Big Lots Reportedly Mulls Bankruptcy Amid Consumer Downturn

The theme of a consumer downturn (mainly for low/mid-tier) remains strong.

On Thursday morning, Dollar General missed Wall Street’s profit and sales expectations and cut its full-year forecast, citing that core customers “feel financially constrained.” With this persisting trend, it’s unsurprising that home goods retailer Big Lots may be teetering on the brink of bankruptcy.

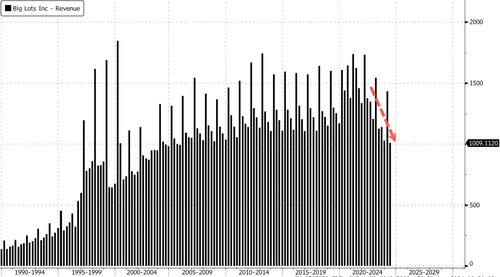

Bloomberg reports that Ohio-based Big Lots, with about 1,400 stores nationwide, has mulled over whether a potential bankruptcy filing is the right move in the near term given the slide in sales, which resulted in a multi-year crash of shares trading in New York.

The company is also seeking investors in a bid to avoid Chapter 11, according to one person familiar. The people asked not to be named sharing information about confidential matters. The plans aren’t final and Big Lots’ path may change. -BBG

***

Big Lots received a loan earlier this year to help it navigate its liquidity crunch. It has been seeking additional financing in recent weeks.

With liquidity drying up, Big Lots has experienced a sharp decline in sales over the last two years as elevated inflation and high interest rates depress demand for big-ticket discretionary purchases.

Bloomberg noted, “The chain on Aug. 12 approved one-time retention bonuses for its top executives totaling over $5 million. Such payments often precede corporate restructurings, especially in Chapter 11, and serve to keep key management from jumping ship during the effort.”

Shares have crashed nearly 99% since peaking above the $70 handle in mid-2021. Paging ‘Roar Kitty’ – it’s time for stock pump. Maybe he’s too busy Ryan Cohen’s lap dog.

Troubled retailers hurt by a consumer slowdown are yet more evidence that the economy is trending in the wrong direction. Hence, the Fed will likely initiate an interest rate-cutting cycle on Sept. 18.

Tyler Durden

Thu, 08/29/2024 – 22:40

via ZeroHedge News https://ift.tt/z3PGHY2 Tyler Durden