Consumer Sentiment Misses As Home-Buying Conditions Hit Record-Low

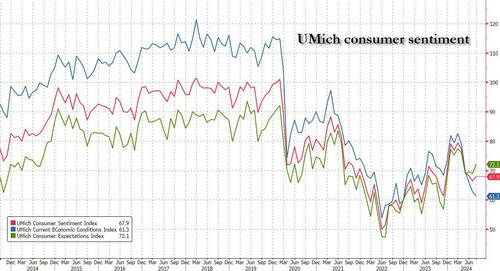

UMich consumer sentiment once again missed expectations slumped in the final August data, even as it staged the tiniest of rebound from the July print with Current Conditions at their lowest since Dec 2022, while homebuying conditions hit a new record low.

Here are the details: the final August Consumer Sentiment print was 67.9, missing estimates of 68.1, but still above the July print of 66.4. The modest rebound was entirely thanks to a bounce in expectations which rose to 72.1 from 68.8, while current conditions declined to the lowest since 2022, sliding to 61.3, from 62.7

While cooling price pressures are helping to stabilize expectations – if not current conditions – consumers remain hamstrung by still-elevated borrowing costs, less hiring and a higher cost of living. The university’s confidence measure is well short of pre-pandemic levels.

“The index of news heard about the economy deteriorated over 20% this month,’’ Joanne Hsu, director of the survey, said in a statement. “In particular, about 25% of consumers mentioned hearing negative news about unemployment, the highest reading since November 2023.”

At the same time, 48% of respondents said they expect interest rates to fall in the coming year, the largest share since 1982.

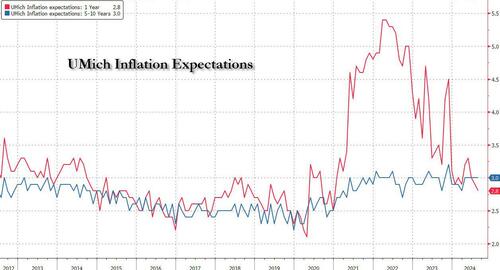

On the positive side, year-ahead inflation expectations fell for the third consecutive month, reaching 2.8%, the lowest since 2020, and down from 3.3% in May. In comparison, these expectations ranged between 2.3 to 3.0% in the two years prior to the pandemic. Long-run inflation expectations were unchanged at 3.0% (and in line with expectations), remaining remarkably stable over the last three years.

Still, these expectations remain elevated relative to the 2.2-2.6% range seen in the two years pre-pandemic.

And while the Kamala admin will try to spin the inflation expectations as favorable, they will have a more difficult time trying to spin the ongoing collapse in Buying Conditions which plunged across the board – for both vehicles and durable goods which tumbled to the lowest level since the end of 2022 – but the focus will be on home-buying attitudes, which once again crashed to new record lows!

While a separate report earlier Friday showed solid consumer spending at the start of the third quarter, discretionary income barely rose and the saving rate dropped to just shy of record lows.

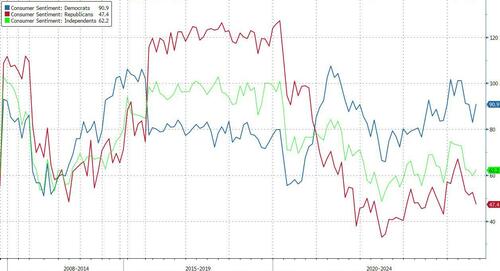

Naturally, like everything else, the August index was mostly influenced by politics. The survey showed more optimism among Democrats after Joe Biden was replaced on the party’s ticket by Kamala Harris. Confidence among Republicans sank to the lowest since November.

At the same time, consumers’ outlook for their personal finances rose to a three-month high: we hope Democrats can pay their bills with their cheerful outlooks.

Tyler Durden

Fri, 08/30/2024 – 10:26

via ZeroHedge News https://ift.tt/Cih8cHn Tyler Durden