Black Swan Catalysts And A Significant Change In Sentiment

Submitted by QTR’s Fringe Finance

What an interesting way to end the third quarter of 2024.

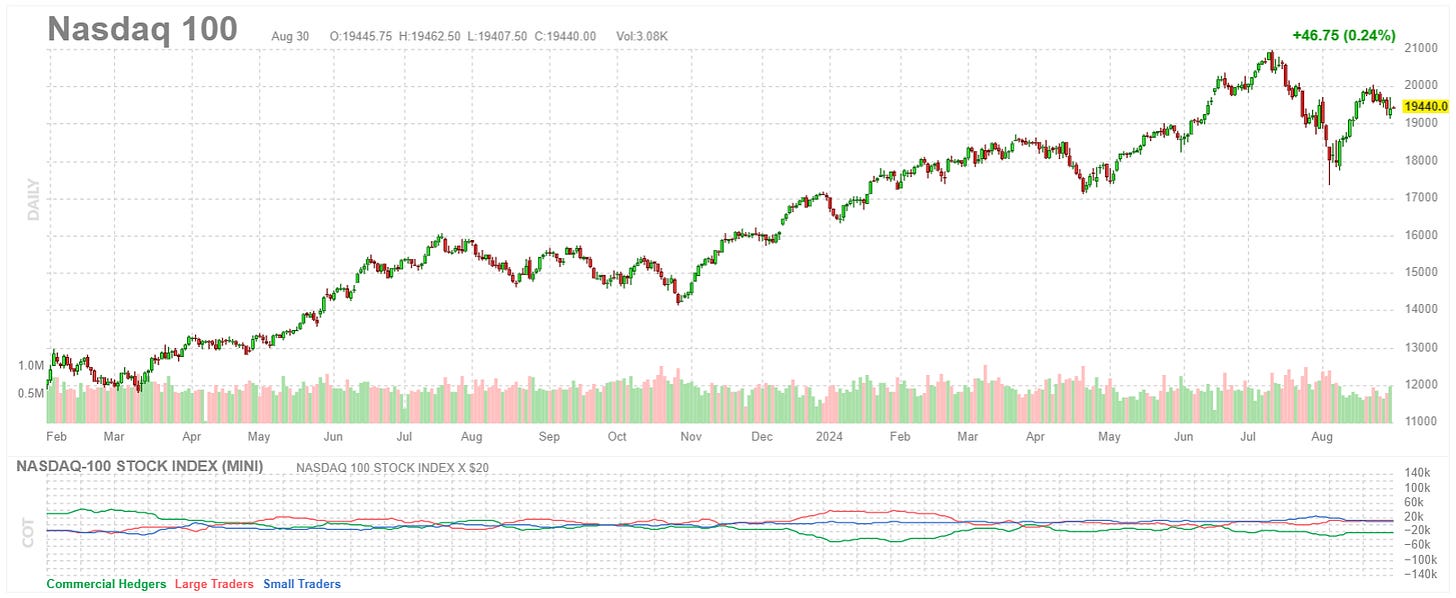

The yen carry trade chaos looked like it was going to break markets permanently a couple of weeks ago, and now here we are, back near highs with “the world‘s most important stock” (and my top contender for a black swan) Nvidia, once again beating earnings expectations yesterday and giving a positive outlook for 2025.

We are also one market review further into 5.5% interest rates, and despite assurances that we will see a rate cut in the coming month, a lot of questions remain up in the air about whether or not it will have an impact. I wanted to offer my updated thoughts on the market on my blog commented on some of the 27 individual stocks that I’ve been watching throughout the year.

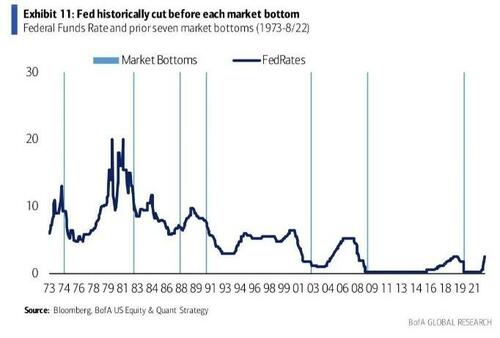

For now, let’s stick to overall feel of markets. As a gold and gold miner investor, I’m extremely encouraged by the fact that we are heading into Fed rate cuts with gold at all-time highs. There aren’t too many historical precedents for what I believe will take place at that point.

I think the Fed is going to try to start cutting 25 basis points at a time and be measured. Despite Powell confirming the pivot at Jackson Hole, commentary from several Fed governors over the last week, including Raphael Bostic last Wednesday, indicates that they are still in no rush to cut and are interested in incoming data—but I think this will be short-lived.

*FED’S BOSTIC: STILL AWAITING DATA TO BE SURE IT’S TIME TO CUT

*BOSTIC PREFERS WAITING LONGER, EVEN IF IT MEANS BEING CAUTIOUS

A 25 basis point cut has been priced in now for over six months. This market is trading as though significantly lower rates, like those in the 2% or 1% range, are imminent. They’re not.

No one is going to get cash from home equity re-fis changing their mortgage rate from 7% to 6.75%. No one is going to see their credit cards lower interest rates. A 25 basis point cut is going to do precisely nothing to unjam the gears of the economy. As I have been saying for a while now, I would not be surprised to see a major market crash after the first rate cut takes place. It could wind up being the ultimate “sell the news” event, the first rate cut.

And it seems to me the market’s mood since Jackson Hole last Friday has been indicating that this news could already be priced in. The market was up after Powell’s speech, but not significantly, and it looked tired.

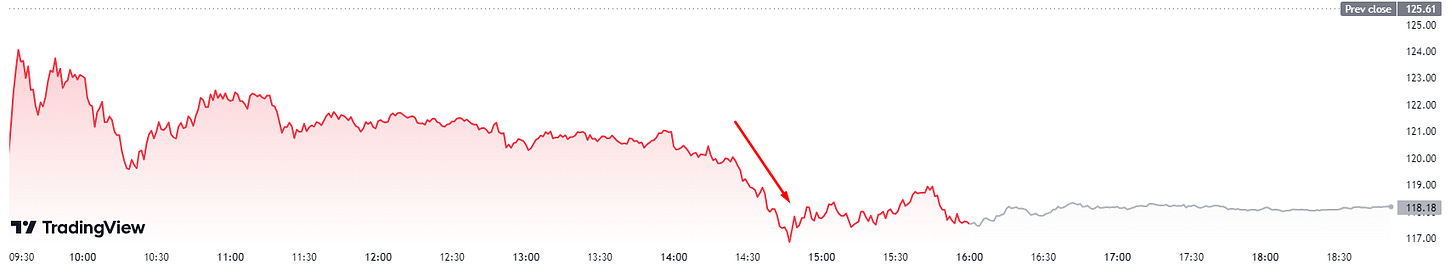

Similarly, yesterday, the market had a lot of trouble keeping a bid under Nvidia which puked to session lows quickly with about 2 hours left in trading, despite the fact that the company beat its earnings report. It bought back some of those gains on Friday.

All over social media and trading desks that I follow, people were talking about the fact that the company didn’t beat the whisper numbers. This means that market expectations are so high for the company that everybody expects a beat, and the stock really only “beats” when it beats the number above the expected beat number.

To quote Dark Helmet: “Everybody got that?”

Putting aside short-term skews, overall, the market simply feels extremely exhausted to me. And make no doubt about it, we cannot go on for an infinite number of days, weeks, and months with interest rates where they are right now and not suffer consequences. I have been late, for sure, in my prognostication that these high rates would eventually crash the market. However, if rates stay here, I know for sure I won’t be proven wrong—just wrong on timing.

Last week’s revision in the jobs numbers was just one of multiple indicators that prove this economy isn’t nearly as healthy as it seems. Job growth in the United States over much of the past year was considerably weaker than initially reported. The Bureau of Labor Statistics’ preliminary annual benchmark revision indicated that there were 818,000 fewer jobs in March than originally estimated. This preliminary revision represents the largest downward adjustment since 2009.

Even when we gear the CPI number with hedonic adjustments and pump the jobs number with government jobs while overpaying for stocks using leverage and paying off household expenses using credit cards, there is only so much runway left for the American economy, the American consumer and the psychology of the American investor. As I said at the beginning of the year, I continue to believe that staple stocks, utilities, miners, commodities, and energy are all going to be safe havens to play in when it comes to buying dips and owning stocks for the time being.

The market is extremely overvalued no matter how you slice it. I still believe my prediction from 2022 will hold true and that we will eventually see massive outsized moves in gold when the Fed fully lets off the quantitative tightening gas and reverts back to the inevitable quantitative easing. Gold was $1,820/oz. when I first wrote that and now sits comfortably over $2,500/oz — $200 oz. higher than my last market review just 2 months ago.

In addition to monetary mayhem, we have numerous additional catalysts coming up with an election where one candidate seems hell-bent on trying to ruin the economy and drive as much money out of the stock market and the country as possible. Oh and then there’s still that pesky fiscal situation in the U.S. that is completely untenable (listen to this interview with James Lavish and read this report from Mark Spiegel to understand).

On top of the election itself and the communist policies that I believe would be extraordinarily dangerous coming from Kamala Harris, the world remains up in arms with each other. The Ukraine-Russia conflict has not ended yet, the conflict in the Middle East continues to boil, and China continues to conduct defense drills around Taiwan. Put simply, the Biden administration has done nothing to quell geopolitical tensions, and we likely won’t see any profound shift until after the election.

If it’s not the yen carry trade blowing up or geopolitics that sets off alarms, it’s going to be commercial real estate, retail bowing out, or massive fraud or unreported liabilities popping up at a company that nobody expects. There are a number of black swan catalysts that could set off selling in addition to good old-fashioned lack of liquidity and a significant change in sentiment—both of which I think are coming.

This time isn’t different. For the individual stocks I like and more detail, read my full September 2024 portfolio review here.

QTR’s Disclaimer: Please read my full legal disclaimer on my About page here. This post represents my opinions only. In addition, please understand I am an idiot and often get things wrong and lose money. I may own or transact in any names mentioned in this piece at any time without warning. Contributor posts and aggregated posts have been hand selected by me, have not been fact checked and are the opinions of their authors. They are either submitted to QTR by their author, reprinted under a Creative Commons license with my best effort to uphold what the license asks, or with the permission of the author. This is not a recommendation to buy or sell any stocks or securities, just my opinions. I often lose money on positions I trade/invest in. I may add any name mentioned in this article and sell any name mentioned in this piece at any time, without further warning. None of this is a solicitation to buy or sell securities. I may or may not own names I write about and are watching. Sometimes I’m bullish without owning things, sometimes I’m bearish and do own things. Just assume my positions could be exactly the opposite of what you think they are just in case. All positions can change immediately as soon as I publish this, with or without notice and at any point I can be long, short or neutral on any position. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I did my best to be honest about my disclosures but can’t guarantee I am right; I write these posts after a couple beers sometimes. I edit after my posts are published because I’m impatient and lazy, so if you see a typo, check back in a half hour. Also, I just straight up get shit wrong a lot. I mention it twice because it’s that important.

Tyler Durden

Sun, 09/01/2024 – 19:50

via ZeroHedge News https://ift.tt/Z84gpbv Tyler Durden