‘The Descent Is Upon Us’: Forget The Sahm Rule, This Indicator Has Perfectly Predicted Every US Recession Since 1930

Authored by Joe Sullivan-Bissett via BondVigilantes.com,

The Sahm rule has triggered: markets, please prepare for landing

The economic cycle is at an interesting inflection point where the effects of higher interest rates are becoming evident in numerous ways, be it a slowdown in the labour market, falling inflation, or wavering consumer and business confidence. Whilst a lower rate of inflation is welcomed, the important question remains: have interest rates been too high for too long, and has this caused irreparable damage to the economy in its current cycle? In this blog, I discuss the breaching of the Sahm rule, and whether the Federal Reserve (Fed) can manage to coordinate a ‘soft landing’, where monetary policy tools are used to reduce inflation to target levels, without pushing the economy into a recession.

Before assessing whether the Fed might be able to achieve this goal, let’s take a step back and assess how the recent inflation predicament arose.

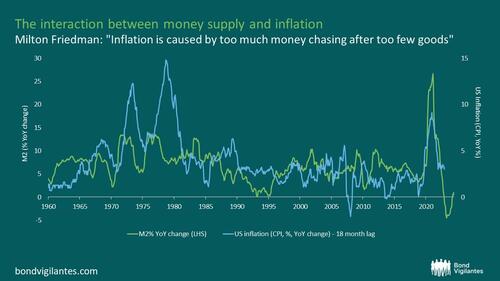

Inflation take-off caused by post-COVID money supply and the invasion of Ukraine

For the 10 years that followed the Global Financial Crisis and preceded the COVID-19 era, inflation in the US ran at an average of 1.8% per year – almost in line with the Fed’s long-term target of 2%. Then, the COVID-19-induced economic shutdowns reduced inflationary pressures as economic activity was halted. Directly after, a combination of monetary policy easing (central banks significantly reducing policy rates and implementing a quantitative easing programme) and fiscal policy easing (governments authorising various measures to help both consumers and businesses deal with the difficult economic environment) vastly increased the money available in the economy. The former is evident in the year-on-year change of Federal Reserve money supply (M2) in the below chart, which I’ve plotted against the change in US inflation (CPI, year-on-year) with an 18-month lag. This is by no means a perfect correlation, not least because the length of the lag hasn’t been chosen with particularly scientific methods, but a visible relationship exists nonetheless.

Source: Bloomberg, August 2024

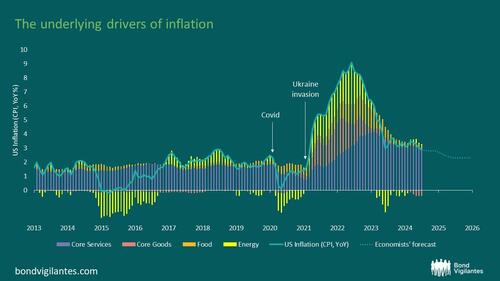

Further to this, additional supply-side inflationary pressures were caused by Russia’s invasion of Ukraine. This was predominantly observed in the cost of energy with the price of commodities, such as oil and natural gas, skyrocketing. However, it also manifested in other categories such as food, with the region producing 30% of the world’s supply of wheat and barley pre-invasion, amongst other staples. The chart below details the rate of inflation since the start of 2013, and a breakdown of the underlying constituents contributing to each inflation print. Whilst the headline inflation number has significantly decreased from the peak in June 2022, it’s noteworthy that services inflation, typically very stable, remains at relatively elevated levels.

Source: Bloomberg, August 2024

Will the Fed successfully navigate the remainder of the inflation journey?

For now, it is too early to tell. Since the Fed embarked on its cycle of monetary tightening (i.e. moving interest rates higher), the market has been contemplating whether the Fed can achieve its goal of reducing inflation to its target level, without significantly disrupting economic growth – now colloquially known as a ‘soft landing’. On the other hand, a ‘hard landing’ would be a situation where the central bank has kept monetary policy too restrictive (whether in size or in length of time), and as a result, causes a significant impact on economic growth, and potentially a recession.

In early August, the release of weak economic data and the resulting market downturn, coupled with the subsequent recovery, was evidence that this debate continues. The market is currently pricing interest rates in the US to be 1% lower by the end of this year, which, given there are only three meetings left (ignoring extraordinary circumstances) where the Fed can reduce the policy rate, means the market is looking for a ‘double cut’ in at least one of the remaining meetings. With this being a reasonably rare move for the Fed, bond market pricing is somewhat signifying a ‘policy mistake’, suggesting that the Fed has kept policy rates too high for too long. Now that the Sahm rule has breached, it is perhaps a reasonable suggestion to make.

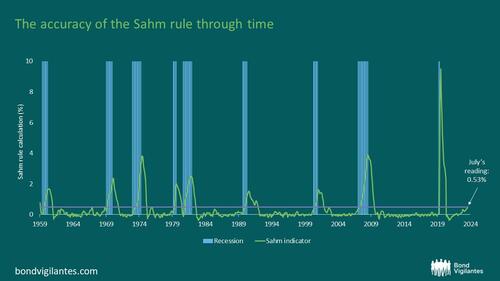

The Sahm rule recession indicator: we’ve reached cruising altitude

The Sahm rule, which was originally developed as an indicator to provide fiscal support to citizens as soon as a recessionary backdrop was evident, has grown in popularity as a key real-time economic indicator that the economy is in a recession. The indicator signals a recession when the three-month moving average of the national unemployment rate exceeds the lowest point over the previous 12-months by 0.5%. The accuracy of the rule is stark, as demonstrated in the following chart which shows that in the post-WWII era, each time the indicator has breached 0.5%, the US economy has been in (or was going into) a recession.

Source: Bloomberg, August 2024

As seen in the chart above, July’s unemployment report tipped the Sahm rule north of the all-important 0.5% mark, albeit only slightly, suggesting the US economy is in a recession.

Taking this one step further, Pascal Michaillat and Emmanuel Saez – both of the University of California – have developed a new recession indicator, somewhat an extension of the Sahm rule, which combines both job vacancy rates and unemployment data. This indicator on average detects a recession 1.4 months after it has started (versus 2.6 months for the Sahm rule) and has perfectly identified all recessions since 1930 (the Sahm rule is only fully reliable from 1960 onwards). You can read more in their paper here; however, in a nutshell, when their indicator reaches 0.3, a recession may have started, and when it reaches 0.8, a recession has started.

Post the July unemployment data, their indicator is at 0.5, suggesting a 40% probability that the US economy is now in a recession.

Further, Michaillat and Saez note that it may have been in a recession since March.

However, it’s not all necessarily doom and gloom for the US economy. Claudia Sahm recently joined the hosts of Bloomberg’s ‘Odd Lots’ podcast to discuss the recent unemployment data. Sahm assessed the reasons why the most recent breach of the rule might not be like previous instances, especially in light of the move higher in unemployment being driven by an influx of labour supply (rather than a significant decrease in job openings), and other economic data remaining resilient. Yet, Sahm highlights the notable decelerating trend in demand for labour and why it might be a suitable time for the Fed to start relaxing monetary policy.

The descent is upon us, all eyes on forthcoming labour data and the Fed’s response

To conclude, things were relatively straightforward post the Global Financial Crisis, in a world where inflation for the most part hovered around the Fed’s target level, but COVID-19 and Russia’s invasion of Ukraine put a halt to that. Money was released into the economy in large volumes to limit the financial damage of lockdowns on consumers and businesses, and inflation rode the coattails of such expansive policies. Bringing inflation back to comfortable levels without the consequential impact on economic growth causing a recession isn’t an easy ask, and time will tell whether the Fed has managed to achieve this. Weighing up the historic accuracy of the Sahm rule, now triggered, with the mitigating factors as to why it may be different this time, is one for continued debate – until forthcoming labour market data further influence the discussion. Time will tell whether the Fed has kept policy too tight for too long, or whether they can still achieve a soft landing. Until then, please fasten your seatbelts, there may be a healthy amount of turbulence in the months to come.

Tyler Durden

Wed, 08/21/2024 – 14:45

via ZeroHedge News https://ift.tt/mnCeVE3 Tyler Durden