Recession-Risk Reality-Check

Authored by Mike Shedlock via MishTalk.com,

Greg Ip says the conditions for recession are not in place. I disagree. And I show where and how he went wrong.

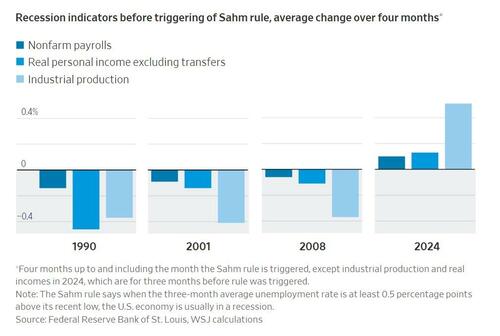

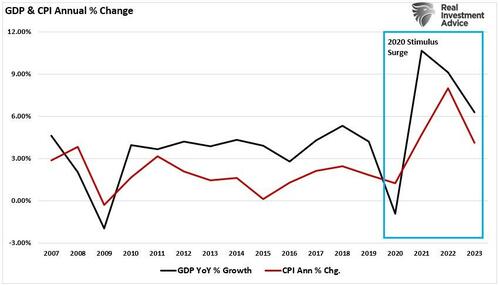

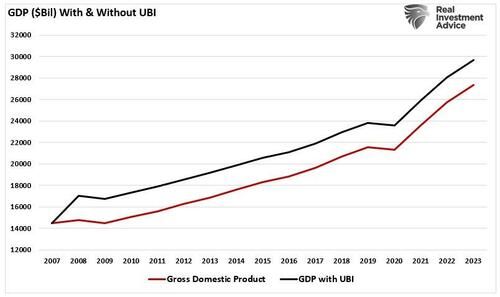

The chart itself explains where Ip went wrong. See if you can figure it out.

“This Doesn’t Look Like Recession” Says Greg Ip

Please consider This Doesn’t Look Like Recession. Here’s How One Could Happen.

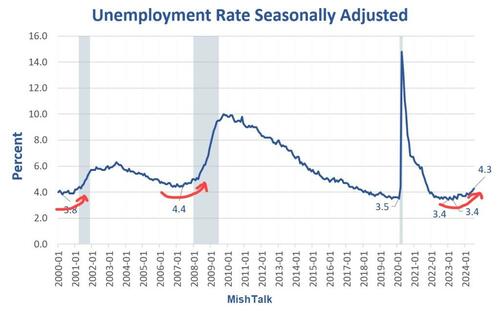

Unemployment is rising, stocks are falling and bond yields are well below short-term interest rates. These are all telltale signs of recession.

But a closer look suggests that while recession risk has risen, the U.S. isn’t in one now. The distinction is crucial because it means it isn’t too late to head off a downturn. It all depends on the Fed, and on the unpredictable moods of investors, consumers and employers.

The increase in unemployment to date, according to a rule-of-thumb popularized by the economist Claudia Sahm, in the past has only occurred during recessions.

To decide if it’s raining, it’s better to stand outside than count umbrellas. Similarly, to determine whether recession has begun, better to look at the indicators the NBER uses than the Sahm rule. Three—payroll employment, industrial production and real (inflation-adjusted) incomes, minus government transfers—were all shrinking in the four months up to and including the month the Sahm rule was triggered, in 1990, 2001 and 2008. In all three, a recession had begun several months earlier.

In the four months through July, payrolls were growing, and in the three months through June, so were real incomes and industrial production. If a recession had already begun, it would be a very unusual one. (Sahm said last week she didn’t think a recession is imminent).

Background on the McKelvey (Sahm) Rule

Edward McKelvey, a senior economist at Goldman Sachs, created the indicator.

Take the current value of the 3-month unemployment rate average, subtract the 12-month low, and if the difference is 0.30 percentage point or more, then a recession has started.

Claudia Sahm, a former Federal Reserve and White House Economist, modified the indicator from 0.3 to 0.5.

Please consider The Sahm Rule: Step by Step written December 7, 2023 by Claudia Sahm.

I created the Sahm rule, and it’s on me to communicate it well. I try. If you have any questions, please add them to the comments.

Sahm claims to have invented the rule. However, credit should go to Edward McKelvey, at Goldman Sachs.

The Lag Effect

Sahm modified the McKelvey rule to eliminate false positive. But that was at the expense of being far less timely.

In the 2008 recession, the Sahm rule triggered three months late. In the 1973 recession, Sahm triggered 7 months late.

Ip’s Huge Mistake

Ip’s huge mistake is comparing conditions in place when the rule triggers instead of conditions when the recession began.

Ip shows 4-month sum pf payrolls as negative, when in fact, they were positive.

Change in Nonfarm Payrolls Oct 2007-Jan 2008

-

Oct: +72,000

-

Nov: +116,000

-

Dec: +105,000

-

Jan: +1,000 Recession Start

Every month was positive, including the start of the recession.

Change In Nonfarm Payrolls Using Sahm Trigger

-

Jan: +1,000

-

Feb: -71,000

-

Mar: -70,000

-

Apr: -219,000 Sahm Trigger (was this remotely useful?)

The Sahm rule did not trigger until three months into the recession when payrolls were -219,000.

And look at December 2007. Despite a report of +105,000. It was clear recession was unavoidable.

Bernanke did not see recession until April, when it obvious to the world.

Industrial Production Index Oct 2007-Jan 2008

-

Oct: 101.6

-

Nov: 102.2

-

Dec: 102.3

-

Jan: 102.1

Industrial production peaked one month before recession started.

Look at Ip’s chart for Industrial Production and note how negative (and wrong) that it is. September Industrial Production was 101.9.

The average of the four months at the start of recession is (101.6 + 102.2 + 102.3 + 102.1) = 102.1 That’s up from 101.9 not hugely down as Ip shows.

Now let’s take a look at things from the perspective of the Sahm indicator.

Industrial Production Using Sahm Trigger

-

Jan: 102.1

-

Feb: 101.8

-

Mar: 101.4

-

Apr: 100.7 Sahm Trigger (was this remotely useful?)

“Real-Time” Nonsense

Sahm labels “her” indicator as “real-time”.

With lags as long as 7 month and never leading in the history of the data to 1948, there is nothing “real-time” about it.

Ip enhances the mistakes by taking a lagging indicator then applying those conditions to other indicators with varying lags.

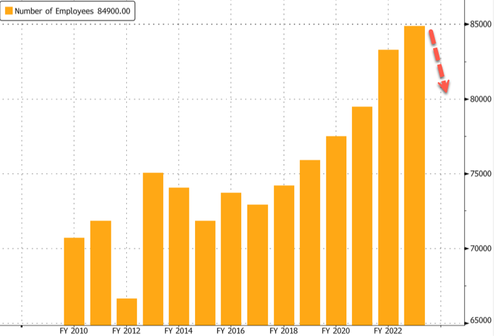

QCEW and Business Employment Dynamics (BED)

Greg Ip also ignores or is unaware of enormous discrepancies between the monthly nonfarm payroll reports, also called Current Employment Statistics (CES) and the QCEW reports.

BED is a large subset of the Quarterly Census of Employment and Wages QCEW which covers 11.6 million businesses

The nonfarm payroll reports are based off surveys of under 700,000 businesses. QCEW is based off 11.6 million businesses.

Expect the BLS to Revise Job Growth Down by 730,000 in 2023

On July 26, 2024, I commented Expect the BLS to Revise Job Growth Down by 730,000 in 2023, More This Year

Bloomberg’s chief economist, Anna Wong, arrived at a -730,000 overstatement in nonfarm payrolls. Using the same data, I calculated (in advance of her number), -779,000.

By her estimate, the BLS jobs overstated nonfarm payrolls by 81,111 jobs every month for 9 months. Click on link for more details.

Yet, here we are, putting faith in nonfarm payroll numbers that are not only lagging, but outright nonsense.

My July 8 Recession Call

July 8: Weak Data Says a Recession Has Already Started, Let’s Now Discuss When

I’ve seen enough. A recession has started. Let’s discuss starting with a very good indicator that has few false positives and no false negatives.

Since then ….

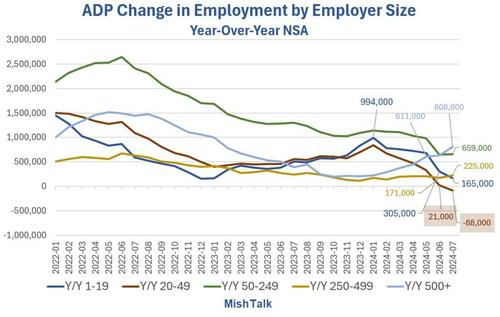

ADP Change in Employment

Data from ADP, chart by Mish

Unemployment Rate

August 2: Unemployment Rate Jumps, Jobs Rise Only 114,000 with More Negative Revisions

August 2, 2024: The McKelvey (Sahm) Unemployment Rate Recession Rule Just Triggered

A recession indicator based off rising unemployment triggered in July. Claudia Sahm, a former Fed economist, takes credit for an indicator she did not invent. Let’s discuss.

Key Points

-

Due to the lagging nature of the Sahm rule, recession is highly likely to already be underway when it triggers.

-

Applying her rules to other indicators is a serious mistake.

-

I like a trigger of 0.4, halfway between the original McKelvey idea and Sahm’s revised rule.

-

Click on above link for details.

Also, please take a look at my July 31 post Small Business Employment Growth Is Now Negative (and What It Means)

ADP data shows year-over-year payroll growth is negative 88,000 for small corporations sized 20-49!

Payroll trends are negative in all but very large corporations (Given Intel’s 15,000 Mass Layoff and tech woes in general, how long will that last?)

Recession is underway.

Tyler Durden

Fri, 08/09/2024 – 14:45

via ZeroHedge News https://ift.tt/Jm07lDn Tyler Durden