Futures Rise Ahead Of Fed’s Favorite Inflation Print

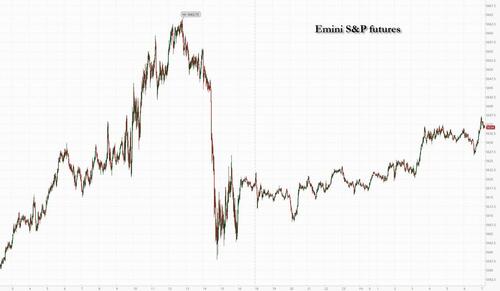

US equity futures were set for a stronger open to close the week after two days of wobbles, with tech stocks outperforming, paring back some of the NVIDIA-induced losses as confidence mounted that the Fed and ECB will cut interest rates in the coming months, after inflation in Europe continued to sink and with today’s core PCE expect to confirm a taming of US inflation. As of 730am, S&P futures rose 0.5% while Nasdaq 100 Index added 0.7% as traders waited to see if the Fed’s favorite inflation indicator, core PCE, confirms the picture of moderating prices. Europe’s main stock index rallied to a record high as euro-area inflation eased to a three-year low, cementing the case for the ECB to cut rates in September. The dollar was flat and 10Y yields were unchanged around 3.86% as treasuries were poised for their longest monthly winning streak in three years. Gold traded near record highs, oil was flat and bitcoin was also unchanged. Today’s macro calendar has Personal Income, Spending and core PCE as well as the UMich consumer sentiment on deck.

In premarket trading, Nvidia edged higher after tumbling 6% the previous day, while other tech names, including Marvell Technology and Dell were boosted by forecast-beating results. Here are some of the other notable premarket movers:

- Abercrombie & Fitch shares rise 2.3% after the apparel retailer was upgraded to buy from neutral at Citi, which sees several reasons as to why the investment story for the stock remains attractive.

- Autodesk shares are up 3.7% after the maker of engineering software reported second-quarter results that beat expectations. The firm raised its full-year forecast for both revenue and adjusted EPS, impressing analysts after coming under pressure from an activist investor.

- Dell Technologies shares rose 5.9% after the computer hardware company reported second-quarter results that beat expectations, with particular strength in orders for AI servers.

- Elastic shares are down 27% after the application-software company cut its full-year revenue forecast. Analysts say execution problems around sales changes made at the start of the quarter had a negative impact on the software company’s results.

- Intel shares rise 2.6% after Bloomberg News reported that the company is discussing various scenarios, including a split of its product-design and manufacturing businesses, as well as which factory projects might potentially be scrapped.

- Intuitive Machines shares soar 19% after the company said it received a $116.9 million contract from NASA to deliver six science and technology payloads, including one European Space Agency-led drill suite to the Moon’s South Pole.

- Lululemon shares rise 4.2% after the the activewear company reported second-quarter earnings. While the firm reported a top-line miss in the second quarter and reduced its full-year guidance, Morgan Stanley sees the revised guidance as achievable, noting that investors might have assigned a floor to its valuation.

- MongoDB shares rise 15.14% after the database software company reported second-quarter results that beat expectations and raised its full-year forecast. Analysts say the results suggest that growth could accelerate with an improving underlying picture.

- Ulta Beauty shares drop 8.5% after the cosmetics retailer trimmed its sales forecast following weaker-than-expected second-quarter results. Analysts flagged the impact of competition as well as the softer macroeconomic environment.

Global stocks are on track for a fourth month of gains, with most data indicating the Fed has achieved a soft-landing, by taming inflation without tipping the economy into recession. While economists expect a slight pick-up in the year-on-year PCE reading later on Friday, that’s not expected to derail prospects for a September rate cut. Bloomberg Economics sees the inflation report reviving talk of a “Goldilocks” economy that allows the Federal Reserve to start cutting rates next month.

“When rates ease, it lifts all boats,” said Florian Ielpo, head of macro research at Lombard Odier Asset Management in Geneva. “Inflation is looking better and economic growth remains decent and that’s the environment we are in.”

No matter today’s PCE print, markets expect the Fed to cut rates next month by as much as 50 basis points (but more likely 25bps after yesterday’s hot GDP and initial claims reports), and by another half-point by year-end. Ielpo said that for traders watching for monetary-policy clues, the US monthly payrolls report due next week would be even more significant than today’s PCE reading. “Inflation is a done deal so markets are more likely to pay attention to what’s happening to employment and growth,” he added, just don’t forget to keep an eye on geopolitics and the price of oil which has resumed its latest ascent and may yet throw a wrench in the Fed’s easing plans.

Expectations for central bank easing saw investors pump $20.7 billion into global bond funds this past week, with Treasuries recording the largest inflow since last October, Bank of America said, citing EPFR Global data. Treasuries were on course for their longest monthly winning streak in three years. But the wagers have weighed on the dollar, which edged lower against a basket of currencies and was set for its worst monthly performance this year.

European stocks rise for a fourth session, taking the Stoxx 600 to another record intraday high as euro-area headline and core inflation slowed as expected in August. Real estate and consumer product shares are leading gains while technology is a drag. Here are some of the biggest movers on Friday:

- Chipmaker-machinery stocks decline in Europe after a Bloomberg report saying Intel is considering splitting the design and manufacturing businesses. BE Semi falls 2.5%, ASML -2.1%, ASMI -1.3%

- Ambu shares fall as much as 14%, the most since November 2022, after the Danish health-care equipment maker reported 3Q numbers that disappointed in its key endoscopy division. Analysts also said a correction was due after the shares gained 14% in July and August.

- BlueNord falls as much 6.1%, the most since July 8, after the Norwegian fossil-fuel exploration firm said operator TotalEnergies intends to implement measures that are expected to not allow maximum technical capacity at the Tyra II field to be reached until 4Q.

Earlier in the session, Asian equities cruised to a six-week high. Hang Seng Tech Index jumps more than 3% and CSI 300 climbs almost 2%. Japanese, South Korean and Australian indexes all firmly in the green.

In FX, the Bloomberg Dollar Spot Index falls 0.1% but is poised to snap its four-week declining streak ahead of US core PCE data, with it up 0.7% on week. Tthe euro is little changed around $1.1080. USD/JPY rose above 145 after dipping back under following a post-GDP spike on Thursday. GBP/USD hovers above mid 1.31-1.32. AUD/USD consolidates around 0.68. NZD/USD grinds higher but remains below Thursday’s peak of 0.6299.

In rates, treasuries are mixed with the yield curve flatter as US trading gets under way, led by similar price action in UK and German bonds after August euro-area headline and core inflation slowed as expected. Long-end Treasury yields are richer by ~1bp curve with front-end and belly little changed, flattening 5s30s spread; the 10Y TSY yield traded 1bp lower to 3.85%. Long-end German yields richer by more than 2bps on the CPI data and held higher on the day with German 10-year yields down 2bps at 2.26%. UK’s by nearly 5bp, narrowing their curve spreads. Curve-flattening has support from anticipation of buying tied to month-end index rebalancing, which will extend the duration of the Bloomberg Treasury Index by an estimated 0.10 year as securities auctioned during the month are added to it. Also, traders anticipate flows tied to corporate bond offerings next week, a historically heavy issuance period

As noted earlier, treasuries are poised for their longest monthly winning streak in three years as traders look past US data on personal income and expenditure due Friday and prepare for the Federal Reserve to start cutting interest rates. US government bonds returned 1.5% in August through Thursday, set for a fourth month of gains that would be the longest run since July 2021, according to the Bloomberg US Treasury Total Return Index. The gauge has been rallying since the end of April, extending this year’s gain to almost 3%, as investors have grown more confident in the case for lower US borrowing costs.

In commodity markets, oil was steady with WTI trading near $76 a barrel, though the main crude benchmark is set for its first back-to-back monthly loss this year on fears that slowing economic growth, especially in China, will impact demand. Iron ore futures pulled back slightly after jumping by about 10% in 10 days to breach $100 a ton. Spot gold climbs $4 to around $2,525/oz.

Bitcoin is holding steady just above USD 59.5k, whilst Ethereum slips slightly. Elon Musk and Tesla win dismissal of lawsuit claiming they rigged Dogecoin.

The US economic data calendar includes July personal income and spending with PCE price indexes (8:30am), August MNI Chicago PMI (9:45am, several minutes earlier to subscribers) and August final University of Michigan sentiment (10am). Fed speaker slate empty for the session. Meanwhile in the Euro Area, there’s the flash CPI release for August and the unemployment rate from July. We’ll also get German unemployment for August, UK mortgage approvals for July, and Canada’s GDP for Q2. From central banks, we’ll hear from the ECB’s Schnabel, Rehn, Kazaks, Simkus and Muller.

Market Snapshot

- S&P 500 futures up 0.4% to 5,633.25

- STOXX Europe 600 up 0.3% to 526.32

- MXAP up 0.8% to 186.82

- MXAPJ up 0.6% to 577.85

- Nikkei up 0.7% to 38,647.75

- Topix up 0.7% to 2,712.63

- Hang Seng Index up 1.1% to 17,989.07

- Shanghai Composite up 0.7% to 2,842.21

- Sensex up 0.4% to 82,426.55

- Australia S&P/ASX 200 up 0.6% to 8,091.85

- Kospi up 0.5% to 2,674.31

- German 10Y yield down 1.6 bps at 2.26%

- Euro up 0.2% to $1.1094

- Brent Futures up 0.6% to $80.42/bbl

- Gold spot up 0.2% to $2,526.17

- US Dollar Index little changed at 101.26

Top Overnight News

- China could allow homeowners to refinance as much as $5.4T worth of mortgages months before the process typically occurs in January, and potentially with different banks. BBG

- Offices in China’s biggest cities are emptier than they were during stringent Covid-19 lockdowns in what analysts say is a sign of how the country’s economic slowdown has hurt business confidence. FT

- Russian companies are having an increasingly difficult time transacting w/partners in China as Chinese banks become worried about running afoul of int’l restrictions and being subject to sanctions. RTRS

- Eurozone CPI is inline w/the Street for Aug, including +2.2% for headline (down from +2.6% in Jul) and +2.8% core (down from +2.9% in Aug). BBG

- Israel’s defense minister said the country should expand its war goals to ensure that the ~60K people displaced from the north by Hezbollah rocket attacks can return home. FT

- Harris is up 1 point in a head-to-head contest vs. Trump and up 2 points if all candidates are included. WSJ

- Intel is working with advisors to explore options, including potentially splitting off its manufacturing operations. BBG

- Apple and Nvidia are in talks to invest in OpenAI, a move that would strengthen their ties to a partner integral to their efforts in the artificial-intelligence race. WSJ

- Recent US inflation readings are “still far” from the Fed’s 2% goal, Raphael Bostic said. He may take some confidence from July’s core PCE deflator, due later. Bloomberg Economics said it probably increased at an annualized pace consistent with target, while the savings rate may have slid further. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded higher across the board despite a lack of fresh catalysts following a mixed lead from Wall Street, and ahead of US PCE and the US long weekend. ASX 200 remained in a narrow range (8,045.10-8,085.00) but was propped up by its Industrials, Energy, and Gold names. Nikkei 225 traded firmer following a choppy start after August Tokyo core CPI surprisingly ticked higher, whilst the Japanese unemployment rate surprisingly rose. Hang Seng and Shanghai Comp opened with modest gains and eventually soared despite a lack of newsflow, whilst Bloomberg suggested the CSI 300 rallied amid heavy volume. Sentiment in China could’ve also seen tailwinds from the PBoC yesterday suggesting it will step up counter-cyclical adjustments and will strengthen financial support to the real economy, whilst the mood was further lifted amid Bloomberg reports China reportedly mulls allowing refinancing on USD 5.4tln in mortgages.

Top Asian News

- China reportedly mulls allowing refinancing on USD 5.4tln in mortgages, according to Bloomberg.

- Japanese government official on industrial output, said if output falls short of plans, August production could fall M/M. September is expected to fall M/M on lower production of semiconductor production equipment and electronic component devices, although the assessment is revised upward, need to be vigilant about the outlook. The official added that the impact of Typhoon Shanshan was not taken into account in August data.

- PBoC injected CNY 30.1bln via 7-day Reverse Repo at a maintained rate of 1.70%.

- China’s major state-owned banks seen buying USD in onshore foreign exchange market to prevent CNH from appreciating too fast, via Reuters citing sources.

- China’s FX Regulator to launch foreign currency non-deliverable forwards (NDFs) on 2nd September within the interbank market.

- PBoC purchased net CNY 100bln of gov’t bonds from dealers during August, via Bloomberg.

European bourses, Stoxx 600 (+0.3%) began the session with a mixed picture, and traded tentatively on either side of the unchanged mark. As the morning progressed, indices gradually picked up and edged towards session highs. European sectors hold a strong positive bias; Real Estate is found at the top of the pile, alongside Basic Resources. Tech is found at the foot of the pile, paring back the prior day’s advances and accounting for the post-earning losses in NVIDIA. US Equity Futures (ES +0.4%, NQ +0.6%, RTY +0.5%) are entirely in the green, with the NQ outperforming, paring back some of the NVIDIA-induced losses. The docket ahead includes the Fed’s preferred measure of inflation, PCE (July).

Top European News

- ECB’s Schnabel: “while risks to growth have increased, a soft landing still looks more likely than a recession”; “Incoming data broadly confirm the baseline scenario”. “In particular, the closer policy rates get to the upper band of estimates of the neutral rate of interest – that is, the less certain we are how restrictive our policy is –, the more cautious we should be to avoid that policy itself becomes a factor slowing down disinflation.”; “In other words, the pace of policy easing cannot be mechanical. It needs to rest on data and analysis.”; “Wage pass-through may be stronger.”. In short, remarks from Schnabel are in-fitting with the data-dependent approach the ECB has been taking but with a slight hawkish skew from the ECB official, in-fitting with her general bias.

- ECB’s Kazaks says services inflation remains sticky. Open to a September discussion on policy easing.

FX

- The Dollar is broadly softer vs. peers in the run-up to US PCE metrics. DXY is currently contained within yesterday’s 100.88-101.57 range.

- EUR is steady post-EZ inflation data which was broadly in-line. However, greater concern could come via the services metric which rose to 4.2% from 4.0%. EUR/USD is contained just below the 1.11 mark and within yesterday’s 1.1055-1.1139 range.

- GBP is firmer vs. the USD but Cable is unable to reclaim the 1.32 handle with the current session high at 1.3198 and south of yesteday’s 1.3227 peak.

- JPY was a touch firmer vs. the USD following firm Tokyo inflation data overnight. In terms of price action for USD/JPY, the pair is back on a 144 handle but still some way north of yesterday’s 144.22 trough.

- AUD/USD is mildly extending on its recent uptrend which has seen the pair breach 0.68 to the upside with newsflow out of China providing support.

- USD/CNH has continued its recent move to the downside with the latest leg lower prompted by reporting from Bloomberg that China is mulling allowing refinancing on USD 5.4tln in mortgages.

- PBoC set USD/CNY mid-point at 7.1124 vs exp. 7.1116 (prev. 7.1299)

Fixed Income

- USTs are flat ahead of monthly US PCE, afterwhich conditions will likely become thinner than normal on account of Monday’s US market holiday. A few fleeting ticks higher on EGB-drivers, but not sufficient to merit a range of more than a couple of ticks; additionally, yields are pivoting the unchanged mark but with an incremental flattening bias.

- Bunds were slightly firmer after French inflation metrics and climbed above 134.00 into the EZ-wide figures. Headline cooled to 2.2% Y/Y as expected, whilst Services rose to 4.2% (prev. 4%); no real reaction was seen in Bunds.

- Gilts are firmer and specifics quite light, though the UK Nationwide House Price index saw an unexpected drop for the month. Gilts at the top-end of the session’s range but shy of the 99.00 handle.

- China’s major state-owned banks seen buying USD in onshore foreign exchange market to prevent CNH from appreciating too fast, via Reuters citing sources.

Commodities

- Crude benchmarks began with a modest upward bias and have continued to inch higher throughout the European morning despite a lack of fresh drivers.

- Thus far, WTI & Brent have been as high as USD 76.53/bbl and USD 80.60/bbl respectively, just shy of Thursday’s USD 76.87bbl and USD 80.78/bbl best.

- Spot gold is essentially unchanged, in-fitting with the tentative performance of FX into monthly US PCE; in a relatively thin USD 2512-2523/oz band, which is towards the upper-end of yesterday’s parameters.

- LME Copper is firmer but around familar levels after a choppy and shortened week; upside being driven by the modestly constructive risk tone and USD pressure.

- Liberian Environmental Protection Agency said China Union’s iron ore Bong Mines is shut down for several environmental violations, according to Reuters.

Geopolitics

- “Lebanese sources: Israeli raids on different areas in southern Lebanon”, according to Sky News Arabiya.

- Missile attack launched on US military base in eastern Syria, according to IRNA.

- There is now a planned call at the theatre commander level between the US and China, according to Fox’s Heinrich. “It comes after China bristled at US Indo-Pacific Command’s Adm. Paparo suggesting this week US forces could escort Philippine ships through the South China Sea, following a months-long series of violent confrontations between Chinese and Philippine ships”.

- Israeli military says local Hamas commander in West Bank City of Jenin killed by Israeli police.

US Event Calendar

- 08:30: July Personal Income, est. 0.2%, prior 0.2%

- July Personal Spending, est. 0.5%, prior 0.3%

- July Real Personal Spending, est. 0.3%, prior 0.2%

- 08:30: July Core PCE Price Index MoM, est. 0.2%, prior 0.2%

- July PCE Price Index YoY, est. 2.5%, prior 2.5%

- July PCE Price Index MoM, est. 0.2%, prior 0.1%

- July Core PCE Price Index YoY, est. 2.7%, prior 2.6%

- 09:45: Aug. MNI Chicago PMI, est. 44.8, prior 45.3

- 10:00: Aug. U. of Mich. Sentiment, est. 68.1, prior 67.8

- U. of Mich. Current Conditions, est. 61.2, prior 60.9

- U. of Mich. Expectations, est. 72.4, prior 72.1

- U. of Mich. 1 Yr Inflation, est. 2.9%, prior 2.9%

- U. of Mich. 5-10 Yr Inflation, est. 3.0%, prior 3.0%

DB’s Jim Reid concludes the overnight wrap

Risk assets put in a decent performance over the last 24 hours, as solid US data outweighed investors’ disappointment about Nvidia’s latest results. It’s true that the S&P 500 was unchanged on the day, but the index was weighed down by the Magnificent 7 (-0.72%) and the equal-weighted S&P 500 (+0.37%) moved up to a new record, as did the Dow Jones (+0.59%) and Germany’s DAX (+0.69%). So in most places it was a pretty decent performance, and overnight the Hang Seng (+1.76%) is also on track to close at a 7-week high. Other risk assets were on the stronger side, with EUR HY spreads at their tightest level in over a month, whilst oil prices moved higher as well. The main exception were sovereign bonds however, which mostly lost ground as investors dialled back the chance of a 50bp rate cut from the Fed next month.

This positivity was driven by several US data releases that collectively pointed away from a recession, leading to a fresh bout of optimism about the outlook. The key headline came from the Q2 GDP numbers. They were actually the second estimates rather than the original release, but they painted an even more positive story than the first estimate released in late July. For instance, headline GDP was revised up to show an annualised growth rate of +3.0% (vs. +2.8% previous estimate). On a year-on-year basis, that leaves real GDP up +3.1%, so these are very good numbers that really don’t look like a recession. On top of that, the GDP release included downward revisions to PCE inflation in Q2, which is the measure the Fed officially targets. Headline PCE was revised down a tenth to an annualised +2.5% rate, whilst core PCE was also revised down a tenth to +2.8%. So a bit closer to the Fed’s 2% target than we previously thought. Today we’ll get the first look at PCE inflation for the month of July, so one to keep an eye on.

On top of the GDP release, yesterday also brought the weekly initial jobless claims, which were basically in line with expectations at 231k over the week ending August 24 (vs. 232k expected). That wasn’t a shock, but it helped to bring down the 4-week moving average as well, which now stands at a two-month low of 231.5k. So again, that’s another release pointing away from a recession, with the weekly claims looking in better shape than they did at the end of July.

With all that data in hand, the general perception was that the economy was doing better than thought, and that a larger 50bp cut from the Fed was now less likely. Indeed, futures lowered the chance of a 50bp move in September from 36% to 32%. And the number of cuts priced in by December also came down from 103bps to 100bps. In turn, that led to a selloff across US Treasuries, with the 2yr yield up +2.9bps to 3.90%, whilst the 10yr yield was up +2.6bps to 3.86%.

For equities, the stronger data initially pushed the S&P 500 nearly 1% higher intra-day, but those gains were pared back and the index ended the day unchanged. Even so, the overall performance still leaned on the positive side, with more than two thirds of the S&P 500 higher on the day, and the equal-weighted version of the index (+0.37%) actually hitting a new record. That came amid gains for more cyclical sectors including financials (+0.85%) and industrials (+0.70%), while energy stocks (+1.26%) led the way as oil prices rallied, with Brent crude up +1.64% to $79.94/bbl. The small cap Russell 2000 (+0.66%) also posted a solid gain. On the downside, the NASDAQ (-0.23%) and the Magnificent 7 (-0.72%) retreated, mostly due to a -6.38% loss for Nvidia after its results the previous evening. To be fair, 5 of the Magnificent 7 were higher on the day, but it is notable how the weakness among the Mag-7 group (which is now -11.7% beneath its peak) has been holding back the overall S&P 500 (-1.3% beneath its peak) from new all-time highs.

In Europe, the main story came on the inflation side, as the initial flash CPI releases came in softer than expected. In particular, Germany’s CPI fell to +2.0% on the EU-harmonised measure, which was the lowest since March 2021, and also beneath the +2.2% reading expected. Similarly in Spain, harmonised CPI was down to a one-year low of +2.4% (vs. +2.5% expected). So that added to investors’ confidence that the ECB were set to keep cutting rates over the coming months, with rising expectations that they might move to a more regular pace of cuts where they happen at every meeting, rather than every other meeting. In light of those releases, European sovereign bonds outperformed US Treasuries. Front-end yields declined, with those on 2yr German yields down -2.9bps, while 10yr yields saw only modest increases for bunds (+1.3bps), OATs (+0.5bps) and BTPs (+0.8bps).

It was a very strong day for European equities as well, with the STOXX 600 (+0.76%) closing just -0.03% beneath its all-time high from May. Tech stocks led the gains, and the advance was seen across the continent, with the DAX (+0.69%) closing at an all-time high, and other indices including the FTSE 100 (+0.43%) and the CAC 40 (+0.84%) posting gains.

Overnight in Asia, the positive sentiment among investors has continued, with gains across all the major indices. In Japan, both the Nikkei (+0.48%) and the TOPIX (+0.45%) are on track for their highest closing levels so far in August, moving past the turmoil from earlier in the month. Elsewhere, the Hang Seng (+1.76%), the CSI 300 (+1.72%) and the Shanghai Comp (+1.34%) have posted very strong gains, and the KOSPI is also up +0.59%. In the meantime, US equity futures are also pointing higher, with those on the S&P 500 up +0.16% this morning.

On the data side, we’ve had several releases from Japan overnight, including the Tokyo CPI reading for August. That showed CPI was stronger than expected at +2.6% year-on-year (vs. +2.3% expected), whilst the core measures were also above consensus. That said, the activity data in Japan was a bit weaker than expected, with retail sales only up +0.2% on the month in July (vs. +0.4% expected), whilst industrial production was only up +2.8% (vs. +3.5% expected). Moreover, the jobless rate ticked up to 2.7% in July (vs. 2.5% expected), which is the highest since March 2023.

To the day ahead now, and data releases from the US include the PCE inflation data for July, along with the University of Michigan’s final consumer sentiment index for August. Meanwhile in the Euro Area, there’s the flash CPI release for August and the unemployment rate from July. We’ll also get German unemployment for August, UK mortgage approvals for July, and Canada’s GDP for Q2. From central banks, we’ll hear from the ECB’s Schnabel, Rehn, Kazaks, Simkus and Muller.

Tyler Durden

Fri, 08/30/2024 – 07:40

via ZeroHedge News https://ift.tt/BxO8pgY Tyler Durden