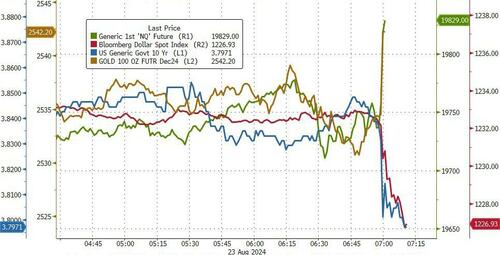

Futures are solidly in the green on the last day of the week ahead of Powell’s Jackson Hole speech, with Tech leading. As of 7:45am S&P futures were up 0.5% while Nasdaq futures gained 0.8% with top MegaCap tech stocks TSLA (+1.5%), NVDA (+1.2%), and AMZN (+69bp). Bond yields are roughly unchanged: the 10Y yield is down 1bp to 3.84% as the USD resumes its slide ahead of what many expect to be another dovish speech by Powell cementing a 25bps Sept rate cut. Commodities are mixed with Oil and Precious Metals higher, while Base Metals are lower. Today, the main focus will be Powell’s speech at Jackson Hole at 10am ET.

In premarket trading, Uber dropped 1% after the company unveiled plans to start offering self-driving Cruise cars to customers on its ride-hailing platform next year. Workday meanwhile surged 13% after the software company said it would increase profitability over the next three years to enable strategic investments. Here are some other notable premarket movers:

- Uber slips 1% after the company unveiled plans to start offering self-driving Cruise cars to customers on its ride-hailing platform next year.

- Workday (WDAY) rises 13% after the software company said it would increase profitability over the next three years to enable strategic investments.

- Cava Group climbs 9% after the fast-casual chain boosted its annual outlook for comparable sales following 2Q results that topped Wall Street expectations.

- Las Vegas Sands falls 1% after UBS cut the recommendation on the casino operator to neutral, noting the slow recovery in the company’s Macau business.

- Red Robin drops 14% after it cut adjusted Ebitda guidance for the full year.

- Roku rises 4% after an upgrade to buy at Guggenheim, which said the company is pivoting toward broadening advertising sales.

- Ross Stores climbs 5% after the off-price retailer boosted its earnings per share forecast for the full year.

- Topgolf Callaway Brands falls 3% after Raymond James downgraded the golf company to underperform, citing the recent deterioration in sales at its namesake chain of high-tech driving ranges.

On to today’s main event, the annual Jackson Hole symposium: Powell’s address, slated for 10 a.m. New York time, has been the main focus for traders all week and markets took a hit on Thursday on concern he would push back on the market’s aggressive easing bets. At the same time, strategists from JPMorgan Chase and Deutsche Bank say they expect moderate bond moves during the conference, while options traders are betting on small swings for stocks in the days ahead.

“For investors, the big question is to what extent Powell validates expectations for a September rate cut, and whether he offers any indication of how big any rate cut might be,” said DB’s Jim Reid, who went on to add that last year Powell said that they intended “to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective”. But over the following 12 months, we’ve seen inflation experience a noticeable decline, along with an increase in unemployment. So from both sides of the Fed’s dual mandate, we’ve moved much closer to a point where the Fed have cut rates in previous cycles.

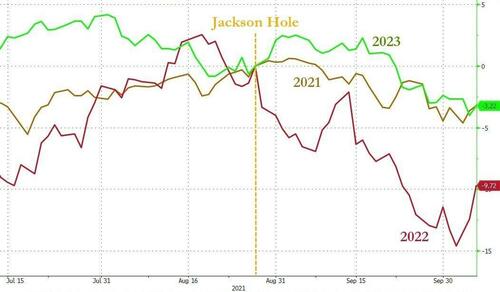

That said, the annual gathering of policymakers and academics in Wyoming may ultimately prove uneventful. Over the past decade, yields on both two- and 10-year notes moved less than 4 basis points on average, data compiled by Bloomberg show. The S&P 500 Index has been more reactionary, fluctuating around 1.3% on average. Of course, a jolt isn’t out of the question, however. Two years ago, Powell surprised the market by delivering a hawkish speech that sent the S&P 500 tumbling 3.4%, while 10-year yields notched an 8-basis-point intraday swing.

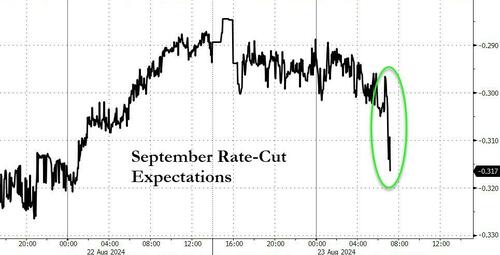

Surprises aside, the market is expecting the Fed to cut next month and preannounce it today with bets on lower Fed rates helping drive a rebound from the slump at the start of August. Investors are pricing in a quarter-point rate cut at the Fed’s Sept. 17-18 gathering, but see almost a full percentage point of reductions by year end, according to futures markets.

“It can be a very high bar for Powell to out-dove markets” said Christopher Wong, FX strategist at Oversea-Chinese Banking Corp. “But at the same time, I doubt many are expecting him to do that — so as long as there is no hawkish surprise from his speech, markets are happy to continue trading the Goldilocks thematic, i.e. fading rallies in the dollar.”

European stocks inch higher, led by auto and bank names, while technology underperforms.

Europe’s main equities benchmark edged up 0.3%. Major markets are higher led by Italy. Thematically, Italian Banks, Macro Recovery and EU Most Shorts are the top performing baskets; Semis lagged. On macro data, France Mfg. confidence prints 99 vs. 96 survey vs. 5 prior. Here are the biggest European movers:

- ALK-Abello shares climb as much as 12% to a record after the Danish allergy-drug maker raised its 2024 guidance for the third time this year, in a second-quarter report that beat estimates on the back of a strong performance in its key European market.

- Royal Unibrew shares rise as much as 5.1%, the most in four months, after the beer brewer raised the bottom end of its full-year guidance range for both net revenue and Ebit growth. Jefferies says this has lifted confidence but notes that consensus is already in line with the new targets.

- Galapagos shares rise as much as 5.2% after the biotech firm said it got US regulatory clearance for an early/mid-stage study evaluating its experimental drug candidate GLPG5101 in patients with relapsed or refractory non-Hodgkin lymphoma.

- Nestle shares fall as much as 4.1% in Zurich, the most in almost a month, after the consumer-goods company said Laurent Freixe will replace Mark Schneider as CEO. Analysts questioned whether the unexpected management change will lead to Nestle walking away from its current financial guidance.

- Dino Polska shares dive as much as 14% to lowest since Oct. 2022 after an earnings miss and softer sales guidance for 2H. Analysts note that Ebitda margin erosion in 2Q is deeper than reported earlier by peer J.Martins. Dino results confirm a difficult situation for food retailers in Poland amid slowing inflation, fast rising wages and fierce competition.

- Melrose Industries slides as much as 5.8% after UBS double-downgraded the stock to sell from buy, saying the market is overstating the size of the UK engineer’s Revenue & Risk Sharing Partnership (RRSP) portfolio.

In FX, the Bloomberg Dollar Spot Index falls 0.2%. The Japanese yen pares an earlier gain to sit 0.2% higher having rallied after Bank of Japan Governor Kazuo Ueda kept rate hikes in play this year. When asked about the market ructions that occurred earlier this month, Ueda played down the significance of the BOJ’s July rate hike in the turmoil. At the same time, he signaled that he doesn’t plan to rush ahead with the next rate hike, saying the BOJ needs to carefully watch the impact of unstable financial markets on the inflation outlook. The pound climbs 0.3% with Bank of England Governor Andrew Bailey also scheduled to speak today.

In rates, treasuries are marginally richer across the curve, keeping yields within 1bp of Thursday’s closing levels, in light trading ahead of Fed Chair Powell’s speech on the economic outlook at the Jackson Hole Economic Policy Symposium, scheduled for 10am New York time. US 10-year yield near 3.84% is about 1bp lower on the day, keeping pace with UK 10-year while outperforming Germany’s; curve spreads also remain within 1bp of Thursday’s closing levels. Ahead of Powell’s Jackson Hole speech, historical analysis has shown that the event has not been a big market mover with a 10-year yield move of less than 4 basis points on average

In commodities, oil prices advance, with WTI rising 1.1% to $73.80 a barrel. Spot gold rises $16 to $2,500/oz.

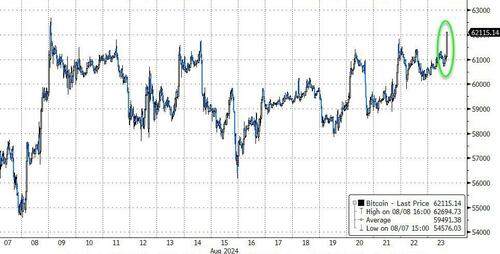

Bitcoin is incrementally firmer and climbs past USD 61K, whilst Ethereum sees gains to a larger magnitude and holds above USD 2.6k.

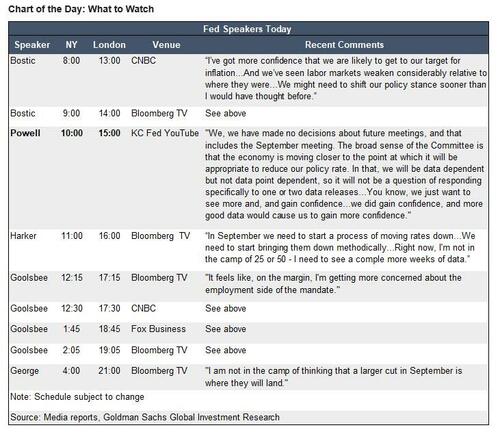

Looking at today’s calendar, US economic data calendar includes July new home sales (10am) and August Kansas City Fed services activity (11am). Other Fed speakers scheduled include Bostic (8am, 9am), Harker (11am) and Goolsbee (12:30pm, 1:45pm, 2:15pm)

Market Snapshot

- S&P 500 futures up 0.4% to 5,615.00

- STOXX Europe 600 up 0.1% to 516.49

- MXAP up 0.2% to 185.08

- MXAPJ little changed at 574.49

- Nikkei up 0.4% to 38,364.27

- Topix up 0.5% to 2,684.72

- Hang Seng Index down 0.2% to 17,612.10

- Shanghai Composite up 0.2% to 2,854.37

- Sensex little changed at 81,106.22

- Australia S&P/ASX 200 little changed at 8,023.90

- Kospi down 0.2% to 2,701.69

- German 10Y yield little changed at 2.25%

- Euro little changed at $1.1120

- Brent Futures up 0.6% to $77.67/bbl

- Gold spot up 0.5% to $2,496.74

- US Dollar Index down 0.11% to 101.40

Top Overnight News

- The Bank of Japan is still on a path toward higher interest rates provided inflation and economic data continue in line with its forecasts, Governor Kazuo Ueda said in his first public remarks following a global market rout.

- US equity futures ticked higher in the run-up to Jerome Powell’s Jackson Hole speech, with traders speculating over whether the Federal Reserve Chair will open the door for interest-rate cuts.

- The Federal Reserve Bank of Kansas City’s annual gathering in Jackson Hole, Wyoming kicked off Thursday evening with a dinner filled with central bankers, economists and reporters from the around the world. Here’s what to expect from the three-day conference.

- China’s attempts to cool a record bond rally have stalled a drop in yields, but at the cost of a collapse in trading activity to an extent that may create more headaches for policymakers

A more detailed look at global markets courtesy of Newsuawk

APAC stocks were ultimately mixed amid cautiousness as braced for a slew of global central bank rhetoric including Fed Chair Powell’s speech at the Jackson Hole Symposium. ASX 200 was restricted amid notable weakness across the commodity-related sectors. Nikkei 225 swung between gains and losses after Japanese CPI printed mostly in line with expectations, while there was also a slew of commentary from BoJ Governor Ueda who stood by last month’s BoJ rate hike. Hang Seng and Shanghai Comp. initially diverged with the former pressured by underperformance in NetEase and Baidu due to earnings disappointment, while the mainland was indecisive amid very few fresh catalysts.

Top Asian News

- BoJ Governor Ueda said concerns about a slowing US economy caused the recent market rout and they closely watching market moves with a sense of urgency as uncertainties remain, while there is no change to the stance that they would adjust the degree of monetary easing if the price outlook is likely to be achieved. Ueda said the July rate hike decision was based on their inflation forecast and the risk of inflation overshoot, as well as stated that the BoJ’s policy path to a neutral interest rate remains highly uncertain but noted that Japan’s short-term interest rate is still very low so if the economy performs well, the BoJ will adjust rates to levels deemed neutral to the economy. Ueda said they may conduct operations nimbly if there’s a sharp rise in long-term yields. Says they removed the wording “continue accomodative environment” from the outlook report, as it was said to be interpreted as not increasing rates for the foreseeable future

- Japanese Finance Minister Suzuki said there is a potential risk of Japan’s financial health deterioration from a rate hike as government debt is high and they cannot rule out the possibility of Japan’s economy falling back into deflation. Furthermore, Suzuki said a weak yen has merits and demerits, while he cannot tell if a strong yen has bigger merits or demerits. Suzuki added the FX intervention in July was effective and intervention was conducted to respond to speculative moves and excessive volatility.

- Tenders showed that state-linked Chinese entities use Amazon’s (AMZN) Cloud unit to access restricted AI chips and models including Nvidia (NVDA) chips banned from export to China, according to Reuters.

- China’s Politburo is holding a meeting, via Xinhua, on developing western China. Must promote the upgrading of traditional industries. Strengthen security guarantees capabilities within key areas. Strengthen energy resource guarantees and the construction of clean energy guarantees. Must persist in building a strong sense of community for the nation, safeguarding unity and border stability.

- “China’s Ministry of Commerce met with automakers and industry associations…The meeting adds to a succession of events that clearly shows China is seriously studying calls of tariff rate hikes on imported large-engine cars, industry insiders said”, GT.

European bourses, Stoxx 600 (+0.2%) are generally firmer, having opened on a mostly flat footing. The complex picked up as the morning progressed; ahead Fed Chair Powell at 15:00 BST / 10:00 EDT. European sectors hold a slight positive bias, but with the breadth of the market fairly narrow. Banks top the pile, joined by Energy, whilst Tech lags slightly. US Equity Futures (ES +0.5%, NQ +0.6%, RTY +0.2%) are entirely in the green, paring back some of the hefty losses seen in the prior session.

Top European News

- ECB Consumer Expectations Survey (July): See inflation in next 12 months at 2.8% (prev. 2.8%); 3yrs ahead sees 2.4% (prev. 2.3%)

- ECB’s Kazaks said EZ inflation is consistent with further gradual ECB rate cuts; assume two more rate cuts this year and there is no reason now not to follow through, according to Reuters.

- UK GfK Consumer Confidence (Aug) -13.0 vs. Exp. -12.0 (Prev. -13.0)

- UK’s Ofgem says the energy price cap for October to December 2024 will rise 10% (exp. 9%) to GBP 1717 (prev. 1568) for a typical household

FX

- USD is softer vs. peers by varying degrees. DXY is holding below the 101.50 mark in the run-up to Fed Chair Powell’s appearance at the Jackson Hole Symposium.

- EUR is a touch firmer vs. the USD and steady on a 1.11 handle after briefly slipping to a 1.1098 low on Thursday. ECB speak today and the ECB’s Consumer Expectations Survey have had little follow-through for the EUR.

- Cable is currently holding around Thursday’s 1.3130 peak, which if breached would bring in the 2023 peak at 1.3142 into view.

- JPY is edging mild gains vs. the USD but ultimately remaining within Thursday’s 144.84-146.52 parameters. Comments from BoJ Governor Ueda overnight brought on some appreciation of the JPY with the Governor very much leaving the door open for further rate hikes.

- Antipodeans are both a touch firmer vs. the USD. AUD/USD appears to be in consolidation mode for now after a recent run of gain.

- PBoC set USD/CNY mid-point at 7.1358 vs exp. 7.1480 (prev. 7.1228).

Fixed Income

- USTs are in a holding pattern into Powell, unchanged within a narrow range around the 113-10 mark and at the low-end of Thursday’s 113-05+ to 113-27 band. Ahead of Powell, benchmarks have generally come under some very modest pressure as crude picks up to incremental session highs.

- Bunds are very much contained and holding within Thursday’s 134.11-135.08 range ahead of Fed Chair Powell. ECB SCE and commentary from Kazaks provided little impetus.

- Gilts are flat and around 99.50, waiting Powell and thereafter a text release from Bailey at 16:00BST (speech scheduled for 20:00BST).

- OATs await updates from how the meeting between French President Macron and the left-wing NFP alliance PM candidate goes.

Commodities

- Crude is firmer intraday despite a lack of pertinent catalysts this morning but in a continuation of the strength seen on Thurday. Brent October sits in a USD 77.03-77.64/bbl parameter.

- Firmer trade across precious metals following Thursday’s session of losses, and with today’s gains also facilitated by a softer Dollar and a weekend of potential geopolitical risks. Spot gold remains under USD 2,500/oz in a USD 2,484.41-2,497.61/oz parameter.

- A sea of green across base metals amid the broader optimism across markets coupled with a generally softer Dollar and a session of losses on Thursday.

- China’s Industry Ministry revised steel production capacity replacement measures and stated that from today, all regions will suspend announcements of new steel production capacity replacement plans.

Geopolitics – Middle East

- EU foreign policy chief Borrell said he discussed with the Iranian Foreign Minister the cessation of military cooperation with Russia and defusing regional tensions, according to Al Jazeera.

Geopolitics – Other

- Ukrainian drone attempted to attack Kursk nuclear plant; the drone was shot down near the plant, via Tass citing sources

- Ukraine’s Air Force said it used a US-made GBU-39 bomb to strike a Russian military target in Russia’s Kursk region.

- NATO air base in the German town of Geilenkirchen has raised its security level based on intelligence information indicating a potential threat, according to Reuters.

- China’s Foreign Ministry said in China-Belarus joint communique that both sides support the peaceful settlement of conflicts, constructive bilateral dialogue among countries, and international cooperation based on mutual benefit and mutual respect.

US event calendar

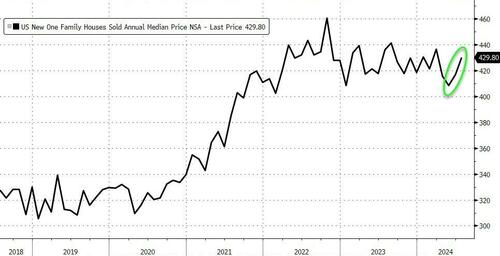

- 10:00: July New Home Sales MoM, est. 1.0%, prior -0.6%

- 10:00: July New Home Sales, est. 623,000, prior 617,000

- 11:00: Aug. Kansas City Fed Services Activ, prior -4

Fed Speakers

- 08:00: Fed’s Bostic Speaks on CNBC

- 09:00: Fed’s Bostic Speaks on Bloomberg Television

- 10:00: Fed’s Powell Speaks on Economic Outlook

- 11:00: Fed’s Harker Speaks on Bloomberg Television

- 12:30: Fed’s Goolsbee Speaks on CNBC

- 13:45: Fed’s Goolsbee Speaks on Fox Business

- 14:15: Fed’s Goolsbee on Bloomberg TV

DB’s Jim Reid concludes the overnight wrap

Markets saw a sizeable pullback over the last 24 hours, with the S&P 500 (-0.89%) posting its worst daily performance in over two weeks, whilst the 10yr Treasury yield (+5.1bps) moved back up to 3.85%. The moves came as investors grew more sceptical about the chances of 50bp rate cuts this year, thanks to more positive data and comments from Fed officials yesterday, which in turn led to a pullback across equities and bonds. But today the focus will now turn to Fed Chair Powell’s Jackson Hole speech, which is in focus given that previous years have often seen noteworthy speeches from the Fed Chair.

In terms of what to expect today, the theme of this year’s Jackson Hole event is “Reassessing the Effectiveness and Transmission of Monetary Policy”, and Powell’s speech simply has the title “Economic Outlook”. For investors, the big question is to what extent Powell validates expectations for a September rate cut, and whether he offers any indication of how big any rate cut might be. Last year, Powell said that they intended “to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective”. But over the following 12 months, we’ve seen inflation experience a noticeable decline, along with an increase in unemployment. So from both sides of the Fed’s dual mandate, we’ve moved much closer to a point where the Fed have cut rates in previous cycles.

Our US economists’ view is that it will be difficult for Powell to pre-commit to a particular trajectory at Jackson Hole. But they do think his comments will imply that the Fed can begin dialling back the degree of restraint soon, opening the door to a rate cut next month. Indeed, the minutes of the July FOMC meeting said that the “vast majority observed that, if the data continued to come in about as expected, it would likely be appropriate to ease policy at the next meeting.” For more details, see their Jackson Hole preview here, where they also look at the case for the Fed starting with a 25bp cut (as per their baseline), and the case for starting with a larger 50bp move.

With the symposium getting underway, yesterday also brought a raft of Federal Reserve speakers, who didn’t lean into the rapid pace of cuts that was being priced by markets. For instance, Boston Fed President Collins said that she didn’t see any “big red flags”, and Philadelphia Fed President Harker said that “I think a slow, methodical approach down is the right way to go”. Meanwhile, Kansas City Fed President Schmid said that he wanted to see more data, saying that “Before we act — at least before I act, or recommend acting — I think we need to see a little bit more.”

That pushback against a 50bp cut got further support yesterday from better-than-expected economic data. In particular, the weekly initial jobless claims were at 232k as expected, which took the 4-week moving average down to 236k. And on top of that, the US flash composite PMI came in above expectations at 54.1 (vs. 53.2 expected), with existing home sales also up to an annualised pace of 3.95m in July (vs. 3.94m expected), marking their first increase in five months.

With all that data in hand, investors moved to dial back their expectations for rate cuts. By the close, they’d cut the chance of a 50bp rate cut in September to 25%, down from 36% the day before. And looking at the year as a whole, the amount of cuts priced by the December meeting came down from 103bps to 97bps. And in turn, there was a meaningful move higher in Treasury yields, with the 2yr yield (+7.3bps) moving up to 4.00%, whilst the 10yr yield (+5.1bps) was up to 3.85%. The rise in US rates helped the dollar index (+0.46%) post its best day in three months, ending a run of four consecutive declines. But overnight we have seen a modest retracement, with the 10yr Treasury (-0.8bps) coming down slightly to 3.84%.

As officials sounded more hawkish than expected, that had an effect on equities too, where the S&P 500 (-0.89%) saw its biggest daily pullback in over two weeks. Tech stocks drove the declines, with the NASDAQ down -1.67%, whilst the Magnificent 7 fell -2.43% on the day, led by losses for Nvidia (-3.70%) and Tesla (-5.65%). The decline was more modest outside of tech as the equal-weighted S&P 500 retreated -0.30%, with financials (+0.48%) and energy (+0.32%) sectors higher on the day. Still, in a sign of a more volatile backdrop, the VIX index (+1.28pts to 17.55) rose for a third consecutive day.

It was a stronger session for equities in Europe, where the STOXX 600 advanced +0.35% on the day to close at a 3-week high. That came as the Euro Area PMIs were notably stronger than expected, with the composite PMI up to 51.2 (vs. 50.1 expected). That was supported by a strong outperformance from France amidst the Olympics, with the French services PMI up to a two-year high of 55.0 in August (vs. 50.3 expected).

Otherwise in Europe, sovereign bonds followed a similar pattern to the US, with yields on 10yr bunds (+5.4bps), OATs (+5.4bps) and BTPs (+5.9bps) all moving higher. That came as investors dialled back their expectations for ECB rate cuts this year, with the amount of cuts priced by the December meeting down -3.7bps on the day to 65bps. Separately, we also had the account of the ECB’s recent meeting in July, which said that the September meeting was widely seen as a good time to re-evaluate the level of monetary policy restriction.”

Overnight in Asia, Bank of Japan Governor Ueda confirmed that it remained their plan to continue hiking rates, saying that “If we are able to confirm a rising certainty that the economy and prices will stay in line with forecasts, there’s no change to our stance that we’ll continue to adjust the degree of easing,” That’s helped the Japanese Yen to strengthen this morning, and it’s currently trading at 145.83 per US Dollar. In the meantime, we’ve also had Japan’s latest CPI inflation data for July overnight, which showed headline CPI coming in a bit stronger than expected at +2.8% (vs. +2.7% expected). That said, the CPI measure excluding fresh food was in line with expectations at +2.7%, whilst CPI excluding fresh food and energy was also in line with consensus with a +1.9% print. All this has helped Japanese government bond yields to move higher overnight, with the 10yr yield up +3.3bps.

Meanwhile for equities in Asia, we’ve seen a more positive performance overnight. For instance, the Nikkei (+0.37%), the CSI 300 (+0.57%) and the Shanghai Comp (+0.28%) have all posted gains, whilst the KOSPI is unchanged. US futures are also pointing to a recovery, with those on the S&P 500 (+0.34%) and the NASDAQ 100 (+0.55%) both seeing solid gains. The main exception to this pattern has been the Hang Seng, which is currently down -0.41%.

To the day ahead now, and the main highlight will be Fed Chair Powell’s speech at Jackson Hole. We’ll also hear from Chicago Fed President Goolsbee and BoE Governor Bailey. Data releases include US new home sales for July, and we’ll also get the ECB’s Consumer Expectations Survey for July.