Authored by Gail Tverberg via Our Finite World,

Today’s economy is like that of the late 1920s…

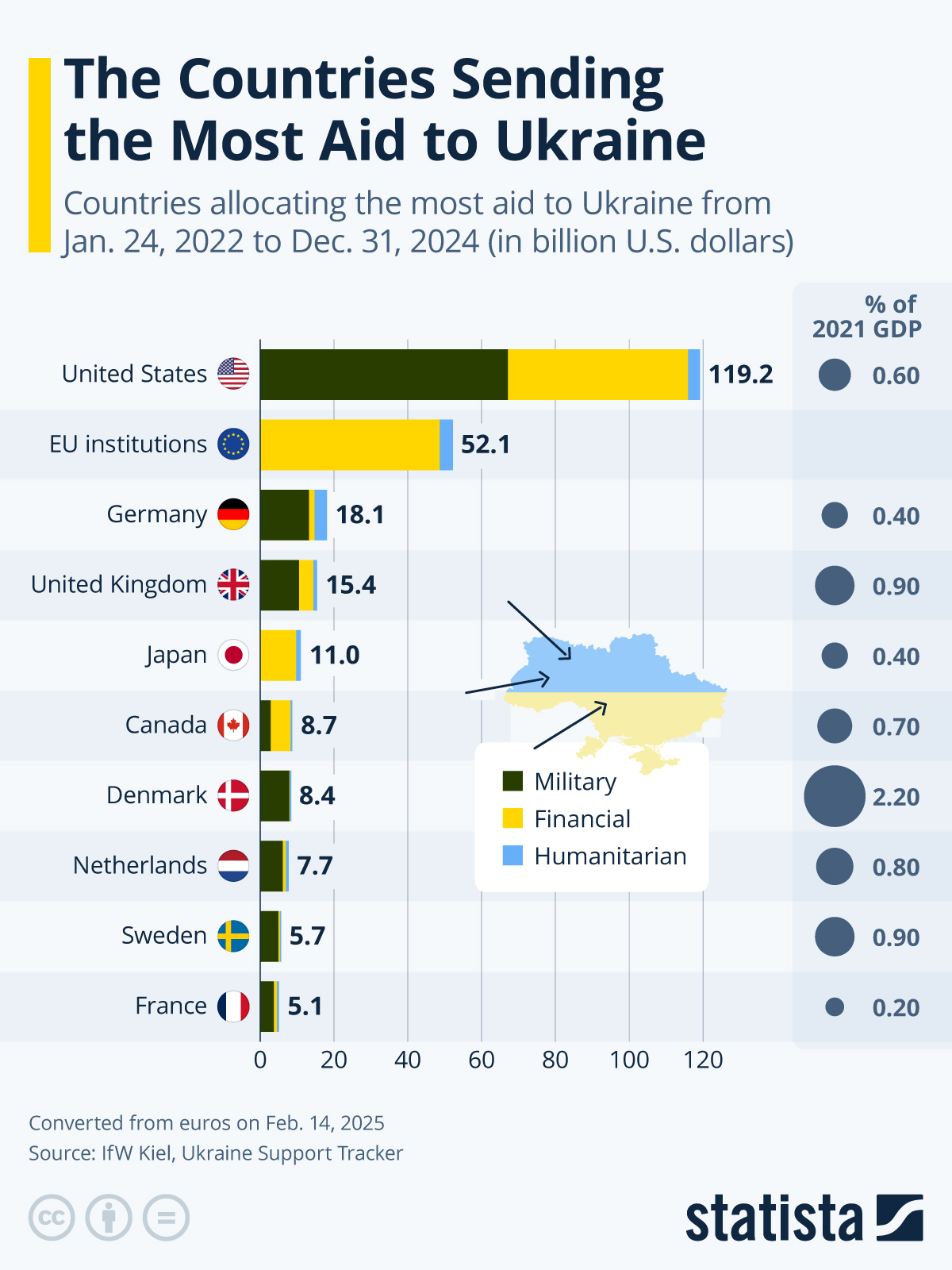

Today, there is great wage and wealth disparity, just as there was in the late 1920s. Recent energy consumption growth has been low, just as it was in the 1920s. A significant difference today is that the debt level of the US government is already at an extraordinarily high level. Adding more debt now is fraught with peril.

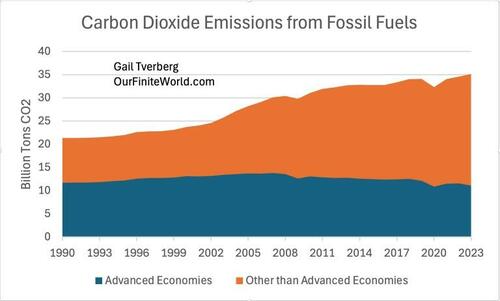

Figure 1. US Gross Federal Debt as a percentage of GDP, based on data of the Federal Reserve of St. Louis. Unsafe level above 90% of GDP is based on an analysis by Reinhart and Rogoff.

Where could the economy go from here? In this post, I look at some historical relationships to understand better where the economy has been and where it could be headed. While debt levels and interest rates are important to the economy, a growing supply of suitable inexpensive energy products is just as important.

At the end, I speculate a little regarding where the US, Canada, and Europe could be headed. Division of current economies into parts could be ahead. While the problems of the late 1920s eventually led to World War II, it may be possible for the parts that are better supplied with energy resources to avoid getting into another major war, at least for a while.

[1] Government regulators have been using interest rates and debt availability for a very long time to try to regulate how the economy operates.

I have chosen to analyze US data because the US is the world’s largest economy. The US is also the holder of the world’s “reserve currency,” allowing demand for the US dollar (really US debt) to stay high because of its demand for use in international trade.

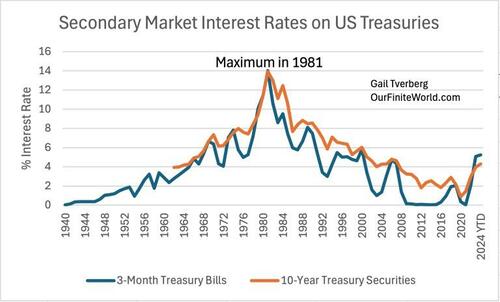

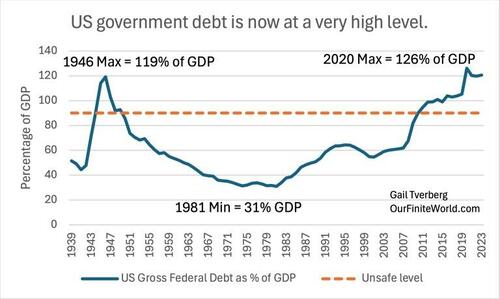

Figure 2. Secondary market interest rates on 3-month US Treasury Bills and 10-year US Treasury Securities, based on data accessed through the Federal Reserve of St. Louis. Amounts for 1940 through 2023 are annual averages. Amount for 2024 YTD is average of January to July 2024 amounts.

Comparing Figure 1 and Figure 2, it is clear that there is a close relationship between the charts. In particular, the highest interest rate in 1981 on Figure 2 corresponds to the lowest ratio of US government debt to GDP on Figure 1.

Up until 1981, the changes in interest rates were either imposed by market forces (“You can’t borrow that much without paying a higher rate”) or else as part of an attempt by the US Federal Reserve to slow an economy that was growing too fast for the available labor supply. After 1981, the same market dynamics no doubt took place, but the overall attempt at intervention by the US Federal Reserve seems to have been in the direction of speeding up an economy that wasn’t growing as fast as desired.

In Figure 2, the 3-month interest rates correspond fairly closely to government target interest rates. The 10-year interest rates tend to move on their own, perhaps somewhat influenced by Quantitative Easing (QE), in which the US government buys back some of its own debt to try to hold down longer-term interest rates. These longer-term interest rates influence US long-term mortgage interest rates.

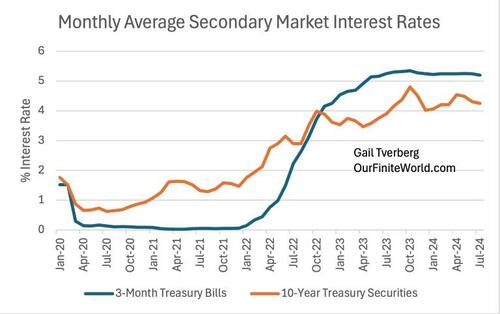

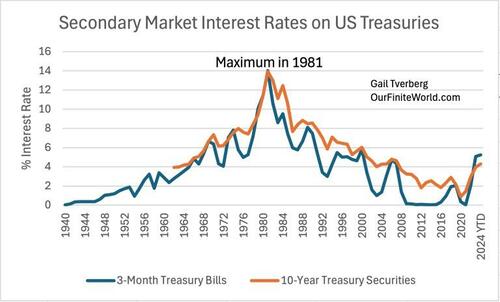

Recent monthly data show that 10-year interest rates started rising very quickly after reaching a minimum following the Covid response in early 2020. The lowest 10-year average rates took place in July 2020, and rates started moving up in August 2020.

Figure 3. Monthly average secondary market interest rates on 3-month US Treasury Bills and 10-year US Treasury Securities, based on data accessed through the Federal Reserve of St. Louis.

This suggests to me that market forces play a significant role in 10-year interest rates. As soon as people started borrowing money to remodel or to move to a new suburban location, 10-year interest rates, and likely the related mortgage rates, started to drift upward again. If this observation is correct, the Federal Reserve has some control over interest rates, but it cannot adjust the 10-year interest rates underlying mortgages and other long-term debt by as much as it might like.

The apparent inability of the Federal Reserve to adjust longer-term interest rates to as low a level as it would like is concerning because the US government debt level is very high now (Figure 1). Being forced to pay 4% (or more) on long-term debt that rolls over could create a huge cash flow issue for the US government. More debt could be required simply to pay interest on existing debt!

[2] An analysis of actual growth in US GDP over time shows how successful the changing strategies in Figures 1 and 2 have been.

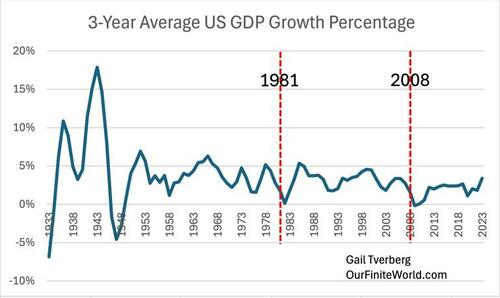

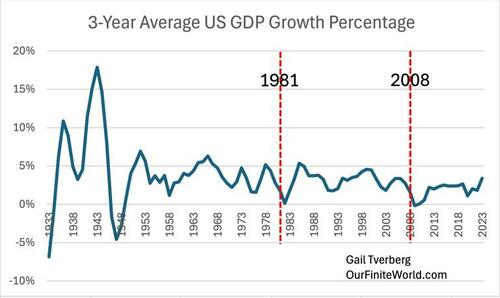

Figure 4. Three-year average US inflation-adjusted GDP growth rates based on data of the US Bureau of Economic Analysis.

In the 1930s, the US and much of the rest of the world were in the Great Depression. Interest rates were close to 0% (not shown on Figure 2, but available from the same data). Various versions of the New Deal under President Roosevelt were started in 1933 to 1945. Social Security was added in 1935. Figure 4 shows that these programs temporarily increased GDP, but they did not entirely solve the problem that had been caused by defaulting debt and failing banks.

Entering World War II was a huge success for increasing US GDP (Figure 4). Many more women were added to the workforce, making munitions and taking over jobs that men had held before they were drafted into the army.

After the war was over, the total number of jobs available dropped greatly. Somehow, private sector growth needed to be ramped, using debt of some kind, to provide jobs for the returning soldiers and others left without work. An abundant supply of fossil fuels was available, if debt-based demand could be put into place to pull the economy along. Programs were put into place to get factories running again making goods for the civilian economy. Additional jobs and energy demand were created by upgrading the electrical grid, increasing pipeline infrastructure, and (in 1956) starting work on an interstate highway system.

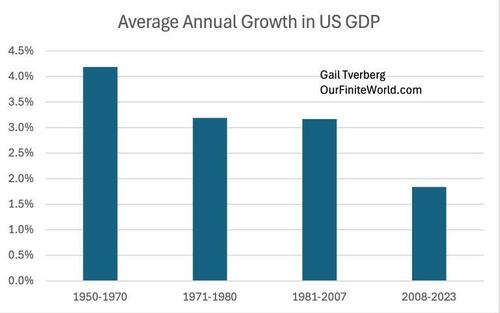

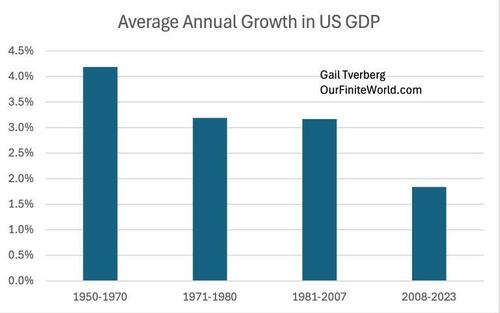

During the period between 1950 to 2023, the average growth rate of the US economy gradually stepped downward, despite all of the debt-based stimulus that was being added after 1981, as shown in Figure 5.

Figure 5. Average annual US GDP growth rates based on data of the US Bureau of Economic Activity.

[3] While growing debt is important for pulling an economy forward, a growing supply of energy is essential to actually produce physical goods and services.

Economic growth involves producing physical goods and services. The laws of physics tell us that energy supplies of the right types, in the right quantities, are necessary to make the goods and services that the physical economy depends upon.

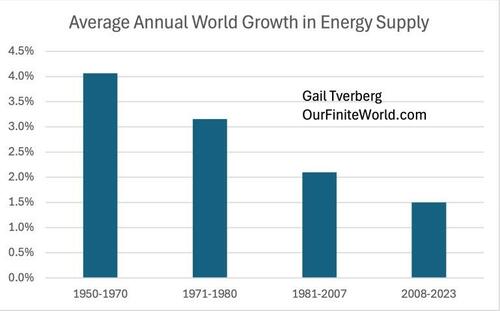

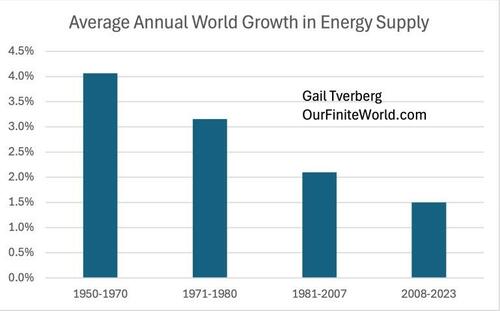

The rate of growth of world energy supply has been stepping down over the years, as the easiest (and cheapest) to extract fossil fuels tend to get extracted first. The average rate of increase of all energy supply (not just fossil fuels) is shown in Figure 6:

Figure 6. Annual rate of increase in energy consumption growth for the earliest grouping is based on data provided by Vaclav Smil in the Appendix to Energy Transitions. Average rates of increase for later periods are calculated from data of the 2024 Statistical Review of World Energy, by the Energy Institute.

Comparing Figures 5 and 6, we can see that average annual US GDP growth approximately matched growth in world energy supplies in the first two periods: 1950-1970 and 1971-1980.

In the period 1981-2007, average US GDP growth (of 3.2%) soared above world energy consumption growth (of 2.1%). I would attribute this primarily to outsourcing a significant share of the US’s industrial production as the economy shifted to becoming more of a service economy. There were multiple advantages to moving to a service economy. US oil supply had become restricted, and a service economy would use less oil. Also, the costs of imported goods would be much lower than those made in the US for several reasons, including more efficient newly built factories, lower-wage workers, and the use of inexpensive coal as a fuel instead of oil.

The encouragement of increased use of “leverage” under Ronald Reagan in the US and Margaret Thatcher in the UK no doubt added to the effect of using more debt shown in Figure 1. The US government started borrowing more money, rather than increasing taxes. Businesses became larger and more complex. International trade started playing a larger role.

Recent low growth in energy supplies has created an economic problem that added debt has only partially been able to hide. (In the latest period (2008-2023), both US average GDP growth (at 1.8%) and world energy consumption growth (at 1.5%) were very low.) Figure 1 shows that the US added huge amounts of debt, both after the 2008 financial crisis, and at the time of the Covid response in 2020. If it weren’t for these huge debt infusions, US GDP growth would no doubt have been much lower. GDP counts the quantity of goods and services produced, not whether added debt has been used to manufacture these goods, or whether customers have used debt to purchase these goods.

[4] In some ways, the world economy today is like the economy of the 1920s.

The 1920s were characterized by both the rising use of debt (especially consumer credit), and wide wage and wealth disparities. This was a time of innovation. Some farmers had modern new equipment that greatly enhanced efficiency, while most farmers could not afford this equipment.

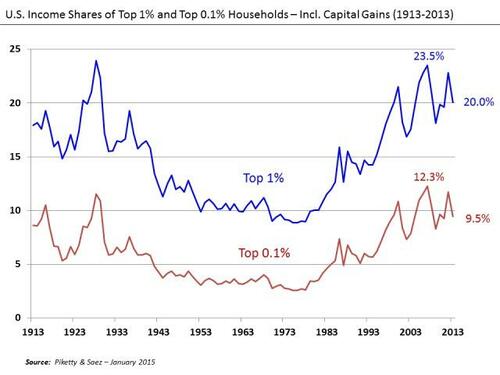

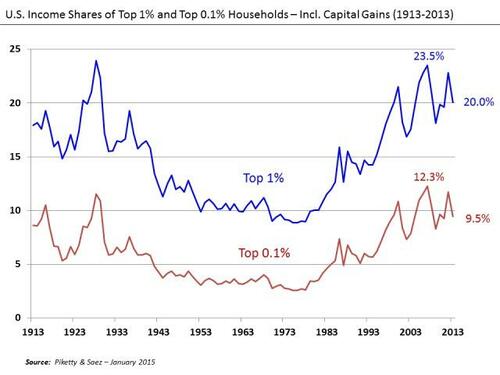

Figure 7 shows a pattern of wage disparity that operates in precisely the opposite direction from the interest rate pattern shown in Figure 2. The lower the interest rates, the more the concentration of wealth among a very small portion of the population. The higher the interest rates, the more evenly wage and wealth is divided.

Figure 7. U. S. Income Shares of Top 1% and Top 0.1%, Wikipedia exhibit by Piketty and Saez.

A comparison of Figure 7 with Figure 6 and Figure 5 shows that (at least for the years since 1950), faster energy consumption growth seems to lead to faster economic growth. With faster economic growth, the economy can support higher interest rates and higher wages for lower-paid workers. There is less push for “complexity” to try to replace workers with machines.

When energy consumption growth is low, the economy tends to grow more slowly. The interest rates that corporations and individuals can afford to pay are relatively low. With low interest rates, asset prices of all kinds soar because monthly payments to buy these assets fall. The prices of stocks, bonds, homes, and farms tend to soar. The already rich become richer and richer, as the poor are increasingly squeezed out of the economy.

Physicist Francois Roddier has said that physics dictates the outcome of widely diverging incomes when energy supply is low. It takes much less energy to supply an economy of a few rich people and many poor people than it takes to support an economy with relatively equal incomes. The vast majority of the supposed wealth of the rich exists as promises that can only be fulfilled in the future if there is enough energy of the right kinds to fulfill these promises. Their promised future wealth does not affect today’s energy use. While the energy use of rich people is somewhat higher than that of poor people, much of the difference disappears when a person considers the fact that much of their wealth is essentially “paper wealth” that may or may not actually be present as the future actually unfolds.

Both the 1920s and the latest period (2008-2023) are very low energy-growth periods. The fact that (2008-2023) is a low energy growth period (at 1.5% per year) can be seen on Figure 6. Energy supply was growing even slightly more slowly in the 1920s (based on data from Vaclav Smil’s Energy Transitions). Population was growing by 1.1% per year in both the 1920s and in the latest period (2008-2023.) Net energy consumption per capita growth was slightly negative (-0.1%) in the 1920s and only a very small positive percentage (0.4%) in the 2008-2023 period. Per capita consumption had been growing much more quickly between 1950 and 1980.

[5] The economy becomes very fragile when the growth of energy supply is low, compared to the growth of the world’s population.

Hidden beneath the surface is the problem that there is not enough energy to go around. This problem doesn’t manifest itself in high prices; it manifests itself in unusually large wage disparities. Very rich individuals (such as Bill Gates and Elon Musk) gain excessive influence. Special interests and their drive for profits also become important. At times, this drive for profits can come ahead of the well-being of citizens.

Citizens become more quarrelsome. Differences between and within political parties become greater. Political candidates no longer treat other candidates with the respect we would have expected in the past. The problem is, in some sense, the problem of a game of musical chairs.

Figure 8. Chairs arranged for Musical Chairs Source: Fund Raising Auctioneer

Initially, the game has as many players as chairs. The players walk around the outside of the group of chairs as the music plays. In each round, one chair is removed and the players must scramble for the remaining chairs. The person who does not get a chair is eliminated from the game.

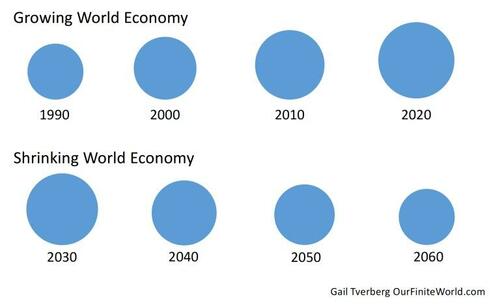

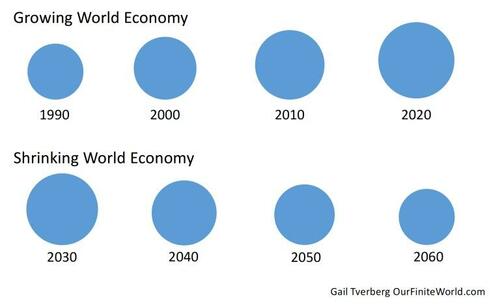

[6] It seems to me that major parts of the world economy are transitioning from a growth mode to a mode of shrinkage.

Figure 9 gives a representation of how the world’s growing economy can be visualized, and how it may change in the future.

Figure 9. Representation of an economy that is growing up until not long after 2020, and shrinking thereafter, by Gail Tverberg.

The fact that growth in the consumption of fossil fuel energy supplies has been retreating to lower levels should be of concern (Figure 6). At some point, the world economy will be in a situation in which the amount of fossil fuels we can extract is falling. While we have some add-ons to the fossil fuel system (including hydroelectric, nuclear, wind, and solar), they are all manufactured using the fossil fuel system and repaired using the fossil fuel system. These add-ons would stop producing not long after the fossil fuel system stops producing. They need fossil fuels to make replacement parts, among other problems.

The amount of growth in energy supply determines the growth in physical goods and services that can be produced. In periods of rapid growth, borrowing from the future, even at a high interest rate, makes sense. In periods of low growth, only loans with a very low interest rate are feasible. When the economy is shrinking, very few investments can repay loans requiring interest.

Needless to say, repaying debt with interest becomes much more difficult in a shrinking economy. In the US, our underlying problem is that since 1981, the US’s financial policy has been “throw every tool in the tool box” at stimulating the economy. We are now running out of tools to stimulate the economy to grow faster. Adding more debt isn’t likely to work very well, or for very long.

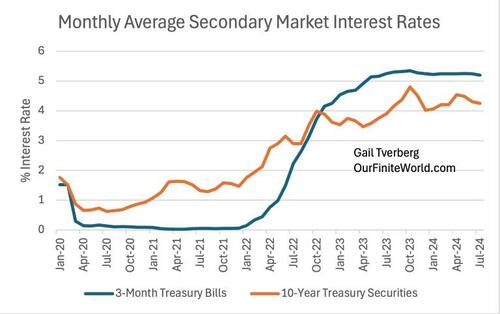

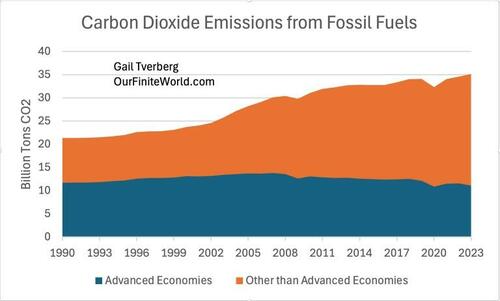

At this point, the many government-funded investments aimed at providing green energy and offering transportation by electricity are not paying back well. Citizens are repeatedly being told that there is a need to move away from fossil fuels to prevent climate change. But world CO2 emissions continue to rise. They simply moved to a different part of the world.

Figure 10. Carbon dioxide emissions for Advanced Economies (members of the Organization for Economic Co-Operation and Development) versus all others, based on data of the 2024 Statistical Review of World Energy published by the Energy Institute.

[7] What does history since 1920 say may be ahead?

It is hard to see that things will turn out well, but we do know that historical civilizations have collapsed over a period of many years. We can hope that if we are facing the collapse of at least part of the world’s economy, this collapse will also be slow. Some intermediate steps along the line likely include the following:

(a) Stock market collapses. After excessive speculation in the stock market in the late 1920s, the stock market collapsed on October 29, 1929, starting the Great Depression. Another major crash occurred in 2008, during the Great Recession. Both of these speculative bubbles seem to have been fueled by low short-term interest rates.

(b) Drops in the prices of homes, farms, and other assets. The Great Depression is noted for major drops in the prices of farms. The Great Recession is known for major drops in the prices of homes. We are now facing a situation with far too much Commercial Real Estate. Its price logically should fall. Farmers are also having difficulty because wholesale food prices are too low relative to the various costs involved, including interest payments relating to equipment purchases and mortgages. The problem is especially acute if farm property has been purchased at currently inflated prices. The prices of farms logically should fall, also.

(c) Debt defaults, related to asset price drops. Banks, insurance companies, pension plans and many individuals owning bonds will be badly affected if defaults on loans or bonds start increasing. (In fact, even if the market interest rates simply rise, the carrying value on financial statements is likely to fall.) If commercial real estate or a farm is sold and the sales price is less than the outstanding debt, the bank issuing the loan will be left with a loss. This debt is often resold, with credit rating agencies falling short in indicating how risky the debt really is.

(d) Failing banks, failing insurance companies, and failing pension plans. Even bankrupt governments defaulting on their loans.

With failing banks, there is less money in circulation. The tendency is for commodity prices to fall very low, putting farmers in worse financial shape than before. They cut back on production. Food production and transport use considerable amounts of oil. Reduced food production leads to less need for oil consumption and thus, falling oil prices. With low oil prices, production tends to fall.

(e) If a government survives, it may try to issue much more debt-based money to try to raise prices. This might work if the country is able to produce all goods locally. But the huge amount of new money (and debt) will not be honored by other countries. The result is likely to be hyperinflation, and still no goods to buy.

(f) Persecution of the wealthier people blamed for society’s problems. If people are poor, and there aren’t enough goods to go around, there is a tendency to find someone to blame for the problem. In Europe, prior to World War II, the Nazis persecuted the Jews. The Jews were often rich and worked in finance or the jewelry business.

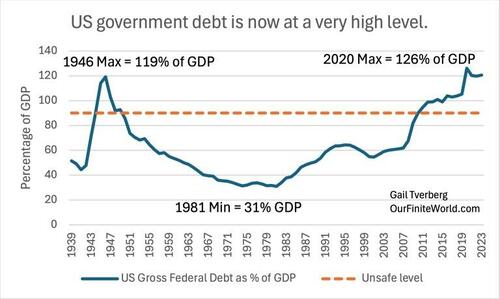

(g) War. War gives the possibility of obtaining resources elsewhere. Figure 4 shows that going to war can greatly ramp up GDP. It is a way of putting laid-off workers back to work. It is an age-old solution to not-enough-resources-to-go-around.

[8] Can any political approach put off the bad impacts suggested in Section [7] above?

A country that can provide complete supply chains based on its own resources, completely within its own borders can be somewhat insulated from these problems, as long as its resources are adequate for its population. I don’t think that any of the Advanced Countries (members of the OECD, which is similar to the US and its allies) can do that today. The US is closer to this ideal than Europe, but it is still a long way away. The central and southern part of the US, which is where Donald Trump’s support is strong, is closer to this ideal than elsewhere.

Trump is advocating adding tariffs on imported goods. Such tariffs would work in the direction of independence from China, India, and other industrialized nations. Trump also seems to advocate staying out of wars, wherever possible. If an area is doing well in terms of energy supply (including food supply), this would be a good strategy.

Kamala Harris is advocating capping today’s food prices. This would please city-dwellers, but it would encourage farmers to quit farming. Capping today’s food prices would also discourage the importation of food from elsewhere, leaving many empty shelves in grocery stores. Indirectly, it would also have an adverse impact on the world’s oil production and the quantity of food grown elsewhere.

Giving more money to poor people would almost certainly lead to more government debt. If countries in Europe were to do this, it would almost certainly devalue their currencies. They would find it harder to import goods from anywhere else in the world.

In fact, the US would likely also encounter difficulty in importing as many goods from elsewhere, if it chooses to give more money to poor people (and fund this generosity through more debt). China and Russia would have even more motivation to abandon the US dollar for trading purposes than they do today. The US, Europe, and other Advanced Economies would increasingly find imported goods unavailable.

Wind, solar, and electric vehicles are not fixing the economy now. Adding more debt to subsidize these efforts would likely have the same bad effects as adding more debt to subsidize poor people.

[9] A guess as to what could be ahead for the US, Canada, and Europe.

Donald Trump is suggesting tariffs and other policies that might be helpful for the parts of the US, Canada, and Mexico that think they might have enough resources to more or less get along on their own in the near future. This includes much of the central and southern part of the US. Central Canada would fit into this pattern, as well. Mexico is connected by pipeline to this area, too. At least in the US, Trump is favored in these areas.

In the highly populated areas along both US coasts, the debt-based policies of Kamala Harris will seem more reasonable because these sections have limited resources to rely on, but lots of population. The only solution they can imagine is more debt. I expect that Europe and the coasts of Canada will follow Kamala Harris’s strategies, but with their own leaders.

I can imagine a scenario in which after the US election, the US will break apart into two sections: a Trump section in the center of the US, and a Harris portion consisting mostly of the two coasts, and perhaps a few northern states. The Trump section will band together with Central Canada and Mexico and try to keep operating for some years longer. The Harris portion will join together with the coasts of Canada and most of Europe to get into war with Russia and China. The Harris portion will issue lots more debt. The Harris group will forget that their areas cannot really make many armaments without a huge amount of international trade. As a result, the Harris group will have great difficulty in being successful at war.