Stock Index Castoffs Have Delivered Enduring And Outsized Returns, Quant Researchers Find

When stocks are ejected from market-cap-weighted indexes, swooping in to load up on them — and hold on to them — can pay off nicely, according to a new paper from Newport Beach, California-based Research Affiliates LLC.

“Once dropped by the index, there is a silver lining for these stocks…they, on average, outperform the market over the next several years, creating a compelling opportunity for investors,” said Research Affiliates chairman Rob Arnott, who co-authored the study with the firm’s research VP Forrest Henslee. They also found that, over the year after being booted from the indexes, deleted stocks have historically outperformed the stocks that replaced them.

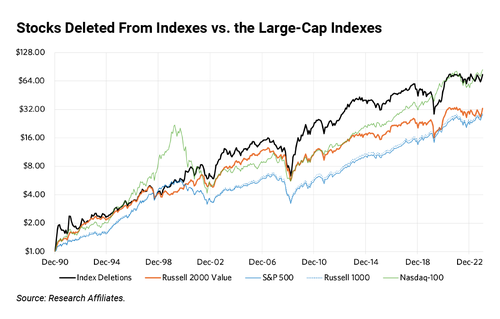

This strategy isn’t about making a quick profit by catching a bounce when the price-pressuring effect of index funds’ mandatory selling subsides. Rather, it assumes the investor holds on to the shares for five years. Had an investor started employing the strategy in 1991, he’d have grown his initial investment by about 74x.

To track the strategy, Research Affiliates has launched the Research Affiliates Deletion Index (NIXT). While based on the research methodology, the NIXT index does have a tweak in the form of a quality screen that includes a company’s debt, total payout ratio and net payout ratio — with stocks falling in the bottom quintile rejected. The index uses an equal weighting and annual rebalancing. No ETF yet tracks it, so, for now, it’s a do-it-yourself opportunity.

Tracking rejects from the S&P 500, Nasdaq-100 and Russell 1000, the strategy is ultimately a small-cap value play:

Stocks that get dumped are by their nature small and cheap. Between 1991 and 2022, deletions traded at a 26% discount to the S&P 500 in terms of their price-to-earnings ratio while additions fetched an 83% premium. — Wall Street Journal

“When an index producer adds or drops stocks from the index, they will inevitably add stocks that are popular, beloved, and expensive and drop stocks that are unloved and cheap,” said Arnott. The strategy’s small-cap tilt springs from the fact that many index deletions are sparked by companies no longer making the large-cap cut.

Some key observations from the study:

- The deleted-stock strategy beat the Russell 2000 Value Index over the past 33 years. “When deletions outpace the Russell 2000 Value, they win by more than 18%, on average…When deletions underperform, they lag by 5.3% on average, with a shortfall of over 10% only twice,” said the authors.

- S&P 500 rejects went on to beat their former index by more than 5% a year.

- Looking solely at the last 10 years, the strategy lagged the three indexes that drive it, which Arnott and Henslee attribute to “the current growth-dominated bull market [that’s] left value and small-cap stocks in the dust.”

“It makes sense that the booted companies would become undervalued and bounce back,” notes Charles Robtlut at the American Association of Individual Investors. “It also makes sense to overlay a quality filter because some companies are booted from the indexes because they are no longer good companies.”

The Journal credits Arnott as a “luminary in the world of finance nerds constantly trying to build a better mousetrap,” noting that a 2005 paper he co-authored sparked the smart beta trend.

Tyler Durden

Mon, 08/19/2024 – 05:45

via ZeroHedge News https://ift.tt/7JZcnXI Tyler Durden