Argentinian Gold Reserves Arrive In London

By Jan Nieuwenhuijs of Gainesville Coins

In June the UK received a gold shipment worth $150 million dollars from Argentina. Most likely, the gold was sent by the central bank of Argentina (BCRA) to be used as collateral in the London Bullion Market.

Newspaper El País reported on July 28, 2024, that part of the official gold reserves of Argentina were transferred abroad. After rumors spread regarding the whereabouts of the Argentinian gold, Minister of Economy Luis Caputo acknowledged that gold was indeed shipped overseas. “If you have [the gold] outside the country, you can get returns,” he shared in an interview with an Argentine TV channel. According to El País President Milei hinted that the gold can be used as collateral to take out a bridge loan, which is essentially a swap.

Normally, “monetary gold” (gold owned by a central bank) is exempt from being disclosed in customs data. However, as I have pointed out in the case of the Chinese central bank buying gold in London, if bullion banks take care of shipping and insurance, the metal does show up in cross-border trade statistics.

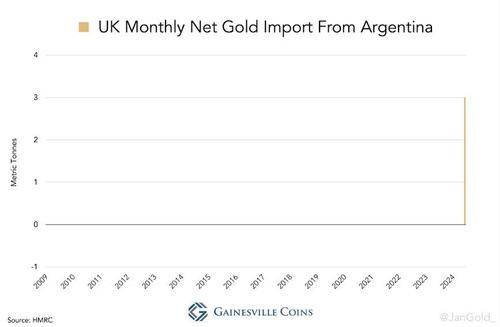

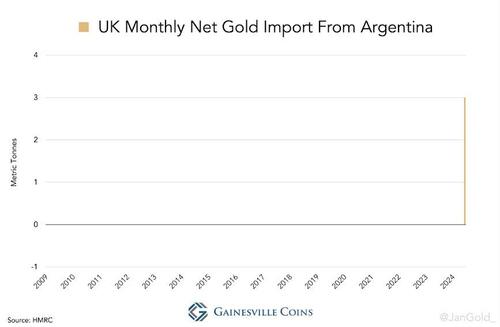

The UK most likely imported 3 tonnes (worth $150 million dollars) from BCRA’s stock, because as far back as data from Britain’s customs department is available, the country never traded an amount of gold of any substance with Argentina prior to June. As officials have confessed that part of the Argentinian monetary gold was sent abroad in June, and for the first time ever the UK—home of the largest gold market globally—imported 3 tonnes from Argentina that month, I am confident this batch can be assigned to BCRA. Which doesn’t exclude the possibility gold was shipped to Switzerland too.

At the end of June, the Argentinian central bank reported to the International Monetary Fund (IMF) to hold the same amount of gold as the previous month. Apparently, BCRA has kept the gold swapped out on their books, which is tolerated by the IMF. The weight of gold reserves of a central bank, according to the IMF, may include, “gold deposits, and if appropriate, gold swapped.”

The 3 tonnes collateral in London is 5% of BCRA’s total reserves of 62 tonnes. There is always a risk gold abroad can be frozen, as happened most recently with 30 tonnes of Venezuela at the Bank of England. Let’s assume BCRA’s lawyers have carefully weighed all pros and cons before approving the gold to be surrendered to a bullion bank in London.

Tyler Durden

Sat, 08/24/2024 – 08:10

via ZeroHedge News https://ift.tt/5g1DbI7 Tyler Durden