Authored by Naveen Athrappully via The Epoch Times,

Hundreds of cities across the United States now have starter homes priced at $1 million dollars or more, as housing shortages push prices to record highs, according to real estate marketplace Zillow.

The typical starter home—or property in the lowest third of local home values—is worth at least $1 million in 237 cities, Zillow said in a July 25 report.

This is the highest number of cities with million-dollar typical starter homes in U.S. history, up from 84 cities five years ago.

Roughly half of the 237 cities are in California alone, followed on the list by New York, New Jersey, Florida, and Massachusetts.

By metropolitan area, the New York City metro area, which includes parts of New Jersey and Pennsylvania, leads with million-dollar starter homes in 48 cities. It’s followed by the San Francisco metro area (44 cities), Los Angeles metro area (35 cities), San Jose metro area (15 cities), and Miami and Seattle metro areas (eight cities each). Zillow attributed the price spike to “a housing shortage that worsened over the [COVID-19] pandemic.”

In June, 1.19 million homes were in inventory, far fewer than the 1.7 million properties in June 2019, according to data from real estate brokerage Redfin. The number of active listings also dropped during this period. The shortage of homes is keeping prices high.

The inventories dipped as mortgage rates shot up, giving many homeowners second thoughts about selling their properties for fear that they would have to buy a new home at higher rates. This helped tighten the housing supply and raise costs.

Zillow predicts that a “slightly more balanced market may be just over the horizon,” which would benefit buyers. The company stated that as the effects of the rate lock ease and builders continue to add more supply, more homes are coming on the market.

“With more homes [for sale], buyers have more time to weigh their options. Rising housing inventory is also helping the negotiating power swing in buyers’ favor as price cuts are at record highs for this time of year,” Zillow stated.

However, Rick Arvielo, head of mortgage firm New American Funding, disagrees that inventory could bring down prices.

“You’re not going to see house prices decline,” he said in an interview with Bankrate. “There’s just not enough inventory.”

Jessica Lautz, vice president of research at the National Association of Realtors, also doesn’t foresee home prices going down.

“We’re actually forecasting that home prices will continue to grow based on the lack of inventory and demand for home ownership,” she previously told The Epoch Times.

Election, Interest Rates

The cost of a typical starter home nationwide is just more than $196,600, according to Zillow, which called the price level “comfortably affordable for a median-income household.”

But as starter home prices have risen by more than half in the past five years, many prospective homebuyers have put off purchases. Last year, the median age of a first-time buyer was 35, a year older than in 2019.

Another factor contributing to buyer hesitancy is the upcoming election in November.

“I’m working with several buyers who are waiting for the election before they make a move,” Matthew Purdy, a Redfin real estate agent in northern Colorado, said in a July 25 statement.

“Some of them say they’ll only buy a home if their candidate wins. Others are waiting because they feel the economy and housing market are shaky, and hope it will improve after the election.

“I am working with a few foreign buyers who are wary about investing any more money in U.S. real estate before they see who takes office.”

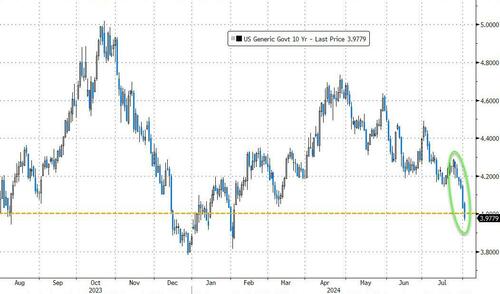

After the election, mortgage rates will continue to play a key role in how willing buyers are to purchase a home. The mortgage rate on a 30-year fixed-rate mortgage has declined by roughly 1 percentage point since the peak in late October 2023.

However, the rate remains more than double what it was three years ago. For mortgage rates to come down meaningfully, the Federal Reserve must bring down its interest rates.

The Fed has kept interest rates unchanged at a range between 5.25 percent and 5.50 percent since July 2023. Investors had expected rate cuts to kick off earlier this year, but that didn’t happen.

To make matters worse, rates could be pushed up further. Fed officials said during the agency’s June meeting that this was a possibility if inflation kept rising or remained elevated.

The longer the interest rates are kept at elevated levels, the longer mortgage rates will also remain higher, making things tougher for buyers.