smoothly from Russia to Europe through Ukraine thus far. However, lows still running smoothly from Russia to Europe through Ukraine thus far.

- Metals mixed with spot gold softer as the risk tone is becoming incrementally more constructive while base metals continue to climb after firmer-than-expected Chinese inflation.

- Ukraine gas transmission operator says Russian gas transit via Ukraine is flowing normally.

Fed Speakers

- Fed’s Goolsbee (non-voter) said the Fed watches markets but they do not drive policy, while he added they are getting back to more normal conditions in the US economy and the question is if the job market will hold or keep worsening. Furthermore, he said that they need to see more than payrolls and more than one month, as well as noted they need to watch the real economy if they are too tight for too long.

- Fed’s Schmid (non-voter) said if inflation continues to come in low, it will be appropriate to adjust policy, as well as noted the current stance of Fed policy is not that restrictive and the Fed is close but still not quite there on reaching 2% inflation goal. Furthermore, Schmid said the path of Fed policy will be determined by data and the strength of the economy, while he would not want to assume any particular path or endpoint for the policy rate.

- Fed’s Collins (2025) on Thursday said: if the data continue the way that I expect, I do believe that it will be appropriate soon to begin adjusting policy and easing how restrictive the policy is.

Geopolitics: Middle East

- Qatari, Egyptian and US leaders said it is time to conclude a Gaza ceasefire agreement and release hostages and prisoners, while they have worked for months to reach a framework agreement and it is now on the table, with only details of implementation missing. Furthermore, they called on the sides to resume urgent talks on Thursday, August 15th, in Doha or Cairo to bridge all remaining gaps and start implementing an agreement without any delay.

- CNN source said lead mediators will attend the next round of negotiations with the CIA director to lead the US delegation, while the meeting that is being planned is expected to take place but needs the approval of Israel and Hamas, while it was later reported that Israeli PM Netanyahu’s office said Israel will send negotiators for August 15th meeting on a Gaza deal and a Hamas official also said that they are ready for ceasefire negotiations to stop the bloodshed, according to source on X

- US senior administration official said President Biden and Defense Secretary Austin reviewed Middle East military deployments, while the official added that there is no expectation that an agreement will be signed by next Thursday and that issues on the table include the sequencing of the exchange. The official added that it is a negotiation and they need some things from the Israelis and the Hamas side, as well as noted that an Iranian escalation would jeopardise hope of getting a ceasefire deal because the focus would shift.

- US Secretary of Defence Austin briefed his Israeli on the nature of the deployment of US forces in the Middle East and stressed the importance of the ceasefire agreement in Gaza, while Austin said the arrival of F-22 jets in the region is part of the efforts to deter, defend Israel and protect US forces.

- Officials believe an Iran assault could be more sudden, larger and longer possibly lasting several days instead of several hours and could also be a coordinated barrage from multiple directions involving Iranian proxies in Iraq, Yemen, Syria and Lebanon, according to Washington Post.

- US CENTCOM said the US military destroyed two Houthi cruise missiles targeting ships.

- Rockets were fired at Kiryat Shmona and Manara settlement in northern Israel, while the Israeli army said air defence systems intercepted a rocket fired from the Gaza Strip towards Zikim and Ashkelon south of Israel, according to Al Arabiya.

- Yemeni sources noted US-British raids on Houthi military sites in Ras Issa and Salif areas in Hodeidah, according to Sky News Arabia.

- “The Israeli army announces the start of an “offensive” military operation in the city of Khan Yunis in the Gaza Strip”, according to Sky News Arabia.

- Iran’s Tasnim says the Iranian Guards Navy’s new missiles have capabilities such as a “highly explosive warhead”, which is undetectable; added “large number” of anti-ship missiles to the IRGC navy.

Geopolitics: Ukraine

- Sevastopol authorities announced a state of air emergency and the shooting down of a Ukrainian anti-ship missile, while it was also reported that a state of emergency was declared after a march attack on Belgorod and Voronezh, according to Al Arabiya.

- Source on X reported that residents said there was a huge blast heard in Rylsk, Rostov-On-Don, Russia.

- A fire broke out at a military airfield in Russia’s Lipetsk region, according to agencies cited by AFP.

- Russia declares Federal emergency in Kursk region, according to RIA.

- Russian official says fighting is ongoing several dozen kilometres from Kurchatov, where Kursk nuclear plant is located.

US Event Calendar

- Nothing major scheduled

Tyler Durden

Fri, 08/09/2024 – 08:19

via ZeroHedge News https://ift.tt/E2zjsLu Tyler Durden