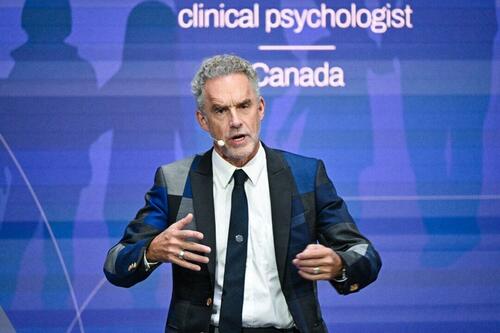

Jordan Peterson’s Free Speech Battle

Authored by Barry Bussey via The Epoch Times,

Since 2016, when Jordan Peterson criticized amendments to Canada’s Human Rights Act and the Criminal Code to include “gender identity and expression” as prohibited grounds for discrimination, he has been in the public eye. He argued that mandating the use preferred pronouns was a form of compelled speech and identity politics run amok.

Peterson’s latest ordeal of having to undergo mandatory training by his regulatory college in order to keep his psychologist’s licence after the country’s highest court refused to hear his appeal, marking another pivotal moment for the free-speech advocate, has once again brought him into the national spotlight.

The college seized upon complaints from individuals around the world—none of whom were Peterson’s patients—to demand that he undergo remedial training on how to conduct himself on social media.

This case transcends Peterson and sets a precedent for all professionals subject to regulatory bodies.

Professionals now face the reality that they must self-censor to avoid punitive actions by their professional overseers. Peterson’s case could impact all Canadian professionals, not just psychologists, by forcing them into ideological compliance or facing professional ruin. It demands serious reflection from all professionals. If you are regulated by a body that determines your livelihood, you have no choice but to recognize the danger and speak out against these encroachments on free speech before it’s too late—for you and for the country.

Peterson revealed that many professionals have reached out to him, emphasizing the importance of this case. But this issue goes beyond just regulatory bodies.

Our key institutions need to be free of ideology. Yet we have witnessed them becoming oriented in the same direction as the prevailing philosophical changes incubated at universities. Justices increasingly rely on law clerks—top law graduates—for research in writing their decisions. These clerks are frequently recommended by professors, some of whom were once court clerks themselves. This close-knit relationship with law schools makes the court system vulnerable to being swayed by the latest academic trends.

Moreover, the courts have increasingly been amenable to the idea that “experts” should be allowed to do their jobs with limited interference. Bureaucratic decisions become sacrosanct because the courts are reluctant to second-guess the “experts.” If charter rights are violated by these decisions, this can be excused if bureaucrats consider “charter values,” a judge-made doctrine requiring decision-makers to consider the “essence” of the charter when making decisions. In Peterson’s case, it is not his freedom of expression that is at stake as much as the “charter values” of diversity, equity, and inclusion.

But the deference to bureaucrats leaves Canadians—including Peterson—without true freedom of expression regarding which ideologies predominate in society.

We are all at a loss in this new reality.

There are too few “Petersons” with the means and courage to fight this societal Goliath. We lose the benefit of professional discourse on issues that matter.

We need the free speech of professionals so that we may benefit from their collective wisdom.

Story continues below advertisement

Peterson has thrown down the gauntlet. He is not willing to back down.

He will go through the mandatory re-education process but has no intention of giving the regulatory college an easy ride, and will be keeping up his challenge.

This is a battle for the very soul of free speech in Canada. It is time to build resilience for what lies ahead.

Tyler Durden

Wed, 08/21/2024 – 12:05

via ZeroHedge News https://ift.tt/svz71xL Tyler Durden