America’s Power Grid Adds Most Generating Capacity In 21 Years As AI Data Center Demand Surges

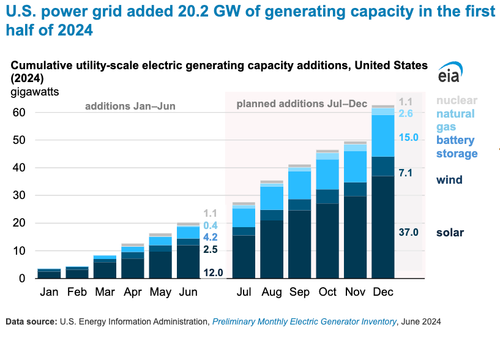

The Energy Information Administration’s Preliminary Monthly Electric Generator Inventory report released earlier this week revealed that developers and power plant owners added 20.2 gigawatts (GW) in new capacity in the first half of 2024, a 21% year-over-year rise amid increasing demand from AI data centers, reshoring trends, and other electrification trends.

Solar power led the way, contributing 12 GW, or 59% of all new additions, with Texas and Florida accounting for 38% of the growth in the first half. Battery storage capacity also saw significant growth, with around 21% of the capacity gains. Wind power added about 12% (2.5 GW).

However, rising energy demand on power grids, from AI data centers and other electrification trends, which we outlined in “The Next AI Trade,” have also slowed the retirement of coal and NatGas power generators.

On the atomic front, nuclear power increased during the first half, with Unit 4 (1,114 MW) at Georgia’s Vogtle nuclear power plant coming online in April. This makes Vogtle the largest nuclear facility in the US. Only one of the plant’s reactors is operational.

EIA forecasts that utility-scale electric generating capacity will more than double in the second half of 2024, reaching about 42.6 GW.

Here’s UBS’ take on the EIA report:

The era of flat electricity demand in developed markets has ended, with large-scale AI and cloud-computing capacity driving a resurgence in demand. With many AI mega-cap leaders committed to zero emission pledges, we expect a strong multi-year cycle of investment in utility-scale renewable power generation and storage capacity. Broadly, we think companies exposed to electrification, energy efficiency, and renewable energy would fare better under a potential Harris presidency, while a Trump administration would likely favor the traditional energy sector. Given the challenges listed renewable energy investments tend to face, we suggest investors look to private infrastructure investments in renewables, which can help diversify portfolios due to their low correlation to other asset classes while providing stable income streams that are often tied to inflation. However, investors should consider the risks inherent to private markets before investing, including illiquidity, long lockup periods, leverage, and over-concentration.

What’s overwhelmingly clear is that after electricity peak demand and energy growth rates fell flat for decades, that is all changing in the era of AI data centers. We have outlined the companies that will prosper in the powering up America theme.

Tyler Durden

Fri, 08/23/2024 – 14:30

via ZeroHedge News https://ift.tt/T0LMQJg Tyler Durden