Gold, Stocks, Bitcoin, & Bonds Surge As Fed Chair Powell Says “Time Has Come For Policy To Adjust”

Watch Live (due to start at 10amET):

Tl;dr: Powell confirmed what was in The FOMC Minutes

“The time has come for policy to adjust,” Powell said:

“The direction of travel is clear, and the timing and pace of rate cuts will depend on incoming data, the evolving outlook and the balance of risks.”

Labor market fears dominate…

“We do not seek or welcome further cooling in labor market conditions,” Powell said, adding that the slowdown in the labor market was “unmistakable.”

Whatever it takes?

“We will do everything we can to support a strong labor market as we make further progress toward price stability. With an appropriate dialing back of policy restraint, there is good reason to think that the economy will get back to 2 percent inflation while maintaining a strong labor market. The current level of our policy rate gives us ample room to respond to any risks we may face, including the risk of unwelcome further weakening in labor market conditions.“

The Fed chief also acknowledged recent progress on inflation, which has resumed moderating in recent months after stalling earlier in the year:

“My confidence has grown that inflation is on a sustainable path back to 2%,” he said

* * *

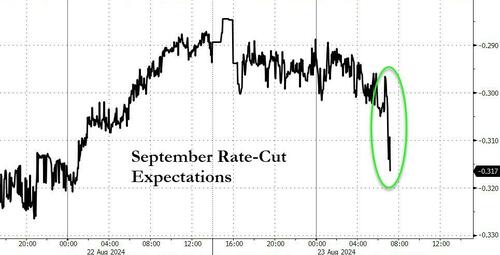

The market was pricing 30bps of cuts in for September ahead of Powell’s speech (and 97bps of cuts for 2024 in total… way more than the 25bps DOTS)…

… and was basically unchanged after his comments…

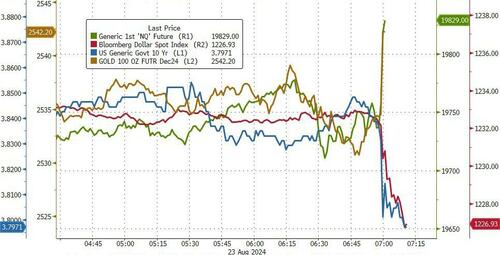

But, stocks, gold, and bonds are all bid on the headlines (and the dollar dumped)…

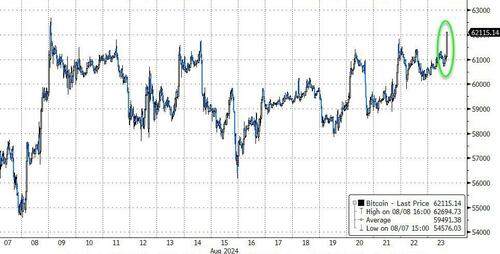

Bitcoin is also breaking out, back above $62 as the short squeeze looms…

* * *

Powell’s Full Remarks:

* * *

The Jackson Hole schedule was released last night, announcing Norges Bank Governor Ida Wolden Bache and Bank of Brazil Governor Roberto Campos Neto will join ECB Board Member Philip Lane on the Saturday overview panel. Both Wolden Bache and Campos Neto have recently had to put a heavy emphasis on exchange rate fluctuations when discussing policy transmission. Wolden Bache has pushed back on some efforts to encourage Norges Bank to control the exchange rate more tightly, and argued FX flexibility is essential for a small, open economy. Krone depreciation features prominently in the Bank’s NEMO model, and is a key reason why they have pledged to hold rates steady. Norges has also shown some concern over how differences in housing market structures can impact monetary policy transmission. And recently they revised their estimate of the neutral rate slightly higher, with an emphasis on global factors. Campos Neto also recently discussed structural factors contributing to a high neutral rate in Brazil in a panel discussion at Sintra, many of which have been exacerbated since Covid including subsidized credit, the debt trajectory, and changes in productivity. Panelists typically give brief speeches at the start of the panel before the broader discussion begins.

Chair Powell will deliver his speech on the economic outlook at 10:00am ET, available via webcast. BoE Governor Bailey will be giving the luncheon address at 3:00pm ET. Text of the papers and speeches will be posted to the website at the time each event is scheduled to begin.

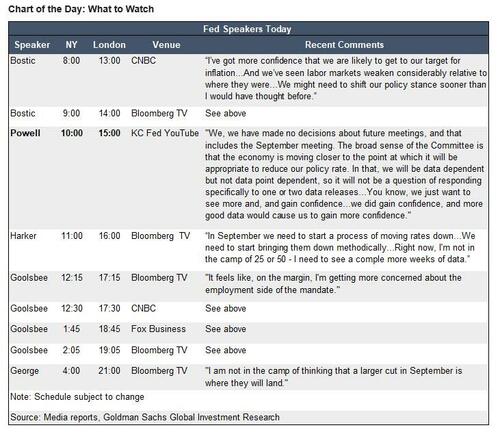

Various Fed speakers will also be giving interviews throughout the day—see the table below for a compilation of what has been announced so far, times may not be exact.

Here is the Fed speaker schedule currently set:

- 8am: Fed’s Bostic Speaks on CNBC

- 9am: Fed’s Bostic Speaks on Bloomberg Television

- 10am: Fed’s Powell Speaks on Economic Outlook

- 11am: Fed’s Harker Speaks on Bloomberg Television

- 12:30pm: Fed’s Goolsbee Speaks on CNBC

- 1:45pm: Fed’s Goolsbee Speaks on Fox Business

- 2:15pm: Fed’s Goolsbee on Bloomberg TV

Yesterday, Collins and Harker gave sideline interviews with Bloomberg, CNBC, MNI, and Fox Business. Harker noted that he thinks the Fed “needs to start a process of moving rates down” in September, but that he needs to see a few more weeks of data to determine whether 25bp or 50bp is appropriate. Collins also said she sees it “soon being appropriate to begin easing policy,” and reiterated that “data will tell us what kind of pace makes sense.” The ECB’s Martins Kazaks also gave an interview yesterday and expressed that he would be “very much open for a discussion of yet another rate cut in September” given recent data.

Goldman’s US economics team expects Chair Powell to express a bit more confidence in the inflation outlook and to put a bit more emphasis on downside risks in the labor market than in his press conference after the July FOMC meeting, in light of the data released since then. A speech along these lines would be consistent with our economists’ forecast of a string of three consecutive 25bp cuts in September, November, and December.

Taking a closer look at what Powell may say today, the focus will be on any hints about the coming Sept rate cut size, whether it is 25 or 50bps. Here are some thoughts on the matter from NewsSquawk:

The gathering of central bankers, academics and policymakers is often looked to for policy’ steer, with focus on any updated assessments on the state of the US economy, and the trajectory of monetary policy. Powell last month said that if inflation and the labor market continued to cool, a rate cut may be appropriate at the September 18th FOMC meeting. For that meeting, money markets are currently pricing around 34bps of rate cuts, which essentially says a 25bps rate reduction is fully expected, with some incremental probability the Fed could go for a larger 50bps cut. The dovish pricing has pared back in recent weeks as inflation continues to cool, and the labor market continues to look resilient amid its slowdown (at one point, markets were fully expecting a 50bps rate reduction a few weeks ago. when growth jitters stoked concerns the Fed may be behind the curve). Powell will also likely be asked about the size of the rate cut. and traders will be watching to see if he leans back on calls for the larger cut (when he was asked about this in July. Powell said it was not something the Fed was thinking about right now). WSJ Fed watcher Nick Timiraos said many officials are ready to start cutting rates by a traditional quarter-percentage-point next month, but are not sure how fast they should go thereafter, adding that labor market data for August could tip the scales in favour of a larger cut if it is as disappointing as July’s readings.

THEMES:

Bank of America says there is a chance Powell could opt for a straightforward update, taking a similar line to which he did in his post-meeting press conference in July: a shift in language from that July message could suggest the committee is nearing, or is dose to. considering easing measures. BofA said. A further signal could be if Powell is stronger in saying that the committee wants to avoid unexpected weakness’ in the labor market, rather than simply responding to it after it occurs.” it wrote. Powell might refer to the June Summary of Economic Projections, which indicated a gradual removal of policy accommodation due to economic uncertainty. “The Fed s definition of achieving a soft landing is bringing inflation back to target without requiring a deterioration in labor market conditions,’’ BofA says. “the battle on inflation isn’t entirely won, but the message could be that it’s been won enough where the emphasis now will be on preventing undesired weakness in the labor market.”

MARKET REACTION:

Meanwhile, analysts at Barclays note some investor concerns about the Fed being ‘behind the curve’, with the balance of risks now tilted towards the employment mandate. Barclays says investors look for more clarity around the new equilibrium policy rate and the path to that rate.

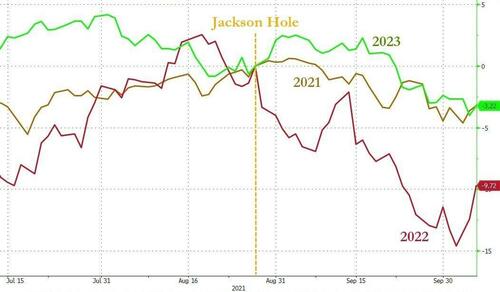

“Crucially, Jackson Hole has become more of a market moving event in recent history,” it writes, “for instance, across assets the average vol-adjustedmove in the 2017-2022 was 1.7x larger vs. the 2010-2016 period.” The bank notes that S&P options currently appear to be fair, as they are pricing a 75bps move, broadly in line with historical pricing (68bps) and average realized moves (72bps). “However, looking at a universe of 35 ETF with liquid options and spanning four asset classes, options on a number of International equity ETFs (EM & EU equity) currently price-in the cheapest moves vs history.

Looking at futures this morning, risk is sharply higher on expectations of a dovish Powell speech, but two years ago, the Fed chair surprised the market by delivering a hawkish speech that sent the S&P 500 tumbling 3.4%, while 10-year yields swung by 8bps intraday.

Finally, a word of caution from BofA’s Michael Hartnett (full note here for pro subs) who reminds us 5 of 6 Powell Jackson Hole speeches saw the S&P 500 drop 7.5% on average in the next 3 months…

…and he asks “Who’s left to buy?” with BofA private client allocation at 62% (Chart 15), and S&P 500 corp cash just 8.8% of assets (Chart 4), often a bearish tip-off

For those looking for more, here is another JHole preview from Rabobank, but here are the key points:

Rabobank’s Fed strategist recently revised his call from one rate cut per quarter to four consecutive cuts starting in September. He believes a (mild) recession is due to begin – if it hasn’t already. Fed Chair Powell could give the starting sign at the Jackson Hole conference today, but he may also give some hints that the market is pricing too aggressive an easing cycle. Of course, there are limitations to the forward guidance Powell can provide, as he does not want to overcommit to any particular outcome in September.

So what room does he have?

- Powell could indicate that he has gained greater confidence that inflation is moving sustainably toward 2%. The FOMC was not yet ready to alter its formal statement in July to include this message, but Powell certainly was willing to at the press conference. The inflation data since then have been encouraging, so Powell could confirm that his confidence in the disinflationary process is improving.

- Meanwhile, Powell could stress the weakness in labour market data as a second – and more urgent – argument for rate cuts. In the July statement, the FOMC already said that it is attentive to the risks to both sides of its dual mandate.

- Finally, the Fed Chair could indicate whether the baseline is a 25bp or 50bp cut. A full set of data will still be released between Powell’s speech and the September meeting, so it would be premature for him to signal the exact size of the forthcoming rate cut. However, he could signal that the Fed is still leaning towards a 25bp reduction, rather than the 50bp that some market participants are still expecting. For example, Powell could stress that he is confident in the stability of markets, and that he does not believe the Fed is behind the curve.

Tyler Durden

Fri, 08/23/2024 – 09:22

via ZeroHedge News https://ift.tt/sYGqf9O Tyler Durden