Authored by Lance Roberts via RealInvestmentAdvice.com,

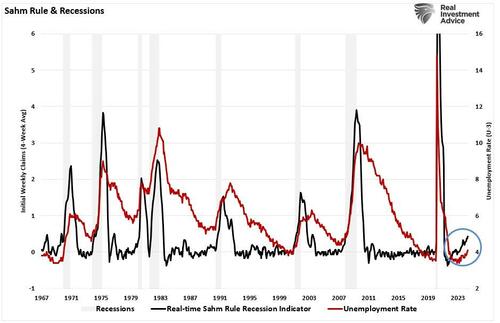

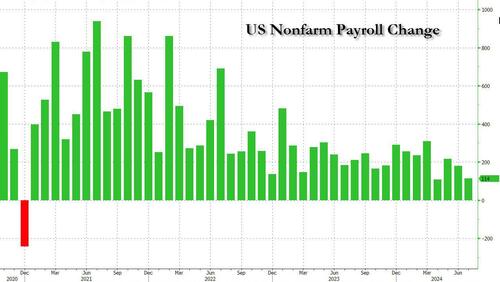

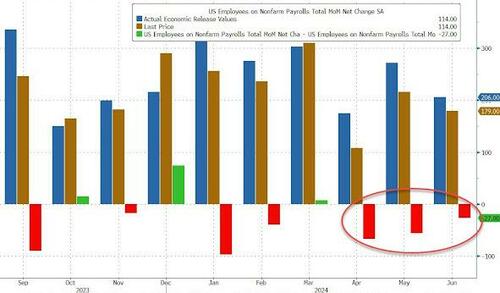

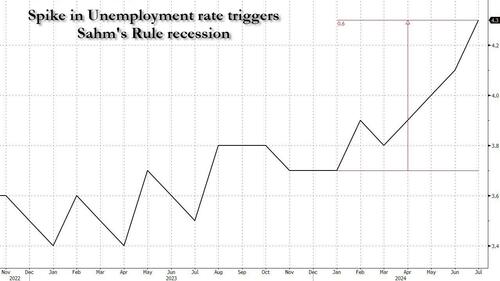

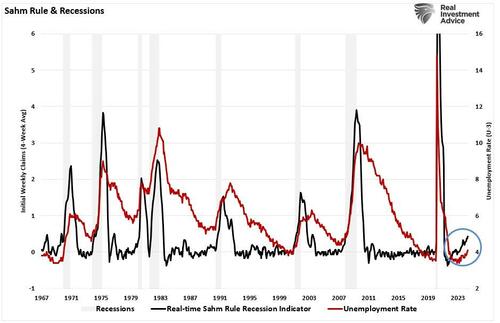

Economist Claudia Sahm developed the “Sahm Rule,” which states that the economy is in recession when the unemployment rate’s three-month average is a half percentage point above its 12-month low. As shown, the latest employment report has triggered that indicator.

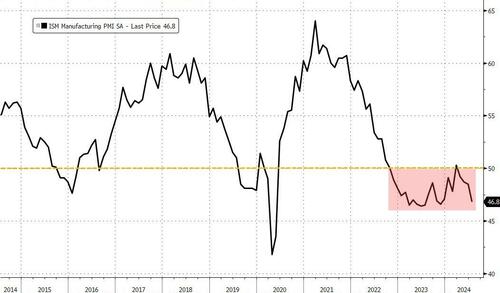

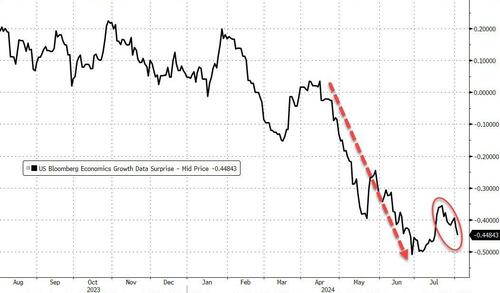

So, does this mean a recession is imminent? Maybe. However, we can now add this indicator to the long list of other recessionary indicators, also flashing warning signs.

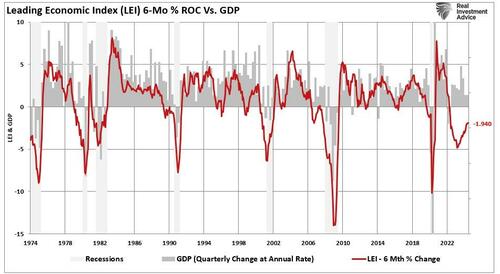

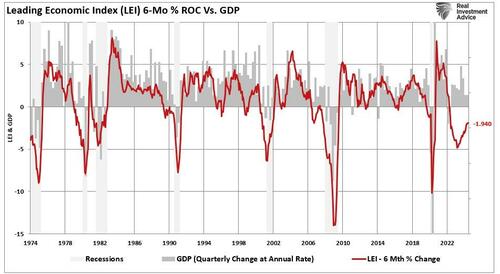

As discussed in “Conference Board Scraps Its Recession Call,” the Leading Economic Index (LEI) has a long history of accurately predicting recession outcomes. As we showed, each previous decline in the 6-month rate of change in the LEI from the Conference Board has aligned with a recession. We are currently in one of the most extended periods on record where the LEI reading has remained below zero but without a declared recession.

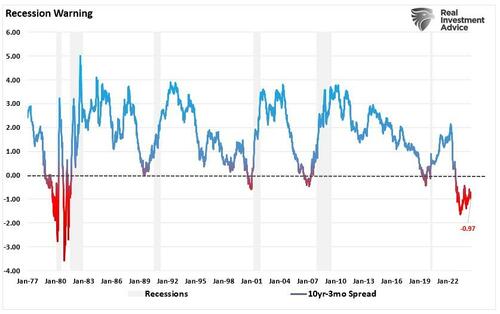

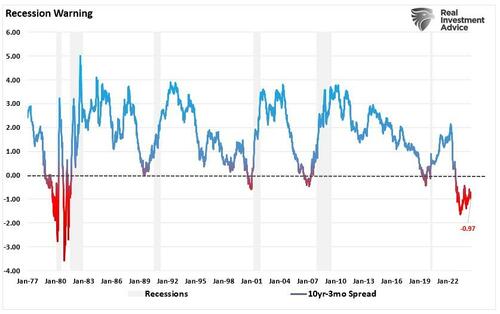

We also discussed the inverted yield curve, which suggests that recession risks remain. To wit:

“While the Conference Board has abandoned its recession call, the bond market has not. The yield spread between the 10-year and 2-year Treasury Bonds remains deeply inverted. Notably, the inversion is NOT the recessionary warning. It is when that yield-curve UN-inverts that signals the onset of a recession. Such has historically occurred in response to Federal Reserve rate cuts to try and offset a rapidly slowing economy.”

Rate Cuts Coming

With the Fed getting ready to cut rates for the first time since 2020, will the yield curve’s un-inversion again signal a recessionary onset?

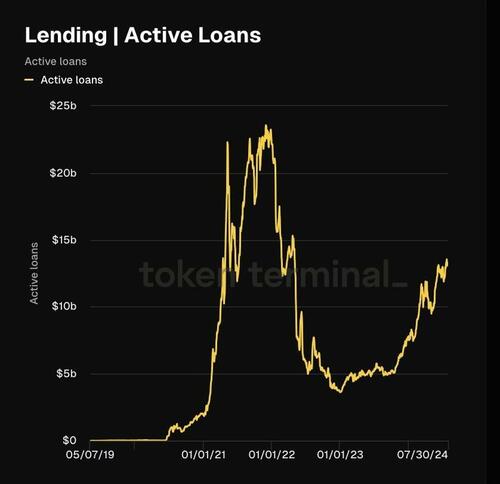

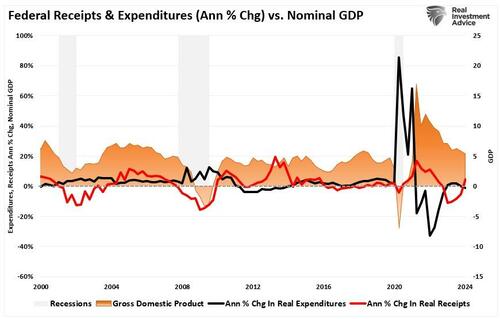

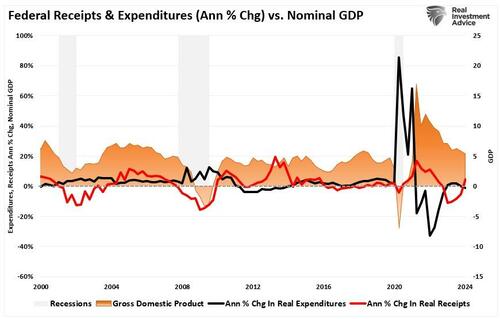

So far, the economy has defied recessionary expectations. That was due to the flood of monetary stimulus from the Inflation Reduction Act and the CHIPS Act and a surge in deficit spending, which supported economic growth. However, that expenditure surge has now peaked and turned lower, dragging on economic growth in the future.

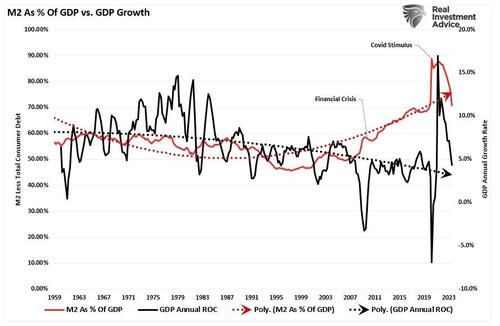

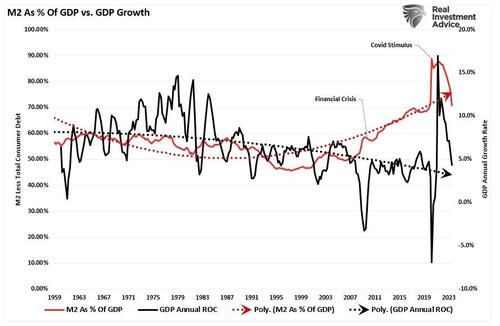

We see that same support to economic activity in the monetary supply (M2) as a percentage of the economy. While those monetary and fiscal supports caused economic growth to surge following the “pandemic-related” spending spree, both are reversing.

However, as the monetary stimulus reverses, the risk of a recession increases as consumption slows.

That is why the “Sahm Rule” and employment in general are among the most critical recessionary indicators.

Why Is Employment So Important?

The U.S. is a consumption-based economy. Critically, consumers can not consume without producing something first. Production must come first to generate the income needed for that consumption. The cycle is displayed below.

Of course, if you bypass the production phase of the cycle by sending checks directly to households, you will get a strong surge in economic growth. As shown in the M2 to GDP chart above, the massive spike in economic growth in the second quarter of 2021 directly resulted from those fiscal policies.

However, once individuals spent that stimulus, economic activity subsided as the production side of the equation remained lagging. Here is the crucial point about employment and why the “Sahm Rule” matters.

“For a household to consume at an economically sustainable rate, such requires full-time employment. These jobs provide higher wages, benefits, and health insurance to support a family. Part-time jobs do not.”

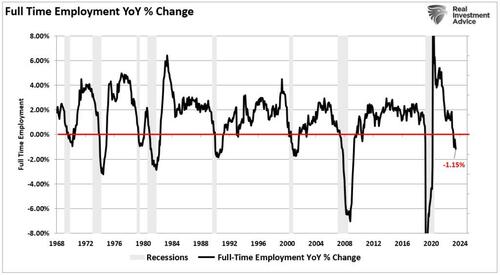

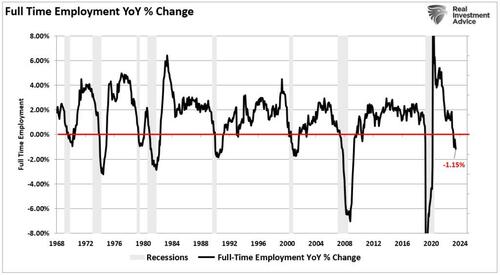

While the media touts the ‘strong employment reports,’ such is mostly the recovery of jobs lost during the economic shutdown. However, the reality is that the full-time employment rate is falling sharply. Historically, when the rate of change in full-time employment dropped below zero, the economy entered a recession.

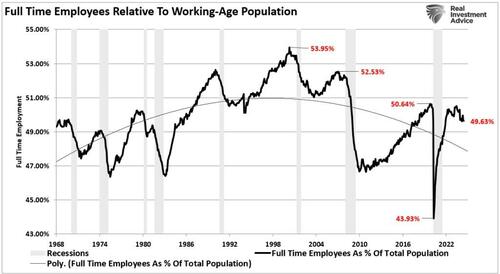

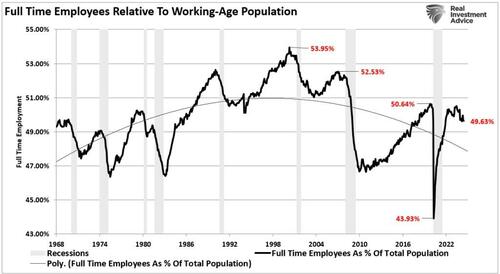

Notably, given the surge in immigration into the U.S. over the last few years, the all-important ratio of those employed full-time relative to the population has dropped sharply. As noted, given that full-time employment provides the resources for excess consumption, that ratio should increase for the economy to continue growing strongly. However, full-time employment has decreased since the turn of the century as automation, technology, and offshoring have risen. While President Biden recently touted strong employment growth in his SOTU address, full-time employment as a percentage of the working-age population failed to recover to pre-pandemic levels.

Notably, sharp downturns in full-time employment have coincided with recessionary onsets. Such should be unsurprising as corporations scale back on labor, their most considerable expense, as consumer demand falls.

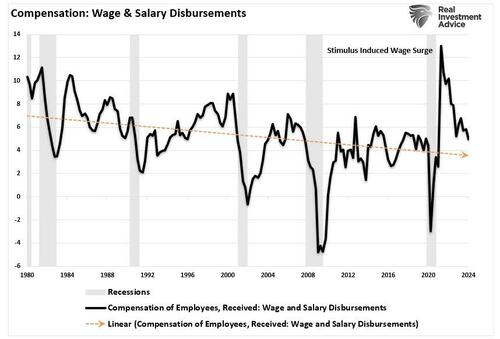

No Job = No Income

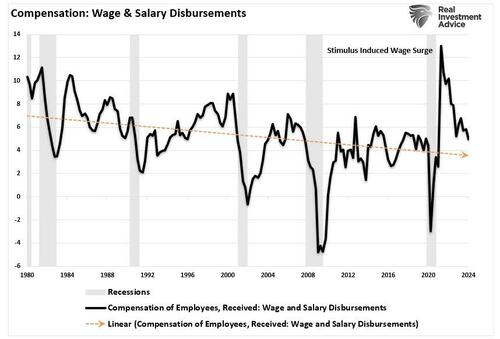

The problem with declines in full-time employment is that, as noted, it negatively impacts economic consumption. While the current administration has been able to offset that decline with a massive increase in deficit spending, the latter is not sustainable. Combine that with the decline in wage growth, and the potential stress on the economy becomes more apparent. As shown, compensation continues to decline even as price inflation remains elevated, which weighs on consumers’ ability to maintain their living standards.

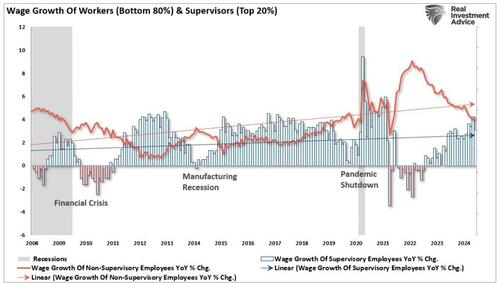

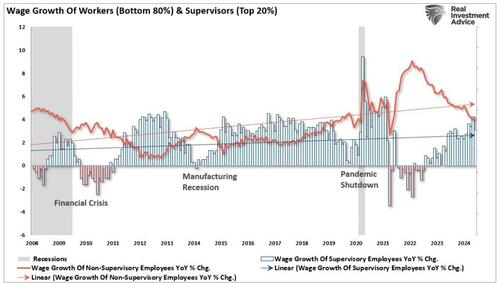

However, that chart is a bit deceiving as it reflects all compensation and wages. Twenty percent (20%) of income earners have seen wages increase, particularly for “C-Suite” executives. However, for the bottom eighty percent (80%) of employees, the decline in wage growth is quite dramatic and on par with previous recessions.

As noted, as the economy slows, employers look to reduce the most costly aspect of any business – employment. Cutting full-time jobs is the most efficient way to protect earnings and profitability. While employers tend to hang on to employees as long as possible, employees eventually get sacrificed when protecting profits. As such, a reasonably predictable cycle continues until exhaustion is reached.

Conclusion

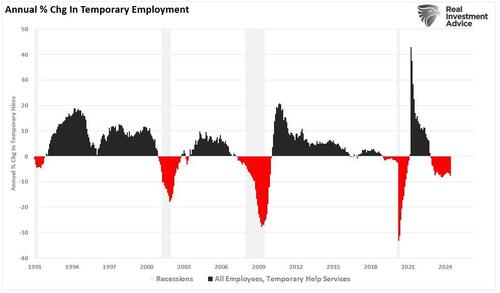

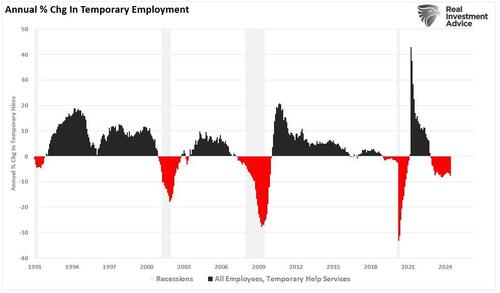

However, it is worth noting that while full-time employment is declining as the economy slows, temporary help is also declining. In other words, companies are slashing employment at all levels, which doesn’t support the “strong economy” narrative.

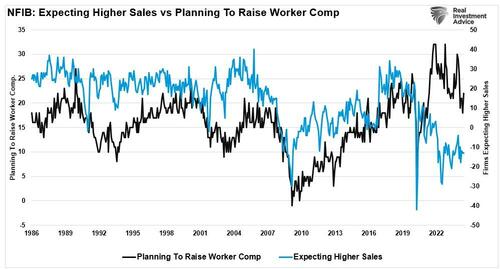

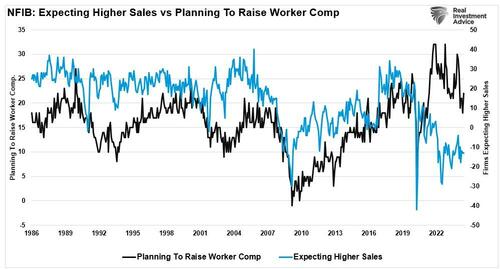

The decline in wages and jobs should be unsurprising. Small businesses comprise 50% of the employment makeup and have failed to see the surge in sales growth touted by the mainstream media. While they initially raised wages to attract talent following the shutdown, that is beginning to reverse as sales fail to materialize.

While there may not be any indication of a recession in the next 12 months, according to mainstream economists, it is likely worth paying attention to what is happening in employment since nearly 70% of economic growth is derived from consumption. The “Sahm Rule” is another essential indicator suggesting that underlying economic weakness is more significant than the headlines suggest.

Sure, this “time could be different.” The problem is that, historically, such has not been the case. Therefore, while we must weigh the possibility that analysts are correct in their more optimistic predictions of a “soft landing,” the probabilities still lie with the indicators.

While the LEI and inverted yield curves suggest that the “conditions” for a recession are present, the “Sahm Rule” and measure of full-time employment tend to be the “evidence” of one.

Of course, this is probably why the Federal Reserve is pushing to cut rates even though inflation remains well above its target.