Jim Grant On Gold: A Constructively Inhibiting Institution

Authored by James Grant via CoolidgeReview.com,

I stand with anachronism. I like the low hum of cultured voices, great books, and the dead authors who wrote them. I believe in the fedora hat, which should be tipped in the open air and doffed in an elevator. I support the gold standard.

Nothing against progress.

The sextant sailed us around the world and the slide rule got us up to the moon, but neither beats your pocket-sized GPS-cum-high-speed-computer-cum-Encyclopedia-Britannica.

I understand the imperative of creative destruction, but where has prudence gone?

It was nowhere to be seen in 2008, when a half dozen great American banks became wards of the state, triple-A-rated General Electric required a government bailout, and the edifice of subprime mortgages collapsed. “The greatest failure of ratings and risk management ever”—that’s what Doug Lucas, an executive director at the Swiss bank UBS, called this shameful episode when it was happening. And it was true.

Financial upheaval is as old as finance. Fractional reserve banking is inherently risky. But the so-called Great Recession stands alone for the pedigree of the victims it claimed—or would have claimed except for the saving, smothering, costly federal intercession.

On Wall Street, the fear of loss is the best regulator. It inhibits the human tendency, especially marked in boom times, to overdo it. Zero percent interest rates and reams of paper money work in the opposite direction. They are the great disinhibitors.

“The creation of debt should always be accompanied with the means of extinguishment,” Alexander Hamilton said.

DRUNK ON CHEAP CREDIT

Recall, if you can, the dot-com bubble of the late 1990s, its bursting in 2000–2001, and the Federal Reserve’s attempts to contain the damage. From 6.5 percent in 2000, the central bank slashed its policy interest rate to 1 percent in 2004.

The dot-com bubble was indeed contained, but a new bubble, this one centered on fixed-income securities, especially mortgages, rose up in its place. It was titanic. And to contain the fallout of its bursting, in 2007–2009, the Fed slashed interest rates to zero. Its counterparts in Europe and Japan explored the new frontier of less-than-zero.

Ten years of ultra-low rates, beginning in 2008, proved that money grew on trees. From Silicon Valley to Washington, D.C., from venture capital to private equity to cryptocurrency to private credit and the public debt, there was money for very nearly anything and everything.

Interest rates, arguably the most important prices in a market economy, inform. That is, market-determined interest rates inform. Manipulated interest rates misinform.

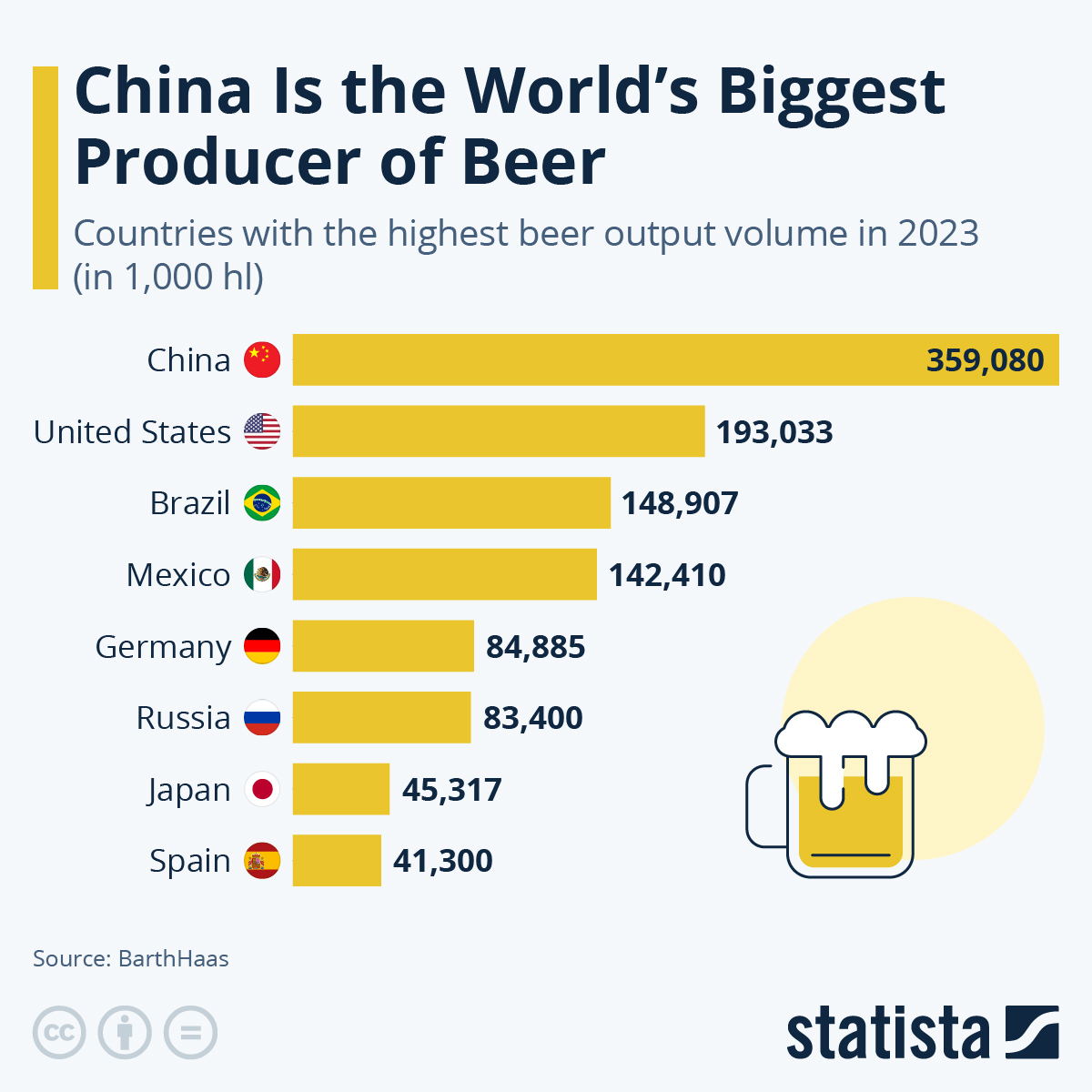

Observe, today, the immensity of the public debt. Note, especially, its accelerating growth. On Donald Trump’s inauguration day, it summed to slightly less than $20 trillion. Four years later, in 2021, it reached almost $28 trillion. In 2024, under President Joe Biden, it topped $34 trillion. The successive Republican and Democratic administrations boosted the debt by more than $14 trillion, as much as the totality of what the country owed as recently as 2011. Cheap dollars and artificial borrowing costs may not have made this dubious achievement inevitable. They certainly made it possible.

In the monetary vein, I think of the chaotic scenes at Cleveland’s Municipal Stadium, home of the old American League Indians, on the night of June 4, 1974. To draw fans into the cavernous ballpark, Indians’ management staged a ten-cent beer promotion. Before many innings had passed, spectators were wandering out on the field to introduce themselves to the players. The full moon didn’t help, but the underlying problem—the remote cause of the seven emergency-room visits and nine arrests—was the mispricing of a substance nearly as intoxicating as artificially cheap credit.

America’s first secretary of the treasury famously wrote that “the proper funding of the present debt will render it a national blessing.”

A little less familiar are the cautionary words that followed. Alexander Hamilton said that he “ardently” wished “to see it incorporated, as a fundamental maxim, in the system of public credit of the United States, that the creation of debt should always be accompanied with the means of extinguishment.” Hamilton explained that he regarded this maxim “as the true secret for rendering public credit immortal.”

Now it’s the debt that’s immortal and the credit that’s at risk.

If good intentions could have solved the problem, the United States of America would command an across-the-board triple-A credit rating. A succession of laws attests to lawmakers’ hopes that the federal accounts would somehow, one day, achieve balance: the Congressional Budget and Impoundment Act of 1974, the Gephardt Rule of 1979, the Balanced Budget and Emergency Deficit Control Act of 1985, the Budget Enforcement Act of 1990, the Balanced Budget Act of 1997, and the Budget Control Act of 2011.

But fiscal New Year’s resolutions have proven no match against the proverbial ten-cent beers on tap at the Federal Reserve. Rock-bottom interest rates and the Fed’s bond-buying program would have tempted a congress of saints to run up the debt. The incumbent sinners hardly needed the push.

The breakdown of American fiscal discipline and the explosion of the U.S. public debt did not occur during the first quarter century of the Bretton Woods system.

AUGUST 15, 1971

The late-twentieth-century sea change in the nature of money deserves more attention on this matter than it ordinarily receives. From Hamilton’s day to Richard Nixon’s, the dollar was defined as a fixed weight of silver or gold. It was exchangeable into that weight of metal, by one class of dollar holder or another, on demand. The Federal Reserve note was just that—a note, a debt instrument, an IOU. It was not money but the promise to pay money.

On August 15, 1971, President Nixon cut short the era of convertibility. The dollar henceforth would be undefined. It would be convertible into small change only. It would derive its value not from Fort Knox but from the U.S. economy, that great regenerative engine of wealth and opportunity. Was this not progress?

It must be said that little remained of the gold standard that Nixon put out of its misery. The classical gold standard died in 1914. A road-show variant, the gold exchange standard, succeeded the original in the 1920s. The Bretton Woods version followed in 1944. Its principal architect, John Maynard Keynes, called it, with some hyperbole, the “exact opposite” of a gold standard.

Under Bretton Woods, exchange rates were fixed, but they might be adjusted. The dollar alone was made exchangeable into gold, but only by America’s sovereign creditors. The United States retained the reserve currency privilege—that is, the privilege to borrow without visible limits in the currency that only America could lawfully print. It has proven enough fiscal rope to hang ourselves.

Certainly, the Bretton Woods system was a step down in monetary rigor and cohesiveness, but what did not occur during its quarter century of operation was the breakdown of American fiscal discipline and the explosion of the U.S. public debt.

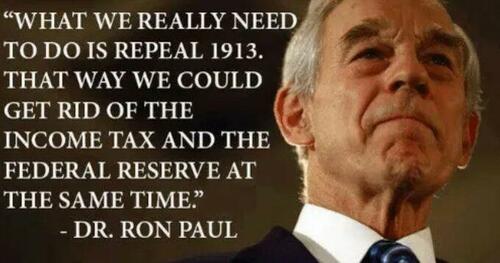

To avoid giving political offense, Alfred Kahn, President Jimmy Carter’s inflation czar, called a recession a “banana.” Maybe “gold standard,” too, needs a verbal makeover, so low is its standing in the eyes of academic economists.

Or, perhaps, a better understanding of the gold standard itself—its workings and character—would move the debate forward. Simplicity is the archstone of the gold standard. What does that mean? First, defining money as a weight of gold; second, allowing that treasure to move freely among participating gold standard nations. It went where it was treated well. “To me,” Federal Reserve governor Adolph C. Miller told Congress during the Coolidge presidency, “the gold standard means a set of practices, a system of procedure, never formulated, never consciously thought out, not invented by anybody, but the growth of experience of the great commercial countries of the world, rather than merely the employment of gold…to redeem all forms of obligations.”

Among the practices to which Miller referred was the protection of bank depositors. Up until the advent of the Federal Deposit Insurance Corporation, that responsibility fell on a bank’s shareholders. In case of the insolvency or impairment of the institution in which they held a fractional interest, the shareholders got a call to stump up more capital—after all, it was their bank, not the taxpayers’. Here was a noble kind of social justice.

Under the gold standard, macroeconomic theory played little part in the formulation of policy. Under the PhD standard, macroeconomic theory drives policy making.

THE PhD STANDARD

The “exact opposite” of the gold standard is really the system in place today in the United States. One might call it the PhD standard. It’s the system of discretionary manipulation of interest rates by doctors of economics to achieve a little inflation—not too much, mind you—and maximum employment.

It’s a feature of the balance sheet of today’s Federal Reserve that operating losses swamp stated capital. Paying out in interest much more than it earns in interest, the Fed finds itself in the position that made Silicon Valley Bank infamous in 2023.

Under the gold standard, a central bank balance sheet held few, if any, government securities. Under the PhD standard, a central bank balance sheet holds almost nothing else.

Under the gold standard, the policy of each participating nation conduced to the prosperity of all participating nations; it was a synchronous, outward-looking system. Under the PhD standard, each nation looks entirely to its own interests.

Under the gold standard, macroeconomic theory played little part in the formulation of policy (indeed, the phrase monetary policy went uncoined until the 1930s). Under the PhD standard, macroeconomic theory drives policy making. And there is the rub. Which theory is correct? Which is relevant?

“Inflation is always and everywhere a monetary phenomenon,” Milton Friedman pronounced. Updating Friedman, John Cochrane, one of the brightest of today’s economic lights, declares, in so many words, that inflation is always and everywhere a fiscal phenomenon. With due respect to each theorist, it’s as if physicists were still arguing about the laws of motion.

“Things without all remedy should be without regard,” said Lady Macbeth. In other words, what’s done cannot be undone.

I take the point that the shift away from convertible currencies to the pure paper kind is a historical fact. But I wonder whether what stands in the way of a fundamental reappraisal of our monetary and fiscal arrangements isn’t really a cultural impasse.

The gold standard was a constructively inhibiting institution. How it would fare in this, the age of the overheard cell-phone discussion about the speaker’s ugly impending contested divorce, is anybody’s guess. Perhaps we should prepare the cultural ground for fundamental monetary reform by bringing back the telephone booth—and, of course, the fedora.

* * *

This article appears in the Summer 2024 issue of the Coolidge Review. Request a free copy of the print issue.

Tyler Durden

Mon, 08/05/2024 – 07:45

via ZeroHedge News https://ift.tt/1fhar4L Tyler Durden