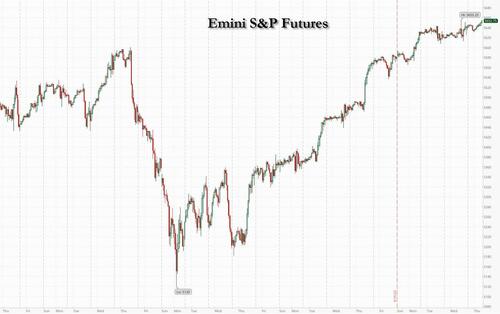

Global Stocks Hit All Time High With J-Hole Expected To Preannounce Rate Cuts

Just over two weeks after the VIX almost touched 70, the market’s freakout is completely forgotten as futures continue rising and a global gauge of stocks approached a record high as traders are now convinced the Fed will deliver its first interest-rate cuts in more than four years, which will take place with both stock and housing prices at all time highs. One can only imagine what happens next. The MSCI’s All Country World index ticked up 0.1%, trading near its all-time record close on July 16. As of 7:45am, S&P futures were 0.2% higher with the index on pace to be up 10 of the past 11 days, while Nasdaq futures gained 0.3%. Europe’s Stoxx 600 index advanced 0.5% as Deutsche Bank AG rallied after predicting a boost to third-quarter results. US futures edged higher. The Bloomberg dollar index is up after rebounding from a 5 month low, while 10Y TSY yields are higher by 3bps to 3.83% after dropping 4 days. Oil is also higher after tumbling to the lowest price of 2024 yesterday. The macro calendar is busy with Initial and jobless claims, Chicago Fed and and existing home sales for July. The Jackson Hole symposium begins tonight with Powell’s highly expected speech due tomorrow at 10am.

In premarket trading, Charles Schwab shares fall 4.3% after Toronto-Dominion Bank has raised $2.5 billion in pricing the sale of Schwab shares at $61.65 each. Paramount Global shares rose 3.7% after media investor Edgar Bronfman Jr. raised his offer to take control of thee CBS parent to $6 billion, according to Bloomberg News. Here are some other notable premarket movers:

- Canadian Solar shares slip 4.2% after the company forecast revenue for the third quarter; the guidance missed the average analyst estimate.

- Estee Lauder shares rise 2.3% after an upgrade to overweight at Piper Sandler.

- SentinelOne shares rise 3.4% after an upgrade to overweight at Wells Fargo.

- Snowflake shares drop 9.6% after the software company reported its second-quarter results and gave an outlook. While the results beat expectations on key metrics, analysts flagged some concerns.

- Sprout Social shares slip 3.2% after receives its first ever sell-equivalent rating since its initial public offering in December 2019, after KeyBanc Capital Markets cut the company to underweight from sector weight and set a new Street low price target.

- Synopsys shares rise 2.4% after the electronic design automation software company reported third-quarter results that beat expectations and raised its full-year forecast.

- Urban Outfitters shares fall 11% after the apparel retailer reported second-quarter comparable retail segment sales growth that missed Wall Street expectations.

- Zoom Video Communications shares rise 3.5% after the video-conferencing software company reported second-quarter results that beat expectations and raised its full-year forecast as new AI and contact centers products continue to deliver. It also announced that CFO Kelly Steckelberg would resign.

Expectations for US rate cuts have completely erased the market slump at the start of August that was sparked by recession fears in the US and a rapid unwind of the yen carry trade. Now, investors are focused on Powell’s speech at the Jackson Hole economic symposium on Friday for further evidence a September cut is coming, but even without it, about 100 basis points of easing are already priced in this year after some -818,000 payroll revisions reinforced the case for lower rates.

“We’ve been long Treasuries for a week now — it’s quiet and yields can grind lower from here,” said Matt Amis, investment director at Abrdn Investment Management Ltd. “Jackson Hole is obviously all the market is waiting for. Powell is desperate to cut, we don’t see why he would want to push back on current market pricing for September.”

The Stoxx 600 rises 0.6%, led by retail and travel names. Retail is the strongest-performing sector, wihle basic resources stocks are the biggest laggards. Here are the most notable European movers:

- CTS Eventim shares rise 11% to an intraday record after the German events company’s first-half revenue beat estimates. The firm now expects significantly higher Ebitda and revenue for its ticketing segment compared with last year.

- Swiss Re advances as much as 3.8%, the most since May, after the Swiss insurance group reported first-half earnings where all its divisions outperformed expectations. Vontobel expects Swiss Re to surpass its FY guidance this year, bar any major large claims.

- JD Sports shares rise as much as 6.3% to hit their highest level since early June after the UK clothing retailer reassured investors with sales growth and increasing market share at a tough time for the broader retail space, according to analysts at Peel Hunt.

- Swiss Prime shares rise as much as 2.6% to hit their highest level since June 2022 after the real estate investor reported strong rental income growth, record-low vacancy rates, an improved valuation for its portfolio and a rosier outlook, according to analysts. The stock is trading at its highest level since June 2022.

- Bavarian Nordic shares rise as much as 13% after the Danish company forecast reaching the top end of its full-year guidance range following an order for its smallpox/mpox vaccine from a European country. Analysts see consensus expectations being increased for the year.

- HelloFresh shares rise as much as 8.5%, hitting the highest intraday level since March, after activist investor Active Ownership disclosed a stake.

- Meko gains as much as 13%, the most since May 2022, after the Swedish automotive parts retailer reported stronger-than-expected earnings, with operating income 41% ahead of Bloomberg-compiled consensus expectations.

- PKO Bank Polski shares gain as much as 3% after Poland’s biggest lender reported 2Q earnings beat on interest income that rose 15% Y/y despite fresh charges on mortgage moratoriums. Analysts praise also further reduction of cost of risk and see that PKO has potential to maintain high profits in the coming quarters.

- Aegon shares drop as much as 6.7% after the insurer’s first-half operating profit dropped on charges booked after the insurer updated its mortality assumptions. Analysts say this is a negative, but highlight underlying results were solid and that guidance has been reiterated.

- GN Store Nord shares drop as much as 10%, the most since August 2023, after the Danish hearing-aid and audio equipment firm reported weaker-than-expected earnings for the second quarter. Morgan Stanley analysts see “modest trims” to consensus estimates for the year.

- Orlen, Poland’s largest energy company, falls as much as 2.8% after it reported net loss in 2Q due to 6.3b zloty charges to finance the country’s household energy price caps. Analysts see Orlen’s plan to cut capex as well as rising profits from electricity segment as a positive signal.

- Instalco falls as much as 12%, the most since November 2022, after the Swedish electrical installations group reported its latest earnings, showing an organic contraction in the quarter of 6.4% vs. 5.5% growth a year earlier.

European data showed a mixed picture for the region’s economy, despite a surprise boost from the Paris Olympics. French services expanded at the fastest pace in more than two years, while in Germany a composite PMI added to evidence that the country’s recovery has fizzled out. Britain’s private sector companies reported their strongest growth in four months alongside cooling price pressures. In company news, shares of Deutsche Bank jumped more than 3%. The lender said it expects a €430 million ($479 million) boost to pretax profit in the third quarter after reaching agreements with more than 80 plaintiffs in a long-running dispute.

Earlier in the session, Asian stocks eked out small gains. The MSCI Asia Pacific Index rose as much as 0.4% after fluctuating in early trading. Tencent contributed the most to the gauge’s increase, while AIA Group also surged after the insurer’s new business value jumped to a record in the first half of the year. Equities in Hong Kong led the gains in the region, as several major companies including Xiaomi reported upbeat results. Those in the Philippines and Japan also advanced, partly helped by expectations of US rate cuts, which may provide support to shares ranging from technology companies to machinery makers. Indonesia and Taiwan markets declined. Bank of Japan Governor Kazuo Ueda, meanwhile, faces intense market scrutiny on Friday when he speaks to lawmakers, after the central bank’s hawkish signals contributed to the global market turmoil earlier this month.

In FX, the Bloomberg Dollar Spot Index is up 0.1% while the Japanese yen falls 0.3%; the pound has risen to the top of the G-10 FX pile, climbing 0.2% against the dollar after UK manufacturing and service PMIs topped estimates. The euro falls 0.1% after more mixed readings from the bloc – manufacturing was weak but services outperformed, in part due to the Paris Olympics.

In rates, treasuries are under pressure in early US trading with the yield curve flatter as front-end yields are about 3bp higher on the day. US rates track a bigger selloff in core European bond markets sparked by August preliminary PMIs for France, Germany and euro-zone. Treasury yields are cheaper by at least 2bp across the curve with 2s10s, 5s30s spreads flatter by about 1bp on the day; 10-year is around 3.82% with comparable bunds and gilts cheaper by an additional 1.7bp and 1.5bp. German government bonds are lower and didn’t show much reaction to a slowdown in euro-zone wage growth in the second quarter.

In commodities, oil prices are little changed, with WTI near $72 a barrel. Spot gold drops $8 to around $2,504/oz.

Bitcoin is flat and holds just beneath USD 61k, with Ethereum also rangebound just above USD 2.6k.

Looking at today’s calendar, the economic data includes July Chicago Fed national activity index and initial jobless claims (8:30am), August preliminary S&P Global US manufacturing and services PMIs (9:45am), July existing home sales (10am) and August Kansas City Fed manufacturing activity (11am). Fed speaker slate empty for the session

Market Snapshot

- S&P 500 futures little changed at 5,645.75

- MXAP up 0.3% to 185.14

- MXAPJ up 0.4% to 575.40

- Nikkei up 0.7% to 38,211.01

- Topix up 0.2% to 2,671.40

- Hang Seng Index up 1.4% to 17,641.00

- Shanghai Composite down 0.3% to 2,848.77

- Sensex up 0.2% to 81,091.03

- Australia S&P/ASX 200 up 0.2% to 8,026.96

- Kospi up 0.2% to 2,707.67

- STOXX Europe 600 up 0.4% to 516.16

- German 10Y yield little changed at 2.22%

- Euro little changed at $1.1148

- Brent Futures little changed at $76.12/bbl

- Gold spot down 0.4% to $2,503.09

- US Dollar Index up 0.13% to 101.17

Top Overnight News

- At least three banks managed to obtain key payroll numbers Wednesday while the rest of Wall Street was kept waiting for a half-hour by a government delay that whipsawed markets and sowed confusion on trading desks.

- Several Federal Reserve officials acknowledged there was a plausible case for cutting interest rates at their July 30-31 meeting before the central bank’s policy committee voted unanimously to keep them steady.

- The euro’s August gains have been relentless, taking it to a one-year high against the dollar on Wednesday, but a cautious tone from Powell on Friday could turn that momentum around.

- It’s arguably one of the last places you’d expect stock investors to turn as China’s economy struggles and its real estate crisis worsens.

- Australia’s second-best performing hedge fund is profiting from greater market swings during earnings seasons, saying investment bank research has failed to track the ups and downs of faster-evolving industries.

- French services expanded at the fastest pace in more than two years, driving Europe’s second-biggest economy as visitors from around the world flocked to Paris for the Olympic Games.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with a mild positive bias after the gains on Wall St where a downward payrolls revision and the FOMC Minutes further supported the consensus for a September Fed rate cut. ASX 200 edged higher but with gains capped as participants digested a slew of earnings, while data showed an improvement across Australia’s flash PMIs although manufacturing remained in contraction. Nikkei 225 marginally outperformed its peers and returned to above the key 38,000 level. Hang Seng and Shanghai Comp. wer e somewhat varied with notable strength in Hong Kong tech stocks after a solid earnings report from Xiaomi, although pharmaceutical stocks and WuXi biologics were at the other end of the spectrum after the latter reported a 24% drop in H1 net, while the mainland remained lacklustre amid growth concerns, trade frictions and a net liquidity drain.

Top Asian News

- BoK kept its base rate unchanged at 3.50% as expected, with the decision made unanimously. BoK said it will examine the proper timing of rate cuts and said confidence is greater that inflation will converge on the target level, while it dropped the phrase ‘sufficient period of time’ in saying it will maintain a restrictive policy stance. BoK Governor Rhee said inflation conditions are appropriate for a cut and that four board members said room for a rate cut should remain open although Rhee also stated that rising financial stability risks warranted the BoK’s decision to hold rates today. Furthermore, Rhee said the pace and extent of an interest rate cut in South Korea will be smaller than that of the US and noted the BoK is communicating with markets using a three-month horizon forward guidance but also stated that forward guidance doesn’t guarantee a rate cut.

- Baidu Inc (BIDU) Q2 2024 (USD): EPS 2.89 (exp. 2.57), Revenue 4.669bln (exp. 4.7bln).

- NetEase Inc (NTES) Q2 2024 (USD): EPS 1.67 (exp. 1.69), Revenue 3.5bln (exp. 3.58bln).

- BoJ is considering adding wage-related items to the Tankan survey, according to Jiji News; aims to analyse wage trends in Tankan survey, reflects on monetary policy decision

European bourses, Stoxx 600 (+0.5%) began the session flat/modestly firmer. Indices were choppy following the various PMI releases, but ultimately trudged higher as the morning progressed. European sectors hold a positive bias, albeit with the breadth of the market fairly narrow. Retail takes the top spot, propped up by post-earning strength in JD Sports (+3.1%). Basic Resources lags, paring back some of the strength seen yesterday, in line with a pullback in metals prices. US Equity Futures (ES U/C, NQ U/C, RTY U/C) are flat/firmer, with traders mindful ahead of the beginning of the Jackson Hole Symposium and Fed Chair Powell’s speech on Friday.

Top European News

- UK Firms Report Faster Growth, Cooler Inflation in Boost for BOE

- Private Equity Fights for UK Tax Perk While Ducking Public Ire

- Norway’s Households Expect Near-Term Inflation to Accelerate

- Euro-Zone Economy Handed Surprise Boost by Paris Olympics

FX

- DXY is a touch higher but ultimately not showing enough of a resurgence to reverse the recent bearish run for the index. DXY went as low as 100.92 on Wednesday, but currently stands around 101.25.

- EUR is marginally softer vs. the USD in the wake of a slew of EZ PMI metrics which ultimately saw continued outperformance in the service sector vs. the manufacturing industry with the former helping the composite to gain a firmer footing above the 50 mark. Elsewhere, a decline in EZ Negotiated Wages for Q2 had little sustained follow-through into the EUR. For now, EUR/USD is contained within Wednesday’s 1.1098-1.1174 range.

- GBP is edging gains vs. both the USD and EUR with solid PMI metrics underpinning the pound. Cable has taken out yesterday’s 1.3119 high and therefore brought the 2023 high into view at 1.3142.

- JPY is trivially softer vs. the USD with markets awaiting two potentially key inflection points for the pair tomorrow. 1) Ueda’s appearance before Parliament and 2) Powell’s appearance at Jackson Hole.

- Antipodeans are both marginally firmer vs. the USD in quiet trade which is showing a mild pro-risk bias.

Fixed Income

- USTs moved in tandem with the net-hawkish move seen in Bunds/Gilts on their own metrics. Docket today sees US PMIs ahead of the commencement of the Jackson Hole Symposium. At a 113-19 base, support from the last few session’s lows at 113-14+, 113-03+ and 112-31.

- Bund price action today has been dictated by PMI releaes. Bunds were initially pressured by strong French PMIs, but the release is subject to extensive Olympic-related caveats, which led to the upside being mostly pared. Thereafter, German numbers were soft lifting Bunds to a 135.08 peak, spurred by the data erring towards another negative quarter and potential recession talk. Ultimately, Bunds are in the red and just below the knee-jerk base which printed on the initial French numbers.

- Gilts were moving in tandem with Bunds into its own release, which was stronger across the board. Overall, a hawkish reaction was seen with GBP picking up and Gilts probing below the earlier 99.87 base; current low of 99.81.

Commodities

- Relatively flat session for crude thus far following Wednesday’s losses. Brent Oct is trading within USD 75.77-76.21/bbl parameters.

- Mixed trade across precious metals with slight gains in spot palladium while spot gold and silver trade subdued in what has been a quiet morning this far, and with little move seen in the metals to EZ PMIs. Spot gold trades in a USD 2,514.69-2,499.18/oz range.

- Base metals are flat trade on Thursday, infitting with the broader tentative mood and following the prior day’s fluctuations, with markets seemingly on standby ahead of the Fed’s Jackson Hole symposium and Fed Chair Powell’s speech in the absence of any other macro impulses.

- Russia’s Novatek has postponed launched of third line at Artic LNG 2 project to 2028, according RBC citing source.

- Chinese crude steel output -9.0% Y/Y in July to 82.9mln tonnes; world steel output -4.7% Y/Y to 152.8mln tonnes.

- UBS continue to expect Brent to recover into a USD 85-90/bbl range over the coming months; Reiterate a step up in Gold ETF inflows required for next leg higher toward their mid-2025 gold target of USD 2700/oz

- OPEC Secretariat received updated compensation plans from Iraq and Kazakhstan.

Geopolitics

MIDDLE EAST

- Ambrey reports a fire at sea approx. 58NM southwest of Salif, Yemen; likely related to the destruction of a suspected unmanned surface vessel

- Israeli forces besiege Tulkarm refugee camp east of the city in the West Bank, while it was also reported that the Israeli army launched raids on 10 areas in Lebanon.

- US officials said to believe that Iranian leaders have decided to postpone the response to Haniyeh’s assassination but fear that Tehran will urge Hezbollah to attack, according to The Washington Post.

- US military announced on Wednesday that the USS Abraham Lincoln entered the Central Command area of responsibility in the Middle East, according to Iran International.

- A fire broke out at a military facility in Russia’s Volgograd region after a drone crashed into it, according to Interfax.

- US Embassy within Kyiv says they see an increased risk of Russian drone/missile attacks in the coming days, due to Ukraine’s Independence Day on 24th August

US Event Calendar

- 08:30: Aug. Initial Jobless Claims, est. 232,000, prior 227,000

- Aug. Continuing Claims, est. 1.87m, prior 1.86m

- 08:30: July Chicago Fed Nat Activity Index, est. 0.03, prior 0.05

- 09:45: Aug. S&P Global US Manufacturing PM, est. 49.5, prior 49.6

- Aug. S&P Global US Services PMI, est. 54.0, prior 55.0

- Aug. S&P Global US Composite PMI, est. 53.2, prior 54.3

- 10:00: July Existing Home Sales MoM, est. 1.3%, prior -5.4%

- 11:00: Aug. Kansas City Fed Manf. Activity, est. -9, prior -13

DB’s Jim Reid concludes the overnight wrap

Markets put in another decent performance yesterday, as the S&P 500 (+0.42%) posted a further advance that left it less than 1% beneath its record high from July. The gains happened despite some negative revisions to US payrolls, but given the widespread expectations that they’d be revised down anyway, the news didn’t lead to a big reaction among risk assets. Plus the revisions only affect the numbers up to March, and don’t change our understanding of the more recent figures, which is ultimately what the Fed cares about. Later on in the session, we then received some dovish-leaning minutes from the Fed’s July meeting, which along with the payrolls revisions helped to cement expectations that the Fed would cut rates pretty rapidly over the coming months, with over 100bps of cuts priced in by year-end again.

In terms of the details of those revisions, what we got yesterday was the preliminary estimate for the annual benchmark revisions, which included an -818k downward revision to the March payrolls number. In other words, that means the monthly payroll numbers would be -68k lower if you assume the revisions are spread evenly across the year. Before the revisions, nonfarm payrolls had been running at an average pace of +242k per month over the year to March, so a downward revision that big would mean the pace was actually +174k instead. So these are still steady gains that are well clear of recessionary levels. But they’re noticeably less robust than previously thought, and the revisions have added to the narrative that the labour market is weakening, particularly after the jobs report at the start of the month.

The dovish mood then got a further boost from the minutes of the July FOMC meeting, which solidified the prospects of a September cut. Several FOMC participants even “observed that the recent progress on inflation and increases in the unemployment rate had provided a plausible case” for a 25bps cut at the July meeting. And while all of the FOMC supported the decision to keep rates unchanged in the end, a “vast majority” saw a September rate cut as appropriate if data came in as expected. There was also a shift in the economic assessment, as most of the FOMC “remarked that the risks to the employment goal had increased” and “some participants also noted the risk that a further gradual easing in labor market conditions could transition to a more serious deterioration”.

In response to the payroll revisions and Fed minutes, the most obvious market reaction was that investors dialled up their expectations for Fed rate cuts. For instance, futures are now pricing in 103bps of cuts by the December meeting (+4.3bps on the day). Bear in mind there’s only three meetings left this year, so that’s implicitly pricing in at least one meeting where they deliver a larger 50bp move. The chance of a 50bp move in September also ticked up from 34% to 36% by the close. Those growing expectations of a 50bp rate cut helped to weaken the dollar further, and the dollar index (-0.40%) fell back for a fourth consecutive session to its lowest since December. In turn, front-end Treasury yields moved noticeably lower with the 2yr yield (-5.3bps) down to 3.93%. This was accompanied by a sizeable steepening of the curve, with the 10yr yield (-0.6bps) down marginally and the 30yr (+1.7bps) higher on the day.

When it came to equities, there was a solid performance yesterday. The S&P 500 (+0.42%) saw a moderate but broad advance, with 80% of its constituents higher on the day and its equal-weighted version (+0.71%) posting a new all-time high. Target (+10.34%) was the second-best performer in the index after it reported that comparable sales were up +2% in Q2, ending a run of four quarterly declines. And it was a strong day for small-caps, with the Russell 2000 posting a +1.32% gain. However, there were a few signs of moderate stress, as the VIX index of volatility ticked up +0.39pts to 16.27pts.

Over in Europe it was a similar story, with moderate gains for the major equity indices that left the STOXX 600 up +0.33%. The broad dollar weakness also helped the Euro to strengthen for a fourth consecutive day, closing at a one-year high of $1.1146. At the same time, investors mirrored the US in dialling up their expectation of rate cuts from the ECB, and sovereign bond yields fell to their lowest in months across several countries. For example, yields on 10yr French OATs (-4.0bps) closed at 2.90%, their lowest since May, whilst yields on 10yr Italian BTPs (-3.4bps) closed at their lowest since December.

The dovish narrative about rate cuts got another boost from lower energy prices, which added to the sense that inflationary pressures were easing. For instance, Brent crude oil prices were down another -1.49% yesterday to $76.05/bbl, which is their lowest closing level since January. It now means that Brent crude is negative on a YTD basis again, and the effects have already been seen filtering through to lower gasoline prices. For example, the AAA’s daily tracker of US gasoline prices was down to $3.40 on Tuesday, which is its lowest level since March.

Overnight in Asia, markets have been trading more cautiously as investors look forward to Fed Chair Powell’s speech at Jackson Hole tomorrow. The Nikkei (+0.38%) has posted a decent gain, along with the Hang Seng (+0.40%). But elsewhere things have been more muted, and the CSI 300 (-0.13%), the Shanghai Comp (-0.04%) have both posted modest declines, whilst the KOSPI (+0.02%) has seen little movement after the Bank of Korea left their policy rate unchanged, in line with expectations. Looking forward, US and European equity futures are also pointing lower, with those on the S&P 500 (-0.14%) and the DAX (-0.08%) falling back slightly.

Elsewhere, one of the main highlights today will be the release of the August flash PMIs, which will offer an initial indication of how the global economy has been performing into this month. Overnight, we’ve already had some of those releases, which have painted a stronger picture so far. For instance, Australia’s composite PMI was back up to a three-month high of 51.4. And in Japan, the composite PMI was at a 15-month high of 53.0.

There was very little other data yesterday apart from the payrolls revisions. However, we did get the MBA’s weekly data on US mortgage applications. That showed the number of applications to purchase a home were down to their lowest since February, even though the contract rate fell to 6.50%, which is the lowest since May 2023.

To the day ahead now, and data releases include the August flash PMIs from Europe and the US. In addition, we’ll get the US weekly initial jobless claims and existing home sales for July, whilst in the Euro Area there’s the European Commission’s preliminary consumer confidence indicator for August. From central banks, the ECB will publish the account of their July meeting.

Tyler Durden

Thu, 08/22/2024 – 08:15

via ZeroHedge News https://ift.tt/8Dl6qkR Tyler Durden