Crypto Tumbles As ‘Harris/Biden’ Admin Moves Another 10,000 ‘Silk Road’ Bitcoin To Coinbase

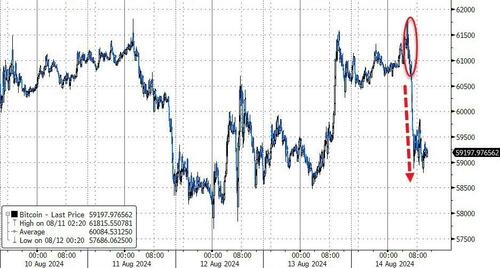

Bitcoin prices fell this morning in reaction to the lackluster CPI (as rate-cut expectations dipped). That selloff broke through $60,000 and accelerated further as headlines broke that the US government moved 10,000 seized Bitcoin from the Silk Road dark web marketplace to a Coinbase wallet Wednesday.

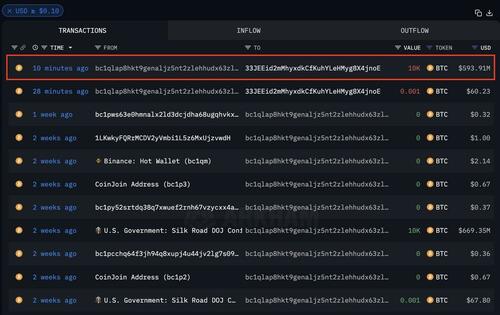

According to the onchain analytics firm, Arkham Intelligence, the funds were seized during the Silk Road raid and are currently valued at $593.91 million.

It’s not immediately clear whether the United States plans to sell or custody the assets.

The transaction follows a previous move of approximately $2 billion worth of Silk Road Bitcoin in late July.

As a reminder, the price action (dowwward) in various cryptocurrencies is front-running expectations of the creditors getting their hands back on these assets and selling them…

…the only problem with that argument is, as we detailed here, the creditors are not selling, they’re HODLing…

“Now, seeing the continued growth and acceptance of their industry, many Mt. Gox creditors may have become even stronger believers in Bitcoin and its future potential, choosing to hodl further.”

So, its really only the algos, reacting to the headlines, that is driving any dips.

“This resilience suggests that while short-term volatility is possible, the long-term impact on Bitcoin’s market dynamics will likely be minimal.”

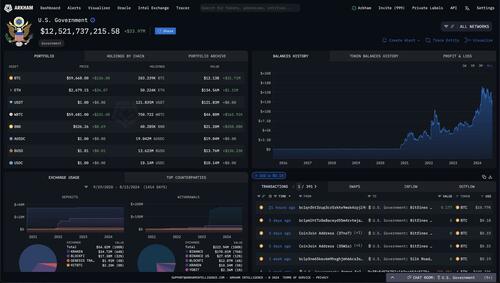

The US government currently holds roughly 203,000 BTC valued at approximately $12 billion at the time of this writing.

The decision by the Biden/Harris administration in the last few weeks to seemingly accelerate the dumping of their ‘seized’ Bitcoin comes right as former President Trump outlined his Bitcoin strategy (including creating a Strategic Bitcoin Reserve).

The Harris campaign continues to desperately try and placate the crypto community – despite almost four years of nothing but hate for the sovereign currency and its heretical holders. Let’s see how Crypto-Kamala’s aides explain the ongoing dumping of assets.

Tyler Durden

Wed, 08/14/2024 – 14:45

via ZeroHedge News https://ift.tt/5QWHwd4 Tyler Durden