Stocks Erase ‘Black Monday’ Losses As Vol Tumbles; Bond Yields & Black Gold Surge

If you took the week off and are just now looking at your book, you could be forgiven for being confused and unimpressed… S&P unchanged, rate-cut expectations notably lower, TSY yields up 15bps, and oil surging.

Source: Bloomberg

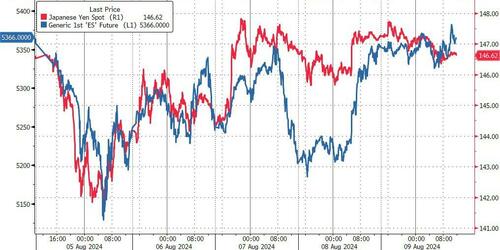

What you missed was a 6% collapse in stocks (and 20bps plunge in TSY yields) on Monday as yen-carry-unwinds wreaked havoc in risk markets with VIX exploding to crisis highs, before vol-sellers piled back in…

Source: Bloomberg

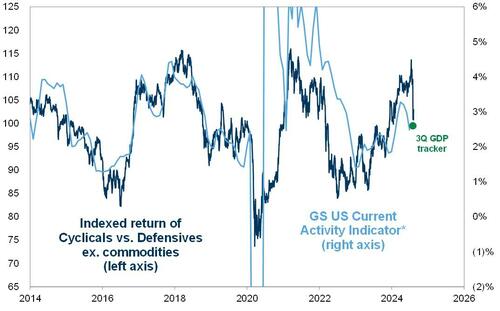

As Goldman’s Tony Pasquariello highlighted this morning, the wedge of market enthusiasm that opened up the summer has narrowed considerably…

Additionally, if you wondered just how correlated global positioning cross-asset was, we found out real quick this week, as the Yen Carry trade dominated all and every asset-class…

Source: Bloomberg

As we mentioned above, the big picture for stocks on the week was ‘meh’ with S&P and Nasdaq back up to unchanged. The Dow a small laggard and Small Caps down for the second week in a row (but obviously well off its lows)…Yes, that is a 6%-ish plunge in Nasdaq and Small Caps on Monday that was erased by the end of the week.

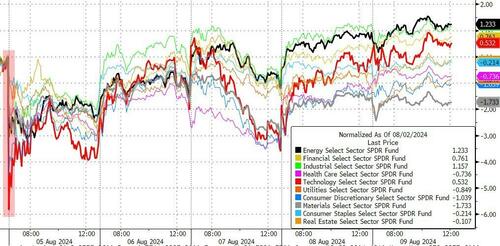

Energy and Tech were among the outperforming sectors (even after Tech’s collapse on Monday) while Materials were the laggard…

Source: Bloomberg

‘Most Shorted’ stocks were squeezed back into the green on the week after Monday’s collapse but remain well down from pre-payrolls…

Source: Bloomberg

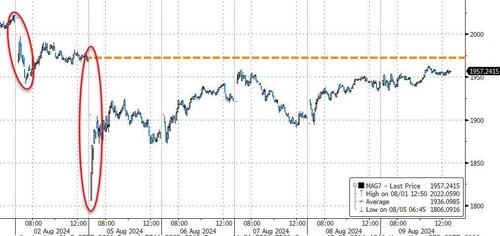

Mag7 Stocks rebounded dramatically off the 8%-plus pukefest at the cash open on Monday, but ended the week in the red still…

Source: Bloomberg

Goldman’s trading desk noted that the floor better to buy today though overall activity light in notional terms (volumes -10% vs the trailing 20 days) and top of book (liquidity) continues to be weak compared to average.

-

LOs very quiet with small buy skew across Hcare and macro products, vs selling tech.

-

HFs selling Tech, Industrials, and Cons Discretionary, vs buying Energy + Macro Products.

Treasury yields were up on the week (with the short-end underperforming – 2Y +18bps, 30Y +12bps on the week), but including Friday’s post-payrolls plunge, yields are still down with the short-end outperforming…

Source: Bloomberg

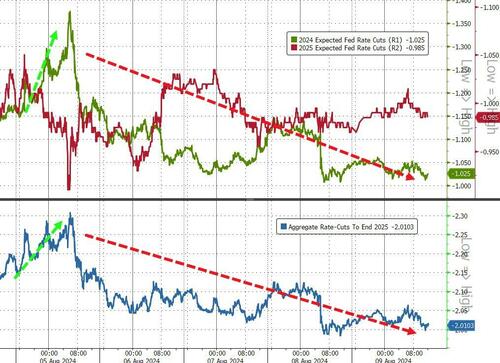

Rate cut expectations tumbled from the initial surge on Monday withe most of the swing in pricing concentrated in 2024…

Source: Bloomberg

The yield curve (2s10s) briefly disinverted on Monday, but was flatter (more inverted) by the end of the week…

Source: Bloomberg

The dollar ended lower on the week as yen strengthened after BoJ folded…

Source: Bloomberg

Gold rebounded yesterday and today, back above $2400 but ended marginally lower on the week…

Source: Bloomberg

Oil prices had a big week, with WTI ripping back from 6-month lows around $72 to $77 by the end of the week (making it back to pre-payrolls levels)…

Source: Bloomberg

Bitcoin also had a wild week only to end approximately unchanged. Having puked from $62k to $50k, it rebounded all the way back to $62k overnight (before finding support at $60k)…

Source: Bloomberg

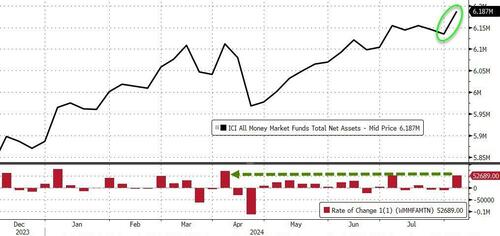

Finally, amid the carnage of the last week, money market fund total assets soared to a new record high…

Source: Bloomberg

A huge $53BN inflow (the most since April – Tax Day) suggests ‘real money’ market participants are perhaps more than a little nervous as HFs, vol-sellers, and algos lift the market on thin volumes.

Tyler Durden

Fri, 08/09/2024 – 16:00

via ZeroHedge News https://ift.tt/YEQdKx6 Tyler Durden